Trade Of The Week: Bullish – ANZ – Long Call

Our trade of the week this week is a bullish range trade turned break out trade on ANZ Banking Group Limited. The stock was seeing most of its price action between the $15.00 to $15.50 levels which is on the lower end of its recent trading range. $15.00 was a major psychological support level with the bank being ‘too big to fail’ and with the bank trading at half the price of its pre-COVID levels. Many traders view the $15.00 to $15.50 level as a bargain price for this stock.

Our trade of the week this week is a bullish range trade turned break out trade on ANZ Banking Group Limited. The stock was seeing most of its price action between the $15.00 to $15.50 levels which is on the lower end of its recent trading range. $15.00 was a major psychological support level with the bank being ‘too big to fail’ and with the bank trading at half the price of its pre-COVID levels. Many traders view the $15.00 to $15.50 level as a bargain price for this stock.

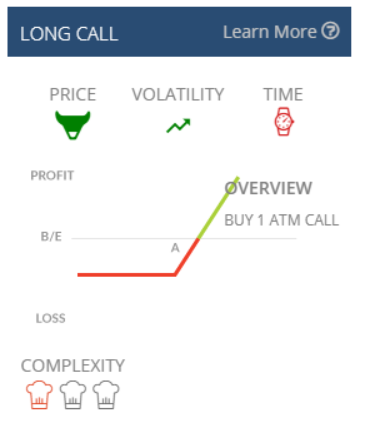

The trade of the week was entered into on the 25th of May and involved entering this position:

Long ANZ $16.00 June 25 Call (A) @ $0.50.

This trade has theoretically unlimited upside potential. However care must be taken as Implied Volatility is above 35 (which is high compared to the IV of 15 the stock is used to). This makes the option more expensive and the time decay more aggressive.

The best outcome is for the stock to shoot for the sky. Seeing prices closer to the $20 level by expiry is realistic (albeit optimistic) given where the stock has been valued historically.

The worst outcome is the option expires worthless if the stock stays below the $16.00 level.

An expiry date of June 25 2020 was chosen to lessen the effects of time decay on the position and to give the stock time to run. Closing out early is always an option – as profits can be locked in today, the current intrinsic value is kept and it prevents time decay from eroding the value of the position if it were to pull back toward the $16.00 level.

Based on pricing at 10:30am on the 2nd of June 2020, this position would currently be $12,500 positive, with a total value of $17,500.

To try trading for yourself using the most powerful Options Trading technology in Australia, click here for a trial for our Implied Volatility platform.

We wish you good luck with your trading, and as always if you have any questions, please feel free to contact our trading desk on (03) 8080 5795.

Past returns do not reflect future returns.

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it is appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.