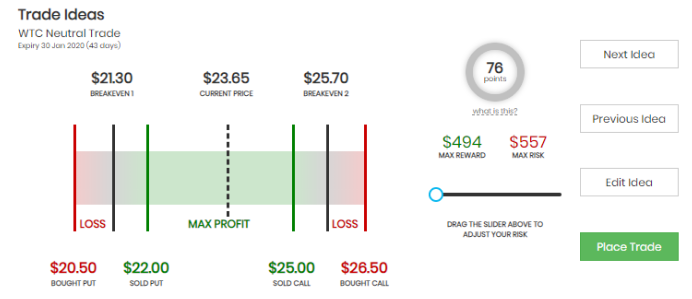

Trade Of The Week: Neutral – WTC – Iron Condor

Our trade of the week is a neutral WTC Iron Condor Trade. We have chosen this trade as it meets our quant tested Iron Condor trade criteria scoring 76 points which currently makes it a ‘Silver’ level trade. Traders use the Iron Condor strategy to generate income in sideways markets by selling the Implied Volatility that is priced into the options and allowing time decay to erode the value of the sold legs, making them cheaper to buy back later, or ideally, allowing them to expire worthless.

Our trade of the week is a neutral WTC Iron Condor Trade. We have chosen this trade as it meets our quant tested Iron Condor trade criteria scoring 76 points which currently makes it a ‘Silver’ level trade. Traders use the Iron Condor strategy to generate income in sideways markets by selling the Implied Volatility that is priced into the options and allowing time decay to erode the value of the sold legs, making them cheaper to buy back later, or ideally, allowing them to expire worthless.

Here are some of the key facts that have contributed to this trade idea:

- We are looking to enter the position close to 45 days to expiry (currently 43 DTE).

- ADX is low at 20.

- The 50 Day MA and 200 Day MA are close and favourable.

- IV Rank is favourable.

With the stock is currently trading at $24.28 we are looking at trading the following strikes:

At the close of trading today were looking at around a 89c credit to enter into this trade.

Your best outcome in this trade is for both legs to expire worthless so you can keep the upfront premium. The theoretical maximum profit is currently $1596, with the theoretical maximum loss $2004. The maximum profit will be achieved if the options expire worthless on the 30th of January 2020 with the WTC stock price closing between the strike prices of the sold call (at $23.00) and the sold put (at $26.00). If the stock falls below $23.00 the maximum loss will occur at $21.50 (which is the strike price of the protective put), with a breakeven point at $22.34. If the stock rises above $26.00, maximum loss will occur at $27.50 (which is the strike price of the protective call), with a breakeven at $26.66.

To try trading for yourself using the most powerful Options Trading technology in Australia, click here for a 7-day trial for our Implied Volatility platform.

We wish you good luck with your trading, and as always if you have any questions, please feel free to contact our trading desk on (03) 8080 5795.

Why Iron Condors?

Iron Condors are one of our favourite options strategies and popular amongst experienced options traders.

A lot of traders spend a large amount of time looking for trades that profit if a stock is going up or going down, but by using Iron Condors you can trade when you believe the stock is doing nothing and moving sideways. They allow you to trade with a neutral view, which provides limited risk and a higher relative probability of success.

Iron Condors are a market-neutral strategy and the Australian market in comparison to the rest of the world is also considered fairly neutral, so it makes sense to put the two together.

So, recently we decided to backtest the numbers and look for ways to optimise the results of our LITT trading system. Read the key findings here.

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first. Past returns do not reflect future returns.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.