Viva Energy REIT Ltd (VVR) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 27/08/18 | VVR | $2.15 | $2.30 | BUY |

| Date of Report 27/08/18 | ASX VVR |

| Price $2.15 | Price Target $2.30 |

| Analyst Recommendation BUY | |

| Sector : Real Estate | 52-Week Range: A$1.94 – 2.28 |

| Industry: Retail REIT | Market Cap: A$1,560.4m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate VVR as a Buy and believe the following key drivers of performance will see the stock outperform the market:

- Quality asset portfolio with weighted Average Lease Expiry (WALE) of 13.2 years with no lease expiries before 2026 and increases of 3.0% per annum bodes well for valuation uplift.

- Majority of assets on triple net leases, where the tenant is responsible for all property outgoings.

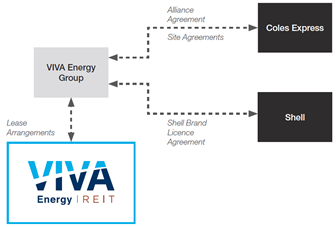

- Viva REIT leases to Viva Energy whom has an Alliance Agreement/Site Agreements with Coles Express and a brand Licence Agreement with Shell. Viva Energy holds ~38% of VVR shares.

- Potential expansion of property network by way of earnings accretive acquisitions.

- Solid capital management with gearing with flexibility to make further acquisitions.

- High barrier to entry; difficult to replicate asset portfolio.

We see the following key risks to our investment thesis:

- Tenant concentration risk.

- Termination of the alliance agreement with Coles Express.

- Competition by other branded service stations.

- Increased cost of fuel supply putting pressure on tenants.

- The sale of properties in the portfolio resulting in decreased rental income.

- Potential for excess supply of service stations thus affecting valuations and other property metrics of the portfolio.

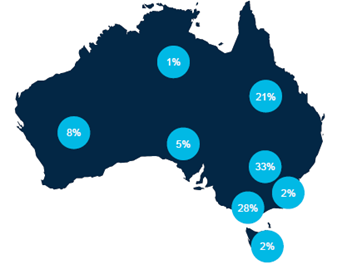

Figure 1: VVR Portfolio Properties by state

Source: Company (FY17)

Source: Company

ANALYST’S NOTE

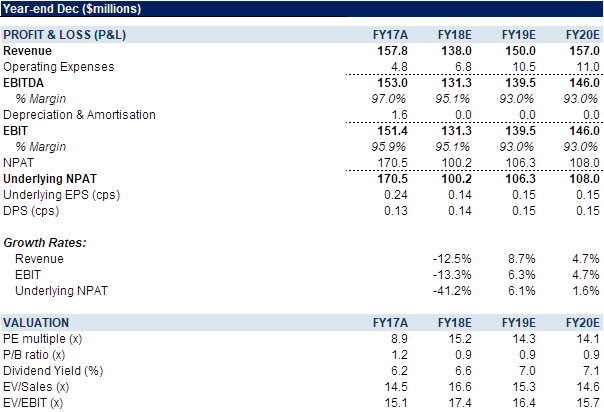

VVR reported solid 1H18 results with distributable earnings of 6.99cps, a +2.8% uplift. In line with the 100% payout policy, the distribution was likewise 6.99cps

Net tangible assets of $2.20 per security was +6.2% higher than 1H17 (or adjusting for the 6.99 distribution, adjusted NTA was $2.13, which is higher than the $2, a year ago). With gearing of 32.5% remaining below the target range of 35-45%; interest cover ratio of 5.6x and drawn-debt 93% hedged for 3.9 years at weighted average cost of debt of 3.84%; this provides VVR with the firepower for potential debt-funded acquisitions (undrawn debt capacity is $192m with full utilisation of that capacity increasing gearing to 37.7%).

VVR continues to manage operating cost well with a management expense ratio of 21 basis points (one of the lowest in the sector and reflective of the nature of the Triple Net leases to major tenant Viva Energy Australia). Trading on a 14.1x PE20, 7.0% dividend yield and 0.9x Price to Book – reiterate Buy.

- Strong visible FY outlook reaffirmed. On the analyst call, management reaffirmed its FY18 guidance stating, “our target payout ratio remains to pay out 100% of distributable earnings to our security holders and our distributable earnings guidance remains unchanged at $0.1381 to $0.1391 per security for 2018”. This implies 3.0%-3.75% growth above FY17.

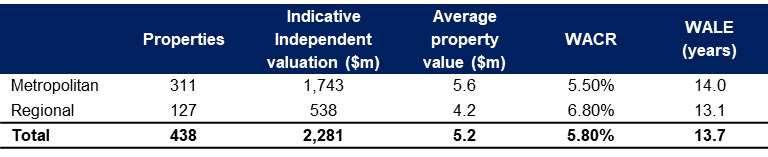

- Solid property portfolio performance – 100% occupied with triple net lease; WALE of 13.2 years; ~3% per annum rent increases. VVR’s portfolio contained 442 high-quality service station and convenience properties valued at $2.33bn with a weighted average cap rate of 5.8%. VVR’s portfolio is geographically diversified across all Australian states and territories with 83% of the portfolio is located in eastern states of Australia with 76% of assets located in metro areas. The overall weighted average lease expiry was 13.2 years and the portfolio are fully leased with 100% occupancy.

- Viva Energy – remains a solid tenant and leading integrated downstream petroleum Company in Australia. Management highlighted a number of key points on their main tenant which we reproduce:

1. Provides ~24% of Australian downstream petroleum market (or 14.2bn litres of ~59.6bn litres based on Australia Petroleum Statistics in 2017).

2. Operates 1,165 service stations nationwide.

3. Owns and operates 44 fuel import terminals and depots which underpin operations.

4. Owns 50% interest in Liberty.

5. Has sole right to use Shell brands in Australia for sale of retail fuel.

6. Has a retail alliance with Coles.

7. Has a strategic relationship with Vitol (one of the world’s largest independent energy commodity trading companies).

8. Has a 38% holding in VVR worth ~$0.6bn.

Figure 3: VVR Portfolio Overview

Source: Company – 1. Includes six properties contracted to be acquired by Viva Energy REIT which were not settled as at 30 June 2017.

Figure 4: VVR Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Viva Energy REIT Ltd (VVR) is an Australian listed REIT that owns a portfolio of service stations across all of Australia’s states and territories. It currently owns 437 service stations in its portfolio. Its service stations are leased on a long term basis to Viva Energy Australia who has licence and brand agreements with Shell and Coles Express. Average value by property is ~ A$5 million, with a weighted average cap rate of 5.9% and a WALE of 14.2 years (as of FY17).

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >