Pact Group Holdings (PGH) – BUY

Pact Group (PGH) delivered FY18 Group earnings (EBITDA) of $237.3m which came in below analyst estimates of $250m, adversely affected by $13m in higher raw material and Australian energy costs in 2H18.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | PGH | A$4.47 | A$4.80 | BUY |

| Date of Report 16/08/18 | ASX PGH |

| Price A$4.47 | Price Target A$4.80 |

| Analyst Recommendation BUY | |

| Sector : Materials | 52-Week Range: A$4.17 – 5.95 |

| Industry: Metal & Glass Containers | Market Cap: A$1,486.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate PGH as a Buy for the following reasons:

- Dominant market share in Australia and growing presence in Asia. Hence provides attractive exposure to both developed and emerging markets’ growth.

- Clearly defined strategy to create shareholder value via “operational excellence program”.

- Attractive dividend yield and undemanding valuation.

- Bolt-on acquisitions (and associated synergies) provide opportunity to supplement organic growth. The acquisition of Jalco (personal care, homecare and automotive sectors), Australian Pharmaceutical Manufacturers (nutraceuticals sector) and Pascoe’s (personal care, homecare and aerosol food sectors) has established contract manufacturing capabilities for PGH (which complements its rigid packaging business).

- Strong management team.

- Solid balance sheet with firepower for further acquisitions.

We see the following key risks to our investment thesis:

- Competitive pressures leading to margin erosion.

- Input cost pressures which the company is unable to pass on to customers.

- Deterioration in economic conditions in Australia and Asia.

- Emerging markets risk.

- Poor acquisitions or not achieving synergy targets as PGH moves to reduce its dependency on packaging for food, diary and beverage clients to more high growth sectors such as healthcare.

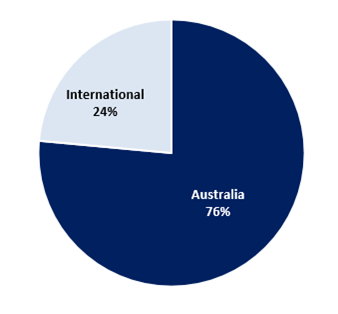

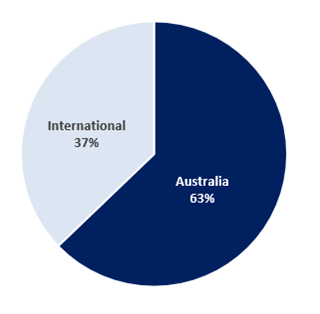

Figure 1: PGH Revenue Split by Segment

Source: Company (FY18)

Source: Company (FY18)

ANALYST’S NOTE

Pact Group (PGH) delivered FY18 Group earnings (EBITDA) of $237.3m which came in below analyst estimates of $250m, adversely affected by $13m in higher raw material and Australian energy costs in 2H18.

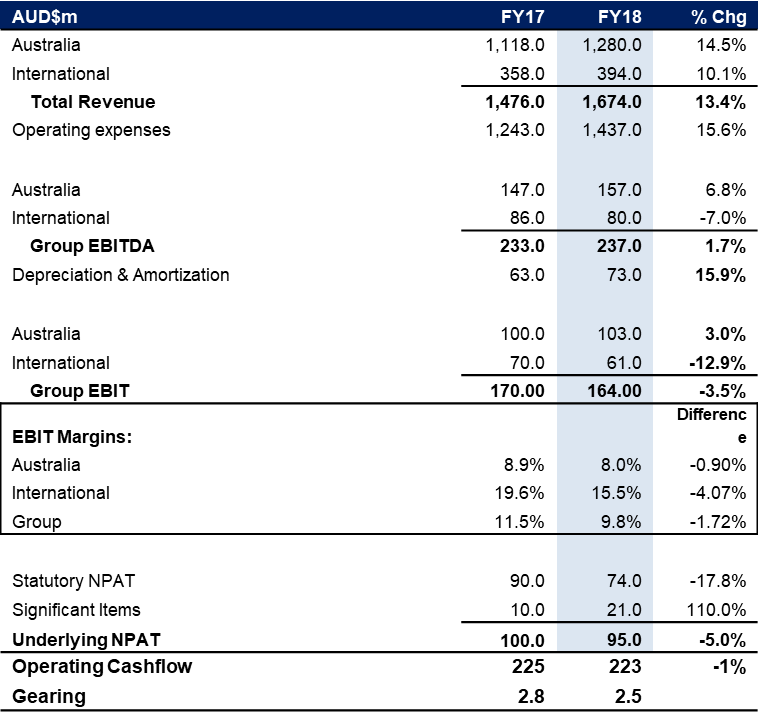

The results saw its share price drop by -18% (biggest drop since IPO). PGH board declared 11.5 cps dividend (65% franked). The international segment results were the biggest drag on PGH’s performance, where EBIT decreased -12.6% and margins fell by 400bps to 15.5%, impacted by weaker industrial demand in China.

On a positive note, PGH’s Australia assets performed well delivering +14.5% increase in revenue and +3.9% uplift in earnings (EBIT). PGH announced the acquisition of TIC Retail Accessories for a purchase consideration of $122m, funded by $62m in cash and $60m in shares, to be completed on 1 October 2018.

Management gave positive FY19 outlook and expects “higher revenue and earnings (before significant items) in FY19, subject to global economic conditions”. Management also gave a guidance on EBITDA, to be in range of $270m and $285m for FY19, which implies a significant uplift in earnings from FY18. Whilst the results were disappointing, the strong guidance given by management for FY19 and undemanding valuation of 11.4 PE20x, 6.0% dividend yield keeps us interested – Buy.

- Strong FY19 Guidance. PGH expects EBITDA (before significant items) between $270m and $285m, which implies an uplift of +13.9% to 20.2% over the pcp.

- Key highlights to PGH results.

1. Strong revenue growth up +13% to $1.7bn over the pcp especially in Australia in contract manufacturing, infrastructure and sustainability sectors, partially offset by lower demand in dairy, food and beverage sector due to a major customer plant closure in dairy sector and drought conditions in the agricultural sector.

2. Earnings (EBITDA) increased +2.0% to $237m adversely impacted by $13m of higher input costs and Australian energy costs.

3. NPAT before significant items of $20.2m, was down -5% to $95m.

4. The Board declared final ordinary dividend of 11.5cps, franked to 65%, bringing total dividend payout to 23cps for the period.

5. PGH continued strong cash generation with cash conversion of 94% and maintained strong balance sheet with gearing ratio decreasing from 2.8x to 2.5x.

6. PGH completed its Asia acquisition and acquisition of ECP and management confirmed that both these acquisitions performed well in line with expectations. - Pact Australia (76% of revenue and 63% EBIT) – performed strongly. The segment saw solid +14.5% uplift in revenue to $1.3bn, driven by crate pooling revenues and organic growth in contract manufacturing, sustainability and Infrastructure sectors. There was a +3.9% increase in earnings (EBIT), however EBIT margin deterioration by 80bps to 8.1% from 8.9% pcp, impacted by higher costs to serve in the rigid packaging businesses and unrecovered energy and raw material costs.

- Pact International (24% of revenue and 37% EBIT) – FY18 results disappointing. The segment saw a +10.3% increase in revenue but earnings (EBIT) decreased by -12.6% to $61.1m due to short term time lag in recovering raw material input costs, unfavorable timing of government project in New Zealand and weak industrial demand in China. Margin also deteriorated by 400bps from 19.5% to 15.5% due to significant mix impact of the Asia acquisition to the segment in addition to adverse impacts from raw materials and FX.

- Acquisition of TIC Retail Accessories to be EPS accretive in year 1. PGH announced it entered into an agreement to acquire TIC Retail Accessories Pty Ltd (TIC) for a purchase consideration of $122m (representing EBITDA multiple of 6.5x), to be funded by $62m cash and issue of $60m shares to the vendors. TIC has FY18 revenues of $95m. PGH would pay earn out payments of up to $30m in FY19 and FY20 (subject to delivery of specific financial hurdles). The acquisition will expand PGH’s geographic reach in the materials handling sector and will further leverage the group’s capability in innovative pooling technologies.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 RESULTS …

Figure 3: PGH Financial FY18 Results

Source: Company

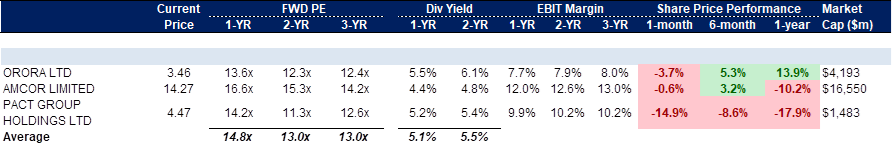

Figure 4: PGH Comparables

Source: BTIG, Company, Bloomberg

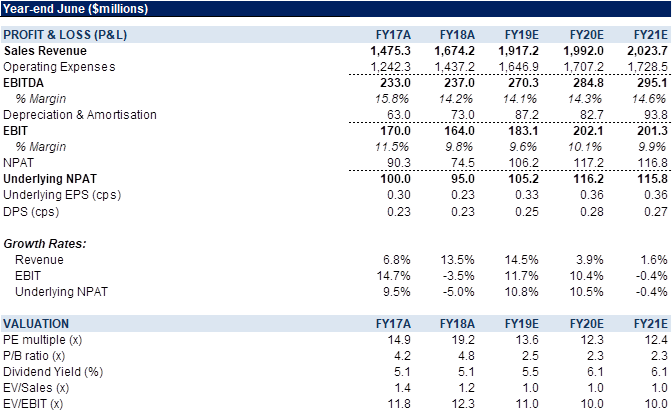

Figure 5: PGH Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Pact Group Holdings Ltd (PGH) was established by Raphael Geminder in 2002 (Mr. Geminder remains a major shareholder with ~39.1% and is the brother in law of Anthony Pratt, Chairman of competitor Visy). Pact has operations throughout Australia, New Zealand and Asia and conceives, designs and manufactures packaging (plastic resin and steel) for many products in the food (especially dairy and beverage), chemical, agricultural, industrial and other sectors.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >