Huon Aquaculture (HUO) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | HUO | A$4.48 | A$4.64 | NEUTRAL |

| Date of Report 16/08/18 | ASX HUO |

| Price A$4.48 | Price Target A$4.64 |

| Analyst Recommendation NEUTRAL | |

| Sector: Consumer Staples | 52-Week Range: A$4.22 – 5.25 |

| Industry: Packaged Foods & Meats | Market Cap: A$412.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate HUO as a Neutral for the following reasons:

- According to management, 2019 production is expected to be ~20,000 tonnes, which is below the record level achieved in FY18, despite “stronger pricing expected to deliver continued growth in operating EBITDA Beyond FY2019 we expect Huon to return to production levels in line with the market’s long term average growth of around 10%”.

- Growing consumer preference for natural and organic products, both in Australia and abroad, may see significant increase in salmon sales and therefore higher share prices.

- Number two player in the domestic market. With rational behaviour around pricing, the concentrated industry could benefit.

- Supportive salmon prices given disruption to global salmon supply.

- High barriers to entry (desired temperatures and regulatory licences difficult to obtain).

- Given the complex nature of salmon farming HUO is unlikely to have its dominant position as an Australian salmon farmer ever seriously threatened.

We see the following key risks to our investment thesis:

- Impact to production due to adverse weather conditions and diseases.

- Potential review of chemical colouring in salmon may lead to further negative publicity and undermine demand for salmon.

- Cost pressures or cost blowout could deteriorate margins significantly given the large cost base relative to earnings (EBITDA).

- Irrational competitive behaviour (domestic and international markets).

- Negative media on the sustainability of the Tasmanian salmon industry.

ANALYST’S NOTE

HUO delivered a strong FY18 result, with revenue up +23%, underlying operating EBITDA up 14% (despite margins deteriorating by 100bps to ~23%) and underlying NPAT up +23% on previous corresponding period (pcp); these headline numbers missed consensus estimates of underlying NPAT ($35.4m actual vs $36.9m expected) and EBITDA ($71.8m actual vs 79.2m expected) – as a result the stock price was down -7.8% on the results release.

Management increased capex for the full year, as the Company invested in growth initiatives and declared a final dividend of 5cps (50% franked).

We maintain our Neutral recommendation – we like the favorable longer term industry trends but and yield to management’s warnings of a poorer FY19 than FY18 – we see HUO more of a 2020 story. Indeed, according to management, 2019 production is expected to be ~20,000 tonnes, which is below the record level achieved in FY18, despite “stronger pricing expected to deliver continued growth in operating EBITDA Beyond FY2019 we expect Huon to return to production levels in line with the market’s long term average growth of around 10%”.

Further, the industry has attractive growth drivers with increasing demand from developing economies as they move towards a higher protein diet and sustainable growth in developed economies as consumer uptake is lifted from the health benefits associated with the consumption of salmon. However, the industry is not without risk, given that a potential blowout in cost can significantly impact margins and adverse weather conditions can impact production.

We maintain Neutral but would not be averse to investors considering HUO as a 2020 story and beyond.

- Company’s outlook comments – a 2020 story with issues in 2019.

1. Demand for domestic market expected to grow ~+10% p.a, with domestic salmon production expected to fall short of demand in FY19 and FY20.

2. Global supply to grow at 3%-4% pa (compared to 7% pa growth in demand) due to production constraints in Norway and Chile (major producers of salmon).

3. Strong demand from Asia is expected to continue, with Asia accounting for 73% of the total consumption by 2025. However, whilst the industry trends are favorable in the long term, HUO faces some issues in FY19 namely, 1H19 operational performance is expected to be impacted by challenging growing conditions that persisted throughout the summer of 2018. Average pricing in FY19 to increase as proportion of contracted export volume rises significantly and domestic supply tightens. Average price for FY19 is expected to remain at $15/HOG kg. HUO expects the cash conversion to decline in 1H19 due to rebuild biologicals. Average cost of production/kg in FY19 is expected to remain unchanged on FY18. - FY18 results overview. Key highlights include:

1. revenue was up +23%, driven by a +25% increase in production volume and strong pricing underpinned by supply and demand market dynamics despite extremely challenging operational conditions in 2H18.

2. Underlying operating earnings (EBITDA) was up +14%, despite margins deteriorating 100bps on pcp to ~23%.

3. Operating NPAT increased +23% over the pcp to a record $35.4m.

4. Average price per HOG kg for the year was down -2% to $13.84.

5. Operating cash flow improved +7.2% on pcp, driven by increased production volumes and firm pricing and a tax refund in second half FY18. Cash conversion averaged 79% of operating EBITDA

6. Gearing ratio (net debt / equity) increased +5% to 26.1% but management expects it to be manageable at this level.

7. Management declared a final dividend of 5cps, 50% franked, bringing the total payout to 10cps for FY18.

8. Capital investment increased to $87.7m largely due to expanded operations in Storm Bay and the construction of 1400 tonne Whale Point Nursery. - Average domestic pricing higher during the year. Management noted an improvement in average domestic price, with price increases in 2H18 driven by healthy demand. Average wholesale price was $15.17/kg in 2H (+6% increase pcp).

- Carving out new sales channel bodes well for future earnings. HUO carved out new sales channel, ‘retail international’ thus reducing its exposure to the spot export market. Management noted that new Asian markets accounted for 4% of annual sales revenue, with average price of $12.71/kg during the year with exports averaging at 14% of sales at an average price of $11.26/kg.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 Results Summary…

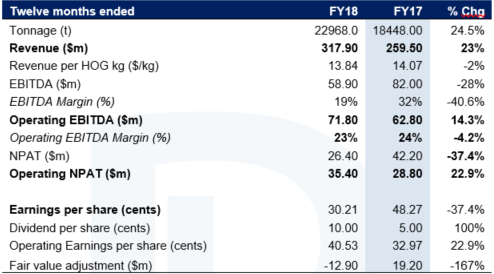

Figure 1: HUO FY18 key trading metrics

Source: Company

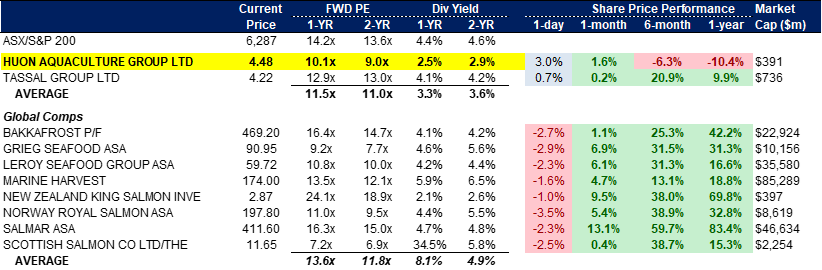

Domestic and global comparable table…

Figure 2: HUO domestic and industry comps table (BB consensus)

Source: Bloomberg

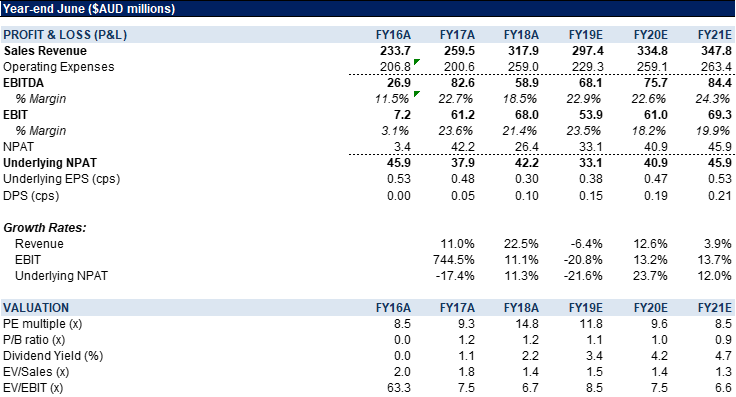

Figure 3: HUO Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Huon Aquaculture (HUO) is a vertically integrated salmon producer in Australia. Its operations span all aspects of the supply chain, from hatcheries and marine farming to harvesting and processing, as well as sales and marketing. HUO’s marine farms are located in the cool, pristine waters of Tasmania, with the Company’s logistics infrastructure delivering salmon efficiently to the major fish markets around Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >