Magellan Financial Group (MFG) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | MFG | A$27.96 | A$29.05 | NEUTRAL |

| Date of Report 13/08/18 | ASX MFG |

| Price A$27.96 | Price Target A$29.05 |

| Analyst Recommendation NEUTRAL | |

| Sector : Financials | 52-Week Range: A$21.8 – 28.4 |

| Industry: Asset Management | Market Cap: A$4,253.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate MFG as a Neutral for the following reasons:

- Trades on expensive valuations and at a premium to its peer-group.

- Acquisitions could pave growth runways, helping to ease the Company’s fund capacity constraints.

- Average base management fee (bps) per annum (excluding performance fee) continues to be stable but there are risks to the downside from pressures on fees (which is an industry trend not specific to MFG alone).

- Risk of potential funds outflow – both retail and institutional (loss of a large mandate).

- Potential change in regulation (superannuation) with more focus on retirement income (annuities) than wealth creation.

We see the following key risks to our investment thesis:

- Decline in fund performance (and hence cause outflows, and lower performance fees).

- Execution risk with the acquisitions.

- Significant key man risk around Hamish Douglass and key management or investment management personnel.

ANALYST’S NOTE

Magellan Financial Group (MFG) FY18 results were strong in our view. Key highlights to FY18 results were:

1. Average funds under management (which increased by 29% from $45.7 billion to $59.0 billion);

2. Profit before tax and performance fees of the Funds Management business increased by 29% to $291.8 million;

3. The Group’s net profit after tax (excluding the one-off Magellan Global Trust net offer costs and non-cash amortisation) increased by +37% to $268.9m (from $196.2m in the pcp); and

4. Total dividends up +57% to 134.5cps with the revised dividend policy positive for investor sentiment.

We reiterate our Neutral position on the basis:

1. We highly rate the management team;

2. Note the strong ability of the firm to attract inflows;

3. MFG has a solid dividend yield;

4. Acknowledge the growth that recent acquisitions potentially provide and management’s strategy going forward; However, MFG still trades at a premium to comparable managers, and we see better value elsewhere.

- Revised dividend policy bodes well for investor sentiment. MFG undertook a review of its ongoing capital requirements and revised its dividend policy to increase its payout ratio. MFG will “pay Interim and Final Dividends of 90% to 95% of the NPAT of the Group’s Funds Management business (excluding performance fees)”. In addition to the Interim and Final Dividends, the Group will pay an annual Performance Fee Dividend of 90% to 95% of the net crystallised performance fees after tax. MFG declared total dividends of 134.5cps for the year, an increase of +57% over the pcp(Final Dividend of 75.1cps (inclusive of a top amount of 8.4cps to align the previously paid Interim Dividend to the new dividend policy and a Performance Fee Dividend of 14.9cps).

- Funds management segment performed strongly. Earnings (profit before tax) jumped +33% to $331.4m (versus $248.3m in the pcp). Before performance fees, earnings jumped +29% to $291.8m (versus $226.8m in the pcp). The strong results were driven by

1. strong investment performance in MFG’s global equities and infrastructure strategies;

2. net inflows of $4.4bn;

3. Acquisition of the Frontier Group (MFG’s North American distribution partner) and acquisition of Airlie Funds Management (“Airlie”) and the launch of the Airlie Australian Share Fund.

4. Further, the segment improved efficiency with a cost to income ratio (excluding performance fees) of 25.0% compared with 26.3% in 2017.

- Funds under management growth. MFG currently has FUM of $69.5bn (split between global equities (76%), infrastructure equities (15%) and Australian equities (9%)) versus FUM of $50.6bn in the pcp. The uplift was due to (1) increase in FUM driven by investment performance of ~$8.5 billion less cash distributions (net of reinvestment) of ~$0.3 billion, net inflows of $4.4 billion and the acquisition of Airlie in March 2018 ($6.3bn).

- Sound growth strategy going forward. In terms of total shareholder returns, MFG is targeting at least 11-14% pa, before additional FUM flows and additional opportunities (7-9% from existing business investment growth through the cycle, and 4-5% from dividend yield). The MFG strategy incorporates:

1. development of self-directed market in Australia, particularly for global equities;

2. marketing Magellan High Conviction Fund and recently launched Airlie Australian Share Fund to advisers in Australia and New Zealand;

3. continued marketing of infrastructure capability and sustainability strategies (formerly called low carbon) to institutional investors globally.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

MFG FY17 RESULTS SUMMARY

Key results summary are provided in the table below.

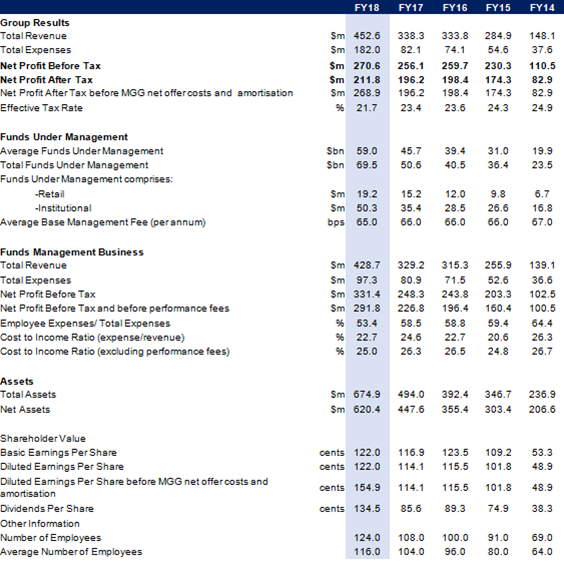

Figure 1: MFG interim results summary for FY14 to FY18 versus pcp

Source: Company

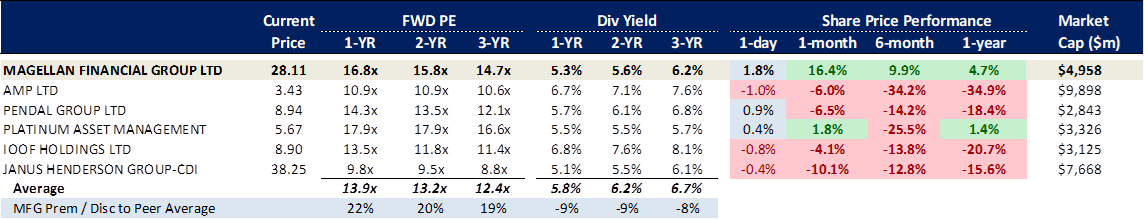

Figure 2: Fund Manager Comparables

Source: BTIG estimates, Company, Bloomberg

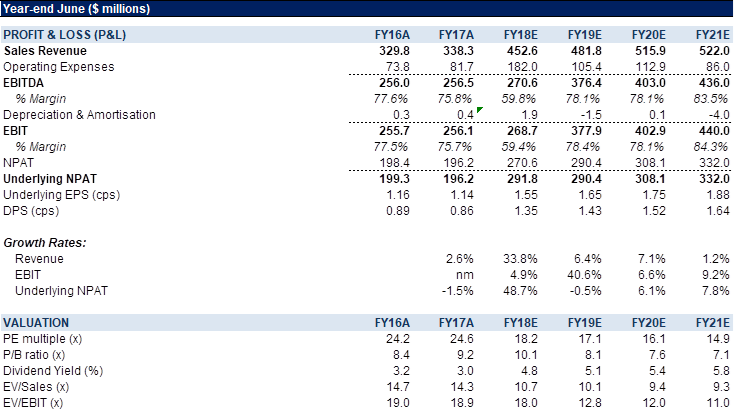

Figure 3: MFG Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

Magellan Financial Group Ltd (MFG) is a specialist funds management business. MFG’s core subsidiary, Magellan Asset Management Ltd, manages ~$53.6bn of funds under management across its global equities and global listed infrastructure strategies for retail, high net worth and institutional investors.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >