HT&E Ltd (HT1) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | HT1 | A$2.49 | A$2.95 | BUY |

| Date of Report 16/08/18 | ASX HT1 |

| Price A$2.49 | Price Target A$2.95 |

| Analyst Recommendation BUY | |

| Sector : Consumer Discretionary | 52-Week Range: A$1.52 – 2.71 |

| Industry: Media | Market Cap: A$769.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate HT1 as a Buy for the following reasons:

- Positive momentum in radio advertising market, with ARN growing ahead of market.

- Whilst subject to regulatory approvals, the sale of Adshel provides management to undertake capital management (special dividend of $220m and a $55m buyback).

- ATO settles with HT1 at less than market expectations.

- Potential corporate activity given changes to media ownership rules.

- Hong Kong Outdoor starts to contribute positive earnings, rather than being a drag of group performance.

We see the following key risks to our investment thesis:

- Decline in advertising dollars (radio and outdoor), especially if the retail sector in Australia comes under pressure.

- ACCC blocks the sale of Adshel.

- Radio experiences structural disruption.

- Increased competition from major player(s) on tenders.

- Execution risk with international expansion.

- ATO tax liability materializes at a level above market expectation.

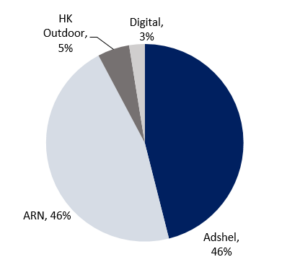

Figure 1: HT1 Revenue by Segment

Source: Company, 1H17 results

ANALYST’S NOTE

HT&E (HT1) delivered a solid 1H18 result, driven by solid trading conditions in Australian Radio Network (ARN) and Hong Kong reporting positive earnings (EBITDA). With the sale of Adshel announced, this segment is now reported as discontinued, which made the overall results a little messy.

Nonetheless, on a underlying basis from continuing operations, group revenue was up +10%, operating earnings (EBIT) up +31% and NPAT up +57% on previous corresponding period (pcp). Pleasingly, ARN is capitalizing on the solid trading conditions in radio, with ARN revenue up +7.3% (pre-accounting changes) versus market up +5.9% (i.e. taking market share). This saw ARN report EBITDA growth of +13% for the half.

Management noted that forward bookings in the ARN business suggest momentum is continuing into the second half. In our view, if sustained, there is +5% upside risk to consensus and our full year earnings estimates. However, management wouldn’t confirm nor deny this math on the analyst call.

At this stage we have left our FY18 EBITDA estimate largely unchanged at $115m (minor adjustment reflects changes to HK Outdoor). We will continue to monitor radio advertising markets and will look to upgrade our estimates should broader market activity be sustained. We have updated our valuation, with the key changes being higher multiples applied to Adshel and ARN. As a result, our price target increases to $2.95 and we maintain our Buy recommendation.

- Adshel now with the ACCC. HT1 has agreed to sell Adshel for $570m to oOh!media (OML), representing a EV/EBITDA multiple of 12.6x. The deal is subject to ACCC approval (expected 30 August). While ACCC will scrutinize the deal, it is difficult to speculate what the outcome may be, nonetheless it does represent downside risk. Having said that, in the worst case scenario, the performance of Adshel during the first half was pleasing, given normalised trading for the first half was up +2%, and July revenues were up approximately +5% on last year (i.e. revenue appears to have accelerated in the second half).

- Capital management announced (worth $0.89 per share). Management expects to use the proceeds from the sale of Adshel for capital management, consisting of a special dividend of $220m and a $55m on-market buyback.

- Should ARN’s momentum continue, upside risk to full year EBITDA. Management noted that first half momentum has continued into the second half, with management noting that forward bookings are currently indicating revenue growth of approximately +5-6% versus +5% in the second half of FY17. In our view, there is upside risk to consensus earnings estimates for the full year given this trading update. Earlier in the year, management noted that they were confident of achieving analysts’ EBITDA estimates of $113-114m (we were already at $115m). However, if momentum is sustained, there is a +5.2% upside risk to our earnings guidance. We suspect consensus is also likely to upgrade their range to $118-120m (i.e., earnings upgrade of 4-5%).

ASK THE ANALYST

Our analysts are ready to answer any questions you have

1H18 RESULTS SUMMARY…

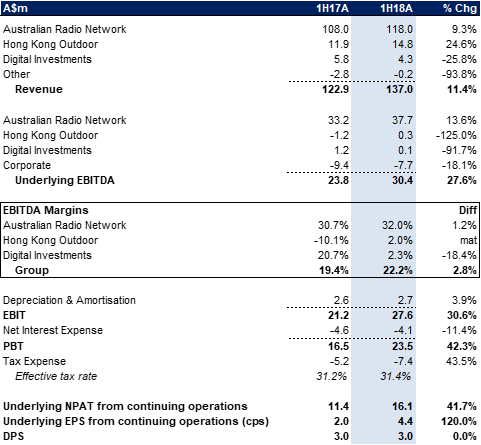

Key headline numbers for the full year versus pcp are presented in the table below.

Figure 2: HT1 1H18 versus pcp

Source: BTIG, Company

Management discussion and results analysis:

- Group headline numbers. Excluding Adshel, results from continuing operations on an underlying basis were very strong, with revenue up +10%, operating earnings (EBT) up +31% and NPAT up +57%. If Adshel was included, Revenue was up +1% and EBITA (EBIT before Amortisation) was up +12%. Final fully franked dividend of 3cps represents a payout ratio of 68% of NPAT from continuing operations.

- Corporate cost cuts provide boost to group EBITDA. A -18.1% decline in corporate costs on pcp provided a reasonable boost to group underlying EBITDA, with management noting they continue to focus on reducing more overheads.

- Strong balance sheet. Net debt rose to $177m (from $114m) due to the deposit HT1 had to make in relation to its ongoing dispute with ATO. Despite this, leverage remains less than 1.5x, with interest cover of more than 16x. The Company has undrawn facility limits of greater than $150m, which is sufficient to cover the contingent tax liability.

- Australian Radio Network (ARN). The overall radio market experienced solid growth during the first half, up +5.9%. Pleasingly, ARN’s revenue was up +7.3% over the same period, with the Company winning market share. First half momentum has continued into the second half, with management noting that forward bookings are currently indicating revenue growth of approximately +5-6% versus +5% in the second half of FY17.

- Hong Kong (HK) Outdoor improves and continue represent significant upside. During the first half, HK ceased being a drag on group earnings and reported a small positive EBITDA (from a loss of $5.3m to gain of $0.3m in 1H18), driven by a +24% increase in revenue and -15% decline in operating costs. Subject to current market conditions persisting, management expects to report a positive EBITDA for the full year. Further, in our view, should this momentum continue, the segment can become a significant contributor to group earnings over the medium term.

Earnings & Valuation…

- Earnings changes. The key change we have made is to our HK Outdoor estimates, as we now expect the segment to be a positive contributor to group earnings. We believe our overall group earnings estimates are likely to prove conservative.

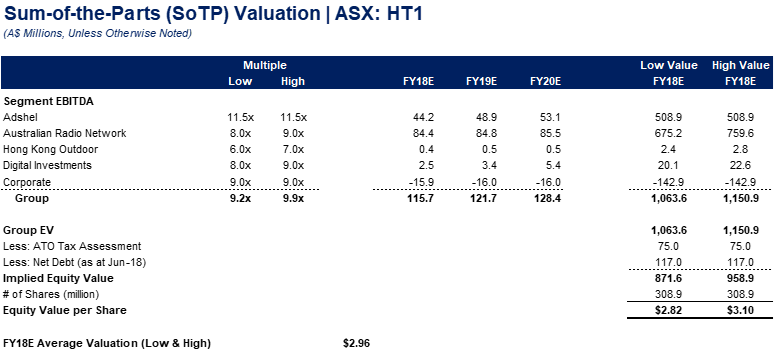

- SoTP valuation. We have used a SoTP valuation to arrive at our valuation of $2.96. Key changes:

1. minimal earnings estimates changes (HK Outdoor);

2. increased our multiples for Adshel and Australian Radio Network (ARN) reflecting improved performance;

3. updated net debt position in line with recent results update. Our price target of $2.95 is our valuation rounded to the nearest five cents.

Figure 3: Sum-of-the-Parts (SoTP) forecasts and valuation

Source: BTIG estimates

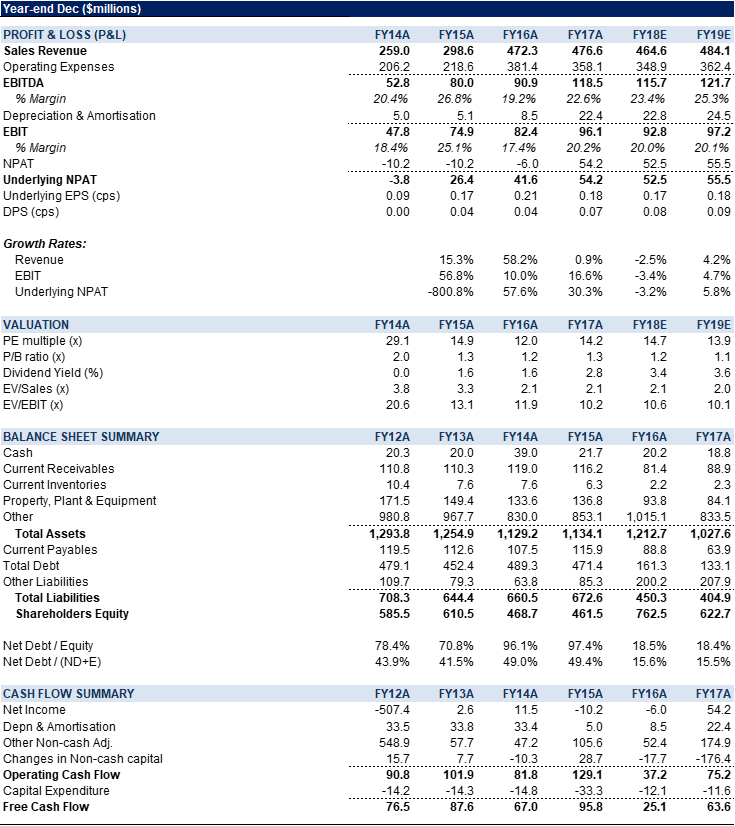

Figure 4: HT1 Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

HT&E Limited (HT1) is a media and entertainment company with operations in Australia, New Zealand and Hong Kong. The Company operates the following key segments:

1. Australian Radio Network (ARN) – metropolitan radio networks including KIIS Network, The Edge96.One and Mix106.3 Canberra;

2. Adshel – street furniture, transit and other outdoor advertising (Australia & New Zealand), reaching 92% of Australia;

3. Hong Kong Outdoor (Cody) – Billboard, transit and other outdoor advertising in Hong Kong, with over 300 outdoor advertising panels and in-bus multimedia advertising across 1,200 buses; and

4. Digital Investments – digital assets including iHeartRadio, Emotive and Conversant Media.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >