Computershare Ltd (CPU) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | CPU | A$19.01 | A$20.55 | BUY |

| Date of Report 16/08/18 | ASX CPU |

| Price A$19.01 | Price Target A$20.55 |

| Analyst Recommendation BUY | |

| Sector : Financials | 52-Week Range: A$ 13.46 – 18.48 |

| Industry: Diversified Financials | Market Cap: A$10,044.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CPU as a Buy for the following reasons:

- CPU is globally diversified with a revenue model that generates predictable recurring revenues and strong free cash flow generation.

- Two main organic growth engines in mortgage servicing and employee share plans should lead to organic EPS growth.

- Expectations of margin improvement via cost reductions program with A$85-A$100m per annum cost-out identified in Stage 1 and Stage 2, with Stage 3 of cost outs yet quantified.

- Leveraged to rising interest rates on client balances, corporate action and equity market activity.

- Potential for earnings derived from non-share registry opportunities due to higher compliance and IT requirements.

- Solid free cash flow and deleveraging balance sheet.

- $200m buy-back to resume in March 2018.

We see the following key risks to our investment thesis:

- Increased competition from competitors such as recently listed Link and Equiniti which affect margins.

- Cost cuts are not delivered in accordance with market expectations.

- Sub-par performance in any of its segments, especially mortgage servicing (Business Services) as a result of higher regulatory and litigation risks; Register and Employee Share Plans as a result of subdued activity.

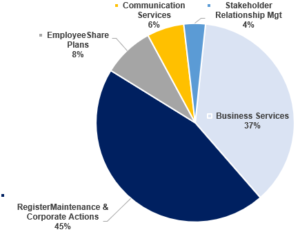

Figure 1 : CPU Earnings (EBITDA) Breakdown by Segment

Source: Company

ANALYST’S NOTE

CPU produced a stellar FY18 result which showed +14.1% Management EPS growth in constant currency (CC) terms to 62.1cps over the previous corresponding period (pcp) (a record profit for CPU and the fastest rate of earnings growth since FY09).

Dividends per share increased +10.5% to 21cps. According to management, earnings were driven by “good progress in Mortgage Services, increased event activity in Stakeholder Relationship Management and Class Actions, cyclical recovery in Corporate Actions, improved margin income and disciplined cost management”.

- Solid FY19 guidance. Management pointed out that in FY19, CPU expects “to deliver around 10% growth in Management EPS… [driven by] stronger contributions in particular from Mortgage Services, Employee Share Plans and margin income… [and] continue to execute our cost out programs, while the outlook for Corporate Actions and some of the large events fee income at this stage looks slightly more subdued than in FY18”.

- Margin expansion was a key highlight… EBITDA margins increased by 150 basis points to 27.1%. Margin income assisted, rising to $175.5m, up 28.9% (which shows how CPU’s earnings are leveraged to rising interest rates).

- Mortgage Services – the highlight. EBITDA of $122.4m was up +65.4% over the pcp, driven by CPU’s US mortgage services business which saw revenue grow +19.0% (with UPB up +35.7% to $81bn). CPU’s UK mortgage services saw flat revenue growth however management expects “significant synergy benefits to be realised in FY19 and FY20”. CPU remains well placed with challenger banks to grow new servicing volumes with its book expected to turn to positive organic growth in FY20-FY21.

- Employee Share Plans. EBITDA of $52.7m was -7.1% lower over the pcp and margin of 23.7% was -190bps lower. This was affected by lower fee revenues and margin income and ‘investing for future’ program costs.

- Register Maintenance and Corporate Actions. The segment saw solid EBITDA growth of +9.7% over the pcp and margin improvement to 33.5%, up 180bps. This was driven by higher margin Corporate Actions revenues, improved margin income and cost out programs driving margin expansion. Management is seeing “Register Maintenance trends improving, with encouraging return to organic growth in 2H”.

- Costs outs ahead of expectations. Stage 1 & 2 cumulative benefits of $49.4m, ahead of schedule $42.0m. Management expects Stage 3 savings to begin in FY19 (total savings of $40m -$55m expected). Overall cost to income ratio of 72.9% was -160bps lower than 74.5% in FY17.

- Free cash flow… Free cash flow is strong at $379.2m which according to management self-funds CPU’s technology initiatives, growth plans and strategic investments, share buyback and reduction in debt. Today we declare an AU 21 cents fully franked final dividend.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

CPU FY18 Results Summary

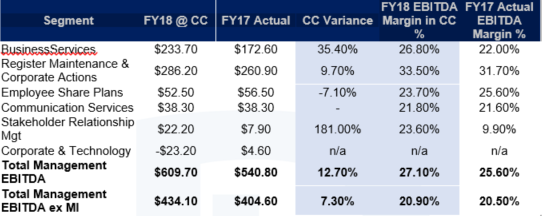

Figure 2: CPU FY18 Results Summary – by Segments

Source: Company

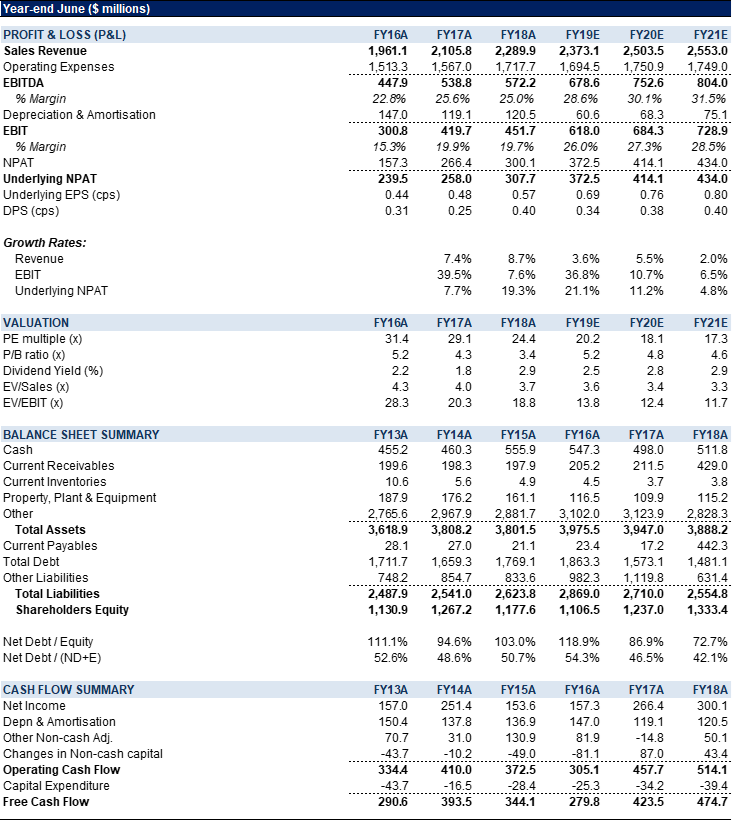

Figure 3: CPU Financial Statements

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Computershare Ltd (CPU) is a global market leader in transfer agency and share registration, employee equity plans, mortgage servicing, proxy solicitation and stakeholder communications. CPU also operates in corporate trust, bankruptcy, class action and a range of other diversified financial and governance services.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >