Newcrest Mining (NCM) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 28/08/18 | NCM | A$19.82 | A$20.90 | NEUTRAL |

| Date of Report 28/08/18 | ASX NCM |

| Price A$19.82 | Price Target A$20.90 |

| Analyst Recommendation NEUTRAL | |

| Sector : Materials | 52-Week Range: A$19.10 – 24.27 |

| Industry: Gold Mining | Market Cap: A$15,262.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate NCM as a Neutral for the following reasons:

- NCM has one of the lowest cost bases amongst gold mining peers in Australia. We expect continued cost outs to lower the All-in Sustaining Cash Cost (AISC), subject to movements in currency (AUD).

- Commodities price (particularly Gold and Copper) surprises on the upside especially due to geopolitical tensions.

- Leveraged to the USD, which we see appreciating against other currencies including AUD.

- NCM has organic growth options at Lihir, Cadia and Golpu.

- Solid assets with long reserve life.

- Strong management team with significant mining expertise.

We see the following key risks to our investment thesis:

- Further deterioration in global macro-economic

- Deterioration in global gold and copper supply & demand equation.

- Deterioration in gold (and copper) prices.

- Production issues, delay or unscheduled mine shutdown.

- Adverse movements in AUD/USD.

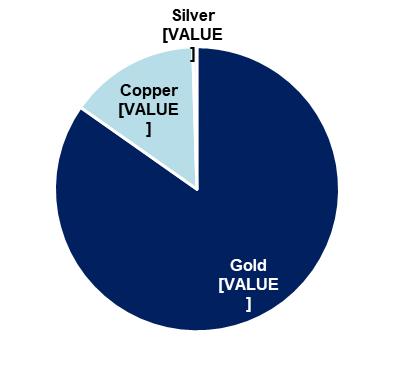

Figure 1: NCM Revenue Breakdown

Source: Company

ANALYST’S NOTE

Newcrest Mining (NCM) posted full year (FY18) results which were impacted by lower production volumes in gold (-1%) and copper (-7%), however came within management guidance.

Notably, NCM saw copper prices surge by +27%, while gold prices were up +4% over the period – pushing group revenue (+2%), EBITDA (+11%), and underlying profit (+16%) up on pcp.

On the cost side, we continue to see NCM as a cost-efficient producer with Group All-In Sustaining Cost (AISC) coming in at $835/oz. While we admit this does represent a +6.1% increase compared to the pcp ($787/oz), this was largely attributable to the stronger AUD over the period which only marginally affected NCM’s AISC margin of $473/oz.

With a mounting war chest of cash ($953m) sitting on the balance sheet, we reiterate NCM’s financial capacity for acquisitions to drive growth.

- FY18 key headline figures.

1. Group revenue up +2% to $3,562m (from $3,477m);

2. EBITDA up +11% to $1,565m and EBITDA margins expanded by +340bps to 43.9%;

3. All-In Sustaining Cost up +6% to $835/oz (from $787/oz);

4. All-In Sustaining margins down a marginal -0.6% to $473/oz (from $476/oz);

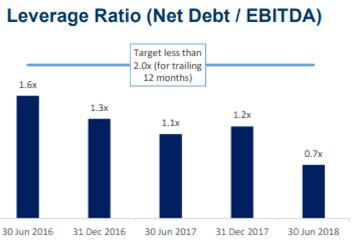

5. Leverage (Net debt / EBITDA) down to 0.7x (from 1.1x), well under the target of 2.0x;

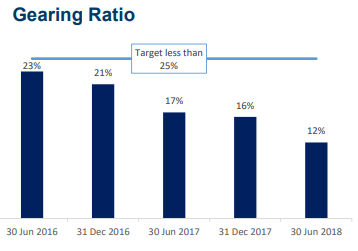

6. Gearing ratio of 12%, less than the management target of 25%, and;

7. A fully franked dividend of US11.0cps. - Acquisition of a 27% interest in Lundin gold. NCM earlier this year, announced their acquisition of a 27% interest in Lundin gold, who are currently building the Fruta del Norte gold mine in Ecuador. The mine is being scheduled for production by the end of CY19.

- Cadia expansion plans disappoint. Details on Cadia’s pre-feasibility study results were also released. 2 years ago, when management first proposed the expansion of the tier 1 asset, 32m tonnes of capacity per annum was expected at a cost of $310m. The study has estimated a further $252m in savings to this amount, on top of an additional 1m tonne of throughput capacity – that is increasing from 32 mtps to 33mtpa. On the analyst call, management stated that the project has the “potential to deliver an impressive 21% return on capital” and are expecting another feasibility study to be completed before the end of December 2019.

- Balance sheet supports likelihood of further acquisitions. Management spent considerable effort in strengthening the balance sheet over the year, with net debt down -31% to $1,040m, both gearing (12.2%) and leverage (0.7x) improving, and cash levels at $953m (up +94% from $492m). As mentioned in our previous note, scope for NCM to acquire further tier 1 assets to solidify its portfolio (consisting of Lihir, Cadia and Golpu – and now Lundin) remain a likely avenue for management. Our concerns remain around any prices that will be paid however, given there is little stress in the sector with gold prices stable.

- Happy to build up cash. On the analyst call, NCM were questioned about their capital management initiatives given their build-up of cash. With their answers somewhat ambiguous, our key takeaway was that the management team are comfortable with continuing to accrue cash in preparation of growth projects.

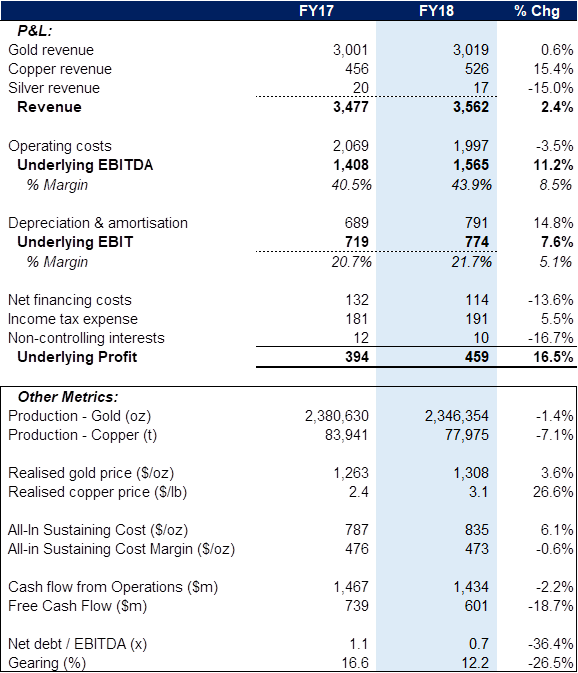

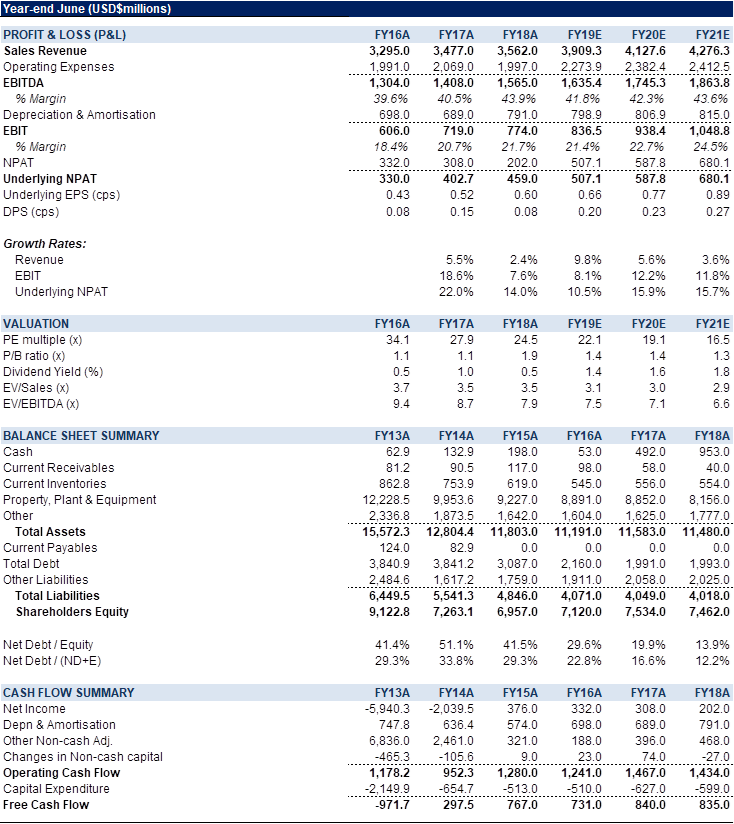

FY18 RESULTS SUMMARY

Figure 2: NCM FY18 financial metrics

Source: Company

P&L. FY18 underlying profit came in at $459m, up 16.5% (from $394m), buoyed by strong increases in realised copper (+26.6%) and gold (+3.6%) prices. Slightly offsetting these benefits however were production volumes for both gold (-1.4%) and copper (-7.1%) which were hurt by the effects of the Cadia seismic event and the tailings facility embankment slump.

All-In Sustaining Costs were slightly higher at $835/oz compared to the prior year ($787/oz), driven by increases in mining activity and milling rates at Lihir and Telfer, and higher general energy costs. NCM also realised a stronger AUD compared to the USD, which adversely impacted operating costs and depreciation expense.

Figure 3: NCM FY18 debt metrics

Source: Company

Balance Sheet. Management spent considerable effort in strengthening the balance sheet over the year, with net debt down -31% to $1,040m (from $1,499m), gearing at 12.2% (from 16.6%) and net debt / EBITDA at 0.7x (from 1.1x). Cash levels also sit at a high $953m (from $492m). This strong cash position has increased NCM’s liquidity coverage to $3.0bn, $2.0bn of which are committed to recently renewed undrawn bank facilities (maturities across FY22 – FY24).

On the analyst call, NCM were questioned about their capital management initiatives given their build up of cash and resilient balance sheet position. With their answers somewhat ambiguous, our key takeaway was that the management team are comfortable with continuing to accrue cash in preparation of growth projects. The Group is running well below target debt metrics and we see this positioning NCM well for when capital intensity ramps up in due time.

Owing to the elevated cash balance, NCM also announced a final dividend of US11.0cps – representing a +47% increase over last year’s final dividend.

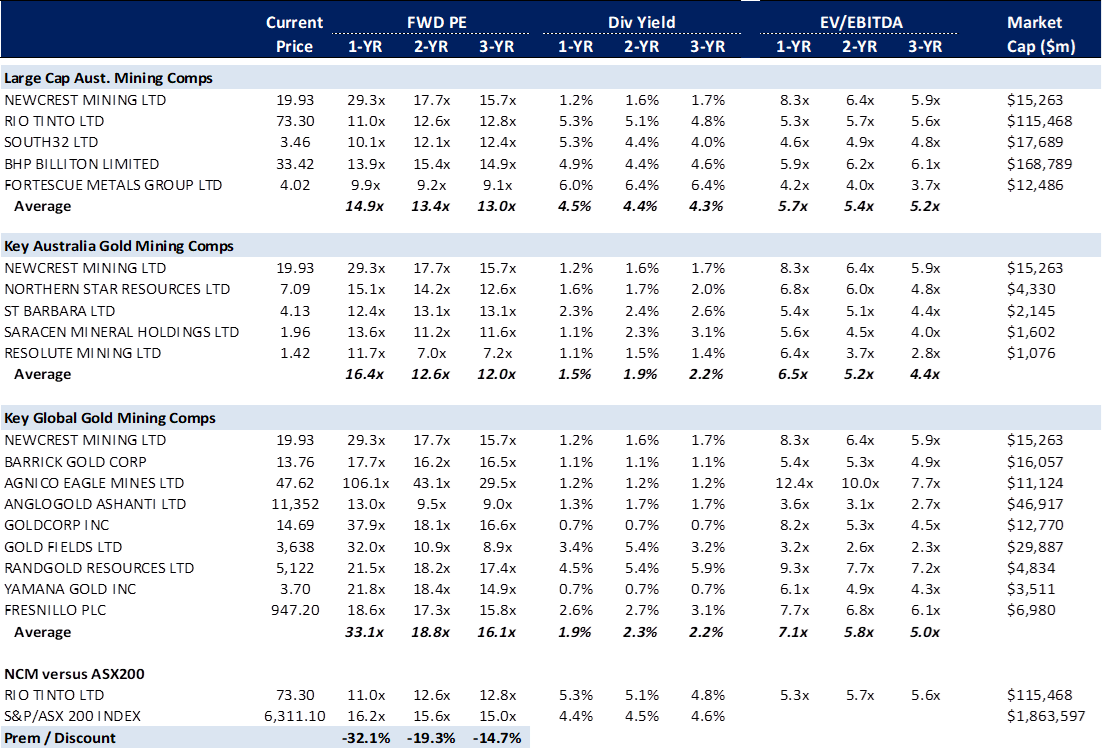

NCM peer group trading multiples…

Figure 4: NCM comps table – consensus >

Source: Bloomberg

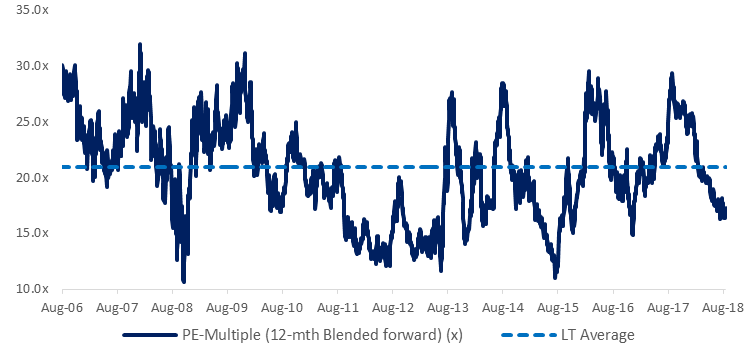

Figure 5: NCM PE-multiple vs long-term average>

Source: Bloomberg

Figure 6: NCM Financial Summary >

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Newcrest Mining Limited (NCM) engages in the exploration, mine development, mine operation, and the sale of gold and gold/copper concentrates. It is also involved in the exploration of silver deposits. The company primarily owns and operates mines and projects located in Cadia and Telfer in Australia; Lihir based in Papua New Guinea; Gosowong based in Indonesia; Bonikro based in Cote dIvoire in West Africa.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >