Baby Bunting Group (BBN) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | BBN | A$2.41 | A$2.60 | BUY |

| Date of Report 13/08/18 | ASX BBN |

| Price A$2.41 | Price Target A$2.60 |

| Analyst Recommendation BUY | |

| Sector : Consumer Discretionary | 52-Week Range: A$1.25 – 2.41 |

| Industry: Retail | Market Cap: A$303.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate BBN as a BUY for the following reasons:

- Mandatory product safety standards for baby goods in Australia limit supply sources and provide barriers to entry to international competitors.

- BBN has the largest presence in Australia amongst specialty baby goods retailers.

- Low risk that online sales threaten high service business model of brick and mortar stores to showcase goods and in-store advice.

- Solid growth story via new store openings (5 planned in FY19).

- Strong market shares (currently sits at ~12% in a highly fragmented market).

We see the following key risks to our investment thesis:

- Retail environment and general economic conditions in addressable markets may deteriorate.

- Competition may intensify especially from online retailers such as Amazon, specialty retailers, department stores, and discounted department stores.

- Customer buying habits/trends may change. Rapid changes in customer buying habits and preferences may make it difficult for the Company to keep up with and respond to customer demands.

- Higher operating and occupancy costs. Any increase in operating costs especially labour costs will affect the Company’s profitability.

- Poor inventory control and product sourcing may be disrupted.

- Management performance risks such as poor execution of store rollout especially into ex-metro areas.

ANALYST’S NOTE

Baby Bunting (BBN) reported solid FY18 results. In prior research reports, we have commented extensively our thoughts on how BBN competes against competitors and specifically implications of Amazon’s forays into Australia – we rated the management team and strategy highly when the market was concerned (and we dare say, at times overly critical).

BBN’s FY18 results were solid but what is more interesting, and we quote management, “BBN’s top 4 specialty baby goods competitors all entered external administration resulting in significant price deflation as a result of distressed retailing. Despite this, BBN was still able to grow sales and transaction volumes within the difficult trading environment”.

The investment debate is:

1. What is the extent of price deflation and when will it end? (in our view, we see prices stabilizing when the competitors in administration fully exit)

2. Whether BBN can execute its store rollout strategy, especially to rural and suburban areas that may not have the population density or supportive demographics; and

3. How large is the Amazon threat? (though we do note the success of BBN’s private label and exclusive products offering and 79% of BBN’s top 250 products are not offered by Amazon).

Since our last Buy report and the share price appreciation, BBN is not as attractive and trades on 24.5x one-year price to earnings and 3.2% dividend yield. However, with a solid team, net cash position (strong balance sheet) and well positioned in the market place – reiterate Buy rating

- FY18 results overview. Key highlights include:

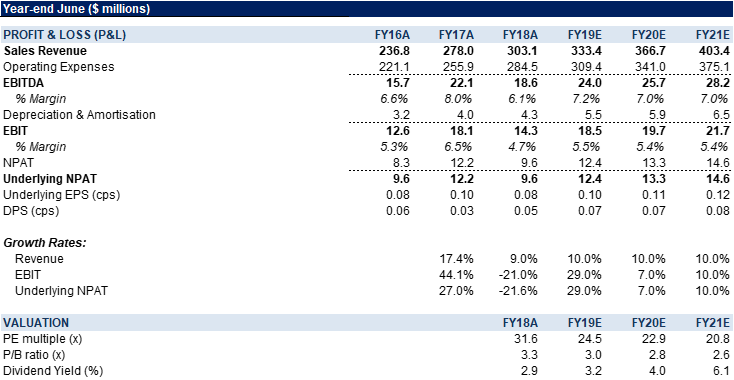

1. sales revenue came in at $303.1m, up +9.0% on the prior corresponding period (pcp) with comparable store sales flat (pcp).

2. At the gross profit income line, this was up +5.9%.

3. Gross margin was slightly impacted by price deflation at 33.3% (versus 34.3% in FY17). Pro forma cost of doing business (CODB) was $82.3m, or 27.1% of sales was an increase of 113 bps over the pcp.

4. Pro forma EBITDA of $18.6m, was down 18.9% versus the pcp.

5. The Board announced a final fully franked dividend of 2.5cps (total dividends of 5.3cps equates to ~70% of the Company’s FY18 pro forma NPAT and lower than in the 7.2 cps paid in FY17).

- FY19 trading and outlook. On the analyst call, management highlighted that they saw “Strong trading for the first six weeks of FY19 with comparable store sales growth of 9.8%” and expect “gross profit margin to recover to be +34% in FY19” as well as FY19 EBITDA “to be in the range of $24m to $27m, excluding employee equity incentive expenses”. This implies that management is expecting “growth of around 30% to around 45%”. The assumptions that management uses includes: comparable store sales growth of mid to high single digits as BBN captures market share from competitors who have exited the market; gross margin to exceed 34% in FY19; and 6 new stores to open (including Toowoomba which opened in July 2018).

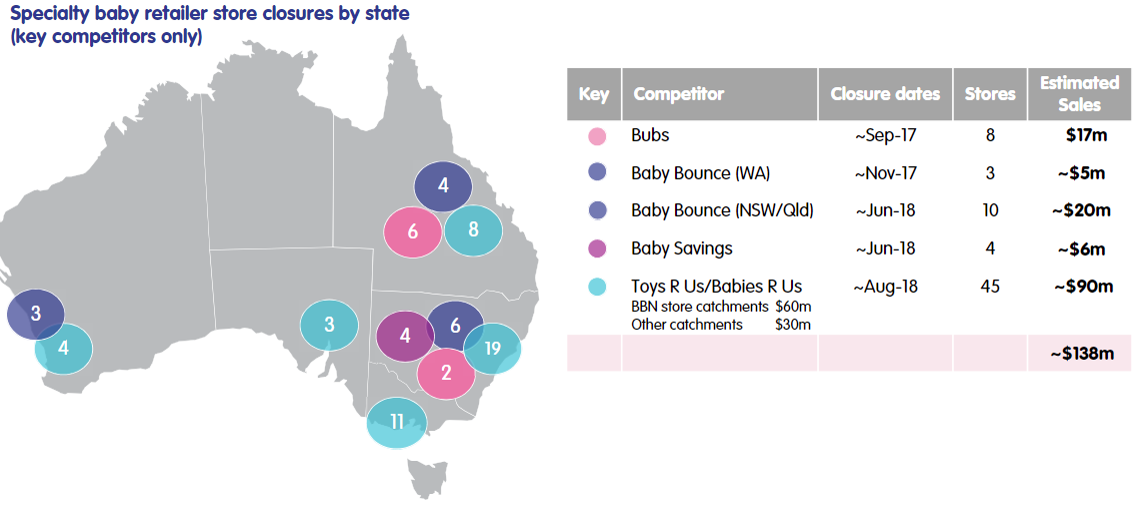

- Store roll-out on track as Baby Bunting’s top 4 specialty baby goods competitors all entered external administration. BBN opened five new stores in FY18 (with Toowoomba, Qld) opening in July 2018. Total number of stores currently stands at 48. According to management on the analyst call, BBN expects to open another three stores in 1H FY19 and two more in 2H FY19. Interestingly, as we have noted in previous research notes, four of BBN’s specialty baby goods competitors all enter administration and as we note closures at Toys R Us / Babies R Us, BBN’s management team is assessing potential store opportunities.

- Expansion of private label and exclusive products wades off competitors. In previous research reports we have commented extensively our thoughts on how BBN competes against competitors and specifically implications of Amazon’s forays into Australia. In FY18, according to management, revenue from BBN’s range of private label and exclusive products grew 100%. ~20.9% of total sales came from this category and was driven by backing of key suppliers who expanded their products range sold exclusively through BBN (especially in the prams and strollers, cots and furniture and the car safety categories).

- Online digital strategy continues to do well. BBN’s saw online sales growth 63% and made up 9.5% of total sales. BBN continues to reap the benefits of its ‘click and collect’ strategy, which grew 66% (and was 27% of online sales) and increases following the establishment of a store in that area. On the analyst call, management pointed to further developments in the website re-platform project with the objective of deploying a new e-commerce platform.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 RESULTS SUMMARY

Figure 1: Specialty Store Closures

Source: Company

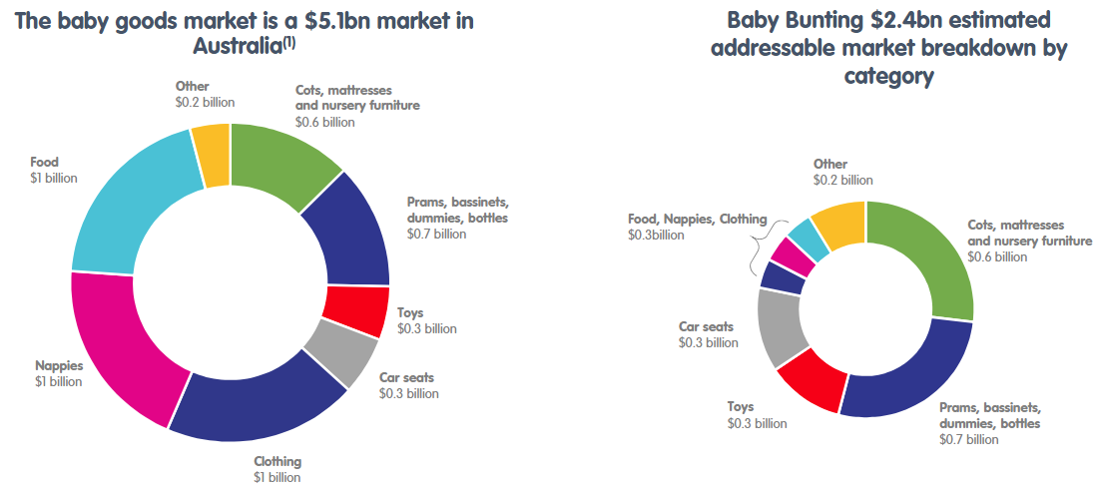

Figure 2: BBN Addressable Market

Source: Company

Figure 3: Domestic Retail Comps

Source: BTIG, Company, Bloomberg

Figure 4: BBN Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Baby Bunting Group Limited (BBN) is Australia’s largest nursery retailer and one-stop-baby shop with 42 stores across Australia. The company is a specialist retailer catering to parents with children from newborn to 3 years of age. Products include Prams, Car Seats, Carriers, Furniture, Nursery, Safety, Babywear, Manchester, Changing, Toys, Feeding and others.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >