ARB Corporation Ltd (ARB) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 24/08/18 | ARB | A$19.92 | A$20.35 | NEUTRAL |

| Date of Report 24/08/18 | ASX ARB |

| Price A$19.92 | Price Target A$20.35 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$16.30 – 23.94 |

| Industry: Auto Parts & Equipment | Market Cap: A$1,575m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate ARB as a Neutral for the following reasons:

- Experienced management team and senior staff with track record of delivering earnings growth.

- Strong balance sheet with low gearing levels.

- Strong presence and brands in Australian aftermarket segment.

- Growing presence in Europe and Middle East and potential to grow Exports.

- Management remains confident of better OEM sales growth in FY19.

We see the following key risks to our investment thesis:

- Higher than expected sales growth rates.

- Any delays or interruptions in production, especially in Thailand which happens on an annual basis.

- Increased competition in Australian Aftermarket especially with competitors’ tendency to replicate ARB products.

- Slowing down of demand from OEMs.

- Poor execution of R&D.

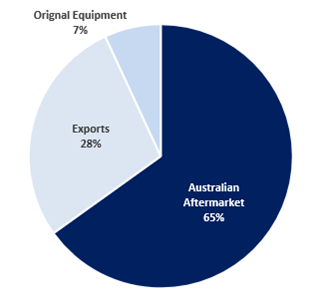

Figure 1: Revenue contribution by customer category

Source: Company

ANALYST’S NOTE

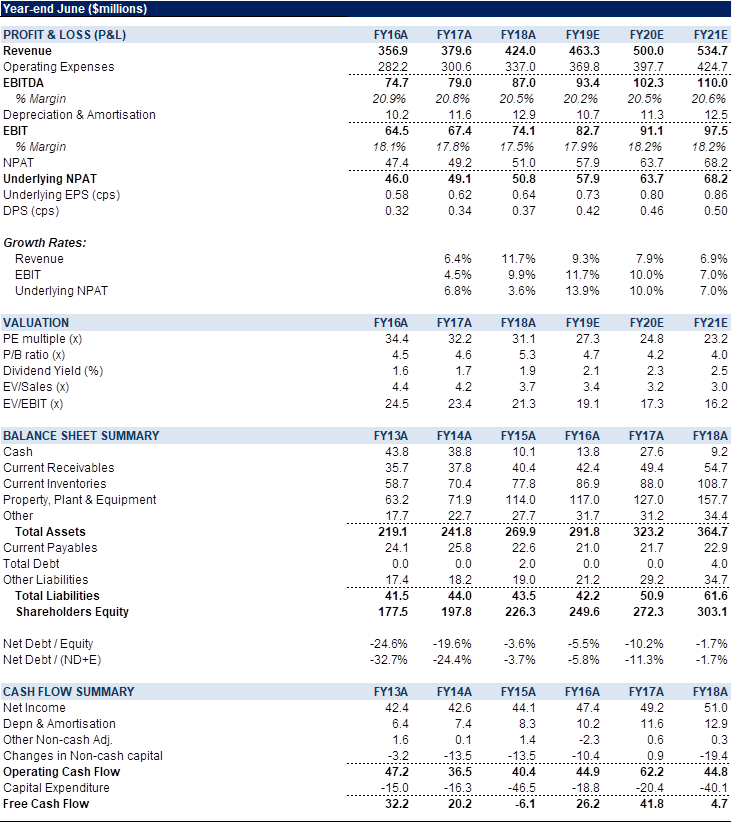

ARB Corporation Ltd (ARB) reported FY18 results, with EPS of 64.3cps, NPAT of $50.9m and revenue of $423.9m, which came in below analyst estimates of 69.3cps, $55.05m and $430.33m respectively.

This saw the share price slide by -7.24%. The exports segment continued to perform particularly well, achieving +14.7% in growth. The Australian aftermarket business was solid with +11.4% growth, while the Original Equipment Manufactures division showed posted a +2.8% growth rate due to some OEM projects being delayed in 2H18 due to programme complications.

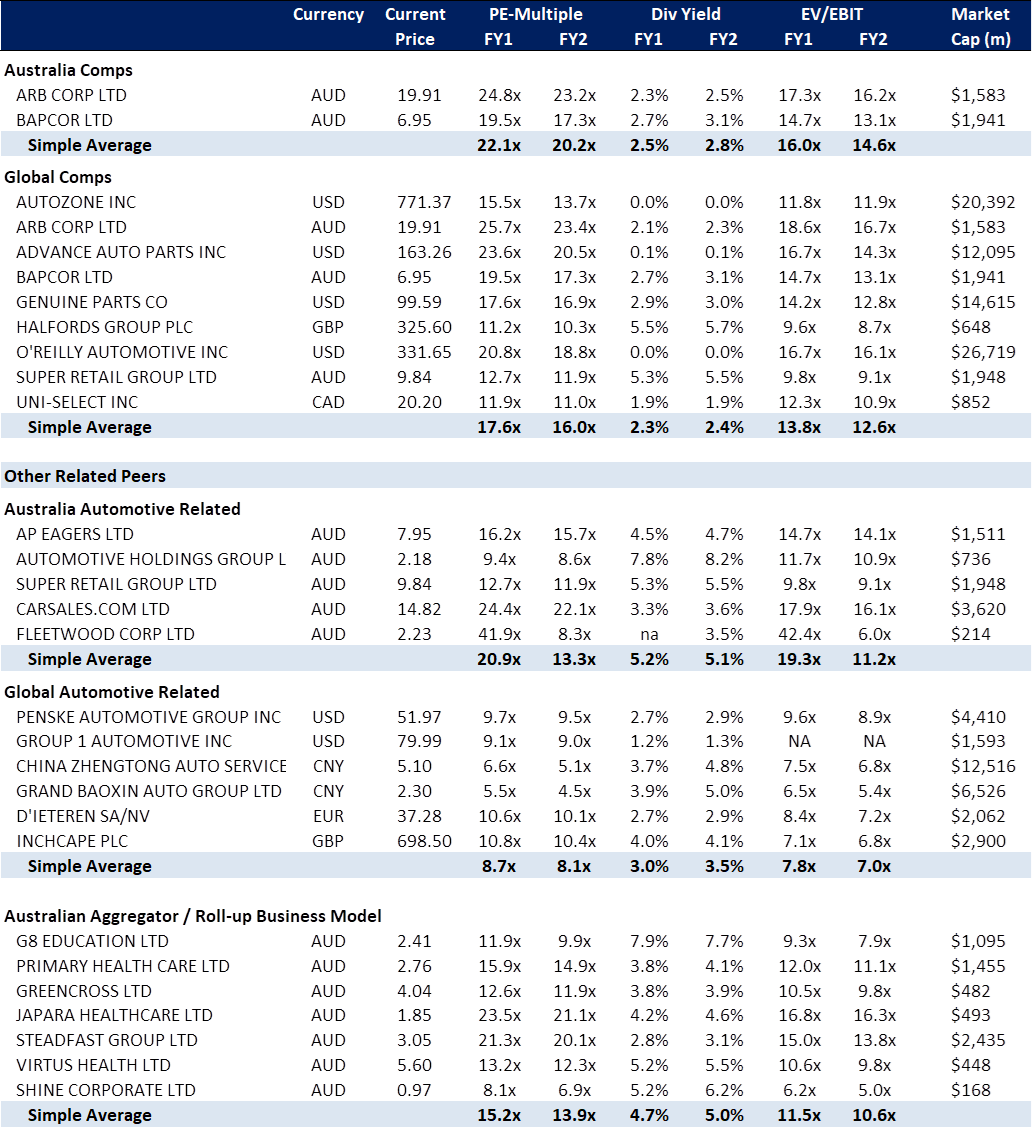

ARB is a quality company with strong management team in our view, however, ARB trades on fair value relative to our DCF valuation, on FY20e multiples of 24.8x PE-multiple and 2.3% dividend yield. Reiterate Neutral.

- FY18 results overview. ARB posted revenue of $423.9m up +11.7% over the pcp and an NPAT of $50.9m (up +3.7%), which included $3m of provision for taxes in prior years expensed in FY18. Excluding this provision, NPAT grew +9.9% over pcp. Consequently, an EPS of 64.3cps (marginally up by 3.5%) was posted. Management also announced a fully franked final dividend of 19.5cps, bringing the total FY18 dividend to 37cps (up +8.8% over the pcp).

- Australian aftermarket. The division grew by a robust +11.4% compared to the pcp. Growth was achieved throughout all states, with New South Wales, Queensland, Tasmania, South Australia and Western Australia showing above-average performance, while Northern Territory growth was below average due to capacity constraints. 2 additional stores were added to the division’s portfolio (since the pcp) totalling 63 ARB stores in Australia, of which 25 are Company-owned.

- Export segment delivers strong performance. Export was a standout in FY18 results; experiencing an impressive growth rate of +14.7% (over the pcp), with ARB showing strong growth in export sales made from distribution centres in Australia, the U.S., the Czech Republic, Thailand and the UAE.

- Original Equipment Manufacturing. Sales to OEM grew by +2.8% and now represents 6.9% of total group sales. Management noted that some OEM projects were delayed in 2H18 due to programme complications but the projects are planned to commence shortly. Management remains confident of better OEM sales growth in FY19.

- Balance sheet remains strong. The balance sheet holds no debt, while maintaining a positive net cash position despite significant expenditure on PPE and inventory in FY18– allowing ARB to seek growth accretive strategies like acquisitions.

- No specific guidance provided. Management provided no specific outlook numbers for the full-year, only stating that “the current economic conditions still remain uncertain. The severe drought in the eastern Australian states will certainly affect ARB’s business to some extent. However, the outlook for the Company is positive and the Board is optimistic about the future. Demand for the Company’s products currently remains healthy in many countries around the world.”

FY18 RESULTS SUMMARY

Figure 2: ARB Comparables

Source: Company

Figure 3: ARB Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

ARB Corporation Ltd (ARB) designs, manufactures, distributes, and sells 4-wheel drive vehicle accessories and light metal engineering works. It is predominantly based in Australia but also has presence in the US, Thailand, Middle East, and Europe. There are currently 61 ARB stores across Australia for aftermarket sales.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >