Bapcor Ltd (BAP) – Neutral

Bapcor Ltd (BAP) FY18 results were largely in-line with consensus estimates, with proforma NPAT of $86.5m coming in consensus range of $85.2m-90.3m which saw the stock price increase marginally.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 24/08/18 | BAP | A$6.95 | A$6.74 | NEUTRAL |

| Date of Report 24/08/18 | ASX BAP |

| Price A$6.95 | Price Target A$6.74 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$5.19 – 7.24 |

| Industry: Distributors | Market Cap: A$1,939.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate BAP as a Neutral for the following reasons:

- The stock price is trading largely in line with our valuation and price target.

- Strong earnings growth profile.

- Further opportunity to grow gross profit margins from better buying terms with tier one and two suppliers.

- Significant distribution network across Australia to leverage from.

- Ongoing bolt on acquisitions and associated synergies.

- Growing BAP’s own brand strategy, which should be a positive for margins.

We see the following key risks to our investment thesis:

- Rising competitive pressures.

- Value destructive acquisition.

- Rising cost pressures eroding margins (e.g. more brand or marketing investment required due to competitive pressures).

- Given the high trading multiples the stock trades at, a disappointing earnings update could see the stock price significantly re-rate lower.

- Integration (and therefore synergies) of recent acquisitions underperform market expectations.

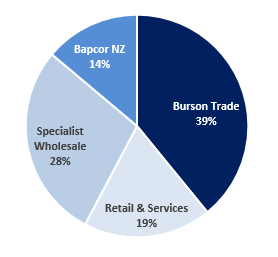

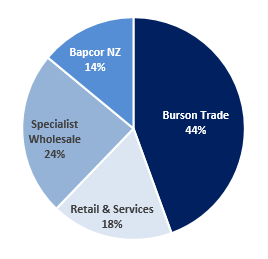

Figure 1: Revenue by segment

Source: Company

Source: Company

ANALYST’S NOTE

Bapcor Ltd (BAP) FY18 results were largely in-line with consensus estimates, with proforma NPAT of $86.5m coming in consensus range of $85.2m-90.3m which saw the stock price increase marginally.

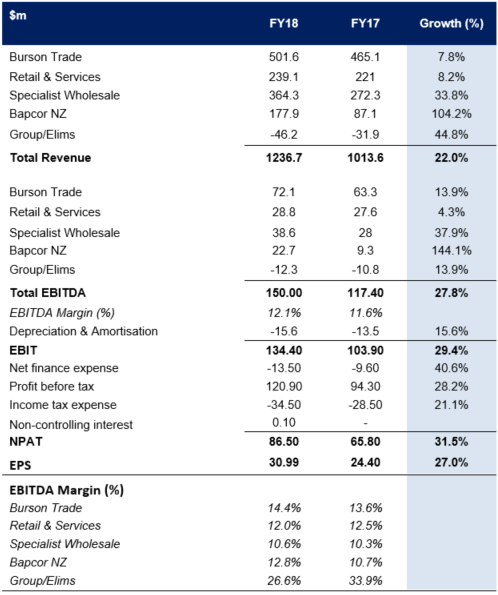

Key financial highlights (including the Hellaby business) versus the previous corresponding period (pcp):

1. revenue up +22% to $1.23bn;

2. Underlying EBITDA growth of +28% to $150m;

3. Proforma NPAT up +31.6% to $86.5m; and

4. EPS at 30.99cps (a +27% increase), indicating healthy organic growth in the underlying business.

Management declared a final fully franked dividend of 8.5 cents per share (up 13.3% compared to the pcp), bringing the total dividends for FY18 to 15.5 cps (up 19.2%). Further, management noted that consensus estimate of FY19 EBITDA of $170m was reasonable and they expect an increase in NPAT of 9%-14% above FY18 proforma NPAT.

We maintain our Neutral recommendation only on valuation grounds only but note management guidance of a strong year ahead (our numbers are on the lower end of guidance or on the conservative side).

- Other FY18 Highlights.

1. Net debt was $289.5m, representing a leverage ratio of 2.0X, was in line with Bapcor’s FY18 target.

2. Strong cash conversion of 98.9% with $57.1m net cash generated excluding acquisitions, dividends and divestment proceeds.

3. Completed divestment of non-core assets of Contract Resources, TBS and Footwear with investment proceeds of NZ$103m. - Burson Trade – strong results. Trade revenue increased by +7.8% to $501.6m led by strong equipment sales growth and EBITDA grew by +13.9% to $72.1m compared to FY17, achieving same store sales growth of +4.4%. Margins also increased by +80bps to 14.4%. BAP acquired Tricor Engineering, a specialist in supply and installation of lubrication equipment for workshops and opened 10 new stores taking the total store count to 170.

- Retail & Service – making good progress. Revenue for FY18 increased by +8.2% compared to pcp, which included a higher mix of company owned stores versus franchise operations across its store network. EBITDA increased +4.4%, while EBITDA margins declined by 50bps, due to increased sales from the new company owned stores, impacting revenue mix. Same store sales growth for company owned Autobarn stores was up +4.7% franchise stores was up +1.4%. Autobarn added 17 new company owned stores to its network during the year, consisting of 8 greenfield stores and the conversion of 9 franchise operations, bringing the total number of company owned Autobarn stores to 48.

- Specialist Wholesale. The Specialist Wholesale segment which comprises eleven business units grew revenue by +33.8% and EBITDA by +37.9% to $364.3m and $38.6m respectively. Revenue increased +11.0% and EBITDA grew by +16.2% (if we were to consider inclusion of Hellaby in full year results). Good performance was recorded across all Specialist Wholesale businesses and BAP acquired AADi (importer/distributor of driveshafts, CV’s, wheel bearings and shock absorbers).

- Bapcor New Zealand. Revenue was $177.9, and EBITDA was $22.7 in FY18 an increase of +104.1% and +144.3% respectively, post Hellaby acquisition, taking into consideration that the acquisition effect was reflected in full 12 months in FY18 compared to 6 months in FY17. Assuming full year of FY17 to include Hellaby results, revenue increased +5.7% and EBITDA grew by +33.1% compared to pcp. BNT trade business (largest business of Bapcor NZ), achieved like for like sales growth of +6.1% reflecting the success of organisation changes, range expansion and market growth.

- Solid FY 19 Outlook. BAP expects continued revenue and profit growth. Management noted that consensus estimates of EBITDA of $170m are reasonable, and they expect increase in NPAT of 9%-14% above FY18 proforma NPAT. We note that our valuation numbers are on lower end of guidance or the conservative side.

FY18 results by segment…

Figure 3: Segment results

Source: Company

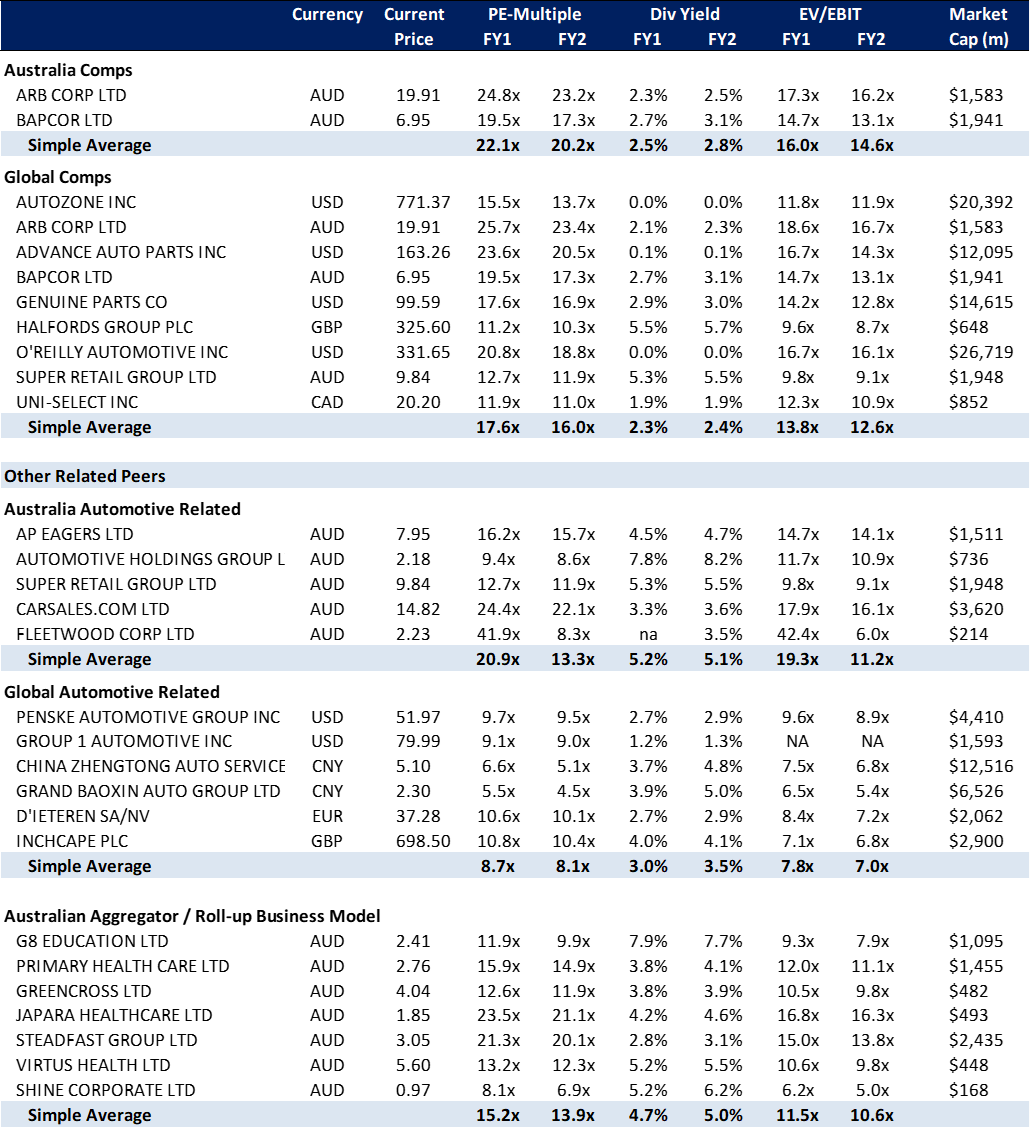

Figure 4: BAP Comparables

Source: Company

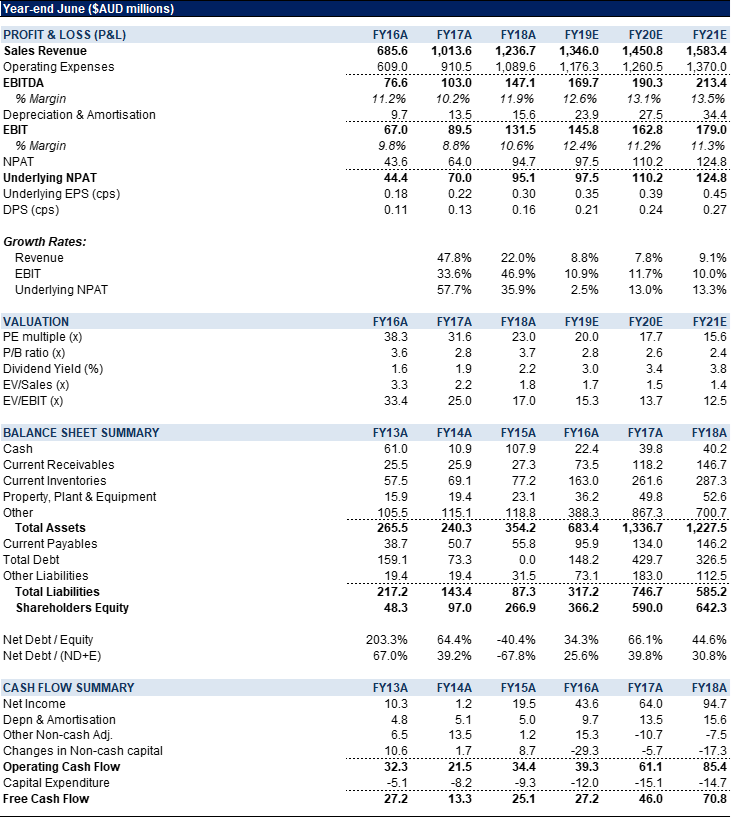

Figure 5: BAP Financial Summary

Source: Company

COMPANY DESCRIPTION

Bapcor Ltd (BAP) is Australasia’s leading provider of aftermarket parts, accessories and services. The core businesses of BAP are:

1. Trade – Burson Auto Parts is a trade focused parts professional supplying workshops with all their parts and accessories.

2. Retail – Autobarn is the premium retailer of auto accessories and Opposite Lock specialises in 4WD accessory specialists.

3. Independents – supporting the independent parts stores via the group’s extensive supply chain capabilities and through brand support.

4. Specialist Wholesaler – the number 1 or 2 industry category specialists in parts supply programs.

5. Services – experts at car servicing through Midas and ABS.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >