Star Entertainment Group (SGR) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 06/09/18 | SGR | A$5.48 | A$5.90 | NEUTRAL |

| Date of Report 06/09/18 | ASX SGR |

| Price A$5.48 | Price Target A$5.90 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$4.71 – 6.39 |

| Industry: Casinos & Gaming | Market Cap: A$5,022.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate SGR as a Neutral for the following reasons:

- Share price is in-line with our valuations and on fair value multiples.

- Growth in revenue from gaming and F&B at key domestic properties as disruptions are reduced and capacity is returned.

- The fallout from VIP issues experienced at Crown is not as bad as initially thought – with VIP play much smaller part of SGR’s overall revenue.

- Investment in sales and marketing and capital works at properties should help drive earnings in the medium to long term.

- Opportunities in QLD for driving turnover in the International VIP Rebate business.

- Loyalty relaunched and investments made in Group capability.

We see the following key risks to our investment thesis:

- Declines in VIP customers, especially after Crown employee arrests in China.

- Competitive pressures, including international (for VIP play) and domestic competitors.

- Increased competition for VIP dollars in Australia and regionally.

- Loss of turnover in 2H17 and beyond.

- Potential for regulatory changes, with a responsible gaming focus.

ANALYST’S NOTE

Star Entertainment (SGR) posted unexpectedly strong FY18 results, with normalised NPAT growth of +20.3% to $258m driven by market share gains in key segments including Sydney and the Gold Coast.

Earnings momentum improved during 2H18 with (normalised) gross revenue up +15.3% on pcp to $2,965m and EBITDA up +14.2% to $588m. SGR posted capital expenditure for FY18 of $477m, with $300-350m expected in FY19.

The Board declared a final dividend of 13.0 cpu, reflecting positive business momentum and increased dividend payout policies.

We maintain our Neutral recommendation given that the Gold Coast business is yet to deliver following increased capex into its expansion investments and volatility of the win rate which continues to erode earnings. SGR trades in line with our valuation and on 16.5x PE20, 3.0% dividend yield.

- Low win rate continues to affect performance. Management reiterated the impact of a low win rate in FY18, that caused significantly different normalised and statutory figures (1.16%, compared to 1.59% in the pcp). SGR quotes a theoretical 1.35% in normalised earnings.

- Sydney. Sydney saw record levels of normalised gross revenue, up +17.5% on pcp, driven by growth in visitation rates (up +11.4% on pcp) and strong contribution from the International VIP Rebate business. With the market starting to normalize following the turnaround from a drop off in volumes of South Asian contributors, the International VIP Rebate business saw market share gains with normalised turnover up +56.7% on pcp. Whilst Slots and Non-Gaming revenue grew +5.3% and +15.0% respectively, Tables revenue continued to fall, down -1.8% due to an unusually low PGR hold rate.

- Queensland. Normalised revenue for Queensland grew +10.5% to $820m, with the successful relaunch of Gold Coast facilities; The Darling and MGF contributing strongly as customers continued to show positive reception to newly commissioned investments. The Gold Coast segment was the highlight of the Queensland result, with domestic PGR table volumes up +30.1% and International VIP Rebate turnover up +40.9% on pcp. Management noted that Brisbane is starting to stabilize with remediation activities starting to take effect, highlighting that Brisbane domestic revenue increased +4.0% in the second half of FY18 on pcp. Normalised EBITDA declined -8.4% on pcp to $178m, after adjusting commissions on revenue share deals to 1.35% International win rate.

- International VIP Rebate business. Management noted that market conditions in the International VIP Rebate business have returned to normal, with the business delivering strong growth from all customer groups in FY18. Front money grew +36.4% on pcp to $4.7bn, with turnover up +54.3% to $61.2bn. Normalised revenues increased +51.8% on pcp to $827m, with statutory revenue up only +11.2%, reflecting the low actual win rate.

- Strategic partnerships and developments underway. The Darling Gold Coast and MGF expansion opened during FY18, delivered on time and producing increased gaming capacity for the business. Construction of the First Joint Venture tower has commenced construction with the fixed cost below previous guidance. The Group also announced its expanded strategic partnership with Chow Tai Fook and Far East Consortium, with marketing integration that will leverage customer networks between the businesses.

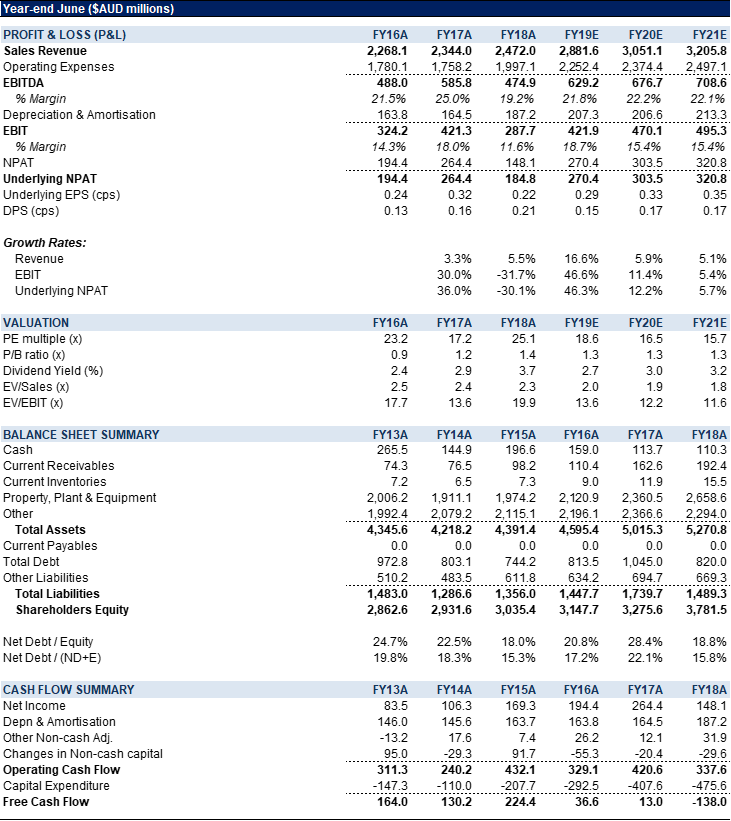

Figure 1: SGR Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

The Star Entertainment Group Ltd (SGR) owns and operates The Star, in Sydney, NSW which includes Hotels, apartment complex, restaurants, bars and nightclubs, Treasury Casino and Hotel in Brisbane which includes hotels, restaurants and bars. and Jupiter’s in the Gold Coast which includes hotels, theatre, restaurants and bars. It engages in gaming, entertainment and hospitality. The company also manages Gold Coast Convention and exhibition Centre.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >