Cochlear Ltd (COH) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 15/08/18 | COH | A$192.75 | A$181.45 | NEUTRAL |

| Date of Report 15/08/18 | ASX COH |

| Price A$192.75 | Price Target A$181.45 |

| Analyst Recommendation NEUTRAL | |

| Sector : Healthcare | 52-Week Range: $140.68 – 209.86 |

| Industry: Healthcare Equipment | Market Cap: A$11,101.4m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate COH as a Neutral due to the following reasons:

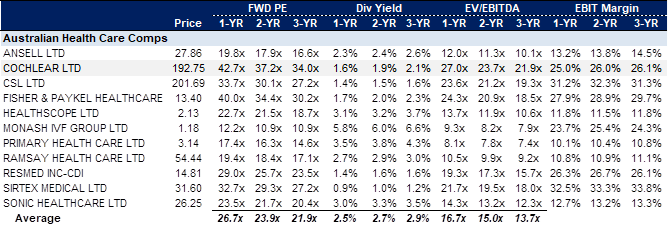

- Trading on fair value on absolute and relative basis of FY20e of 35.7x, ~1.6% dividend yield.

- Attractive hearing loss market with (1) ~5% of world’s population or 360m have disabling hearing loss (328m adults and 32m children); (2) 1 in 3 people over age of 65 affected by hearing loss; (3) less than 5% market penetration.

- Market leading positions globally.

- Direct-to-consumer marketing expected to fast track market growth.

- Best in class R&D program (significant dollar amount) leading to continual development of new products and upgrades to existing suite of products.

- New product launches driving continued demand in all segments.

- Attractive exposure to growth in China, India and more recently Japan.

- Solid balance sheet position.

We see the following key risks to our investment thesis:

- Product recall.

- R&D program fails to deliver innovative products.

- Increase in competitive pressures.

- Change in government reimbursement policy.

- Adverse movements in AUD/USD.

- Emerging market does not recoup – significant downside to earnings.

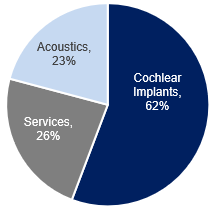

Figure 1: COH Revenue by Segment

Source: Company

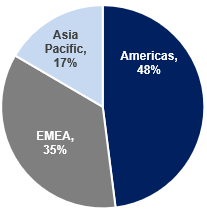

Source: Company

ANALYST’S NOTE

At times, even though a Company may produce a strong result, if it does not meet the higher growth rates expected by the market (as it did in this case, with revenue and net income, -1.9% and -0.9% lower than consensus respectively), the stock price declines (by -3.0% in this instance).

Otherwise, COH in our view produced a solid FY18 result.

Key highlights to the results include:

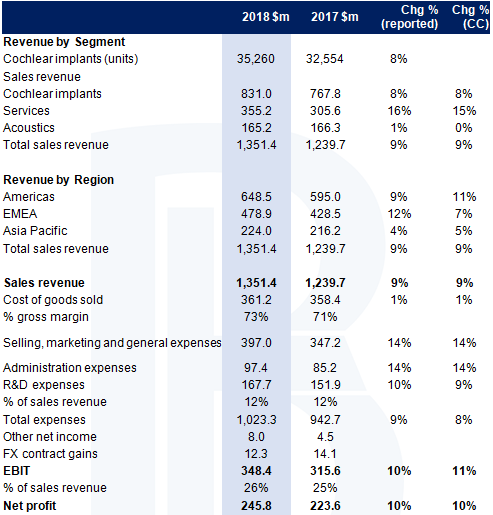

1. Reported revenue was up +9% (+9% in constant currency) to $1,351.4m driven by Cochlear implant units’ sales, up +8% to 35,260 (or up +11% excluding Chinese Central Government tender units).

2. expenses increased by 9% (8% in CC) to $1,023.3m.

3. EBIT increased +10% (+11% in CC) to $348.4m, with the EBIT margin increasing by one percentage point to 26%.

4. Reported net profit of $245.8m, was up +10% (up +10% in CC).

5. COH produced strong cash flow generation which supported the 14% increase in the final dividend to $1.60 per share, with full year dividends up 11% to $3.00 per share (~70% payout).

We maintain our Neutral recommendation although it trades on a lofty FY20E 37.2x one year forward price to earnings and 1.6% dividend yield.

- Strong FY19 guidance and outlook. On the analyst call, management pointed out “for FY19, COH expects to deliver reported net profit of $265-275m, an 8-12% increase on FY18”. COH is “targeting to maintain the net profit margin”. COH has “a number of large long-term investment projects including the development of our China manufacturing facility, with the construction phase expected to be complete by the end of FY20, and investments in IT platforms to strengthen our connected health, digital and cyber security capabilities. These projects are expected to increase capital expenditure levels to $80-100m per annum over the next few years”. Management continues “to target a dividend payout ratio of around 70% of net profit”.

- Cochlear implants (62% of revenue) – strong performance driven by sales in emerging markets. The segment saw revenues grew 8% (8% in CC) with unit growth of 8% (up 11% excluding the impact of Chinese Central Government tender units; FY18 result included ~1,100 Chinese Central Government tender units compared to ~1,900 in FY17.). Reported average selling prices were stable in constant currency but there was some price pressure in some markets, particularly Western Europe. Across the developed world (80% of revenues), sales of units grew by +9%, especially driven by sales in US and UK. The Nucleus 7 Sound Processor (a world’s first which is specifically made for iPhone cochlear implant sound processor), was launched in 2Q and drove market share gains for COH. In emerging markets, sales of units grew by over 15% (adjusted for the impact of lower Chinese Central Government tender units), especially in the Middle East and the China private pay market.

- Services (sound processor upgrades and other) (26% of revenue) – performed strongly. The segment saw revenue increase by 16% (15% in CC) driven by

1. Release of the Nucleus 7 Sound Processor during the 2Q18; and

2. First full year of revenue from Sycle (audiology practice management software business acquired by COH in May 2017). - Acoustics (bone conduction and acoustic implants) (12% of revenue) – the negative of the result following a strong FY17 result. Revenue declined by 1% (0% in CC), following a strong 26% growth in CC in FY17. According to management, they are seeing solid demand for the Baha 5 sound processor range.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

COH FY18 FINANCIAL RESULTS…

Figure 3: Results Summary

Source: Company

Figure 4: Healthcare Comparables

Source: Company

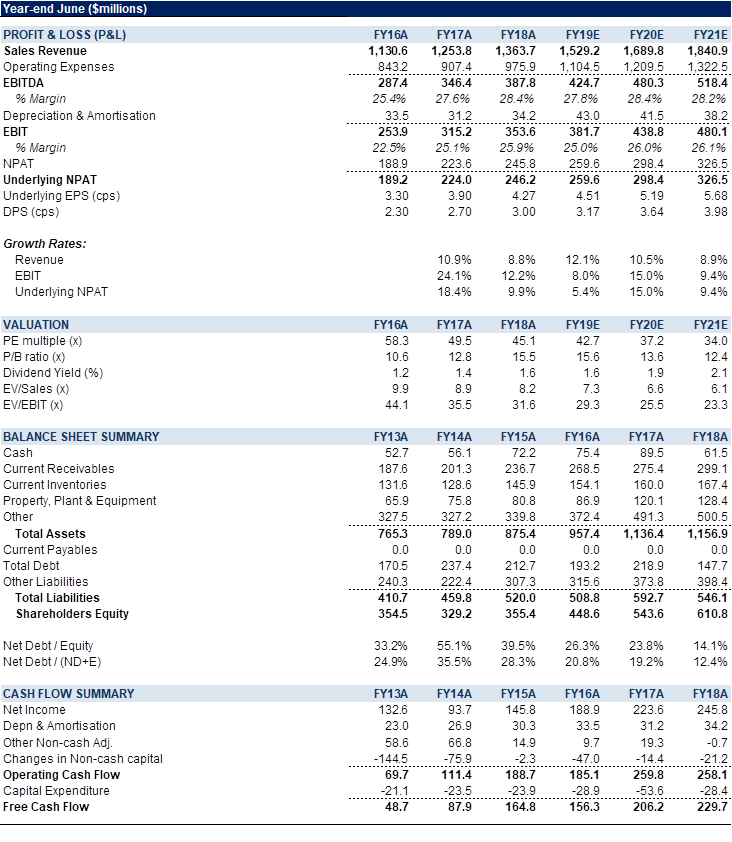

Figure 5: COH Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Cochlear Ltd (COH) researches, develops and markets cochlear implant systems for hearing impaired people. COH’s hearing implant systems include Nucleus and Baha and are sold globally. COH has direct operations in 20 countries and 2,800 employees.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >