Beauty is in the eye of the investor!

Insync invested into Estēe Lauder 3 years ago. Why did we, how is this investment progressing and what are its prospects? To begin, Estēe Lauder meets Insync’s 3 key criteria;

Insync invested into Estēe Lauder 3 years ago. Why did we, how is this investment progressing and what are its prospects? To begin, Estēe Lauder meets Insync’s 3 key criteria;

- It was (and still is) on the right side of global disruption, benefitting from global megatrends.

- Is consistently highly profitable based on its ROIC (Return On Invested Capital)

- Strong management that’s future focused with its business well positioned

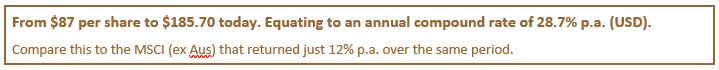

In aggregate these factors have once again combined to produce compounding growth in earnings and cash flows. Here’s the Insync scoreboard on this count so far;

We agree with its founder Estēe; Yes, “Everyone can be beautiful”, and so are the returns for investors too. Insync’s approach identifies great performers early into their sustained growth in profitability, whereas many of our peers come in well after.

Why we invested in Estee Lauder. The Lipstick Effect

Today, the global beauty industry is a $532 billion (USD) business. The world’s largest beauty market is the USA, with about 20% share followed by China (13%) and Japan (8%). While projections for growth vary, most data points we are monitoring indicate that it will continue to advance at a 5% to 7% compound-annual-growth-rate (CAGR) to reach around $800 billion by 2025.

The beauty industry is a resilient one and is handling retail disruption with relative ease. With record retail store closures in all sectors globally, half the growth in beauty is online. This may be unsurprising, but it implies that the other half of the growth is from stores. It’s hard to find another market segment where that’s true. Should the world economy dip, the beauty business is more likely than other discretionary categories to hold its own. Its resilient, and this in Insync’s opinion, is due to the “Lipstick Effect”.

How Disruption Impacts Beauty?

Low growth – low inflation is probably with us for a while yet. Combined with tectonic shifts in consumerism taking place at a time when technological advances are also occurring at breath taking pace, this creates a very challenging operating environment for most businesses and industries. This profoundly impacts the beauty industry and is one of the few ‘consumer staples’ where the incumbent behemoths are using their R&D (research and development) muscle to pivot, at any scale they wish, to take advantage of underlying disruptive trends in beauty.

Interestingly, established prestige beauty brands remain the preferred choice. Despite consumers looking to try new beauty products, most consumers are satisfied with the products they use today. A recent survey showed that over 80% agreed with the statement “My personal beauty and grooming needs are met by products I can buy today.” 55% are likely to “choose a trusted brand that I know over a new brand that I haven’t used before.” The same percentage (55%) saying “I am loyal to the face, body, hair or beauty care items I use.” For the likely economic environment in the years ahead this is very good news for Estee Lauder investors.

What is Coming in Global Beauty?

Understanding consumer habits is critical to staying ahead in the beauty industry. Insync’s rigorous research and studies identifies certain longer-term patterns and trends. Here are some;

- Gen Z consumers (aged 18 – 25) are really driving the beauty industry. The generation spending an average 5 hours a day on social media. In China, for example, appearance is important as it ties in with their confidence and how people see them (much like here). They also look at their skin critically – using a magnifying mirror to really analyse it thoroughly!

- Customisation and personalisation are increasing fast. Consumers are constantly looking for products that are created to specifically address their problems.

- A rapidly aging population with societies obsessed with youthfulness. Men and women increasingly want to retain youthful appearances (groomed and nurtured by the cosmetics industry worldwide). Aging demographics has led to a robust demand for anti-aging products in order to prevent wrinkles, age spots, dry skin, uneven skin tone, and even hair damage, creating room for innovation in cosmetics. This boosts industry growth.

- Women in the middle class aspire to prestige beauty brands. It has been estimated that the global middle class will grow by 600 million people. This equates to more than $5 trillion in added global spending power by 2028, an increase of 50%. Beauty regimens are becoming more sophisticated and consumers are spending more on prestige beauty products. For example;

- Women in China aged between 15 and 65 spend $23 annually on prestige beauty compared to $255 in the US on average.

- Korea, which was an emerging market in prestige beauty only 20 years ago, now spend $276.

- Brazilian women spend $21 per year, in India, just $2 –huge growth opportunities.

Why Estēe Lauder in Particular?

When one considers innovation, most think of a technology company. Insync’s portfolio of companies includes innovative companies outside the technology sector. Innovation is key to delivering sustainable earnings growth in a low growth and low inflation environment. Simply investing in innovation however is not enough. The whole company must possess an innovative mindset and strong capital allocation processes to ensure the business is continuously generating high levels of profitability for every dollar that is invested in the business (ROIC).

Estēe Lauder views itself as a brand-led innovation company. One creating a multiyear pipeline of transformative products across its brand portfolio. From upstream discovery to downstream R&D execution, their aim is to deliver noticeable, meaningful benefits to consumers. Beauty is one of the fastest-moving industries in the world with a constant stream of innovation, be it in the form of delivery systems, raw materials, packaging, product textures, trends, or buzzy ingredients.

As Estēe launch new products into markets, they are acutely aware of very specific local trends to be able to respond well to consumer tastes. Examples include:

- Japan has a very defined standard of beauty – flawless skin; and there are many skincare steps (sales) before applying foundation.

- In Korea, they see more colour in this market, leading the way in creating lip trends.

- In China, consumers are more focused on the look of the face and the finish of their products. This is a market where consumers really care about their foundation and their lip products.

For more information on other Megatrends, please visit Insync Funds Managers’ Website here.

EQT Responsible Entity Services Limited (“EQT”) (ABN 94 101 103 011), AFSL 223271, is the Responsible Entity for the Insync Global Quality Equity Fund and the Insync Global Capital Aware Fund. EQT is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This information has been prepared by Insync Funds Management Pty Ltd (ABN 29 125 092 677, AFSL 322891) (“Insync”), to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Insync, EQT nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

This publication contains general securities advice. In preparing the advice, Reach Markets Australia has not taken into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision on the basis of this advice, you need to consider, with or without the assistance of a securities adviser, whether the advice in this publication is appropriate in light of your particular investment needs, objectives and financial situation.

Reach Markets Australia and its associates within the meaning of the Corporations Act may hold securities in the companies referred to in this publication. Reach Markets Australia does, and seeks to do, business with companies that are the subject of its research reports. Reach Markets Australia believes that the advice and information herein is accurate and reliable, but no warranties of accuracy, reliability or completeness are given (except insofar as liability under any statute cannot be excluded). No responsibility for any errors or omissions or any negligence is accepted by Reach Markets Australia or any of its directors, employees or agents. This publication must not be distributed to retail investors outside of Australia.

It is recommended that you seek independent advice and read the relevant Product Disclosure Statement before making a decision in relation to any investment. Any advice contained in this communication is general and has not taken into account the investment objectives, financial situation and particular needs of any particular person.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.