Regis Healthcare (REG) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 03/09/18 | REG | A$3.35 | A$3.56 | NEUTRAL |

| Date of Report 03/09/18 | ASX REG |

| Price A$3.35 | Price Target A$3.56 |

| Analyst Recommendation NEUTRAL | |

| Sector : Healthcare | 52-Week Range: A$3.14 – 4.20 |

| Industry: Healthcare Facilities | Market Cap: A$1,051.9m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate REG as a Neutral for the following reasons:

- Market-leading position in the industry.

- Ageing Australian population to provide positive tailwind.

- Ongoing brownfield and greenfield developments in pipeline to drive earnings.

- A large and geographically diverse portfolio.

- An experienced management team.

We see the following key risks to our investment thesis:

- Competitive risk from listed and unlisted providers will intensify following the industry’s deregulation.

- New projects fail to deliver the earnings uplift.

- Pricing pressures following the industry’s deregulation will put downward pressure on margins.

- Budget cuts to aged care will increase customers’ out-of-pocket expenses, thereby lowering demand.

- Churn risk as new government initiatives will allow customers to switch between providers, with REG losing out on any unspent funds.

- Project development delays or cost blow-outs.

- Breakouts in influenza which impact upon occupancy levels continue.

ANALYST’S NOTE

The share price of Regis Healthcare Ltd (REG) saw a marginal decline of -1.7% after the company reported FY18 revenue of $594.4m and normalized EBITDA of $117.1m, which came in below consensus estimate of $603.3m and $119.9m respectively.

Normalized NPAT of $56.9m was down -7% over pcp, primarily impacted by government subsidies cuts in residential aged care funding scheme and lower occupancy in 1H18 due issues relating to influenza and gastro, however management noted that occupancy has returned to normal with 94% occupancy rate at the end of the period.

REG announced three new development facilities will be open to residents by 2018-end, expecting further net RAD cash flows of $220-$270m, which management plans to use to retire debt. Management expects EBITDA in FY19 to be largely in line with FY18 normalized EBITDA.

We maintain our Neutral recommendation on REG as the overall aged care thematic remains attractive:

1. Ageing Australian population to provide continuous demand;

2. Strong development pipeline providing earnings upside from FY19 however having said that, we believe REG (and along with peers) will continue to struggle for organic growth given Federal Government’s budget cuts to residential aged care funding scheme and the industry’s deregulation will intensify competitive pressures. We expect more acquisitions to supplement organic growth pressures, however this strategy is not without risk.

- FY18 results key highlights. Compared to previous corresponding period:

1. Growth was slightly impacted by government funding cuts to the residential aged care funding scheme, however offset by contribution from new facilities and acquisition of Presbyterian care Tasmania.

2. Staff costs as a percentage of revenue rose +3.6%, largely driven by addition of cleaning services cost in labour, which was previously included in resident care expenses.

3. Normalized NPAT of $56.9m was down -7%, however still in line with guidance provided in 1H18, primarily driven by increased depreciation and interest expenses due to completion of greenfield developments.

4. Management declared a fully franked final dividend of 8.65cps, bringing the FY18 dividend payout to 17.93cps, representing a payout ratio of 100% of reported NPAT.

5. Occupancy increased to 94% towards the end of FY18, with average occupancy of 93.4% for the period impacted by lower occupancy in 1H18 due to influenza and gastro.

6. Net debt of $403.8m, an increase of +72.9% was well within covenants with core debt to EBITDA ratio of 1.8x.

- Expansion pipeline update. REG opened four new facilities as part of its Greenfield Development Program in FY18, with a further three facilities to open by 2018-end. The program would have delivered 10 new facilities with a total of 1,247 new places and by FY18-end, 35% of these places were occupied with $112m of net RAD cashflow already collected. Management noted no further investment would be required to deliver these facilities and anticipates further $220m-$270m of net RAD cashflow to flow in from them which would be used to retire debt. REG progressed its strategy regarding its retirement living developments with commencement of construction of stage 1 of for Blackburn South in Melbourne, Vic, which would involve construction of more than 350 retirement living units and progression of Nedlands redevelopment in Perth, WA, with the completion of the master planning process resulting in the recent lodgment for planning approval in August. Management reconfirmed integration of Presbyterian Care Tasmania portfolio will be EPS accretive in FY19.

- FY19 Outlook. Management expects FY19 EBITDA to be broadly in line with normalized FY18 EBITDA, driven by increased contribution from facilities and Presbyterian Care Tasmania Facilities becoming earnings accretive, partially offset by effect of Federal Government funding cuts and higher expenses resulting from changes to ACFI. Management further noted, “it is anticipated that Facilities still ramping up will contribute EBITDA of circa $25m when all new developments reach their steady state in FY21, growing from the $5.5m anticipated to be delivered in FY19. A further $220m – $270m of net RAD cashflow is anticipated to come between FY19 and FY21 from completion of the ramp up of the development sites, for which a total of 1,247 new places will have been delivered by the end of 1H FY19. This will be used to pay down debt.”

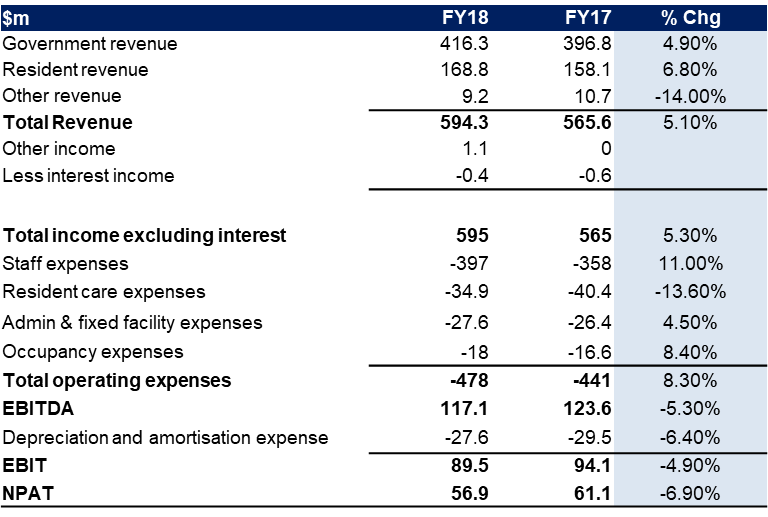

FY18 RESULTS SUMMARY...

Key performance numbers for FY18 on pcp are presented in the table below.

Figure 1: REG financial results summary

Source: Company, BTIG

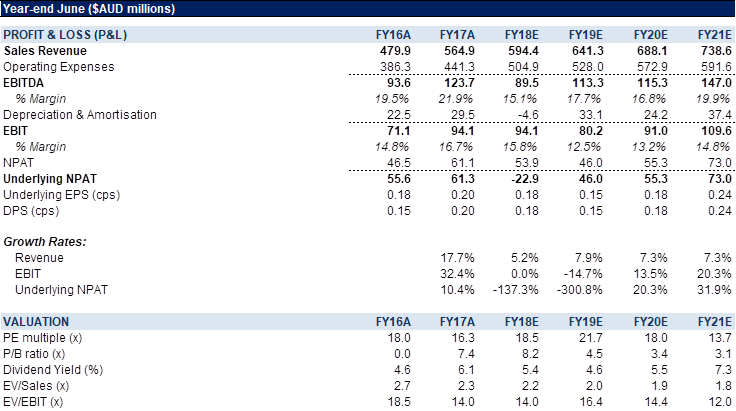

Figure 2: REG Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Regis Healthcare Limited (REG) is a diversified residential aged care provider, with 4,719 Operational Places across 45 facilities located in Victoria, Queensland, Western Australia, New South Wales and South Australia and with 78% of facilities located in high density, urban areas.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >