How to Trade in a Bear Market

Thursday 12 March marked the end of the 11-year bull run, and introduced the beginning of a bear market.

Thursday 12 March marked the end of the 11-year bull run, and introduced the beginning of a bear market.

Volatility is usually higher in bear markets, investor confidence drops, and many investors opt to sell off their stocks over fear of further losses, thus fueling a cycle of losing value and potential. This time is no different. The market has S&P/ASX200 has dropped 33% in the last three weeks and many are unsure of how to navigate.

Bear markets are usually rectified naturally; as the stock prices fall, some investors will choose to buy up the cheap stock. This buying pressure can bolster the market, causing it to change trading trajectory to sideways, or become the favourable ‘bull market’ as confidence increases. To contextualise this cycle, from 1900 to 2013 there were 32 bear market periods, lasting an average of 15 months each period.

But for now, as the market falls, it’s important to know how to trade in these conditions.

As John Maynard Keynes said: “Markets can stay irrational longer than you can stay solvent.”

There are a few tips and tricks for trading during the low morale of the bear period.

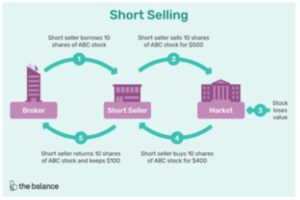

The first is shorting. Although it has restrictions under Australian Law, there are methods of shorting that are entirely above board. Shorting refers to “selling” stocks you do not actually own in the hope of buying them back at a lower price. While shorting can be suitable for the advanced investor, buying put Options is another more widely available and safer method of trading in a bearish market.

An Option is a financial contract which gives the buyer the right, but not the obligation, to buy or sell an underlying asset at an agreed upon price prior to or on a specified date. There are two types of Options – Call Options and Put Options.

The buyer of a ‘Call Option’ contract has the right, but not the obligation, to buy an underlying asset at a specified price for a specified time at an agreed upon premium.

The buyer of a ‘Put Option’ contract has the right, but not the obligation, to sell an underlying asset at a specified price for a specified time at an agreed upon premium.

The ‘Strike Price’ is the agreed upon price at which you can buy or sell the underlying asset.

When you buy a call option, the value of this option will increase as the price of the underlying asset increases above the strike price. This is because you own a contract which allows you to buy the underlying asset at the strike price. As the market price of the underlying asset has risen above the strike price, you can exercise your option to purchase the underlying asset below the market price, then sell the underlying asset back at the market price, keeping the difference in prices as profit.

When you buy a put option, the value will increase as the price of the underlying asset decreases below the strike price. This is because you own a contract which allows you to sell the underlying asset at the strike price, as the market price of the underlying asset has fallen below the strike price. That means you can exercise your option to sell the underlying asset above the market price, then buy the underlying asset back at the market price, keeping the difference in prices as profit.

Trading put Options is well-suited for bear market conditions.

How to trade Options in a bear market

The Long Put and Bear Put Spread are two of the most popular Options Strategies in a Bear Market.

The simplest bear market strategy to understand is the ‘Long Put’. A long put position is entered into by simply buying put contracts with the strike price ‘A’ shown above. You will initially pay a premium to enter this position. The value of the option contracts will increase the further the market falls below the strike price ‘A’.

Another popular strategy is the Bear Put Spread. The position is entered into by buying one put contract at strike ‘A’, and selling one put contract at strike ‘B’. You will reach you maximum profit at strike ‘A’ and maximum loss at strike ‘B’. Compared to a long put strategy you will have a lower maximum profit but also a lower maximum loss.

With short-selling of equities being unavailable to most retail investors, option trading is a very attractive alternative. These contracts allow you to capture the downside movements in the market.

To capitalise in bearish times it is important to remain as informed as you can, structure your own trading system in which you can remain resilient and profitable in spite of market volatility, and set up strategies that will work in those conditions.

*Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it is appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.