Cleanaway Waste Management (CWY) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | CWY | A$2.05 | A$2.12 | NEUTRAL |

| Date of Report 23/08/18 | ASX CWY |

| Price A$2.05 | Price Target A$2.12 |

| Analyst Recommendation NEUTRAL | |

| Sector : Industrials | 52-Week Range: A$1.30 – 2.08 |

| Industry: Waste Management | Market Cap: A$4,176.0m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CWY as a Neutral for the following reasons:

- Trading at fair value relative to valuation of domestic and global peers.

- Solids segment is growing at slightly GDP plus, with potential to benefit as CWY’s sales team focuses more on price increases.

- Liquids and Industrial Services expected to turnaround as well as benefit from strong oil prices.

- Solid balance sheet with targets to push capex spend lower than D&A.

- High barriers to entry – hard to replicate assets & solid margin business.

We see the following key risks to our investment thesis:

- Weaker than expected performance for its Solids segment.

- Little price increases possible for Solids segment.

- Poor performance in Liquids and Industrial Services.

- Slow to no recovery in oil price.

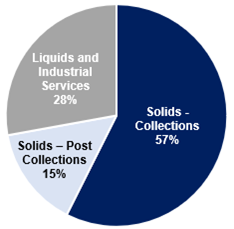

Figure 1: Revenue by Segments

Source: Company

ANALYST’S NOTE

CWY reported strong FY18 results amidst changing regulatory environments in National Sword Policy and Recycling, with organic growth experienced across all segment revenues, earnings (EBIT) and margins.

Key highlights included:

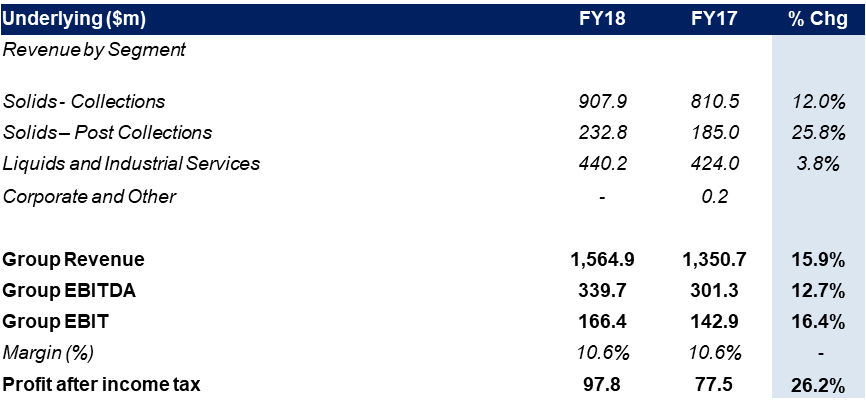

1. Underlying net revenue up +15.9% to $1564.9m.

2. Underlying EBITDA up +12.7% to $339.7m.

3. Underlying EBIT up +16.4% to $166.4m.

4. Underlying NPAT up +26.2% to $97.8m.

5. Cash flow performance was strong with operating cash flow up +16.7% and free cash flow up +86.6%.

The acquisition of Toxfree Solutions has been completed and Management reiterated that it will deliver ~$35m in synergies over 2 years. Whilst no quantitative guidance was provided by CWY, management did provide positive comments on CWY’s future earnings profile.

We have no doubt about the quality of the management team and assets and that CWY should provide consistent and stable returns (barring any unforeseen issues), however, we reiterate our Neutral recommendation on valuation grounds.

- Solid FY18 results despite experiencing industry-wide headwinds.

1. On an underlying basis, net revenue grew +15.9%, EBITDA grew +12.7% and EBIT grew +16.4% on pcp. NPAT rose +26.2% on pcp, despite downward pressure as a result of industry wide changes to recycling and commodities markets which increased costs of sorting material and negatively impacted commodity prices.

2. The Company announced a fully franked final dividend of 1.4 cpu with DRP open.

3. Cash flow performance was strong with operating cash flow up +16.7% and free cash flow up +86.6%. - Solids Collections (~57% of revenue). Net revenue for Solids Collections increased +12% to $907.9m, EBITDA increased +2.9% to $165.5m and EBIT grew +2.0% to $100.8m. Results were attributed to both volume and price increases across major solid waste collection categories. Management highlighted that pricing remains competitive in major cities, with collection margins experiencing downward pressure during the year due to industry wide changes to recycling markets. Major contracts signed in FY18 are expected to underpin continued revenue growth in FY19.

- Solids Post Collections (~15% of revenue). The segment recorded increase in net revenue by +25.8% to $232.8m, EBITDA increase by +21.3% to $116.6m and EBIT increase of +45.4% to $56.4m on pcp. Strong results were driven by increased activity levels in Melbourne, with the South East Melbourne Transfer Station becoming fully operational. FY19 should see contribution of new transfer station in Erskine Park (scheduled to be completed by 1H19).

- Liquids & Industrial Services (~28% of revenue). Compared to pcp, the segment recorded an increase in net revenue of +3.8% to $440.2m, increase in EBITDA by +7.0% to $63.0m and EBIT gains of +10.6% to $35.5m. Management expects more improvement in this division, given synergies that will be gained following Toxfree acquisition in May 2018.

- Acquisition of Toxfree completed and integration underway. The acquisition of Toxfree was completed during 2H18 and management is certain that integration will take two years, delivering $35m in synergies. In our view, management has a clear strategy for this integration with its six major pillars to deliver success and we believe this will provide significant upside given the productivity benefits of the acquisition.

- No quantitative FY19 guidance, but Management confident about growth. CWY did not provide quantitative guidance in FY18 results, however Management remains confident that all three operating segments will report improved earnings in FY19.

FY18 RESULTS SUMMARY…

Figure 2: CWY Results Overview – Group level (Underlying Results)

Source: Company

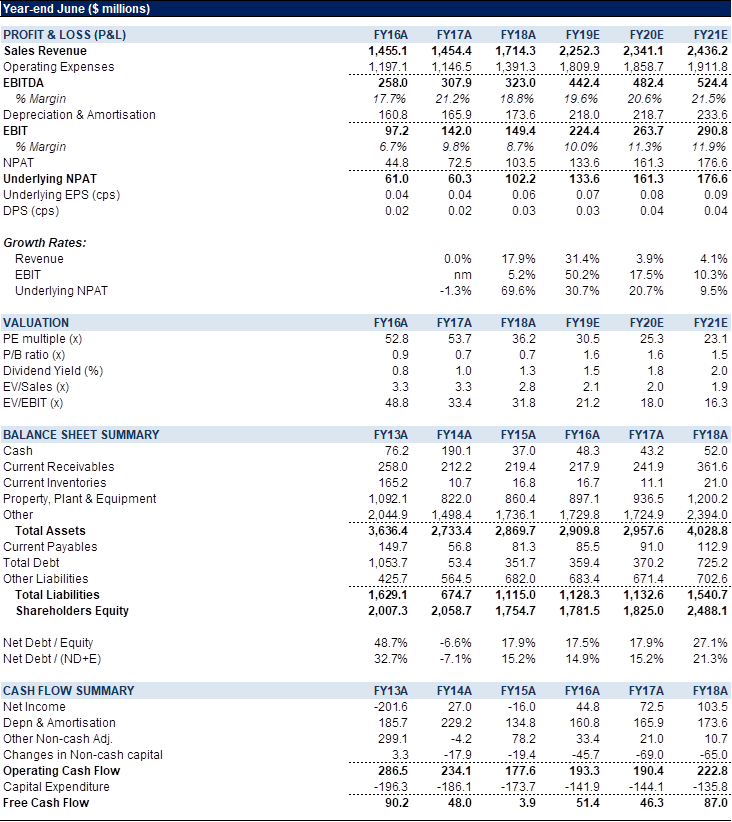

Figure 3: CWY Financial Summary

Source: Company

COMPANY DESCRIPTION

Cleanaway Waste Management Ltd (CWY) is Australia’s leading total waste management services company. CWY has a nation-wide footprint in solid, liquid, hydrocarbon and industrial services (with ~200 solid, liquid, hydrocarbon and industrial services depots and processing facilities across the country servicing well over 100,000 customers. CWY operates three core segments: (1) Solids (Collection) operates the largest network of collections vehicles in Australia operating from more than 100 depots, servicing 90+ municipal councils; (2) Solids (Post Collections) has one of the largest post collections asset bases in Australia with a growing network of transfer stations and landfill assets; (3) Liquids & Industrial Services encompasses the largest hydrocarbons recycling business in Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >