Trade Of The Week: Bearish – CIM – LITT Short

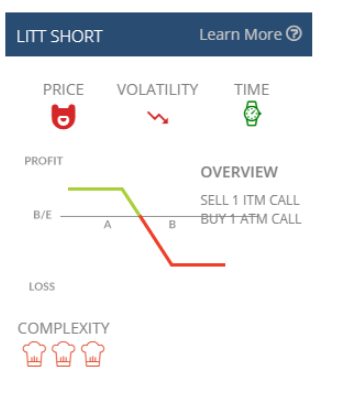

Our trade of the week this week is a LITT Short on CIM. This trade was not flagged by our scanners however now that the ADX has risen and the stock is trading slightly above 52 week lows it could be flagged any day. This trade is an at-the-money Bear Call Spread. With this trade you receive your maximum profit up front in options premium and the best outcome is for the position to expire worthless.

Our trade of the week this week is a LITT Short on CIM. This trade was not flagged by our scanners however now that the ADX has risen and the stock is trading slightly above 52 week lows it could be flagged any day. This trade is an at-the-money Bear Call Spread. With this trade you receive your maximum profit up front in options premium and the best outcome is for the position to expire worthless.

Here are some of the key facts that have contributed to this trade idea:

- We are looking to enter the position close to 45 days to expiry (currently 43 DTE).

- The stock price is below the 50 Day MA, which in turn is below the 200 Day MA.

- CIM has been seeing a lot of price action around $28.00. sellers break through this support level there me be another breakout move lower.

- IV Rank is favourable.

- Liquidity is poor so you may have to move away from the theoretical price to get filled.

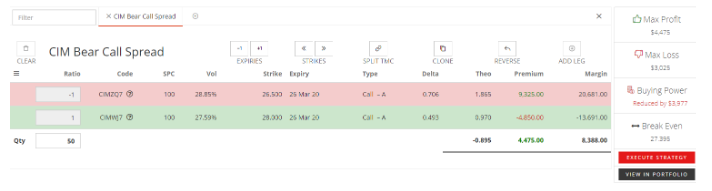

With the stock currently trading at $27.81 we are looking at trading the following strikes:

Sold Call 26.50 26 Mar 20 Call @ 186.50

Bought Call 28.00 26 Mar 20 Call @ -97

At the close of trading today we’re looking at around a 89.5 credit to enter into this trade.

With 50 units your best outcome in this trade is for both legs to expire worthless so you can keep the upfront premium. The theoretical maximum profit is currently $4,475, with the theoretical maximum loss $3025. The maximum profit will be achieved if the options expire worthless on the 26th of March 2020 with the CIM stock price closing below strike price of the sold call at $26.50. If the stock expires at or above the strike of the protective call at $28.00 the maximum loss will occur. The breakeven is at $27.395.

To try trading for yourself using the most powerful Options Trading technology in Australia, click here for a trial for our Implied Volatility platform.

We wish you good luck with your trading, and as always if you have any questions, please feel free to contact our trading desk on (03) 8080 5795.

Past returns do not reflect future returns.

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.