Afterpay Touch Group

FY18 (4Q18) and full year (FY18), which saw its share price re-rate more than +37% in a few days.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 24/07/18 | APT | A$15.04 | A$17.50 | BUY |

| Date of Report 24/07/18 | ASX APT |

| Price A$15.04 | Price Target A$17.50 |

| Analyst Recommendation BUY | |

| Sector : Financial | 52-Week Range: A$2.94 – 16.19 |

| Industry: Diversified Financial Services | Market Cap: A$3,244.9m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate APT as a Buy for the following reasons:

1. First mover advantage, having built up ~2.2 million clients and over 16,000 partnerships with retailers.

2. Data monetization for APT and clients (potentially introduce data mining services).

3. Vertical expansion – health, beauty, entertainment, travel.

4. International expansion – U.S. is off to a good start, however APT can look to penetrate other developed markets (e.g. Europe).

5. Potential corporate activity.

6. Strong management team.

We see the following key risks to our investment thesis:

1. High valuation which is susceptible to de-rating should growth rates miss expectations.

2. Expansion into new verticals disappoints management and market expectations.

3. Increased competition from major player(s).

4. Execution risk with international expansion.

5. Increased regulation.

6. Significant data breach.

ANALYST’S NOTE

Afterpay Touch Group (APT) has provided a very strong sales update for the fourth quarter FY18 (4Q18) and full year (FY18), which saw its share price re-rate more than +37% in a few days. All trading indicators mentioned in the update indicate very strong momentum in the business, with the company guiding towards FY18 revenue of $142m, which is +23% above pre-announcement consensus estimates ($115m) and +36% above our estimates.

The launch into the U.S. also appears to be tracking well. Despite the share price re-rating+116.1% since our initial Buy call in Feb-18, we believe there is more room for appreciation. We retain our Buy recommendation on APT, given its strong market positions with retailers (first mover advantage), opportunities to replicate its business model across different verticals (initial signs are encouraging) and move into the U.S., whilst not without risk, presents a significant opportunity.

We estimate the U.S. could contribute more than US$1.0bn in revenue and US$350m in net transaction margin over the long-term. On the downside, increased regulator (ASIC) scrutiny does present some downside risk, however we remain comfortable with the business model and any potential changes.

- Trading update – key points.

1. More than $2.18bn of total underlying sales in FY18 (+289% on pcp). 4Q18 sales up +171% to $736m vs. pcp.

2. Approx. 16,500 retailers and 2.2 million customers.

3. Strong start to the U.S. segment since launching, with 400 retailer contracts signed (over 200 retailers live on platform) and $11m of underlying sales in the first full month.

4. In-store continues to build momentum, with approximately 10,000 shop fronts now live with Afterpay.

5. A stronger Net Transaction Margin (NTM) is expected in 2H18 versus 1H18.

6. A new $200m receivables funding facility closing to finalizing.

7. FY18 guidance. Management expects full year group revenue and other income of $142m, group EBITDA (operating earnings) $33-34m and group EBTDA (operating earnings excl. interest) $27-28m.

- Ongoing retailer momentum and highly engaged client base. APT continues to add merchants to its platform with little marketing efforts, in our view. The number of merchants have increased from approximately 11,500 in 2Q18 to 14,000 in 3Q18 (up +22% on prior quarter) to 16,500 in 4Q18 (+18% on prior quarter). The Company noted that of the 2.2 million members, 2.0 million were active (that is a rate of 91%), with average customer spent over a 12 month period increasing from $900 (12-mths to 31-Dec-17) to $1,100 (12-mths to 30-Jun-18). Further, the Afterpay mobile App has been downloaded more than 1.6 million times (up from 850k at first half FY18).

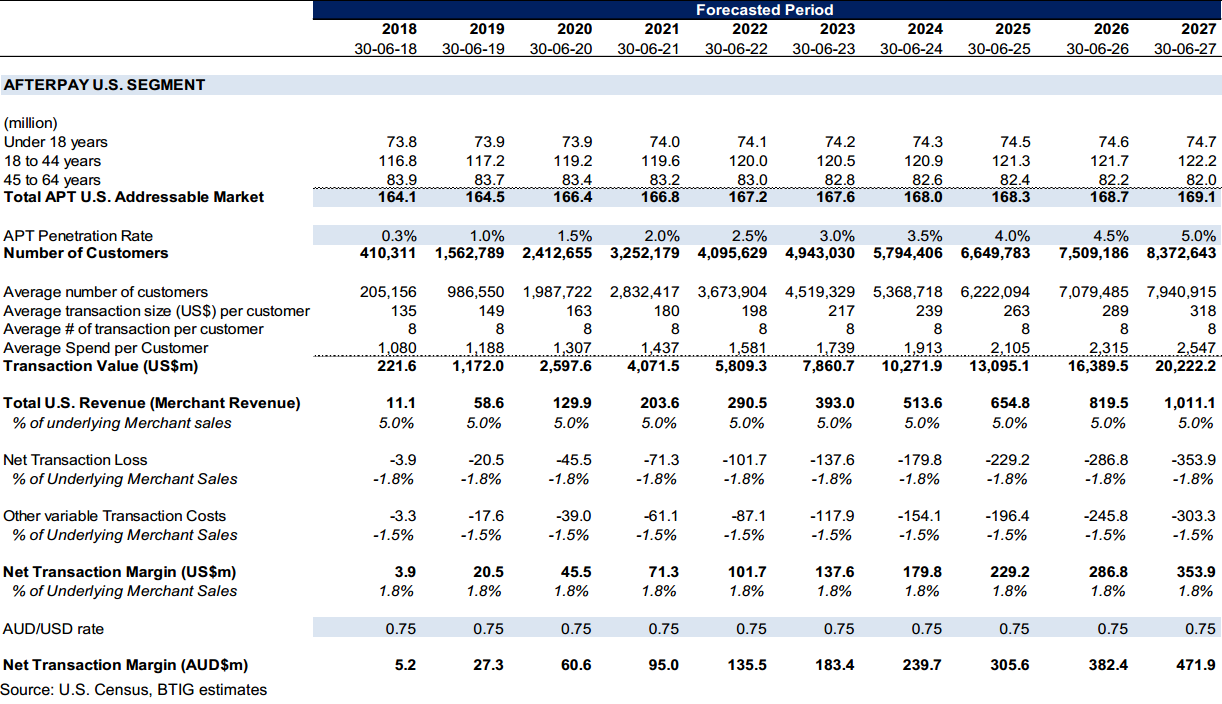

- U.S. off to a good start – what is it worth to APT’s financials? Using U.S. Census population growth estimates, we have derived a basic revenue model for APT’s U.S. segment. On our estimates, over the long-term the segment could contribute more than US$1.0bn in revenue and net transaction margin of more than US$350m.

- Valuation. We will look to fully incorporate our U.S. revenue and earnings estimates post the full year results. At this stage we have incorporated the U.S. segment’s valuation by applying a multiple to the U.S. revenue opportunity over the long-term and adding this to our ANZ segment’s valuation. Our new price target is $17.50.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

WHAT IS THE U.S. OPPORTUNITY WORTH?

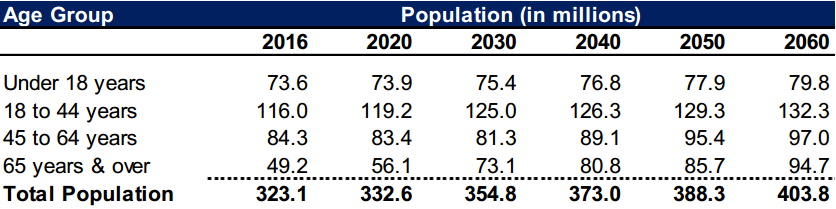

Total addressable market. In order to quantify APT’s U.S. opportunity we first seek to determine the total addressable market. According to U.S. Census projections (“Population Projects for 2020 to 2060” issued March 2018), the U.S. is projected to grow by 78 million over the coming four decades, from 326 million in 2017 to 404 million in 2060 (that is, on average of 1.8 million people per year).

Figure 1: U.S. population projects by Age 2020 to 2060

Source: U.S. Census, BTIG

Revenue model. Using the above U.S. Census population estimates, we have derived a basic revenue model for APT’s U.S. segment. On our estimates, over the long-term the segment could contribute more than US$1.0bn in revenue and net transaction margin of more than US$350m.

Figure 2: APT U.S. revenue model

Source: Bloomberg

COMPANY DESCRIPTION

Afterpay Touch Group (APT) is a technology-driven payments company based out of Australia. APT comprises of the Afterpay and Touch products and businesses. The Company provides a “buy now, take now and pay later” business model. Merchants sign up to Afterpay which enables their retail customers to pay for purchases in four installments without interest. APT pays merchants upfront, taking the credit and fraud risk upon themselves. Customers can pay by debit or credit card (Visa/Mastercard) – for this reason, APT considers banks and credit card providers to be “collaborators” instead of competitors. Merchants benefit because they are able to increase sales to customers who would normally not be able to afford to make purchases in a single lump sum.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >