Spark New Zealand (SPK) – Neutral

Spark New Zealand (SPK) reported FY18 results that beat consensus estimates on the earnings front. Compared to the previous year, adjusted EBITDA (excluding Quantum implementation costs) was up +2.2% to $1.0bn as a result of ongoing revenue growth across mobile, cloud, security and service management and net labour cost reductions.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | SPK | A$3.57 | A$3.36 | NEUTRAL |

| Date of Report 23/08/18 | ASX SPK |

| Price A$3.57 | Price Target A$3.36 |

| Analyst Recommendation NEUTRAL | |

| Sector : Telecommunications Services | 52-Week Range: A$15.11 – 21.73 |

| Industry: Telecom Carriers | Market Cap: A$11,623.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SPK as a Neutral for the following reasons:

- We take a cautious approach and yield to management’s comments around FY18 but note the attractive dividend yield of 7.4%.

- Market-leading position in New Zealand. Dominant market share in Mobile, Broadband and is the leader in IT Services.

- Strong capacity for growth demonstrated across all segments, with IT expected to continue to be a key driver as more consumers and businesses migrate to the Cloud.

- Investments in Broadband and the roll-out of 4.5G should see its lagging broadband segment improve.

- Multi-product offerings provide interesting points of differentiation from other telco providers.

- Current gearing (net debt /EBITDA) of 1.17x is solid compared to A-credit rating requirement of under 1.5x.

- Implementation of “Agile” leading to further cost reductions and operating efficiencies.

- Increasing customer demand for higher-margin cloud-based services.

- Increases in ARPU growth and connections despite weak industry conditions

- SPK still commands a strong market positions and has the ability to invest in technologies and areas which could provide room for growth.

We see the following key risks to our investment thesis:

- Unsuccessful migration of copper wire customers resulting in earnings drag in May due to weather conditions.

- More competition in its Mobile and Broadband segments leading to aggressive margin contraction, especially as products become commoditised.

- Risk of cost blowout (for instance in network upgrades or maintenance).

- Churn risk.

- Balance sheet risk (including credit ratings risk) should earnings decline due competitive and structural risks.

- Reduced flexibility and increased net debt if unable to fund total dividend by earnings per share

- Any network disruptions/outages.

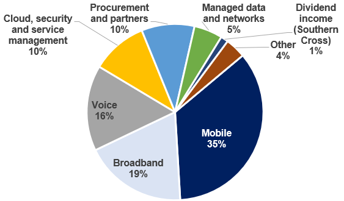

Figure 1: Revenue split by Product

Source: Company, BTIG

ANALYST’S NOTE

Spark New Zealand (SPK) reported FY18 results that beat consensus estimates on the earnings front. Compared to the previous year, adjusted EBITDA (excluding Quantum implementation costs) was up +2.2% to $1.0bn as a result of ongoing revenue growth across mobile, cloud, security and service management and net labour cost reductions.

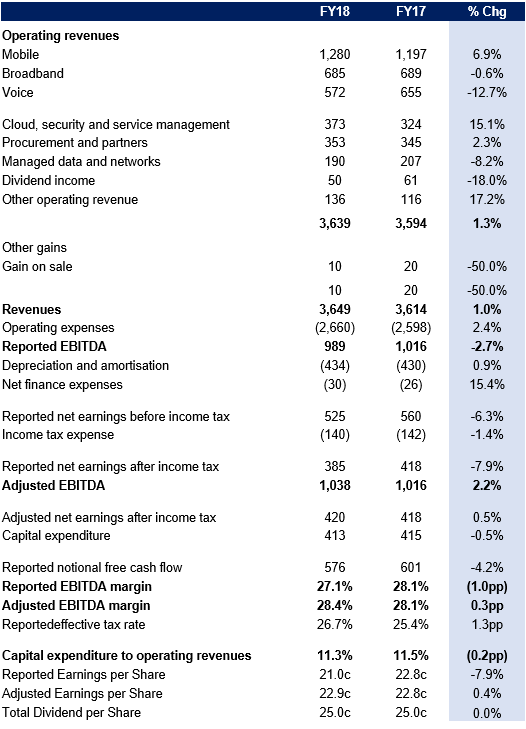

Group revenue was +1.0% ($35m) higher at $3.65bn, driven by significant revenue growth across mobile (+6.9%) and cloud, security and service management (+15.1%) partially offset by continuing declines in voice, managed data and networks revenues.

Adjusted NPAT was up +0.5% to $420m on prior year due to underlying EBTIDA growth, partially offset by +0.9% increase in depreciation and amortisation from a shift toward investment into shorter asset lives and finance expenses on higher average net debt. Capex was in line with the prior year at $413m – within the targeted range of 11% – 12% of operating revenues. Current net debt to EBTIDA (1.17x) continues to provide SPK with sufficient debt headroom.

Consistent with guidance given in FY17, Southern Cross dividend declined -18% to $50m, with FY19 dividend expected to decline significantly to between $10 – $20m as pre-purchase capacity from large customers decreases (FY19 DPS to be in line with FY18 at 25.0cps 75% imputed). FY19 earnings per share is expected to be between 23c – 24c (while DPS is expected to be 25.0cps as management may use debt to supplement earnings).

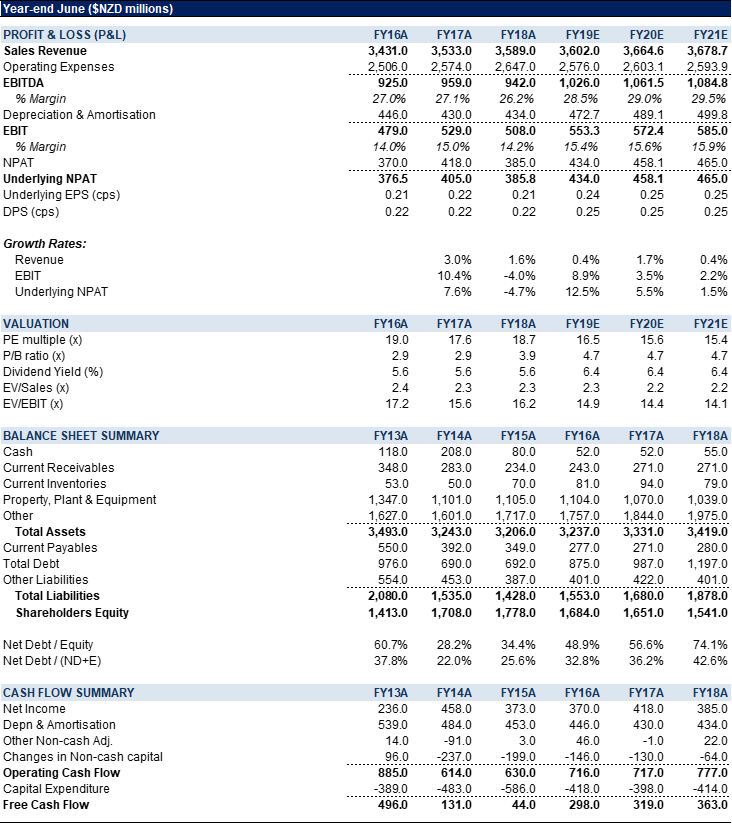

SPK trades in-line with our valuation and on 6.4% dividend yield; we see the stock offering stable returns and in a trading range; reiterate Neutral.

- Overall FY18 results highlights + Guidance. Group revenue increased +1.3%, and adjusted earnings (EBITDA) increased +2.2% on stable margins of 28.4%. interestingly, FY19 earnings per share is expected to be between 23c – 24c (while DPS is expected to be 25.0cps as management may use debt to supplement earnings).

By products:

1. Mobile (~35% of revenue; 38.9% market share) – saw revenue growth of +6.9%, driven by continued ARPU growth (+1.2% on prior year) and pay-monthly connection growth of +6.3% from the successful launch of an unlimited consumer mobile plan and increased migration from pre-paid to pay-monthly (Mobile gross margin up +5.3% on prior year). SPK is the only New Zealand provider to grow revenue market share, connections and ARPU during FY18.

2. Broadband (~19% of revenue; 41.5% market share) – revenue is down -0.6% on prior year. Interestingly, management noted “aggressive acquisition pricing and increases in input costs which are proving difficult to pass through” and the “market approaching saturation”.

3. Cloud, security and service management (~10% of revenue) experienced +15.1% increase in revenue growth to $373m, driven by the launch of new security products (now outpacing more labour-intensive service management products) and demand for higher-margin cloud-based services.

4. Voice and Managed Data and Networks (~5% of revenue) saw accelerating revenue decline of -12.7% and -8.2% respectively due to the ongoing shift from landline voice to other lower-margin fibre-based alternatives and ongoing competitive pricing pressures.

- FY19 outlook…Management guided total revenue to $3,600m to $3,670m (flattish versus $3,599 in FY18), EBITDA to a range of $1,025m – $1,055m (+3.4 to +6.4% uplift above $991m in FY18), Capex at ~$410m (from $413m in FY18 and within their targeted capex at 11-12%), EPS of 23c – 24c (22.9c in FY18), and DPS in line with the prior year at 25.0cps, 75% imputed. Management aims to deliver a “total dividend that is fully funded by EPS of 25c or above” and “while EPS remain below 25c, SPK may choose to use debt to supplement earnings”.

FY18 RESULTS SUMMARY…

Figure 2: FY18 Financial summary

Source: Company

Figure 3: SPK Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Spark New Zealand Ltd (SPK) is a New Zealand based telecommunications company. SPK’s key services are the provision of telephone lines, mobile telecommunications, broadband services and IT services. Its key product offerings are Spark Home, Mobile & Business, Spark Digital, Spark Ventures, and Spark Connect. The Company operates four main segments:

1. Spark Home, Mobile & Business;

2. Spark Digital;

3. Spark Connect & Platforms; and

4. Spark Ventures & Wholesale.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >