Combustible cladding remains a safety concern – could graphite be the answer?

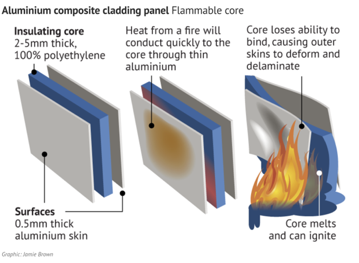

The death of 72 people in the 2017 Grenfell fire sparked global outrage. A faulty refrigerator may have been to blame for the incident itself, however the rapid and fatal spread of the fire over the structure’s 24 floors was enabled by its exterior combustible cladding.

The death of 72 people in the 2017 Grenfell fire sparked global outrage. A faulty refrigerator may have been to blame for the incident itself, however the rapid and fatal spread of the fire over the structure’s 24 floors was enabled by its exterior combustible cladding.

Combustible cladding has long been a safety concern. The Grenfell fire gave the British Government a final push to deal with it, announcing a £200 million (AU$368 million) package to assist private building owners to remove the dangerous material from the structures.

Australian states meanwhile commissioned their own reviews of private and public buildings to identify whether similar risks existed within our own cities.

The reports didn’t make pretty reading for the state authorities.

Since the 1990s, building standards in Australia have often prioritised building on a large scale with lower standards than our American compatriots. In a recently filed class-action lawsuit against Arconic Architectural Products, the supplier of the Reynobond PE panels that adorned Grenfell Tower, the plaintiff’s Philadelphia court filing stated that “due to its highly flammable nature, Reynobond PE cannot be sold or fit for high-rise buildings in the US and Arconic therefore determined to exploit the European market and export the danger they couldn’t sell at home”.

Given the situation in Australia, it appears the European market may not have been the only one these cladding companies have sought to abuse.

In Victoria alone, 681 buildings were found by the VBA audit to be covered in combustible cladding. In central Melbourne, three fires in the past five years have been a result of, or exacerbated by their external cladding. This includes the fire that broke out in February this year in the Neo 200 complex in Spencer Street, which had the same exterior cladding as Grenfell Tower. Similar to Grenfell, the cladding allowed the fire to quickly spread over several floors of the building, however the Metropolitan Fire Brigade fortunately managed to get it under control in time to prevent the loss of life. Some people are referring to the situation as a ‘crisis’.

Unfortunately, the cladding cannot simply be removed, as it serves an important function of protecting the outer shell of the building. Governments and contractors are scrambling to find alternative options to replace the use of the existing cladding products.

One innovative idea is to utilise graphite in the construction of cladding, given that it’s already used for heat and fire protection in other building materials and personal electronics.

The only problem is that there is a scarcity of high-quality and suitable graphite presently available to meet current demand, particularly in the case of expandable jumbo-flake graphite which can fetch prices of around AU$3000 per tonne. This price doesn’t even include the recent upswing in demand as a result of increased battery production for products such as electric vehicles and general energy storage. Blackearth Minerals (ASX: BEM) is however in a unique position to tap into this market and meet some of the supply demands for products such as safe cladding. They have not only received positive scoping study results at the Maniry Graphite Project in Southern Madagascar, but recently BEM also published the findings undertaken by German company NGS, stating that Maniry graphite:

- “Is suitable for the preparation of expandable graphite”

- “Qualifies for the production of high value graphite foil and many other applications”

BEM has commenced offtake discussions and further product test work as part of the Maniry Graphite Project feasibility study. Financial analysis indicates the project will deliver strong financial returns with moderate capital expenditure requirements for the 10+ year project life after the first ore is processed.

BlackEarth Minerals trades under the ASX code: ‘BEM’

More information on BlackEarth Minerals can be found at their Investor Centre.

*Reach Markets are paid a retainer to assist BEM with private investor management.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.