Crown Resorts (CWN) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 08/08/18 | CWN | A$14.21 | A$14.60 | NEUTRAL |

| Date of Report 08/08/18 | ASX CWN |

| Price A$14.21 | Price Target A$14.60 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$10.8 – 13.88 |

| Industry: Casinos & Gaming | Market Cap: A$9,156.5m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CWN as a Neutral for the following reasons:

- VIP looks to be beginning to show signs of recovery.

- Quality mature assets, which are highly cash generative and difficult to replicate.

- New Sydney casino, if delivered on time and budget, could offer a significant step change in earnings for CWN.

- CWN is leveraged to growth in Australian tourism.

- Continued success of marketing initiatives could bump up VIP performance.

- Capital management initiatives – additional special dividends or share buy-backs.

We see the following key risks to our investment thesis:

- Competitive pressures, including international (for VIP play) and domestic competitors.

- Better than expected inbound Chinese tourism numbers into Australia.

- Any construction delays or regulatory risk with Crown Sydney.

- Credit-rating risk (given our expectation of significant capital expenditure over the next five years).

- Regulatory risk.

- Capital expenditure fails to deliver adequate returns.

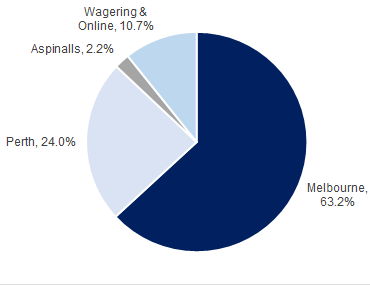

Figure 1: CWN revenue by segment

Source: Company

Source: Company

Source: CompanyANALYST’S NOTE

CWN’s FY18 results at the revenue and profit line both came in ahead of market expectations, with adjusted normalised NPAT (pre-significant item) of $386.8m ahead of estimates at $368.4m. However, this was driven by -54.6% decline in net interest expense over the year.

Nonetheless, CWN’s normalised EBITDA of $878.2m came in +2% above consensus estimate. The Company also re-commenced a $400m share buyback to start August 30.

Operating group revenue of $3.5bn was up +7.9% on prior corresponding period (pcp), driven by +38.2% growth in VIP program play in Melbourne (up +73.9%). However, given this is a lower margin business, EBITDA margin for Melbourne actually declined by 120bps over the year.

We maintain our Neutral recommendation based on valuation grounds, with CWN trading on a PE-multiple of ~24x whilst providing mid-single digit earnings growth, on our estimates. With a strong balance sheet and ongoing capital management, we expect the share price to be well supported.

- Group overview.

(1) Operating revenue of $3.5bn was up +7.9% on prior corresponding period (pcp), driven by +38.2% growth in VIP program play in Melbourne (up +73.9%).

(2) Both companies will merge into a newly created holding company (“New Amcor”) incorporated in the U.S. with an intended tax domicile in the UK.

(3) Normalised operating earnings (EBITDA) of $878.2m were up +6.1% on pcp, driven by Melbourne (+9.5%) and Wagering & Online (+81.8%).

(4) Final dividend of 30cps was declared, taking the full year dividend to 60cps, in line with expectations

- Crown Sydney on track. Crown is still on track for completion of the project by “first half of calendar year 2021.” Whilst capex for the Sydney project has been moved around, management have maintained their overall project cost estimate at $2.2bn gross ($1.4bn net). Management noted that 80% of the trade work has been contracted. Management also noted that stage 1 of the apartment sales had closed, however didn’t disclose any details (e.g. number of apartments).

- Capital management re-announced. CWN re-commenced the previously suspended share buy-back announced on 4 August 2017. CWN intends to undertake a new on-market share buy-back of approximately $400m of shares. Based on the pre-announcement share price of $13.32, the new buy-back equates to approximately 4.4% of issued capital.

- Why is CWN holding on to Aspinalls? Aspinalls continues to struggle, with revenue declining -35.5% to $64.4m and EBITDA fell -54.9% to $12m over the year. Management attributed a number factors leading to the underperformance:

(1) higher win rates in the business led a volume decline;

(2) disruption from refurbishment work at the club;

(3) stricter compliance requirements leading to reduced ability to have funds transferred into the UK; and

(4) drop in middle east customers base). Management noted that for clients travelling through to London, Aspinalls does benefit from this volume, however their VIP business in no way reliant on having this casino. We believe management is likely to consider this asset given some of the structural issues at play.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

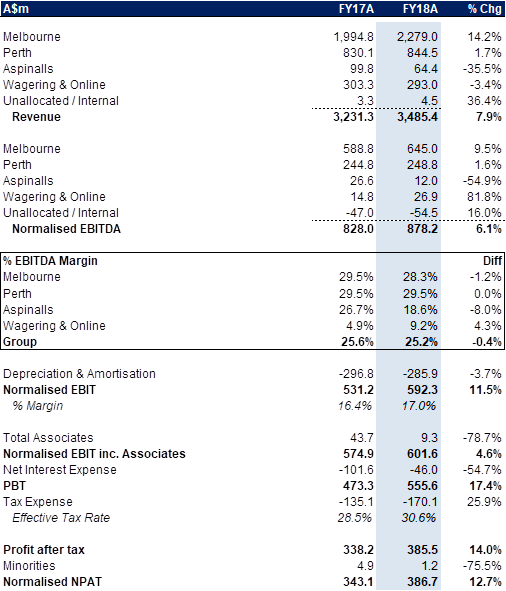

CWN FY18 RESULTS SUMMARY…

In the figure below, we present CWN’s FY18 normalised P&L relative to FY17.

Figure 3: CWN FY18 results summary

Group overview.

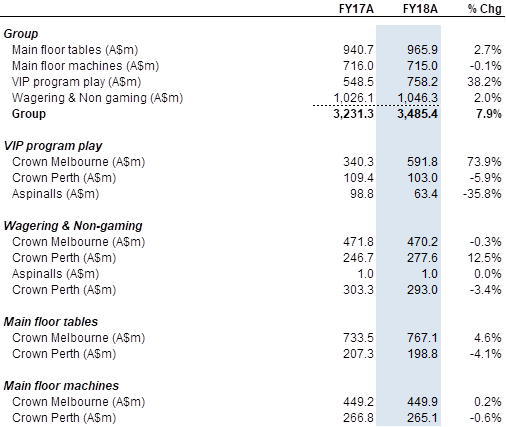

1. Operating revenue of $3.5bn was up +7.9% on prior corresponding period (pcp), driven by +38.2% growth in VIP program play in Melbourne (up +73.9%).

2. Normalised operating earnings (EBITDA) of $878.2m were up +6.1% on pcp, driven by Melbourne (+9.5%) and Wagering & Online (+81.8%).

3. Normalised NPAT of $386.7m was up +12.7 on pcp.

4. Final dividend of 30cps was declared, taking the full year dividend to 60cps, in line with expectations.

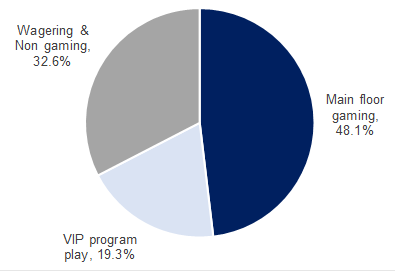

Figure 4: Revenue breakdown by activity

Source: BTIG, Company

Melbourne. Normalised EBITDA margins in Melbourne declined by 120bps over the year, driven by:

(1) strong growth in VIP program, which is a lower margin business;

(2) low growth in the main gaming floor revenue, which is a higher margin business; and

(3) increased in fixed costs (energy and insurance costs in particular) in Melbourne.

VIP coming from junkets. CWN is experiencing increased VIP volume coming from junkets. As management have previously noted, with a reduced business development team, junkets allow more effective way to attract clients given they are more organised and becoming more sophisticated. With direct now being a smaller part of the VIP segment, this clearly has an impact on CWN’s margins.

Perth improving, but still under pressure. Perth trading conditions appeared to have slightly improved relative to the first half, using the activity on the main gaming floor as a proxy. In the first half, main gaming floor revenue was down -3.3%. However, for the full year, revenue was down -2.2%, with second half revenue down -0.8%. Most of the year-on-year decline was attributable to main floor tables. The moderating rate of decline is an encouraging sign for trading conditions. Management called out that the premium end, rather than mass play, remains weak.

Sydney capex moving around. Whilst capex for the Sydney project has been moved around, management have maintained their overall project cost estimate at $2.2bn gross ($1.4bn net). Management noted that 80% of the trade work has been contracted in relation to this project, which means less and less chance of the final cost estimate moving out. Management also noted that stage 1 of the apartment sales had closed, however did not disclose any details (e.g. number of apartments).

Aspinalls. Aspinalls continues to struggle, with revenue declining -35.5% to $64.4m and EBITDA fell -54.9% to $12m over the year. Management attributed a number of factors leading to the underperformance:

(1) higher win rates in the business led a volume decline;

(2) disruption from refurbishment work at the club;

(3) stricter compliance requirements leading to reduced ability to have funds transferred into the UK; and

(4) drop in middle east customers base.

CWN VALUATION

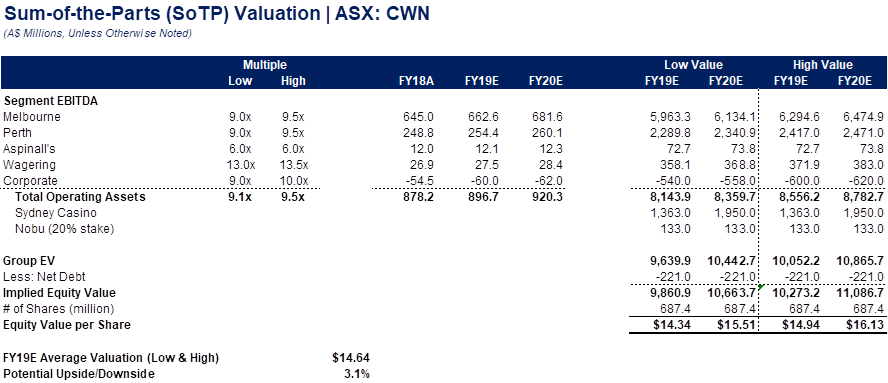

Figure 5: CWN SoTP valuation

Source: BTIG estimates

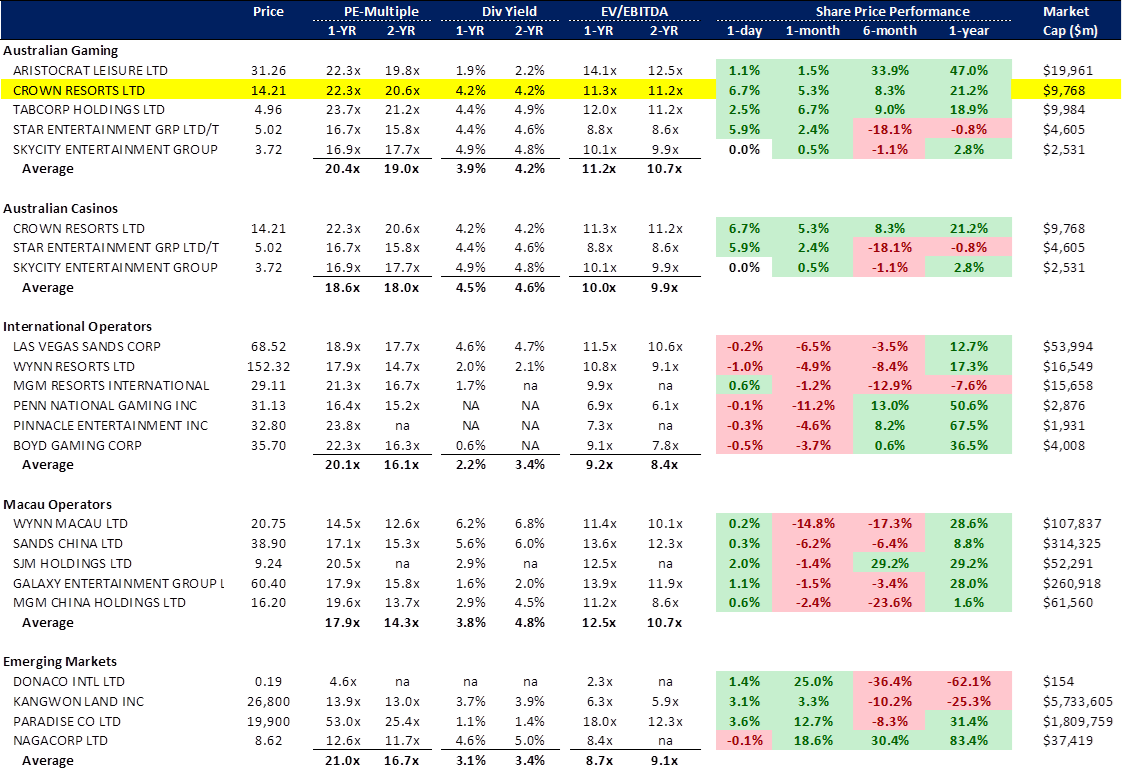

Figure 6: Gaming Comparables Table

Source: Company

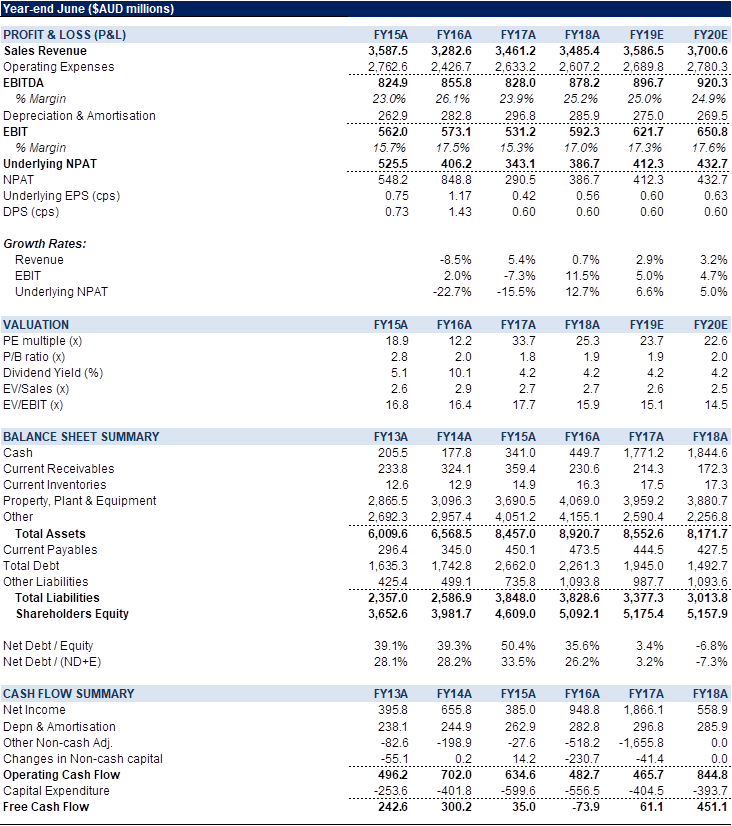

Figure 7: CWN Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Crown Resorts Ltd (CWN) is Australia’s largest operator of casinos along with hotels and conference centre facilities. In Australia, CWN owns and operates Crown Melbourne Entertainment Complex and Crown Perth Entertainment Complex which services mass market and VIP segments. Overseas, CWN also owns and operates Crown Aspinall’s in London. CWN also has a portfolio of other gaming investments. CWN’s wagering and on-line social gaming operations include Betfair Australasia (a 100% owned, on-line betting exchange) and DGN Games (a 70% owned, on-line social gaming business based in Austin, Texas).

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >