REA Group Ltd (REA) – NEUTRAL

REA reported another solid set of results, delivering double-digit growth across key trading metrics. Relative to the previous corresponding period (pcp), group revenue increased +20.3% to $807.7m, EBITDA increased +21.7% to $463.7m.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | REA | A$85.30 | A$87.65 | NEUTRAL |

| Date of Report 13/08/18 | ASX NEUTRAL |

| Price A$85.30 | Price Target A$87.65 |

| Analyst Recommendation NEUTRAL | |

| Sector : Information Technology | 52-Week Range: A$65.01 – 93.70 |

| Industry: Software Services | Market Cap: A$11,235.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate REA as a Neutral for the following reasons:

- Clear #1 market position in online property classifieds, with consumers spending over 3.8x more time on realestate.com.au app than the number two website in FY18.

- Growth opportunities via expansion into Asia and North America.

- Recent strategic partnerships with National Australia Bank (property finance) should be positive in the long.

- Upside in key markets – particular in areas where it is under-penetrated and could potentially win market share from competitors.

- New product developments to increase customer experience.

We see the following key risks to our investment thesis:

- Competitive pressures lead to a further de-rating of the PE-multiple.

- Volume (listings) outlook remains subdued in the near term.

- Execution risk with Asia/North America strategy.

- Failing to get an adequate return on the recent acquisition of iProperty.

- Value/EPS destructive acquisitions.

- Decline in Australian property market.

- Given REA trades on a very high PE-multiple, underperforming to market estimates can exacerbate a share price de-rating.

- Recent tightening of lending practices by banks would affect Financial services business.

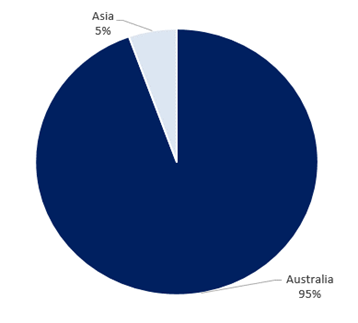

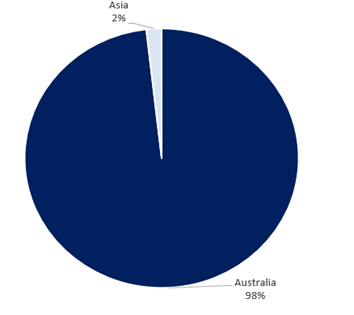

Figure 1: REA revenue by segment

Source: Company, FY18

Source: : Company, Note: US is loss making as at FY18

ANALYST’S NOTE

REA reported another solid set of results, delivering double-digit growth across key trading metrics. Relative to the previous corresponding period (pcp), group revenue increased +20.3% to $807.7m, EBITDA increased +21.7% to $463.7m.

NPAT and EPS both increased by +22.6% to $279.9m and 212.5cps, respectively. Driving group performance was the Australian business, with ongoing solid growth in premium-listing products (price increases / increased penetration / improved mix).

We are attracted to REA’s (1) market leader position in Australia; (2) growth opportunities via diversification of segments and international opportunities; and (3) the potential step change in earnings from the new Financial Services segment.

However, with listings likely to be weaker in the short term and REA already trading on very healthy trading multiples, we maintain our Neutral recommendation. The fact REA can deliver +21% growth in listing depth revenue whilst the market is down -2.0% talks to the resilience of the business model.

- Premium (depth) growth offsets market decline. Overall Australian revenue grew +21% to $763.4m on pcp driven by Financial Services segment (revenue increased to $29.3m from $4.6m) and listing depth products (up +21%). Management noted that although total residential listings in Australia declined approximately -2.0% for the year, Melbourne and Sydney listings were up and provided a mix benefit given they represent higher yielding areas.

- REA taking share of Domain.According to management, REA is taking market share away from Domain particularly in Melbourne. In our view, this talks to REA’s strong platform, that even in a negative listing environment nationally, the Company grew revenue and take market share.

- FY19 first half listing expected to be lower. Listing volumes are likely to be weaker in the first half of the year as

1. they will be cycling strong comparative periods in Sydney and Melbourne and

2. upcoming elections will likely see subdued activity (Victoria in November and NSW in March). - Developer business posts steady revenue despite challenging conditions. REA continues to see a significant drop in developer business as new project commencements dropped off. Pleasingly, volume growth in the segment (new customers – approximately 500 added during the year) meant that year on year revenue was in fact steady. Management noted that should BIS Oxford’s forecast for apartment commencements to drop by -23% in FY19 materialise, REA should still see a slight uptick in revenue for the year given volume decline will be offset by new customer acquisitions.

- Financial services solid outlook despite macro challenges. The segment’s FY18 results came in at the upper end of Company’s guidance. We expect the segment to deliver strong growth in the near-term as REA continues to grow its broker network (despite management noting the Royal Commission was creating some uncertainty), even though the Company is also experiencing volume growth of new loans written had moderated as lenders had tightened lending practices.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

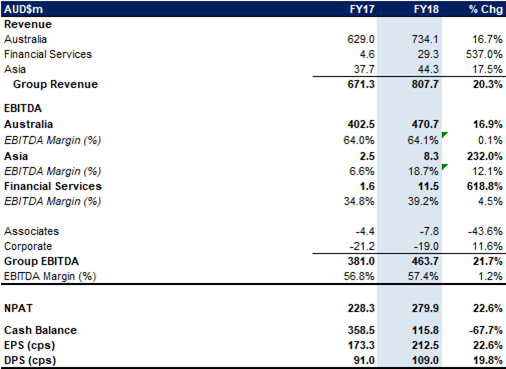

FY18 RESULTS SUMMARY…

Figure 3: REA FY18 group headline numbers versus pcp

Source: Company

FY18 group results.

1. The Board declared a final dividend of 62 cps fully franked, representing total dividend of 109 cps for FY18 (up +20% on pcp).

2. Australian residential listing depth revenue increased +23% on pcp to $513m, driven by the success of Premiere All offering.

3. The Asia segment saw revenue up +17.5% and EBITDA up +232% on pcp, driven by MyFun, Thailand and Indonesia, partially offset by decline in property markets due to changes to government and banking regulations

Australia. The Australian business recorded revenue growth of +21% to $763.4m (including revenue of $29.3m from financial services), driven by an increase in residential revenue of +23% to $513m, despite a decrease of -2% in overall residential listing volumes. Management attributes the ongoing success of its residential Premier All offering to growth of residential revenue. Developer and Commercial listing depth and subscription revenue increased +4% due to strong growth in Commercial and steady revenues in the Developer business despite significant decline of -19% in advertised project commencements. The Financial Services segment generated revenue of $29.3m and EBITDA of $10.8m. The growth in Financial Services segment was driven by inclusion of Smartline.

Asia. The Asian business performed well, considering challenging trading conditions driven by changes to government and banking regulations. Despite this, continued investment in Asian markets resulted in revenue growth of +17.5% to $44.3m and EBITDA growth of +232% to $8.3m. REA has strengthened its position in Malaysia (1.6x more visits than #2 site) and Indonesia (1.2x total time on site than nearest competitor), increased its market position to number 2 position (from 4th) in Singapore (fastest growing property portal), and consolidated its brands in Hong Kong. REA’s strategic investment in PropTiger in India made good progress as revenue for FY18 increased +48%.

North America. Move Inc (REA group own 20% stake) reported revenue of US$452m (up +15% pcp) and net loss of US$1.5m (up from US$1.1m in pcp). The US tax reform resulted in a one-time $11.5m deferred tax adjustment which was excluded from the reported loss of US$1.5m for the period.

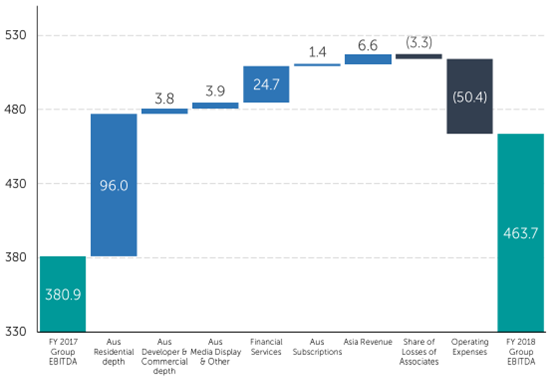

Figure 4: REA FY18 group EBITDA drivers (A$m)

Source: Company

Acquisitions. In FY18, REA completed its acquisition of 80.3% stake in Smartline, a premier mortgage broking franchise group for a consideration of $82.1m, of which $67.6m was funded from existing cash reserves with the remainder recognized as contingent consideration. In September 2017, REA acquired a 70% stake in the mortgage broking business realestate.com.au Home Loans Mortgage Broking Pty Ltd, a NAB owned subsidiary, which will be accounted for as an associate within the Financial Services segment. Since the launch of realestate.com.au Home Loans, there have been over 350,000 financial profiles saved and more than $75m per month in loan applications. On 1 June 2018, REA acquired 100% of Hometrack Australia Pvt Ltd, a provider of property data services to the financial sector for a purchase consideration of $126.3m, funded from existing cash reserves and a debt of $70m. Hometrack Australia is forecasted to deliver revenue of $14-16m and EBITDA of $6-7m in FY19 and cost synergies are expected to flow in once the Hometrack business is fully integrated.

FY19 Outlook. Although management did not provide specific guidance, they expect the Australian Residential business to benefit from recent price increases and higher levels of Premiere and total depth product penetration. For the first half of FY19, listing growth rates would reflect prior year’s strong listing environment in Melbourne and Sydney and management anticipates weaker listings in the lead up to the Victorian election in November and the NSW election in March. New project commencements are forecasted to be significantly lower in FY19 and Developer business is expected to be slightly up year-on-year with the decline in volumes more than offset by new customer acquisition and the benefit of longer duration of project profiles.

REA COMS TABLE AND TRADING MULTIPLE…

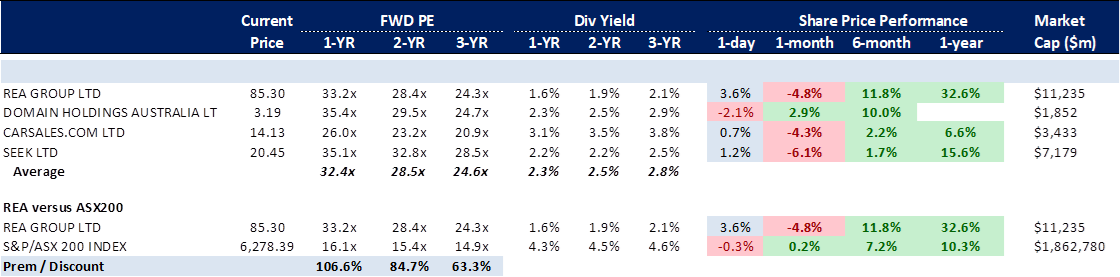

Figure 5: REA versus locals peers

Source: Bloomberg, BTIG

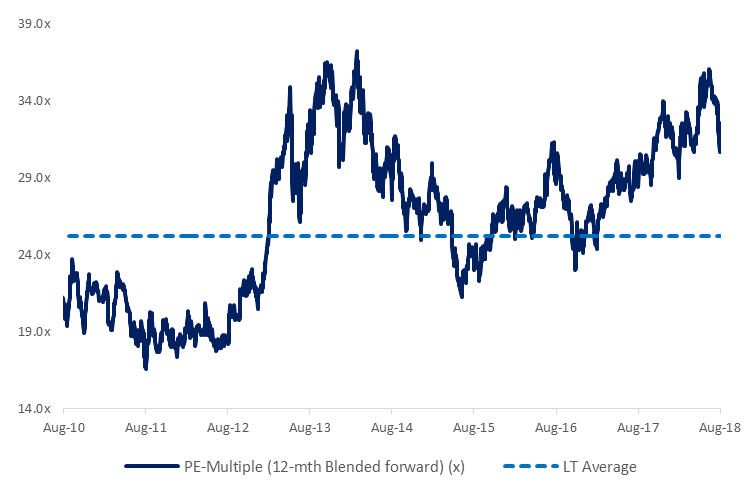

Figure 6: REA PE-multiple versus long-term average

Source: Bloomberg

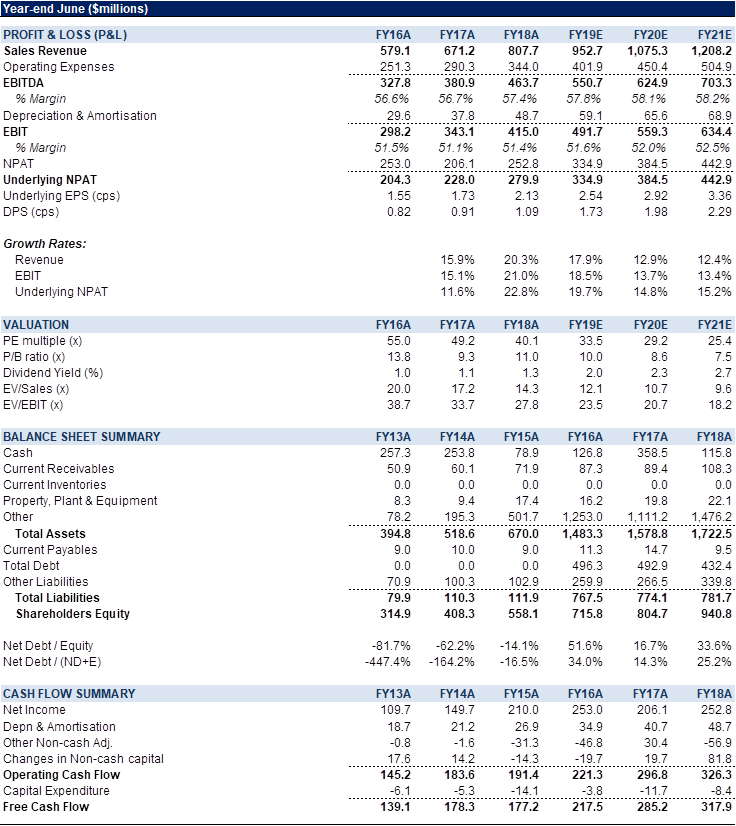

Figure 7: REA Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

REA Group (REA) is one of Australia’s leading integrated energy companies and the largest ASX listed owner, operator and developer of renewable energy generation in Australia. The company sells and distributes gas and electricity. Further, it also retails and wholesales energy and fuel products to customers throughout Australia. The business operates four main segments: Energy Markets, Group Operations, New Energy and Investments.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >