Folkestone Education Trust (FET) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/08/18 | FET | A$2.71 | A$3.10 | BUY |

| Date of Report 09/08/18 | ASX FET |

| Price A$2.71 | Price Target A$3.10 |

| Analyst Recommendation BUY | |

| Sector : Financials | 52-Week Range: A$2.56 – 3.00 |

| Industry: REIT | Market Cap: A$697.5m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate FET as a BUY for the following reasons:

- FET is a play on

1. population growth;

2. increasing awareness in the importance of early childhood education;

3. increasing number of families with both parents working and hence demand for child care services (3.7% increase in families using LDC services in 12 months since September 2017). - FET’s tenants possess strong financials (~55% Goodstart Early Learning, 9% Only About Children, 8% Best Start Educare, 8% G8 Education and 20% other).

- Continual acquisitive activity, repositioning and recycling for increased operator profitability NQS quality ratings and expansion.

- Strong history of delivering continuing shareholder return and dividends.

- Solid balance sheet position.

- Strong property portfolio metrics.

- Strong focus on decreasing reliance on CPI rent reviews for consistent and enhanced long term rental growth.

- Manageable excess supply coming online at the site of FET’s existing assets over the next two years.

- Currently trading inline to its NTA.

We see the following key risks to our investment thesis:

- Regulatory risks.

- Deteriorating property fundamentals.

- Concentration tenancy risk, especially around Goodstart Early Learning.

- Sentiment towards REITs as bond proxies stocks impacted by expected cash rate hikes.

- Oversupply of childcare centres

- Slow wage growth and on the back of rising costs of living. (however, increased funding at mid-lower end of the income families may provide relief.

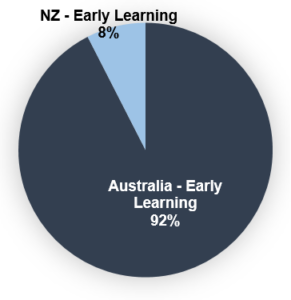

Figure 1: : Segment split by carrying value

Source: Company

ANALYST’S NOTE

Folkestone Education Trust (FET) has been the best performing A-REIT on the S&PASX300 Index over a 10 year period, and second over a 5 year period (as of 30 June 2018).

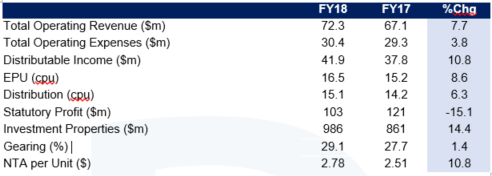

FET’s FY18 results were solid, reflecting robust earnings with distributable income of $41.9m, an increase of +10.8% over the previous year.

Distribution saw an increase of +6.3% on pcp to 15.1 cents per unit (cpu). Whilst the sector may experience short to medium-term oversupply pressures, FET’s leading market position, government incentives (such as subsidies), continual Australian job growth, population growth as well as increasing awareness in the importance of early childhood education, will see increased utilization of long day care services in our view.

Net Tangible Assets (NTA) increased by +10.8% to $2.78 per unit mainly due to property reevaluations; FET’s share price is currently trading largely in line with its NTA. We reiterate our long-term Buy recommendation.

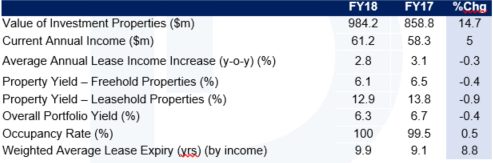

- Property portfolio performance continues to stand out.

Key highlights:

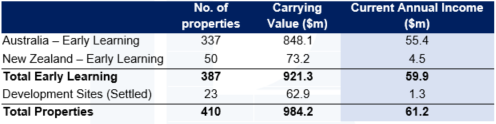

1. annual income of $61.2m, was up +5.0%.

2. Value of properties grew +14.7% to $984.2m.

3. Weighted average lease expiry (WALE) grew to 9.9 years (from 9.1 years) and the portfolio is 100% occupied.

4. 34 market reviews resulted in a +4.7% increase overall.

5. Over FY18, 62 properties out of the 355 properties in the portfolio were revalued resulting in an uplift of ~$56.7.

6. FET disposed of 19 properties providing total gross proceeds of $56.7m at an average yield of 6.3% and a +8.9% premium to carrying values as at the contracted date.

- Development pipeline remains strong. FET’s development pipeline consists of 29 sites with a forecasted completion value of A$170.3m. Upon completion (expected to be settled in FY19), management believes that they will add ~A$10.6m per annum of net rental income

- Strong industry outlook despite rising childcare fees and low wage growth. While rising costs of living and low wage growth may hinder demand and hence profitability, the government has issued a new funding package to mitigate such issues. The CCS package (started in July 2018) will reduce out of pocket expenses to parents who may be eligible based upon income levels and utilisation. Further, increasing population and job growth has fueled the construction of new childcare centres, adding to a historically undersupplied market, and in FET’s management’s view, in line with demand. Management has also indicated that concerns about overall oversupply are overblown, as the tightening criteria for debt funding and a general reduction in expansion plans by operators will moderate growth in supply. Further, it is likely that any added pressures from oversupply will likely lead to delay in delivery, deferment or cancellation of numerous projects (over 5 years, <50% of sites that have received development approval for childcare have been constructed).

- Solid balance sheet. Whilst FET’s gearing increased to 29.1% (from 27.7%), FET still retains significant headroom, with gearing level well below debt covenants and below its targeted long-term rate of 30-40%. FET’s cost of debt (all-in) has decreased from 4.1% to 4.5% over the previous period and weighted average debt maturity extended from 2.4 to 5.0 years. FET has $47m in debt capacity to fund the development pipeline.

- Strong FY19 outlook. Management expects completion of 8 developments during FY19, 14 market rent reviews and 11 option renewals due. On the analyst call, management guided to FY19 distributions forecast of 16.0 CPU (up +6.0% pcp).

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FET FY18 RESULTS SUMMARY

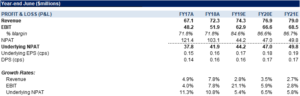

Figure 2: FET Results Summary

Source: Company

Figure 3: Property portfolio annual income breakdown 344 756.4

Source: Company

Figure 4: Property portfolio performance

Source: Company

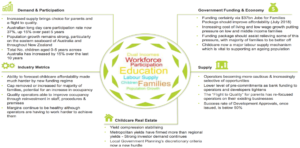

Figure 5: Childcare Overview FY18

Source: Company

Figure 6: FET Financial Summary

Source: Company

COMPANY DESCRIPTION

Folkestone Education Trust (FET) is an ASX listed Real Estate Investment Trust (REIT). It is the largest Australian property trust investing in early learning properties within Australia and New Zealand. The Trust has total assets under management of $829.1 million and 388 early learning properties in its portfolio. In June 2014, the Trust changed its name from Australian Education Trust (AEU) to Folkestone Education Trust.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >