Carsales.com Ltd (CAR) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | CAR | A$15.85 | A$15.61 | NEUTRAL |

| Date of Report 23/08/18 | ASX CAR |

| Price A$15.85 | Price Target A$15.61 |

| Analyst Recommendation NEUTRAL | |

| Sector : Information Technology | 52-Week Range: A$12.66 – 16.45 |

| Industry: Internet Software and Services | Market Cap: A$3,861m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CAR as a Neutral for the following reasons:

- Leading market position in online car classifieds.

- Overseas expansion provides new growth opportunities from the core Australian market.

- Bolt-on acquisitions provide opportunity to supplement organic growth.

- The Company can sustain high single-digit and low double-digit revenue growth.

- CAR’s move into adjacent products and industries.

We see the following key risks to our investment thesis:

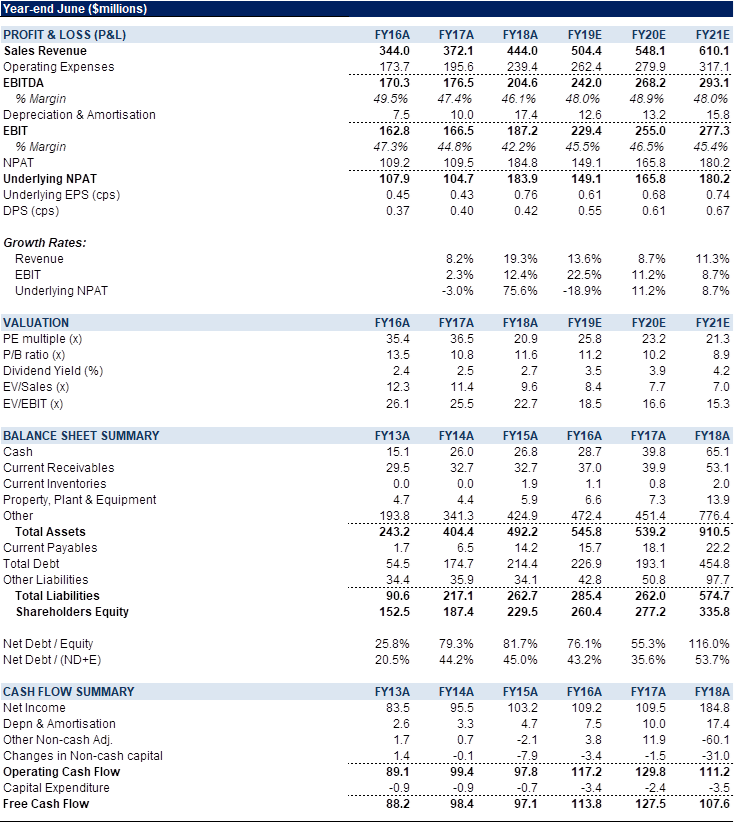

- Rich valuation – on our estimates trading on a FY20E PE multiple of 23.2x.

- Competitive pressures, that is car dealer driven substitute platform or the No. 2 & 3 player gain ground on CAR.

- Motor vehicle sales remain subdued.

- Finance and Related Services segment continues to be a drag on earnings.

- Value destructive acquisition / execution risk with international strategy.

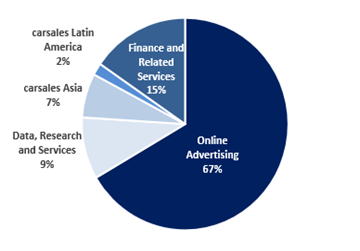

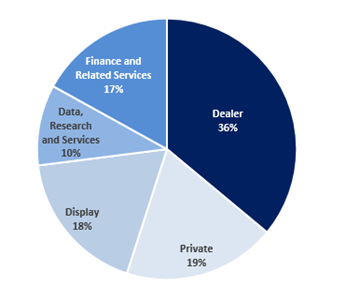

Figure 1: CAR revenue by segment

Source: Company

Source: Company

ANALYST’S NOTE

CAR stock price was up +9.8% after the company’s FY18 results met consensus estimates (revenue of $444m was ahead of estimates of $440.5m and EBITDA of $204.6m versus estimates of $206.7m

Excluding the impact of acquisition, revenue grew +12% and EBITDA was up +8%, however group EBITDA margins declined to 46.1% (a product of declining margins in the International and Finance businesses).

Further, CAR’s domestic core business remains solid as ever, with domestic online advertising revenue up +10%, with Private contributing +21% and International business started to perform well with strong growth in Webmotors.

However, we fail to get more excited about the stock given CAR is currently trading on a FY20E PE-multiple of 23.2x on our estimates and largely in-line with our valuation (which in our view is adequately reflecting near-term upside).

- FY18 results overview.

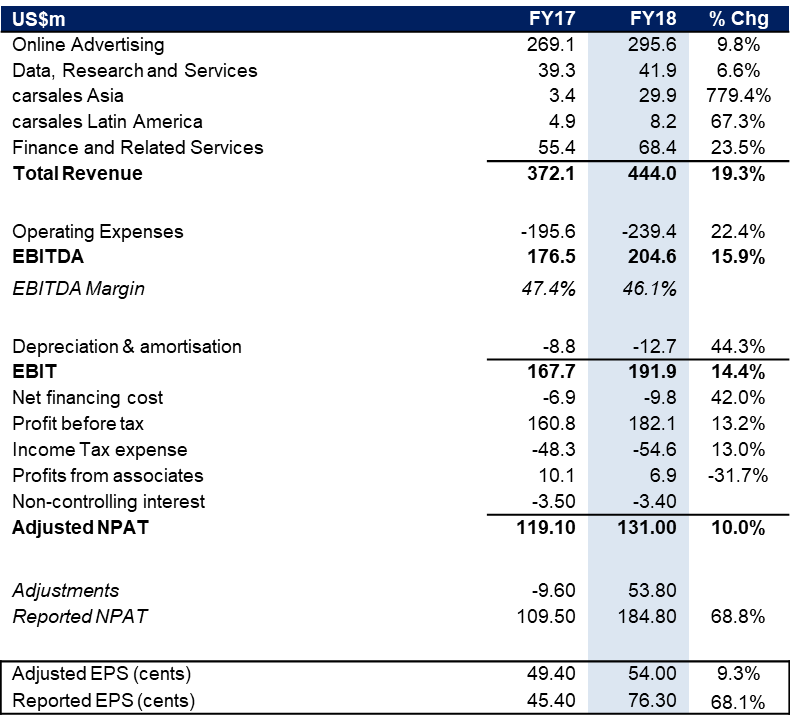

1. Solid top-line organic growth with underlying group revenue up +19.0% (driven by +9.8% growth in online advertising and acquisition of SK Encar) and underlying operating earnings (EBITDA) up +16.0%. Excluding the impact of acquisition, revenue and EBITDA were up +12% and +8% respectively.

2. Adjusted NPAT was up +10% on pcp.

3. Domestic core business margins continue to expand with core segments seeing a +0.9% uplift in margins however group EBITDA margins declined to 46.1% from 47.4% in FY17, pertaining to decline in Stratton margins and losses from soloautos and demotores.

4. Adjusted EPS growth was +10%, with final dividend being declared at 23.7 cps, up +10.0% over pcp.

5. Leverage increased to 1.9x and net interest cover declined to 20.8x, due to increased debt levels to fund SK Encar acquisition but the management claims the ratios to still be at a very strong level. - Domestic segment performs strongly. CAR’s core domestic segment continued to deliver double digit growth at +12.0% with online advertising up +10.0%, Data, Research and Services up +7.0%, and FR&S’ revenue jumping +24.0%. Online Advertising revenue growth was attributed to the strong performance of Private segment (revenue up +21.0), reflecting positive yield from tiered pricing and strong revenue growth in tyresales, Instant offer and RedBook Inspect. DR&S revenue grew by +7% driven by continued demand from OEM’s, car insurers and finance companies and introduction of a new warranty product. FR&S saw an impressive +24.0% jump in revenue but EBITDA declined by -3%, as operating expense grew 5.2% (a product of higher sales commissions and higher investments in people and technology). Within FR&S, core finance broking business showed +10% growth in revenue on pcp, reflecting higher volume and higher average net amount financed, partially offset by drag on the revenue due to credit tightening.

- International segment driven by strong performance of Webmotors. The International portfolio performed well, delivering +54% growth in revenue (44% organic growth) and +76% growth in EBITDA, led by strong performance of Webmotors in Brazil and the acquisition of SK Encar, partially offset by EBITDA loss in Soloautos (-33m Mexican pesos) and Demortores (-28m Argentine pesos) pertaining to increased costs due to management’s aggressive pursuit of clear market leadership. SK Encar was successfully integrated into the carsales group in January 2018, achieving +17% revenue growth and +10% EBITDA growth. Webmotors delivered outstanding performance with +81% EBITDA growth, driven by +43% growth in dealer revenue.

- Outlook commentary.

1. CAR expects domestic adjacent businesses to continue to grow favorably with contribution from premium listing and promote products staying strong.

2. Management anticipates revenue, EBITDA and NPAT growth to remain solid in the domestic business and solid performance of Finance and Related Services business.

3. CAR is expecting SK Encar to display solid revenue and earnings growth in FY19.

4. The integration of core IP and tech into the Latin American businesses will continue, and management hopes will drive an uplift in revenue.

FY18 RESULTS SUMMARY…

Figure 3: FY18 P&L summary

Source: Company, BTIG

Figure 4: CAR Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

Carsales.com Ltd (CAR), founded in 1997, operates the largest online automotive, motorcycle and marine classifieds business in Australia. Carsales is regarded as one of Australia’s original disruptors and has expanded to include a large number of market-leading brands. The Company employs over 800 and develops world leading technology and advertising solutions in Melbourne.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >