The Bank of Mum and Dad: Helping your children get into the property market

According to an Australian Financial Review article last year, the ‘Bank of Mum and Dad’ is now the ninth largest lender in Australia, accounting for more than $29 billion in outstanding home loans. This makes it bigger than Bank of Queensland, HSBC Bank, Citigroup and Teachers Mutual Bank.

According to an Australian Financial Review article last year, the ‘Bank of Mum and Dad’ is now the ninth largest lender in Australia, accounting for more than $29 billion in outstanding home loans. This makes it bigger than Bank of Queensland, HSBC Bank, Citigroup and Teachers Mutual Bank.

In many cases, assistance from parents is the only way that first home buyers can get into the expensive Sydney and Melbourne property markets, which have quadrupled in value over the past 20 years, according to CoreLogic.

Entry to the property market has never been more difficult. Lender approval policy has tightened dramatically over the past few years and now we are seeing a fast price recovery in Melbourne and Sydney. In the December 2019 quarter, Melbourne and Sydney property prices have risen quicker than at any other time over the past 3 years. Momentum has been building since the unexpected federal election result in May 2019, which was followed by multiple interest rate cuts and the removal of the 7.00% minimum assessment rate for all lenders by the Australian Prudential Regulation Authority (APRA). The removal increased borrowing capacity and delivered some much needed stimulus to a property market that had been flagging in its dominant Sydney and Melbourne markets for two years, and which was starting to have knock-on effects in the broader economy. We can feel the buyer frenzy in our business with Clients buying property deep into December and reporting unusually high numbers of attendees at open for inspections in January, typically a quieter month.

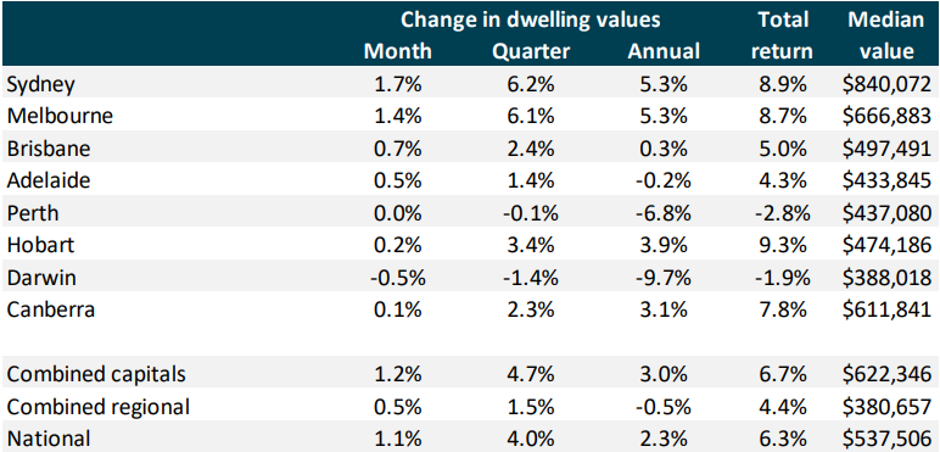

The below chart from the December CoreLogic Home Value Index report shows the last month, quarter and annual changes in property (combined house and unit) values as at December 31st, 2019:

This rebound and projected growth (some pundits are predicting 25% – 30% growth in Melbourne and Sydney over the next 3 years) has put the topic of ‘affordability’ back into the spotlight.

The latest Perceptions of Housing Affordability report by CoreLogic noted the number one concern for survey respondents was their ability to save for a deposit. This was followed by getting approved for a loan, at a time when lenders are scrutinising every expense would-be borrowers make.

The Federal government opened their First Home Loan Deposit Scheme (FHLDS) on January 1st, however it’s limited to 10,000 places (there are approximately 110,000 loans given to first home buyers each year) and its capped at a $600,000 purchase price in Victoria and $700,000 in New South Wales. It’s a bit of a lottery and it is not going to have any lasting impact on affordability.

Going it alone

In the majority of cases, accessing credit without assistance from parents is the only option and based on the median Melbourne house price of $860,000 the minimum deposit at the majority of mainstream lenders (who offer competitive interest rates) is approximately $125,398 after allowing for Government costs and estimated legal and lender fees. This does not include the substantial Lenders Mortgage Insurance premium (in excess of $28,000 at this level), along with a potentially higher interest rate (see below) that is added to the loan and tougher loan approval criteria. Keep in mind that Lenders Mortgage Insurance only protects the lender so it’s a substantial additional cost.

How can parents help?

Some common ways for parents to assist include:

- rent-free accommodation;

- co-ownership (all parties on title);

- a cash deposit; and

- a limited security guarantee.

The rate of price growth in the property market often outpaces a first home buyer’s ability to save so whilst the rent-free accommodation is a kind gesture, it may not result in entry to the property at the desired price point.

Co-ownership can present difficulties for all parties. The child would not be responsible for servicing the parent’s share of the debt and the parents are usually at a very different financial stage of life so their ability to exit the loan and property sale is very important. This can lead to challenges around possible Capital Gains Tax and stamp duty if the child wishes to remain in the property when you exit.

A cash deposit can be a welcome and helping hand up the property ladder from parents however it can leave a substantial hole in cash reserves and opportunity cost (i.e. could the cash have been invested elsewhere) should also be considered.

A limited security guarantee usually involves a registered mortgage over property owned by parents (or siblings at some lenders) limited to the required loan amount above 80% of the child’s property purchase valuation. It will remove the requirement to pay Lenders Mortgage Insurance and it will usually open up more competitive variable interest rates, as most lenders price for risk i.e. they will be more likely to negotiate when their risk is lower.

To elaborate further, and using the previously mentioned Melbourne median house price of $860,000 as the example, if the purchaser had saved $40,000 and was able to contribute this amount towards the purchase, the parents guarantee amount would be limited to $184,298.

Cost of not helping

In 2018, CoreLogic completed a study of historical property prices across Australia and they stated that if the historic averages continue, Sydney house values would be breaking the $6.3 million mark and Melbourne would be over $5.8 million by 2043. These numbers are staggering. Whilst an early inheritance may not have been on the radar of many parents, the idea of funding a much higher entry price after they’re deceased (and with possible tax consequences), might bring the discussion forward.

What are the risks?

Many structures and specific products have been designed for the purpose of allowing parents to assist their children with property acquisition. However, loan security guarantees from family members, and the lack of lender controls around them were raised as a key issue in multiple cases at the 2018 Royal Commission into misconduct in the Banking, Superannuation and Financial Services Industry. APRA has recently backed this up by expressing concerns around the possibility of parents entering unconscionable deals with children, which are also commonly uncommercial, and which create big financial liabilities for them in their retirement.

Some of the key risks to consider include:

- children who split from their partner and cannot afford to repay the loan;

- loan default and parents becoming liable for the repayments; and

- impact to retirement if the family home needs to be sold whilst a guarantee mortgage is registered against it.

A 6 step action plan

- Documentation. Decide if you are contributing cash or equity in a property and document it. Consider if you want protection in the event of a child’s relationship breakdown. Will your original deposit contribution be removed from a subsequent property settlement? Consider how your contribution impacts your estate plans and the child’s siblings (if applicable). Is a new Will required? Decide if your contribution is repayable and if yes, also discuss the loan terms. Is a binding financial agreement required? Seek independent legal and financial advice.

- Structure. If you are providing equity ensure your child’s loan is structured properly. In our business we always recommend that clients split their home loan, even if using the same loan product, rate etc.., This provides an easily identifiable guarantee portion which can be targeted for accelerated debt repayment and release of the guarantee property. We also prefer to separate the security properties, so the parents’ property is only securing the smaller loan in the child’s name.

- Planning. Work with your child to ensure they understand risk and money management. If the contribution is repayable, either to you directly, or to a lender under a guarantee structure, there should be a clear debt repayment and exit plan to focus on the release of the guarantor property as quickly as possible. Stress-testing at higher interest rates and reduced income levels should be undertaken prior to entering any loan agreement.

- Insurance. We encourage our clients to seek professional advice on personal risk insurance. This can include life insurance, total and permanent disablement insurance, trauma insurance and income protection insurance. These insurances are an important consideration for any home loan borrower, and they should be viewed as a critical component of any risk management plan when a parent’s property is at risk.

- Review. If the contribution is repayable, either to you directly, or to a lender under a guarantee structure, regular reviews of your child’s property value and borrowing capacity should be undertaken. It is easy to ‘set and forget’ under a home loan structure and this mindset may unnecessarily delay the release of your property as security and expose you to an extended period of risk.

- Loan advice. In a lending environment that is continually changing, and one that has recently seen the introduction of new standards such as comprehensive credit reporting and open banking, it has never been more important to obtain professional credit advice. If you would like to more about guarantor lending, or any type of finance, please do not hesitate to contact me on 0417 109 585 or [email protected].

Author details

Karl Bower is Managing Director of Bower & Co. Advisory (www.bowerco.com.au), a boutique Mortgage Broker firm with a mission to help their clients reduce debt, protect their assets and build wealth. The business was established in 2006 and Karl has worked in the banking and financial services industry since 1995.

General disclaimer

The information provided in this article is for general information only. Please do not rely on the content as a substitute for specific legal or financial advice. Before making any decisions, you should consider your specific objectives, financial situation and needs.

Reach Markets Disclaimer

This article is provided by Karl Bower, Managing Director of Bower & Co. Advisory (www.bowerco.com.au). The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

This publication contains general securities advice and does not take into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision on the basis of this advice, you need to consider, with or without the assistance of a securities adviser, whether the advice in this publication is appropriate in light of your particular investment needs, objectives and financial situation.

Reach Markets and its associates within the meaning of the Corporations Act may hold securities in the companies referred to in this publication. Reach Markets does, and seeks to do, business with companies that are the subject of its research reports. Reach Markets believes that the advice and information herein is accurate and reliable, but no warranties of accuracy, reliability or completeness are given (except insofar as liability under any statute cannot be excluded). No responsibility for any errors or omissions or any negligence is accepted by Reach Markets or any of its directors, employees or agents. This publication must not be distributed to retail investors outside of Australia.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.