Senetas Corporation Limited (SEN) – Update

New products and cybersecurity awareness to drive growth over the next few years.

Directors

Francis Galbally, Chairman

Andrew Wilson, Executive Director

Lt General Ken Gillespie, Non-Executive Director

Lachie Given, Non-Executive Director

Lawrence Dave Hansen, Non-Executive Director

Phillip Schofield, Non-Executive Director

Market Data

ASX Code: SEN

Current Price: $0.084

52 week Share Price Range: $0.059 – $0.14

Market Capitalisation: $90.1 million

Enterprise Value: $77.9 million

Capital Structure

Shares on Issue (listed): 1,081 million

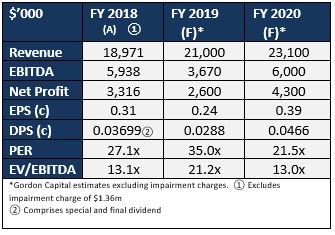

Financial Summary

Shareholders

1. Madison Park LLC: 19.9%

2. Francis Galbally: 13.1%

Senior Analyst

David Spry, (03) 9607 1371

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 31/07/19 | SEN | $0.087 | N/A | N/A |

| Date of Report 31/07/19 | ASX SEN |

| Price $0.056 | Price Target N/A |

| Analyst Recommendation N/A | |

| Sector: Technology | 52-Week Range: $ 0.059 - 0.12 |

| Industry: Software - Application | Market Cap: $ 94.08 million |

Source: Commsec

Key Points

- Thales (acquirer of Gemalto) will continue to be Senetas’ exclusive global distributor.

- With Thales being the global leader in digital security including encryption, the potential market coverage for Senetas’ products has been massively enhanced.

- Lower profit expectations for FY2019 with a solid rebound forecast for FY2020.

- Traditional and new hardware encryption products, virtual technologies, SureDrop and cybersecurity awareness to drive growth over the next few years.

Investment Proposition

Senetas is well positioned to participate in the growth of the global hardware encryption market. The US, Asia, European and Middle-East markets represent significant growth opportunities for Senetas with governments, defence departments and commercial organisations becoming increasingly aware of the risks of cyber-attacks and the integrity of data in motion.

The distribution agreement with its partner Gemalto secures access to its global sales, partnering and support locations, enabling Senetas to penetrate new major markets and gain from cross-selling opportunities. Senetas is continuing to undertake investments and acquisitions in software based technologies leveraging its distribution and technical capabilities in order to enhance revenue growth.

With a growing presence in international markets, superior technology, positive industry fundamentals, strong balance sheet and with a number of new products being released to the market, Senetas remains a growth story.

Event

On July 15 2019, Senetas confirmed that Thales (recently acquired Gemalto) will continue to be Senetas’ exclusive global distributor. Products to be distributed include the Senetas high-speed network encryptor product portfolio including the virtual network encryptor CV1000 under the brand SafeNet High Speed Encryptor (HSE). A further update will be provided on the addressable market and new product releases in the final result release which is expected late August.

Analysis and Comment

While we were expecting Thales to continue to be the exclusive global distributor for Senetas’ products the confirmation eliminates any market concerns. With Thales having such a huge customer and sales force base and with a market coverage approximately eight times that of Gemalto, there is potential for Senetas to substantially increase its global exposure on how SafeNet HSE secures across networks.

We remain positive on Senetas with the significant pipeline of new products being released to the market and with the increased cybersecurity awareness across governments and the private sector. The continued growth in data flows across Layer 2 networks and the requirement for software based encryption solutions for Layer 3 and 4 networks provide substantial growth opportunities for its products. Larger scale virtual encryption with Layer 3 compatibility and new opportunities in Europe with further certification should also drive growth.

Until the new virtual encryption, SureDrop and transport layer independent hardware products start to build sales momentum (expected later 2019), revenue will continue to be driven by Senetas’ traditional hardware encryption products. While we expect sales of the 100Gbps will continue to grow, profitability in FY2019 is expected to be impacted by higher input costs, increased investment in R&D and the equity accounted loss impact of Votiro Cybersec Global. A higher portion of overall revenue in the future will be derived from software based solutions which are delivered as a service (SaaS). This will increase annuity style income which should be far more predictable.

For FY2019, we are forecasting a 22% decrease in operating profit after tax to $2.6m (excluding the impact of the impairment charges in FY2018 and FY2019) on revenue growth of around 10.5%. For FY2020, we expect operating profit after tax to increase 64% to $4.3m on revenue growth of 10% as margins improve. Over the longer-term, we would expect Senetas to be able to sustain revenue growth of at least 10% per annum.

With the stock selling on an EBITDA multiple of 13.0x for FY2020 based on our current forecasts, we believe the valuation does not fully reflect the potential of Senetas’ new products many of which will open up significant new growth markets and the potential of Thales to substantially increase global market penetration.

Risks and Challenges

- Senetas has one key product in encryption so would be vulnerable if the product became obsolete or superseded or the outlook for the product changed. To mitigate this risk, Senetas is constantly upgrading its products and adding new features to ensure that its products are at the forefront of the latest technological developments.

- Senetas generates 60-70% of its revenue from the sale of goods and therefore the number of units sold in a period is the key driver of revenue. As we have previously noted revenue flows can be lumpy and predicting revenue in a particular period is often difficult. With Senetas focussing on virtualised encryption and software based encryption products (subscription based models) revenue should become more predictable in the future.

- For distribution of its products, Senetas relies on partners with the master distributor being Thales who account for the majority of Senetas’ sales and revenue. If for some reason this agreement was discontinued, there would be material downside risk for Senetas.

Business Overview

The core business of Senetas is the design and manufacture (under contract) of high performance encryption hardware. The product range known as CypherNet is capable of encrypting nearly any LAN/WAN infrastructure with no loss of performance. Senetas’s layer 2 technology encrypts voice, video, or data streams at a wire speed up to 100Gbps, significantly reducing the complexity and importantly the cost in meeting data protection and privacy requirements. They are purpose built to satisfy security requirements from small branch locations to high speed corporate and data centre environments.

Senetas CN is a complete family of high-performance purpose built encryptors for ETHERNET, SONET, FIBRE CHANNEL, LINK and ATM networks. Products include: CN4000 series 10Mbps to 1Gbps encryptor – compact and versatile ideal for SME’s; CN6000 series 1Gbps to 10Gbps encryptor rack mounted and carrier grade true end to end network encryption; and the CN8000 10 by 10Gbps multi-link/multi-port which are efficient hub and spoke encryptors. Product enhancements and new developments have included: the CN4010 low cost encryptor, the CN6010 cost reduced 1Gb rackmount encryptor and more recently the CN9000 ultra-high speed high assurance encryptor designed to secure data at 100Gbps. The CN9000 supports complex, ultra-fast network topologies; enabling 100% security for Cloud computing, Big Data and data centre services. Senetas has FIPS approval allowing sales of its new 100Gbps encryptor to US government agencies and other organisations that provide services to the government.

Senetas has also developed a customised algorithm product for customers and virtualised encryption products (CV1000 released June 2018) which have opened up Layers 3, 4 and more Layer 2 markets. The CV series virtualised encryptor enables rapid scalability, flexibility and cost-effective data protection to the virtual edge. The successful development of this product reinforces Senetas’s capability to deliver cost effective encryption solutions with global applications. It has opened up significant new market opportunities for Senetas as data networks continue to grow in size enabling new business efficiencies. With the continued increase in cyber threats and stronger data protection laws, the case for strong encryption solutions is growing. The CV1000 enables customers to encrypt their large sale and extended virtualised network links that otherwise may not be protected. Senetas is continuing to explore opportunities to work with technology partners to address the potential opportunities in large scale networks having recently entered into a technology partnership and distribution agreement with ADVA.

Senetas has the most certifications and is the only global player in Layer 2 high assurance encryption: Common Criteria EAL4+, FIPS 140-2 Level 3, Communications-Electronics Security Group (CAPS) for its Ethernet IG product in the UK and NATO (North Atlantic Treaty Organisation) information security product certification covering NATO member states. This gives Senetas a distinct advantage over its major competitors ATmedia, Certes Networks and InfoGuard, when selling to the government sector and major commercial organisations as it provides assurance that its products conform to the highest quality and technical standards. Senetas is currently progressing additional certifications in Europe and in Eastern Europe for its custom algorithm encryptor.

Senetas operates a ‘go to market’ model whereby Thales is its exclusive distributor in global markets (excl. Australia and NZ) under its SafeNet Identity and Data Protection Solutions brand. Thales has substantial global market reach operating in 68 countries with over 30,000 organisations utilizing its data encryption and access management solutions. Senetas shares in revenue from product sales as well as maintenance sales and also provides customer support services.

For Senetas’ virtualised encryption technologies, ADVA also represents a route to market through its technology partnership and distribution agreement. This enables Senetas to embed its high-speed networking encryption technology into ADVA’s industry-leading virtualisation technology, Ensemble Connector. ADVA is a leading provider of network solutions for the delivery of cloud and mobile services. By combining ADVA’s Ensemble suite with Senetas’ virtual encryption engine will provide a disruptive solution for site-to-site and site-cloud encrypted VPN’s. The ADVA agreement complements the distribution agreement with Thales with Senetas now having two independent routes to market for its two virtualised encryption technologies. In Australia and NZ, Senetas sells and distributes its products through a number of channel partners including UXC Ltd, Nextgen and HP.

Business Drivers and Growth Profile

Senetas has a sustainable business model and having the most product certifications with access to a global distribution channel through its partner Gemalto, is well positioned to exploit the large growth opportunities existing in the high speed data encryption market. In a globally interconnected environment, organisations are experiencing unprecedented growth in valuable digital assets in the form of intellectual property, scientific data, business information and government privacy and secrets. The digital universe size is expected to increase by at least 40% per annum to 2020 and it is estimated that only around 50% of this growth rate is currently being protected.

While vast amounts of money are invested in securing data at rest (intrusion detection systems, email and malware security and firewall protection), organisations often underestimate the magnitude of risk to critical data while it is in transit across private or public networks. Cyber intrusions are clearly the largest threat to these digital assets while they are stored, moved and shared. Data privacy and protection regulations have been introduced by governments with heavy penalties for breaches. Australia’s new federal data breach notification laws came into effect in February 2018 which requires businesses to report cyber incidents to the Australian Information Commissioner and individuals impacted by data breaches which is likely to result in serious harm. With Europe’s new data privacy and security laws now in effect, businesses conducting business in Europe will also be subject to significantly tighter data privacy requirements. In the US, all but two states have laws requiring consumer notification of security breaches involving personal information. This increases the importance of encrypting data which is positive for Senetas.

The majority of global networks are still Layer 3 IP/TCP routed networks (80%). With the substantial growth in network traffic (volume and reach), the high-bandwidth applications such as data-centre connectivity, disaster recovery/business continuity measures and data storage replication, organisations and network providers are increasingly embracing the benefits of layer 2 Ethernet services. Layer 2 encryption is designed to be transparent to end users with little or no impact on network performance and the cost per gigabyte is the lowest. With the growth in data volumes, driving greater adoption of Layer 2 networks and the increased awareness of the need to protect valuable data travelling around networks at very high speeds, Senetas being the market leader in Layer 2 encryption technology and with its proven range of certified encryption protection solutions for governments, defence departments and the commercial market is a major beneficiary of this trend.

Senetas’s highly innovative and responsive R&D program will continue to be a major growth driver in the future. Recent milestones reached include the commercialisation of development of the 100Gbps encryptor, the customised algorithm products and its virtual encryption product. Senetas’s ultra-high speed 100Gbps ethernet encryptor was developed to satisfy the requirements of large customers who are upgrading their networks from 10Gbps to 100Gbps. Early sales have been encouraging and we expect growth to accelerate over the next few years.

Senetas has developed its ‘custom algorithm’ encryptors for new and growing markets particularly in Eastern Europe, which allows customers to select their own algorithm giving them security control as a result. Sales will commence when the certification process is complete (expected 2019). This represents a new and large market for Senetas and there are no competing products that match its product capabilities. Senetas’s virtual encryption product was released ahead of schedule and represents the first virtualised encryptor to provide strong encryption for large scale multi-layer (layers 2, 3, and 4) networks carrying sensitive data across thousands of end-points. This has opened up large scale market opportunities for Senetas well beyond its current core customer base. Also, being a subscription based model will help to offset the lumpiness of product sales aiding predictability and cash flow.

Senetas’ technical skills enable it to re-engineer encryptors using its core technology – hardware and virtual to suit the requirements of the customer. This was behind the recent successful technology and distribution agreement with ADVA, the leading provider of open networking solutions for the delivery of cloud and mobile services. With Senetas’s high speed networking encryption technology being embedded into ADVA’s virtualisation technology, significant new market opportunities across service provider customers and enterprise-focused resellers as well as the large public cloud providers have been created by the provision of a solution for site-to-site and site-cloud encrypted VPN’s. Revenue flows are expected to commence in 2019 and should continue to build as product volumes increase.

Senetas is continuing to invest in software based technologies which are aligned with its competencies; leveraging its encryption, security and networking skills. The capital cost of these investments is modest and they are in line with Senetas’s stated strategy of diversifying product revenues, enhancing growth and expanding its addressable markets. They have the potential to add significant value for shareholders over the longer-term as they build scale. Current investments include: SureDrop (Drop Box file sharing capability); Votiro Cybersec Global (content disarm and reconstruction (CDR) technology; DeepRadiology Inc. (medical learning and artificial intelligence); and EON Reality Inc. (world leader in Augmented and Virtual Reality).

General Advice Warning

The information contained in this Report is only of a general nature and does not constitute personal financial product advice. In preparing the advice no account was taken of the objectives, financial situation or needs of any particular person. Therefore, before acting on the advice readers should consider the appropriateness of the advice with regard to their particular objectives, financial situation and needs. Readers should obtain and consider any relevant Product Disclosure Statements before making any decisions about the subject matter of this Report and should seek independent professional advice.

Read the full disclaimers here >

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >