ResMed Inc

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 06/08/18 | RMD | A$14.45 | A$15.35 | NEUTRAL |

| Date of Report 06/08/18 | ASX RMD |

| Price A$14.45 | Price Target A$15.35 |

| Analyst Recommendation NEUTRAL | |

| Sector : Healthcare | 52-Week Range: A$9.16 – 14.93 |

| Industry: Medical devices & equipment | Market Cap: A$20,626m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate RMD as a Neutral for the following reasons:

- Global leader in a significantly under-penetrated sleep apnea market.

- High barriers to entry in establishing global distribution channels.

- Strong R&D program ensuring RMD remains ahead of competitors.

- Growth in masks accelerating in FY18, lifting gross profit margins.

- Bolt-on acquisitions to supplement organic growth.

- Leveraged to a falling Australian dollar.

- Share buyback to be supportive of share price.

We see the following key risks to our investment thesis:

- Disruptive technology leading to better patient compliance.

- Product recall leading to reputational damage.

- Competitive threats leading to market share loss.

- Disappointing growth (company and industry specific).

- Adverse currency movements (AUD, EUR, USD).

- RMD needs to grow to maintain its high PE trading multiple. Therefore, any impact on growth may put pressure on RMD’s valuation.

ANALYST’S NOTE

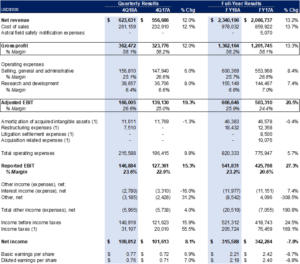

RMD’s fourth quarter FY18 (4Q18) results came in line with market expectations, with revenue of US$623.6m +12% above pcp and adjusted EPS of US95cps +23% above pcp. For the full year (FY18), revenue of US$2.34bn was +13.2% above pcp but -2.0% below our estimates. Adjusted operating earnings (EBIT) of US$607m was -1.7% below our estimates and +21% above pcp. Both gross margin of 58.2% (equal to our estimates) and EBIT margin of 25.9% were in line with our expectations. Solid top line growth was complemented with strong costs control over the quarter, with SG&A increasing by just +3% and R&D up +6% on pcp (in constant currency terms). This meant that the group adjusted EBIT margins expand by 160bps on pcp over the quarter.

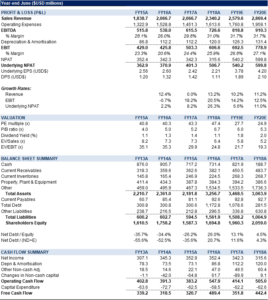

We maintain our Neutral recommendation. We continue to see solid revenue growth as the Company continues to capitalize on increasing penetration of cloud connected devices and ongoing focus on operating efficiency which should be supportive of earnings growth and operating leverage.

In the near-term, competitor product launches will likely see RMD’s growth rates moderate, leading to a more market growth rate profile. However, as an external study noted, approximately 936m people suffer sleep apnea globally and 425m sufferers would be considered moderate to severe. The long-term outlook remains very attractive.

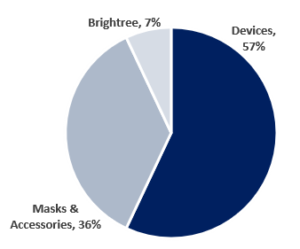

- 4Q18 results. RMD’s fourth quarter FY18 (4Q18) results were in line with market expectations, with revenue of US$623.6m in line with estimates of US$623.9m and adjusted EPS of US95 cps in line with market estimates of US95cps. The Company raised its quarterly dividend to US37cps from US35cps. Devices revenue in the Americas was up +9% on pcp, whilst for the RoW was up +6% in CC terms. Masks & Accessories had a solid quarter, with global constant currency (CC) growth of +13% and +12% growth in Americas.

RMD winning market share. Management noted they are winning market share in masks and devices. Whilst the extra market growth rate is difficult to determine, according to management (and consistent for a number of years now), the devices market is growing at mid-single digits and the masks market is growing at high single digits.

- Gross margins slightly disappointed. Gross profit (GP) margins for the quarter and full year were largely unchanged from pcp, despite the strong growth in mask and accessories which is a higher margin product (vs. devices). Management noted the largely flat year on year outcome at the GP line was due to decline in average selling prices (ASP) partially offset by manufacturing and procurement efficiencies.

- Outlook guidance slightly positive on costs. Management FY19 guidance was slightly positive for SG&A expenses, which are now expected to be in the range of 24-25% of revenue, lower than previous guidance of around 25%. Management continues to see more efficiencies gains coming from the back office. On the negative side, effective tax rate guidance range of 22-24% was slightly above our expectations.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

TRADING UPDATE

Trading update – key points.

1. Gross profit margin is expected to be broadly consistent with 4Q18 (58.1%), assuming current exchange rates and, products and geographic mix;

2. SG&A expenses are expected to be in the range of 24-25% of revenue, which is lower than previous guidance of around 25%;

3. R&D expected to be 6-7% of revenue;

4. For FY19, the Company expects its effective tax rate to be in the range of 22-24%.

Revenue. Solid performance over the 4Q18 period, with RMD appearing to take market share in both devices and masks. Devices revenue in the Americas (U.S., Canada, Latin America) was up +9% on pcp for the quarter, whilst for the RoW it was up +6% in CC terms (up +12%). Masks & Accessories had a solid quarter, with global constant currency (CC) growth of +13%, with Europe and Asian markets growing at +16% in CC terms. Masks growth in U.S., Canada and Latin America was +12% over the same period.

RMD winning market share. Management noted they are winning market share in masks and devices. Whilst the extra market growth rate is difficult to determine, according to management (and consistent for a number of years now) devices market is growing at mid-single digits and the masks market is growing at high single digits.

Revenue tailwinds during the year. Change in reimbursement incentives in Japan and France over the year had a positive impact on performance as customers increased their adoption of RMD’s cloud connected devices. However, management noted that in France they expect year on year growth to normalize in FY19. Further, South Korea also began reimbursing diagnosis and therapeutic treatment for sleep apnea in July. Whilst not a large market as RMD’s U.S., France and Japan, nonetheless it’s a positive.

Healthcarefirst. Management noted that on 9 July, the Company had acquired Healthcarefirst, which offers electronic health record software, billing and coding services as well as advanced analytics to home health and hospice agencies. The acquisition will allow RMD to grow in the home health and hospice segment and complements existing solutions from Brightree. For calendar year 2017, Healthcarefirst reported revenue of US$29m.

Costs. Strong costs control over the quarter was a key standout from our point of view, with SG&A increasing by +3% and R&D up +6% on pcp (CC). With double digit revenue growth and strong cost control, group adjusted EBIT margins expanded 160bps on pcp over the quarter.

Outlook guidance. Management provided the following outlook statements for FY19:

1. Gross profit margin is expected to be broadly consistent with 4Q18 (58.1%), assuming current exchange rates and, products and geographic mix;

2. SG&A expenses are expected to be in the range of 24-25% of revenue, which is lower than previous guidance of around 25%;

3. R&D expected to be 6-7% of revenue;

4. For FY19, the Company expects its effective tax rate to be in the range of 22-24%.

SUMMARY OF 4Q18 & FY18 RESULTS…

We have summarised RMD’s 4Q18 profit & loss (P&L) in the table below. FY18 revenue of US$2.34bn was +13.2% above previous corresponding period (pcp) but -2.0% below our estimates. Adjusted operating earnings (EBIT) of US$607m was -1.7% below our estimates and +21% above pcp. Both gross margin of 58.2% (inline) and EBIT margin of 25.9% were in line with our expectations.

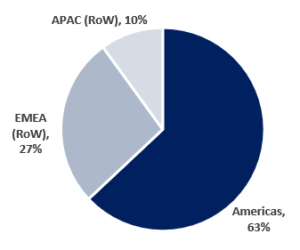

Figure 1: RMD revenue by region

Source: Company, 4Q17

Source: Company, 2Q17

Figure 3: RMD 4Q18 & FY18 P&L summary

Source: BTIG estimates, Company

Figure 4: RMD Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

ResMed Inc (RMD) develops, manufactures, and markets medical equipment for the treatment of sleep disordered breathing. The company sells diagnostic and treatment devices in various countries through its subsidiaries and independent distributors. RMD reports two main segments – Americas and Rest of the World (RoW) – with US its largest market. The company is listed on the Australian Stock Exchange (ASX) via CDIs (10:1 ratio).

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >