How to trade in a sideways market

A good Options trading system involves strategies that will work in bullish markets as well as bearish and sideways markets. Navigating a sideways market can be difficult for most traders, as there is a level of uncertainty as to which direction it could move in next, and whether they stand to make or lose money in the process. While trading in a sideways market still has its risks, there are strategies that can help to minimise potential losses and use the market to your advantage.

During a sideways market, prices remain in a tight range. In the simplest terms, the market plateaus and there are no significant upward or downward price trends during the period. There are two levels that we look for during a sideways market – support and resistance. Support is the price level where buyers come back. These buyers snap up the stock which prevents the price from falling below this support level. Resistance is where the sellers unload their holdings to the market. Once the price has reached this level, the sellers will re-enter. The selling pressure will prevent the stock price from increasing above the resistance level.

Traders can take advantage of sideways markets with a range of options strategies which are discussed below.

The iron condor is one of our favourite strategies, because of its limited risk and a higher probability of success. It’s entered through a combination of four different contracts that don’t have an inherent bullish or bearish bias. You basically enter a bull put spread (strikes A and B) and a bear call spread (strikes C and D).

The best outcome is that the stock price remains between the sold call and the sold put legs. This way you get to keep the premium you received when you opened the trade and all the legs of the trade will expire worthless, thus paying brokerage only on expiry.

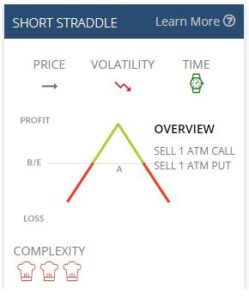

The short straddle is entered by selling a call option and a put option with the same strike price (strike A) and expiration date. This strategy is often used by traders when they hold the view that the underlying asset will not move significantly higher or lower before expiration. As the loss of this strategy is unlimited, it’s mostly performed by advanced traders. Selling a call and a put at-the-money will deliver some good premium at the beginning of the trade.

A short strangle, also known as a sell strangle, is another neutral strategy that involves simultaneously selling a slightly out-of-the-money put (strike A) and a slightly out-of-the-money call (strike B) of the same underlying stock and expiration date. Once again, this trade has unlimited risk if the market picks a direction. As the loss of this strategy is unlimited, it’s mostly performed by advanced traders.

The idea behind the Buy-Write strategy is to make a profit from Options premiums, by buying the underlying stock and selling call options of the same underlying. Seeing you own the underlying stock, you are protected if the share price rises above the strike price of the sold call. As the price of the underlying stock increases, the liability of the sold call option also increases. If you are assigned, you will be obligated to sell the stock you already own at the strike price you selected.

A long butterfly call position involves selling two at-the-money calls (strike B), then buying one in-the-money call (strike A) and one out-of-the-money call (Strike C). A long butterfly put position involves selling two at-the-money puts (strike B), then buying one in-the-money put (strike A) and one out-of-the-money put (strike C).

Both of these trades result in the same pay off diagram. The best outcome is that the share expires at the same strike of the sold legs (point B). If the future share price deviates from the point B there is protection in place which limits the losses.

To learn more about Options trading and the strategies used by professionals, join our upcoming Live Online Trading Webcast

*Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.