JB Hi-Fi Limited (JBH) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 14/08/18 | JBH | A$23.28 | A$27.50 | BUY |

| Date of Report 14/08/18 | ASX JBH |

| Price A$23.28 | Price Target A$27.50 |

| Analyst Recommendation BUY | |

| Sector : Consumer Discretionary | 52-Week Range: A$21.64 – 29.47 |

| Industry: Electronics | Market Cap: A$2,686.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate JBH as a Buy for the following reasons:

- Undemanding valuation and offers an attractive yield of ~6%, on our estimates.

- Being a low-cost retailer and able to provide low prices to consumers (JB Hi-Fi & The Good Guys) puts the Company in a good position to compete against rivals (e.g. Amazon).

- The acquisition of The Good Guys gives JBH exposure to the bulky goods market.

- Market leading positions in key customer categories means suppliers ensure their products are available through the JBH network.

- Clear value proposition and market positioning (recognized as the value brand).

- Growing online sales channel – now makes up 4.8% of JBH total sales.

We see the following key risks to our investment thesis:

- Increase in competitive pressures (reported entry of Amazon into the Australian market).

- Increase in cost of doing business.

- Lack of new product releases to drive top line growth.

- Store roll-out strategy stalls or new stores cannibalise existing stores.

- Execution risk – integration risk and synergy benefits from The Good Guys acquisition falling short of targets).

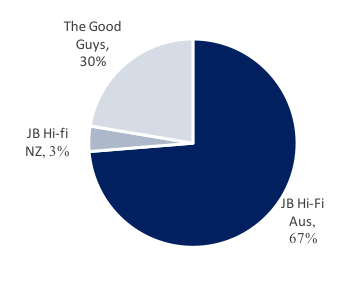

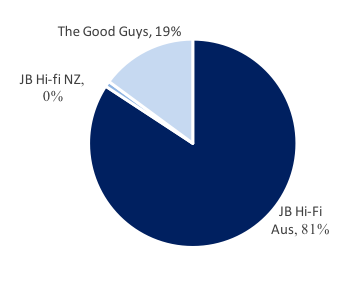

Figure 1: JBH Revenue by Segment

Source: Company, FY18

Source: Company, FY18 results

ANALYST’S NOTE

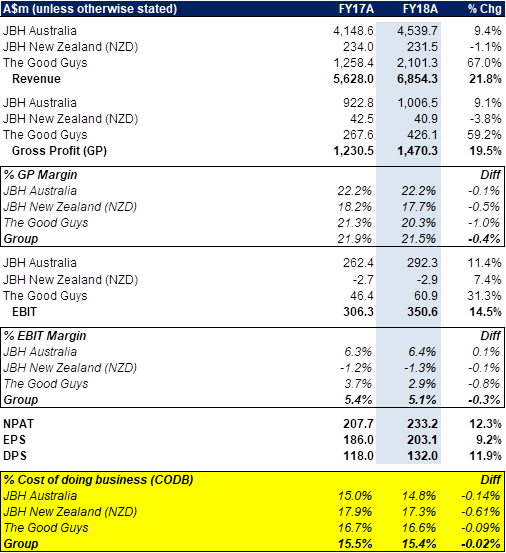

JBH delivered a solid FY18 result which came in ahead of management’s guidance and consensus estimates. The core Australian business continues to perform strongly (delivering double digit earnings growth) whilst The Good Guys and NZ are facing some challenges, although not insurmountable.

Interestingly, the Company in May downgraded its FY18 group NPAT guidance to around $230m from previous guidance of $235 – 240m.

In the end JBH only missed the lower end of its original guidance by -0.8%. However, at the time the share price de-rated by approximately -14%. With the stock trading on FY20E PE of 10x and at a significant discount to the market, maintain Buy.

- FY18 results ahead of consensus estimates. JBH’s full year results came in ahead of consensus estimates:

1. Sales of $6.85bn was in line with estimates;

2. Operating earnings (EBIT) of $350.6m was ahead of estimates of $345.5m;

3. EPS of 203.1cps was ahead of estimates of 199.5cps; and

4. DPS of 132cps was ahead of estimates of 130cps. - FY19 outlook and July trading. JBH is forecasting total group sales of approx. $7.1bn for FY19, which is largely in line with current consensus estimates of $7.13bn. July 2018 trading update:

1. Total sales growth for JB Hi-Fi Australia in July 2018 was +2.9% with comparable sales growth of +0.3%;

2. Total sales growth for JB Hi-Fi New Zealand in July 2018 was -2.1% with comparable sales growth of +3.4%;

3. Total sales growth for The Good Guys in July 2018 was +2.7% with comparable sales growth of +1.4%. - Management’s May-18 earnings downgrade now appears unnecessary, in our view. At a presentation in May the Company downgraded its FY18 group NPAT guidance to around $230m from their previous guidance of $235 – 240m, due to competitive pressures in The Good Guys. However, JBH’s FY18 NPAT of $233.2m is +1.4% above the revised guidance and is only -0.8% below the low end of the previous guidance. The share price de-rated approximately -14% as a result of this downgrade.

- The Goods Guys (TGG) struggling, but not broken. The Good Guys (TGG) is experiencing gross margin pressure in the Home Appliance segment due to competitive pressures. We highlighted in our previous note how Harvey Norman (HVN) is aggressively competing on pricing as indicated by HVN’s 1H18 Franchising Operations sales growth of +4.8% delivering -44bps decline margins. While short term challenges persist, JBH is implementing strategies (new management team, sales team and incentives) to improve performance. We do not believe irrational pricing behaviour is profitable on a long-term basis and therefore, are of the view this should abate in due course.

- The quality of the core franchise again on display. The core JB Hi-Fi Australia segment (~83% of group EBIT) again delivered a very strong result despite competitive pressures and Amazon’s launch in Australia. Relative to pcp, revenue for the segment was up +9.4% and EBIT was up +11.4% on strong cost control.

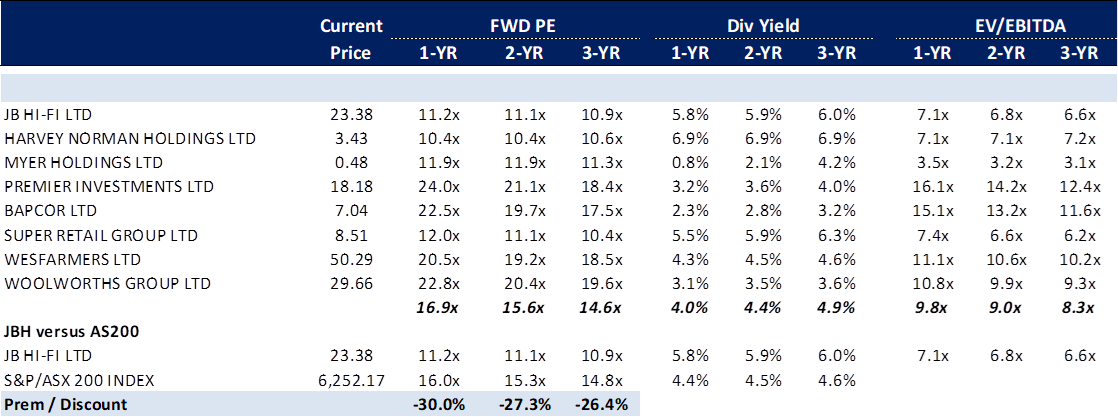

- Attractive relative valuation. Relative to the ASX200 JBH is trading at a -30% discount. In our view, these trading multiples adequately reflect all the near-term challenges.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

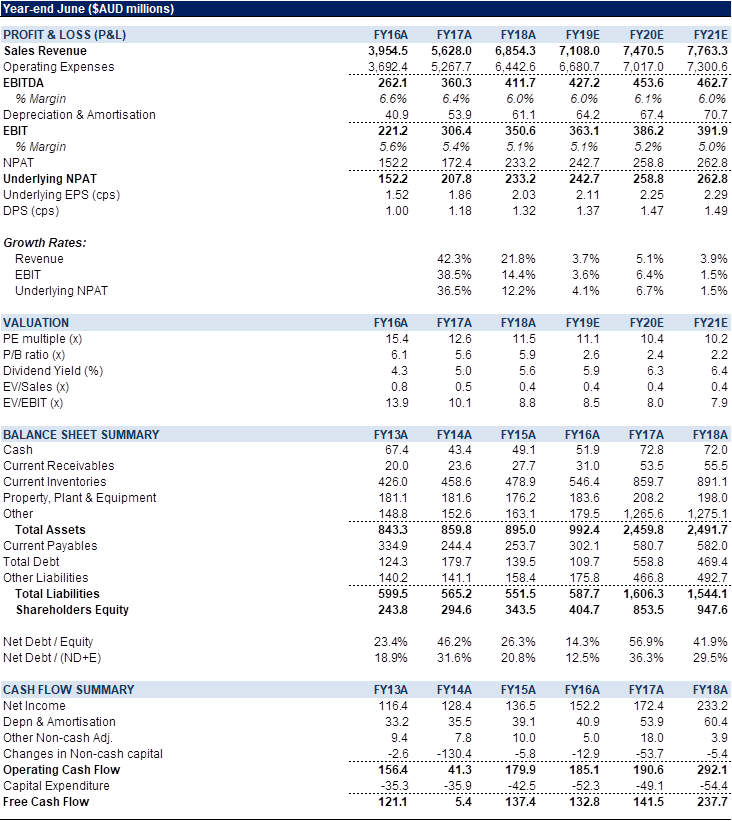

JBH FY18 RESULTS SUMMARY…

Figure 3: JBH FY18 group headline numbers versus pcp

Source: BTIG, Company

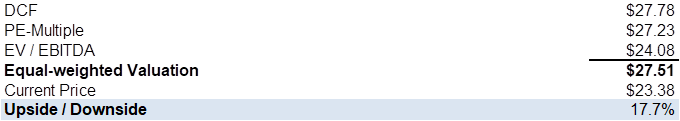

VALUATION…

We have adjusted our estimates for the updated guidance provided by management. We have updated the trading multiples for our multiples-based valuations. Our price target is based on our blended valuation of $27.51 (rounded to the nearest ten cents)

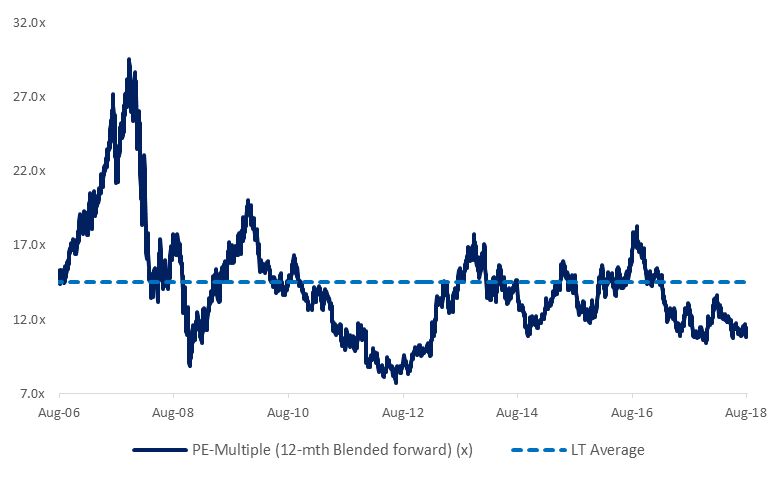

Relative valuation. JBH trades at a significant discount to its peer group average and the ASX200 market multiples (on consensus numbers) – on FY19E numbers JBH is at a -30% discount to the broader market. In our view, these trading multiples adequately reflect all the near-term challenges. The stock is also trading well below its own historical trading average.

Figure 4: JBH valuation(A$m)

Source: BTIG estimates

Figure 5: Peer group valuation – consensus estimates

Source: Bloomberg

Figure 6: JBH PE-multiple vs long-term average

Source: BTIG estimates

Figure 7: JBH Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

JB Hi-Fi Ltd (JBH) is a home appliances and consumer electronics retailer in Australia and New Zealand. JBH’s products include consumer electronics (TVs, audio, computers), software (CDs, DVDs, Blu-ray discs and games), home appliances (whitegoods, cooking products & small appliances), telecommunications products and services, musical instruments, and digital video content. JBH holds significant market-share in many of its product categories. The Group’s sales are primarily from its branded retail store network (JB Hi-Fi stores and JB Hi-Fi Home stores) and online. JBH also recently acquired The Good Guys (home appliances/consumer electronics), which has a network of 101 stores across Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >