Trade Of The Week: Uncertain – XJO – Long Straddle

Our trade of the week is a XJO Long Straddle. This trade is used when you are uncertain of which direction the market is going to go, but you expect it to be a big move either way. It is also a way of going long volatility.

Our trade of the week is a XJO Long Straddle. This trade is used when you are uncertain of which direction the market is going to go, but you expect it to be a big move either way. It is also a way of going long volatility.

Here are some of the key facts that have contributed to this trade idea:

- Implied Volatility is around 10 which is historically low. This means long positions in options will be cheaper to buy.

- ADX is below 20 (18.1) which hints there is no major directional bias in the market.

- The market is close to a major resistance level at the ceiling of the long term upward trend since February 2019.

- The market is close to a major expected pivot point at 7000 points.

- The market recently pushed through 52 week and all time highs and may continue to break out and rise further

- Alternatively the market may bounce off resistance and revert back to a lower level.

- A big movement in either direction could increase volatility leading to more expensive options prices, allowing you to receive more premium when closing the position.

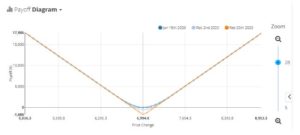

Based on the XJO Index closing at 6994.8 this afternoon we are looking at trading the following strikes:

Buy XJO1W7 7000 20 Feb 20 CALL @ 83.5

Buy XJOIX7 7000 20 Feb 20 PUT @ 95.5

Total cost = ($83.5 + $95.5) x 10 = $1,790

Max profit is theoretically unlimited.

Max loss is $1,790

If the trade makes a large move in either direction then you may decide to close down the position and take the profits. Be aware of the effect that time decay will have on this position if the market doesn’t move far from the strikes at 7000. You may consider closing the position around the end of January to minimise its impact.

To try trading for yourself using the most powerful Options Trading technology in Australia, click here for a 7-day trial for our Implied Volatility platform.

We wish you good luck with your trading, and as always if you have any questions, please feel free to contact our trading desk on (03) 8080 5795.

Past returns do not reflect future returns.

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.