Vocus Group Ltd (VOC) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 27/08/18 | VOC | A$2.79 | A$2.59 | NEUTRAL |

| Date of Report 27/08/18 | ASX VOC |

| Price A$2.79 | Price Target A$2.59 |

| Analyst Recommendation NEUTRAL | |

| Sector : Telecommunication Services | 52-Week Range: A$2.11 – A$3.33 |

| Industry: Integrated Telecommunication Services | Market Cap: A$1,735.9m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate VOC as a Neutral for the following reasons:

- VOC’s full integration of Nextgen into its network will enable VOC to increase leverage and scalability resulting in significant cost advantages (and hence EBITDA margins) and possibly market share.

- Australia Singapore Cable project to provide a new revenue stream for 25 years upon completion.

- Experienced management team.

- Potential takeover target – the Company has been previously approached by Private Equity.

- Reinstatement of dividends should see the share price re-rate.

- Undemanding valuation and trading at a discount to peer group average, hence adequately factoring in short-term company specific challenges.

We see the following key risks to our investment thesis:

- Intensifying competition resulting in increase in churn amongst customers and reduced EBITDA margins.

- Poor acquisitions.

- Unsuccessful or delayed integration of VOC’s acquisitions as well as not achieving synergy targets.

- Australia Singapore Cable build sees capex blowout and not achieving an appropriate ROIC.

- Industry transition to NBN and UFB results in increased churn and lower subscribers.

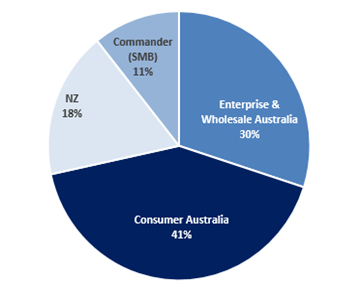

Figure 1: Revenue split by segments

Source: Company (FY17)

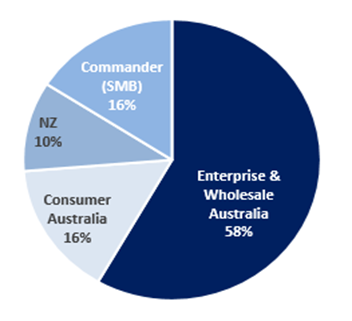

Source: Company

ANALYST’S NOTE

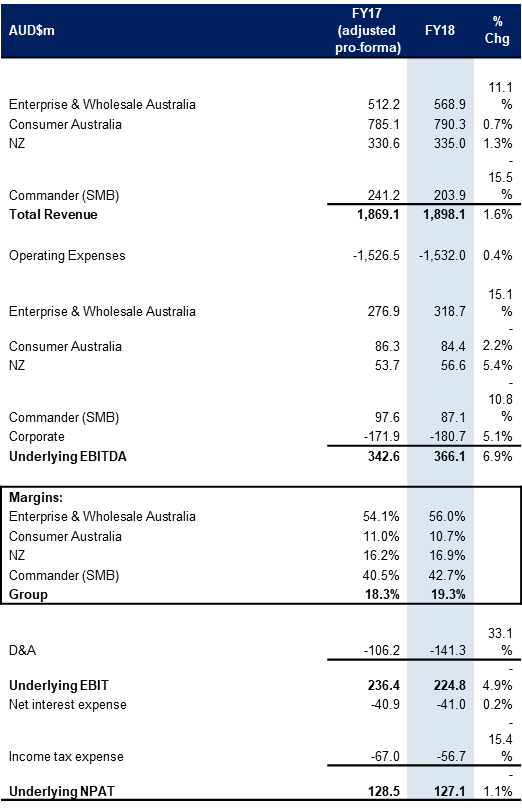

VOC’s FY18 results came slightly below consensus estimates, with underlying EBITDA of $366.1m (below market estimate of $369m), revenue of $1.898bn (below estimate of $1.936bn) and underlying NPAT of $127.1m (below estimate of $127.72m).

However, in our view, the results are solid considering significant internal changes going on in VOC and headwinds from overall challenging market conditions. The cash conversion improved significantly from 52% in FY17 to 88% in FY18 and VOC refinanced debt increasing the weighted average tenure to 3.4 years with net debt of $1bn at the end of the year.

Management confirmed the completion of Australia Singapore Cable by September 2018. There were new appointments across the executive team, including the appointment of a new CEO and two new executive directors.

At this stage we continue to maintain our Hold recommendation despite clearly seeing value in the stock from a valuation perspective relative to peers (which is warranted, in our view as we await further indications that the new management team is executing on strategy.

- FY19 outlook. Management expects:

1. Underlying EBITDA of $350m – $370m (which equates to flattish growth).

2. Depreciation & Amortisation of $160m – $165m.

3. Capex excluding Australia Singapore Cable of $160m – $170m with Australia Singapore Cable capex in H1FY19 of $162m. Management plan to re-invest $15m in the business during FY19 to drive revenue and earnings growth in FY20 and beyond. On the analyst call, management stated, “the Enterprise, Government and Wholesale businesses are expected to gain momentum and the ASC and the Coral Sea cable will both contribute to revenue and earnings. The New Zealand business is also expected to continue to perform strongly…. Margin erosion in the Australian Consumer business caused by migrating customers to the NBN will continue, but this is expected to be off-set by the benefits of cost savings associated with moving to a digitally led business model. We are focused on urgently addressing the significant turnaround challenge with our Commander business, securing its customer base and re-establishing the brand in the market.” - FY18 Divisional highlights.

1. Enterprise & Wholesale revenue was up +11% driven by a disciplined and structured approach to sales. Operating earnings (EBITDA) was up +15%, with margin expanding 190bps on pcp due to increased sales of long haul network.

2. Consumer revenue was marginally up +1% on pcp, affected by extreme competition in Australian telecom market and significant disruptions due to NBN transitioning however the segment was able to retain its NBN market share. EBITDA declined -2% and margins were down 30bps due to increased costs.

3. New Zealand revenue was up +4%, driven growth across voice and data services. EBITDA was up +8% on pcp, with margins improving by +90bps.

4. Commander (SBM brand) revenue declined -15%, leading to a decline in EBITDA by -11% despite margin improvement of 220bps. To address this decline, the business was separated into a stand-alone business unit to bring increased focus and accountability. - Improved cash conversion. VOC improved its cash conversion significantly to 88% from 52% in FY17 and normalised its working capital balances. Management expects impacts of deferred revenue, onerous provision unwind and SAC to be significantly less in FY19 and confirmed strong focus on cash to continue.

- Strong balance sheet. Net debt decreased slightly to $1.001bn (from $1.029bn at in FY17) with weighted average tenure of 3.4 years. Covenants relating to interest and gearing ratios remained unchanged with net leverage ratio (2.73x vs threshold of <3.75x), interest cover ratio (8.9x vs threshold of >5x) and gearing ratio (30% vs threshold of <60%) all remaining comfortably lower than the threshold.

VOC FY18 RESULTS SUMMARY…

Figure 3: VOC FY18 key headline numbers

Source: Company

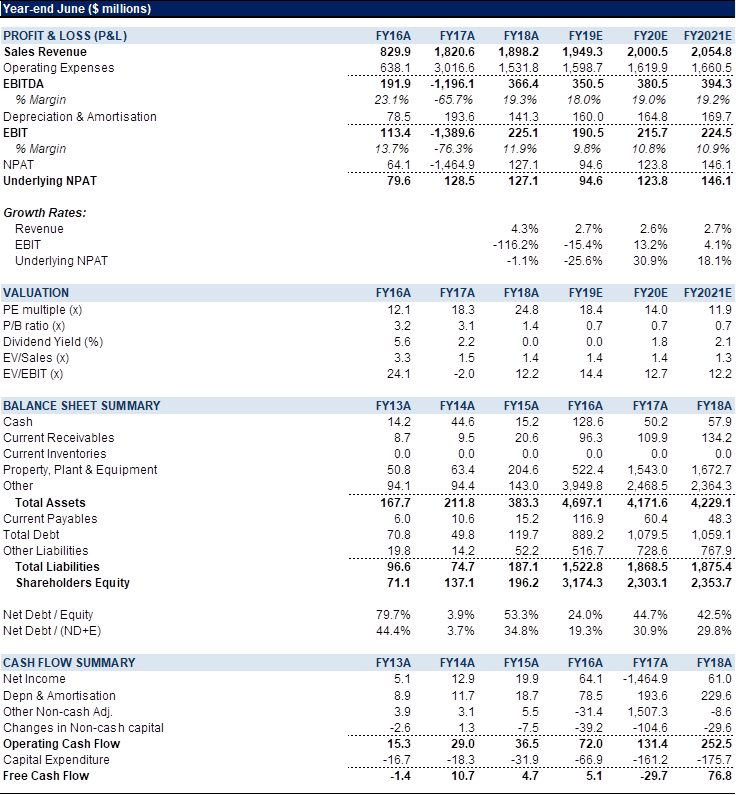

Figure 4: VOC Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Vocus Group Ltd (VOC) is a vertically integrated telco provider operating in Australia and New Zealand. VOC primarily provides telco and energy services to customers across its mass market, corporate and government channels through its extensive national infrastructure network. This network consists of metro and back haul fibre connecting all capital cities and most regional centres across Australia and New Zealand.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >