Croplogic Ltd (CLI) – Special Report

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/11/18 | CLI | A$0.026 | N/A | N/A |

| Date of Report 09/08/18 | ASX CLI |

| Price A$0.026 | Price Target N/A |

| Analyst Recommendation N/A | |

| Sector: Agtech | 52-Week Range: A$0.02 – 0.12 |

| Industry: Agriculture | Market Cap: A$3.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We see the following positive drivers for CLI:

- Access to remote areas. Croplogic technology is widely accessible and does not face limitations imposed on systems typically reliant on a National Broadband Network (NBN) connection (which most agtech services currently available utilise). Aided by its own, robust satellite system and 3G/4G, Croplogic possess a large potential acreage exposure and scalability capabilities.

- Non-intensive capital requirement. Croplogic’s technology is mostly remotely operated, whereby the interconnectedness of its technologies allows management and little in-person maintenance visitations, therefore eliminating many unsustainable costs associated with geospatial constraints. Further, one out of its three core technologies (Croplogic Predict) functions purely on an algorithm that feeds information into itself and allows for a 100% gross margin after minimal set up costs.

- Macroeconomic demand. There is currently still a heavy reliance on inefficient traditional methods by farmers. Coupled with a required increase in current food production by ~70% to support the estimated 9 billion population by 2050, we see increasing demand for cost efficient, yield optimisation crop technologies.

- Difficulty replicating Croplogic technology. The unique CropLogic algorithmic system is patented and CropLogic has proprietary aerial imagery and other technologies that allows superior technology advantages and cost efficiency. Further, Croplogic owns first, exclusive rights to many NZPFIR crop models that exist, or are in development. As such, Crop Logic is well positioned to cater to the diversity of demand across various international markets. Additionally, as more crop models are deployed, growth of serviceable acres and faster compounding of field data for further model cross-development.

- Complete product offering. While larger conglomerates have actively acquiring products and services, none currently offer the complete picture of technology that Croplogic does to aid with seeding and help regulate climate effects, soil conditions, plant conditions and offer aerial imaging data. While digitalisation is a focus for Croplogic, investors should note that agricultural tech uptake occurs less rapidly than that of traditional fintech companies due to the nature of users and their proclivity toward technology usage.

We see the following key risks to our investment thesis:

- Competitors’ economies of scale and reputation advantage. Competitors, specifically larger conglomerates such as McCain, Monsato and John Deere, may be able to offer more price competitive options. If CropLogic is unable to secure its first mover advantage, it may be unlikely that CropLogic will be able to stay competitive from a pricing standpoint.

- The race for market share and profitability. The current flow of funds into the agriculture technology sector indicates an increasing pool of capital and large appetite to fund this sector and many similar companies focused on innovation. However, this also means that smaller competitors who are similarly experiencing rapid growth may take away market share from Croplogic or limit its growth potential. For example, early-stage peers such as Farmer’s Edge, within one year secured 4 million acres under management and a market presence in Canada, Russia, Australia, and South America. FarmLogs, another early-stage peer, has garnered 15% of row crops within 2 years. If such competitors are able to operate with cost efficiency and an expansive access to regional areas, such pressures and cost inflation, Croplogic’s path to profitability will be hindered. However, it is unlikely that farmers will switch technologies, given that Croplogic offers competitive pricing and ease-of-use technology – emphasizing the need to secure market share ahead of competitors.

- Product switching. Croplogic offers superior and simple to use technology. However, competitors may realise this competitive advantage and imitate the simplicity of features of and find a more cost-efficient approach. Thus, with more competitive pricing, this may impact Croplogic growth trajectory.

- IP Risk. Intellectual property must be managed from the perspective of both consumer and sellers of IP products and services domestically and globally. In emerging markets such as China or India, IP risk poses a significant threat to CropLogic’s profitability. Further, laws regarding IP protection in such nations are limited or difficult to enforce in the event of breaches. However, significant development has occurred regarding the reform of China’s IP laws to expand admissible evidence, increase damages, reform legal structures and introduce new policies to limit unfavourable foreign protectionism bias.

- Low replacement and uptake rates. Croplogic customers may not find the need to update technology or retain usage of such technologies. Additionally, the market may not recognize the value in Croplogic technology and retain traditional farming methods (difficult to change farmers’ behaviour) or utilise competitor technology. Where products are ill-suited to different markets (crop model type, differing weather conditions and strains of crop), uptake may be low and yield curve will be volatile as a consequence. (“Multi-peril insurance is subsidized in markets like in the USA, but continues to be a gap in the Australian farm business model” – Robert Poole, KPMG). While efforts to overcome uptake risks may be negated with transformational advancements in breeding new plant varieties for Australian farmers, the current lack of regulatory uncertainty creates a major barrier to such advancements.

- Need for ongoing innovation and investment in R&D. Due to the increasingly competitive race to secure market share with efficient, usable and cost-effective technology, Croplogic must continually innovate and strategically position itself to capture the high demand for yield optimization and farming productivity services.

- Loss of major contract and market share. Losses in these areas may significantly reduce revenue and earnings potential.

- Exposure to a wide range of political and currency risks. With the expansion into Australia, and future potential expansion into regions inherently characterized by volatility (Russia, China and India), Croplogic may encounter difficulties forecasting and planning for such risks.

ANALYST’S NOTE

Croplogic (CLI) is a agtech company which assists farmers in improving crop yields by utilizing its proprietary crop model technology with in-field agronomy support teams to provide further advice to growers.

Farmers are able to utilise CLI technology to optimise irrigation and fertilisation needs to maximise yields. With a solid established position in the U.S. already to build from and launch in Australia, we believe the current share price of CLI is factoring in little upside from this. In fact, in our view investors appear to be interpreting CLI change in strategy from acquisition led to organic-growth focused as a negative. We in fact hold a different view. Our experience covering companies who have deployed an acquisitive strategy (also referred to as a roll-up strategy) have in fact destroyed shareholder value over the long run. In this note we discuss why the recent change in corporate strategy is the right one and address other key drivers for the stock.

Company overview. Formed in 2010, Croplogic aims to assist farmers in improving crop yields by combining 30 years of extensive research and testing with exclusive use of NZIPR crop model technology with in-field agronomy support teams to provide further advice to growers. Farmers can utilise Croplogic technology to optimise irrigation and fertilisation needs to maximise yields. Croplogic operates three core technologies: digital (remote sensory), imagery & AI, and predictive modelling, with all three at different stages of development.

The shift away from acquisitive strategy is the right one, as roll-up strategies seldom work, in our view. The Company has shifted its corporate strategy away from one of being acquisitive to a commercial-led model. Management will now focus on a commercialization strategy with a focus on direct sales and/or partnerships. In our view, whilst the temptation is there for management to acquire company after company to quickly grow its presence and footprint, our experience in covering companies deploying roll-up strategy is one that it has more often ended in shareholder destruction over the long-term (sometimes spectacularly – e.g. ABC Learning). Whilst bolt-on, opportunistic acquisitions will remain part of CLI’s corporate strategy, it will not be core.

Base set, positioned for organic growth in the U.S. In our view, CLI’s initial acquisition of Professional Ag Services LLC in FY17, leading to a consequent ownership of approximately 30% of the potato production client base in Washington DC (the second largest producer of potatoes in the U.S. after Idaho) provides the company with a solid base to organically grow from. Further, we note that whilst neighbouring U.S. regions are CLI’s immediate target, opportunities in the wider 52 states, particularly the Midwest, are also within CLI’s scope.

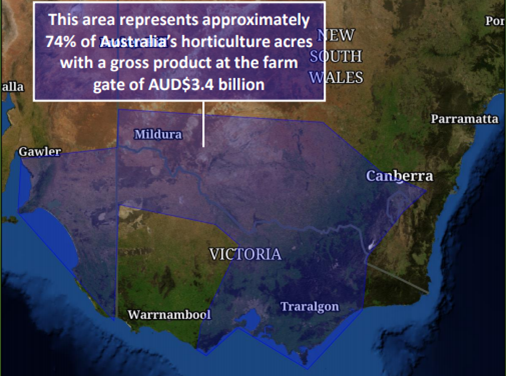

Australia presents a significant near-term opportunity and share price catalyst. CLI expanded its Croplogic Realtime core technology into Australia in September 2018. Focused on where 74% of Australia’s horticulture acres are located and supported by the Australian and New Zealand government grants, the Company aims to establish a first mover advantage and further build referencability. We expect management to provide progress updates on Australia over the coming 12 months, which could be a positive share price driver

ASK THE ANALYST

Our analysts are ready to answer any questions you have

Investment Drivers…

In this section we address CLI key investment drivers.

Macroeconomic and long-term demand outlook attractive. A heavy reliance on inefficient traditional methods by farmers currently endures, contributing to unsurprising drops in average farmer net cash income (-3.0% in FY14, -19% in FY15, -11.5% in FY16). Coupled with a required increase in current food production by ~70% to support the estimated 9 billion population by 2050, a high demand for cost efficient, yield optimization crop technologies persists.

“Australian agriculture is on the brink of an upgrade” – P2D project. The Accelerating Precision to Decision Agriculture (P2D) project is supported by funding from the Australian Government and is focused on three main aims:

1. facilitating the development of digital technology in Australian agriculture;

2. fostering the establishment of appropriate legal frameworks, data systems and access to critical datasets; and

3. identifying the data communication systems required to deliver the benefits of digital agriculture to the Australian farm and agribusiness sectors. In a report released by P2D it stated, “economic modelling has shown that digital agriculture could increase the gross value of Australian agricultural production by $20.3bn (25% increase on 2014-15 levels)”. The report indicated that significant productivity gains were expected across the sector.

The shift away from an acquisitive strategy is the right one, as roll-up strategies seldom work, in our view. The Company has shifted its corporate strategy away from one of being acquisitive to a commercial-led model. CLI’s management will now focus on a commercialization strategy with a focus on direct sales and/or partnerships. In our view, whilst the temptation is there to appease short term growth targets by undertaking acquisitions in a short amount of time (funded by multiple equity raisings and debt), the real beneficiaries of this are vendors selling out. Our experience in covering companies deploying roll-up strategy is one that it has more often ended in shareholder destruction over the long-term (sometimes spectacularly – e.g. ABC Learning). Recent case study – Automotive Solutions Group (4WD) raised $30m of investor funds during an IPO end of 2016 to rollup regional car accessories’ companies from around Australia. It took the firm one year to destroy most of the shareholder funds (by overpaying vendors and lack of strategic direction), only to be bought out by AMA Group (AMA) at a fraction of the IPO price. Other more well-known firms – such as G8 Education Group (GEM) and Primary Health Care (PRY) – also previously had aggressive acquisition strategy to rapidly increase footprint, which invariably in the end had to be changed to organic-led. Whilst bolt-on, opportunistic acquisitions will remain part of CLI’s corporate strategy, it will not be core.

Base set, positioned for organic growth in the U.S. In our view, CLI’s initial acquisition of Professional Ag Services LLC in FY17, leading to a consequent ownership of approximately 30% of the potato production client base in Washington DC (the second largest producer of potatoes in the U.S. after Idaho) provides the company with a solid base to organically grow from. Further, we note that whilst neighbouring U.S. regions are immediate targets, opportunities in the wider 52 states, particularly the Midwest, are also within CLI’s scope.

Figure 1: U.S. growth opportunities located close to current area of operation

Source: Company Reports

Not your standard tech, for not-so-tech-savvy client. In our view, investors must appreciate the notion that whilst CLI is a technology driven company, the proliferation of its technology is not like other traditional tech companies – such as a social media app (which can be instantly downloaded by thousands) or software product which can be downloaded with minimal before and after support. It is important to understand CLI’s end client – a farmer who tends to be less tech-savvy and removed from the tech gadgets of city life. This is further amplified by the fact that farmers today are still deploying traditional technology-light farming practices (which provides an opportunity for companies like CLI) and therefore these clients require extensive support to ensure compliance. With this in mind, CLI’s after-sales agronomy support is a key competitive advantage, in our view. Whilst the after-sales support service provides assistance to farmers, it also provides a significant opportunity to upsell and introduce new technology to the existing client base.

Rest of the world “blue sky” opportunity. We agree with management with respect to taking a cautious approach to expanding to other parts of the globe. In our view, an established track record of solid uptake of CLI’s core technologies in Australia and U.S. will provide the case study to move into other markets. What would be a red flag for us is if management starts to spread its finite resources in trying to capture several markets at once. Whilst we have used the term blue sky for the rest of the world opportunity, we would note that discussions and trials have already taken place to take advantage of the large demand for agtech in nations such as Russia, India, China and Canada. To this end, Croplogic has been working closely with four big multi-national firms in such nations, e.g. McCain, Simplot, PepsiCo and the $6 billion Lamb Weston company. However, doing business in emerging markets represent and bring with it its own challenges. Croplogic must appreciate that China and India are comprised of numerous markets, each vastly different from the other. Further, the impact of local regulations, laxed governance models and policies, as well as unwritten local rules must be factored into business considerations.

Cost efficiency of farms and expanding R&D efforts. In our view ongoing investment in R&D is critical for CLI to ensure technology updates keep its product offering ahead of competitors. In the past, such developments have enabled the introduction of predictive yield optimising services, which allow for a pricing premium. A current focus on integrating IoT technology enabling a reduction of capital and operational costs of Croplogic’s data collection system will further increase cost efficiencies when implemented in the near future. Previously, geospatial constraints led to both necessitated higher costs and limited access to remote areas. However, developments in Croplogic technology have allowed for more efficient targeting of smaller or more remote farms to increase serviceable acres via fully “server-less” data ingestion software architecture, and without a reliance on National Broadband Connection (NBN). Croplogic aims to reduce current costs of $20/acre down to $13/acre, with the main drivers of costs coming from labour, capital (hardware) and vehicle fuel.

Australia presents a significant near-term opportunity and share price catalyst. CLI expanded its Croplogic Realtime core technology into Australia in September 2018. Focused on where 74% of Australia’s horticulture acres are located and supported by the Australian and New Zealand government grants, the company aims to establish a first mover advantage and further build referencability. In our view, CLI experience and client base in Washington DC could potentially also assist in the adoption rate of CLI’s technology in Australia. The U.S. market happens to be among the largest markets in the world, hence increasing adoption there will likely see domestic farmers follow suit. Hence, in our view, referencability does not only work from region to next region, we believe it also works across the globe should existing customers experience positive results.

Figure 2: CLI Australian focus

Source: Company Reports

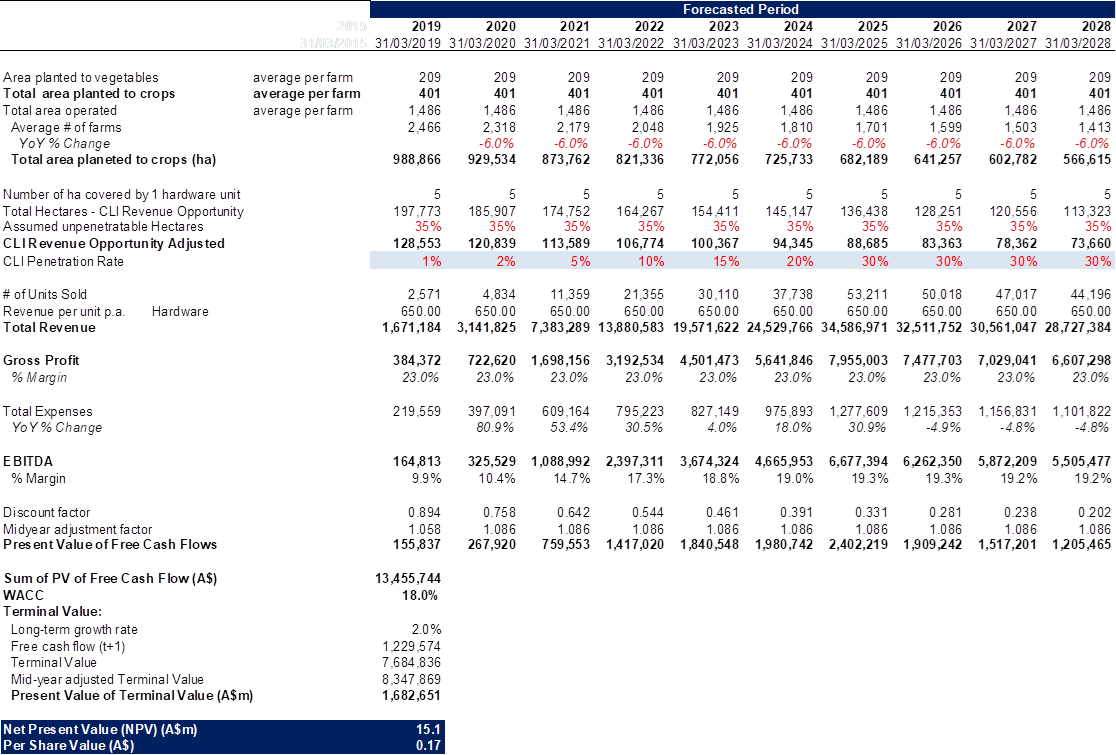

What could the Australian segment alone be worth? We have attempted to quantify what the push into Australian market could be worth at the group level. Our complete working is provided in the figure below. Key assumptions:

1. we have focused on planted areas of crops in Australia (using ABARES Australian vegetable-growing farms survey 2014015);

2. we assume total average farms are declining on a 6% p.a. rate;

3. we assume 35% of this market is not penetrable by CLI (location / competitor strong holds etc); and

4. we assume long-term penetration rate of 30% (similar to CLI’s U.S. experience). The our NPV analysis suggests the Australian opportunity alone is worth $0.17 per share.

Figure 3: CLI Australian NPV analysis

Source: BTIG estimates

Australian opportunity is significantly larger with all target commodities. What is important to highlight is that the above NPV analysis only provides potential valuation upside from vegetables only. It is important to note that CLI’s key target commodities also include tree stocks (nuts and citrus) and vines (table and wine grapes). The Company recently announced that it had secured space in Mildura Australia, in collaboration with SproutX, Mildura Regional Development and the Victorian Government as part of the Mildura Regional Development – Smart Farm Project.

Industry Overview…

Key industry drivers: Trade and Market access, R&D efforts, Infrastructure, Costs, Environmental sustainability, People and future of labour in agriculture, Access to capital and trust in agriculture; trust in food, which are all enabled by regulation, innovation and new technology, as well as coordination of the industry.

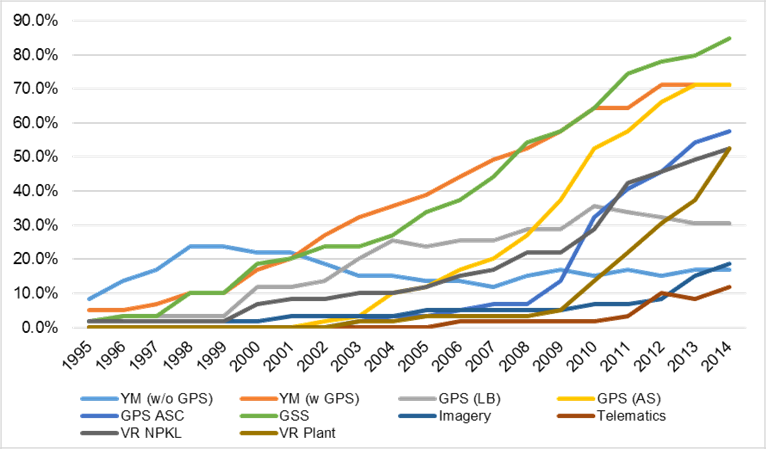

Over the previous three years, we have seen increased focus on Australian AgTech and FoodTech development. With approximately 300 AgTech and FoodTech companies operating within Australia, it is clear the sector is seeing a strong influx of players, as well as a demand for capital invested to support a bourgeoning sector. Abroad, investor interest was catalysed by U.S. Monsanto AgTech company’s US$1.1bn takeover of the Climate Corporation in October 2013, seeing to a breakout of investment in 2015 – US$4.6bn invested across 526 deals in the agricultural value chain. A soaring demand for agricultural productivity and yield optimisation technologies can be observed, even though farmers still predominantly rely on lower efficiency, traditional methods of farming (only 7% of farmers in 2013 using yield optimisation technologies). These rates have risen substantially (see figure below), and are likely to continue rising due to the need to increase world food production by almost 70% in the coming 12 years to support the growing population of a projected 9.8 billion by 2050 (+2.2bn estimation vs the population today). As such, it is essential that farmers are aware of and are willing to adopt cost efficient yield optimisation technologies. For this adoption to be successful, it is essential that changing consumer preferences are accounted for, burgeoning new markets be reached, access to capital to fund this new phase of growth exists, talent is attracted and retained, and productivity is boosted from technology and innovation.

Figure 4: Percentage Adoption of Precision Agriculture Technologies

Source: Castle, M.H. (2016).

It is clear the expectations of the modern consumers are shifting around the globe to one of an increased demand for information about the provenance of their food and its fibre content. Coupled with an increasingly globalised community, and therefore an adoption of new food sources, supply chain models (and increasingly digitally) are preferred which allows for a more direct connection to the product’s point of origin.

However, global trade rules are often equally fickle and complex. Furthermore, significant declines in commodity prices since the 2013-14 period have negatively impacted net farm incomes, leading to three consecutive years of net income declines, according to USDS 2017 ERS Farming Sector Income Forecast of ERS (Annual U.S. net farm income captures and reflects all economic activity, input expenses and marketing conditions that have prevailed during a specific time period, and therefore the overall health of the national farm economy). Further, government payments in 2017 are projected to be slightly lower (-0.2%) to US$13.0bn from lower marketing-assistance loan benefits and cost share programs according to the 2017 ERS, Outlook for U.S. Agricultural Trade. While USDA forecasts a slight increase in farmer income (+3% year-on-year) and thus the potential temporary stabilisation of the sector, current weak prices for many major crops signal future turbulence. Nonetheless, technological advancements will be able to aid farmers and consumers alike to overcome such challenges of product traceability advancement and global trade compliance automation.

The predominant trends in the food production markets are:

- A greater influence of Asian cuisines. With an increasing popularity for Asian cuisines, increasing opportunities for expansion of existing businesses or for new entrances lie in the opening of significant markets, with niche products to move quickly into the mainstream, and thus the opening of significant new market opportunities for farmers. As Australia currently has the second largest agricultural area in the world, after China and before USA, it is well positioned to take advantage and increase its dominance in the farming sector.

- Increasingly prominent wellbeing trends. Factors such as taste, or price are now considered less so in comparison to animal welfare, sustainability, safety and nutrition.

- A greater awareness of sustainability, welfare and safety standards. Rather than being solely focused on productivity, farmers must now also be motivated to meet ethical, environmental and nutritional standards. Australia is considered a global leader in such standards, however, it is only with coordination between entities with active marketing presences in key export markets that this perception is proven and maintained.

- A greater focus on emerging market contribution to food production. Recent advances, such as the China-Australia Free Trade agreement has provided Australia with solid access to a mix of both established and growing markets. As the balance of wealth shifts from West (developed markets) to East (emerging markets), it is imperative that Australia ensures its trade agenda to maximise opportunities in this region as a key driver for revenue. Such agendas by local farmers are supported by the Trans-Pacific Partnership (TTP) as well as the Regional Co-operation Partnership Agreement.

The lull in world productivity…Sectors have been plagued by stagnating productivity from heavier regulations arising after the GFC as well as current trade policies. With current trade war talks between the U.S. and China, any changes or volatilities caused by this poses direct threats to the future of Australian agriculture vision of sustainably increasing production by 70% as well as enabling the farming sector to utilise the benefits of free trade. Further, market access is likely to be impeded by ‘non-tariff barriers’ for each countries’ unique import and export requirements, exacerbated from protectionist reasons by any tensions between large agricultural producers such as the U.S. (3rd largest) and China (largest).

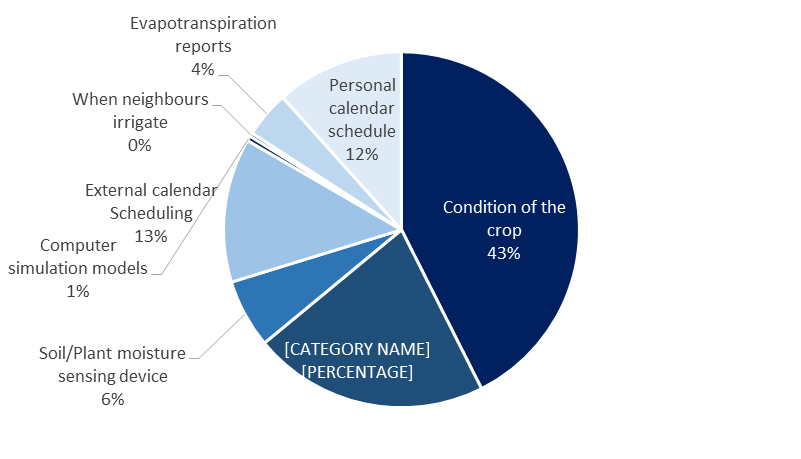

A demand for capital and innovation…According to Sam McClure (KPMG), the Australian agricultural sector has suffered from a lack of capital and funding due to investor preference for longer investment periods, steady returns and prospects characterised by low risk. Greener pastures (2002) states that around $600bn in additional capital will be required in supply chains and on farms between the present and 2050, with a further $400bn will be needed to support older farmers exiting the sector and allow the next generation of farmers to buy them out. Furthermore, this capital will be required to help advance agricultural technology to provide increasingly cost efficient, accessible and greater yield optimisation potential for farmers. Water and climate predicates the regularity of farmer earnings, which can vary yield substantially year-on-year. Agtech innovation is currently underutilised, with a survey conducted in 2013 by the U.S. Department of Agriculture Farm and Ranch Irrigation showing that U.S. growers still tended to prefer traditional methods of farming, with only ~7% of crop irrigation utilised technology in 2013.

Figure 5: Methods used in deciding when to irrigate (U.S., 2013)

Source: USDA, Farm and Ranch Irrigation Survey, 2013.

Company Overview…

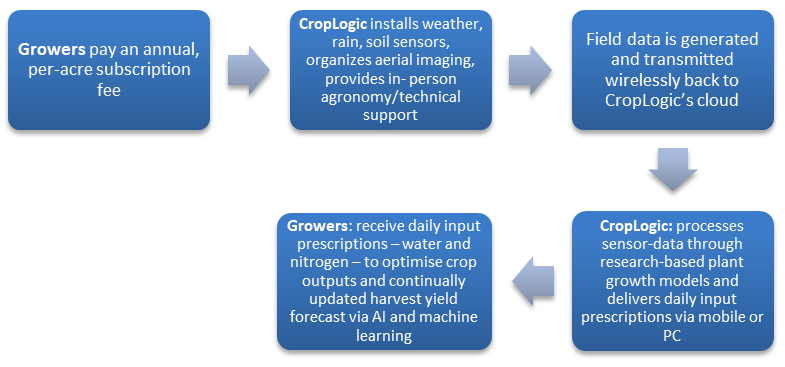

The figure below outlines CLI service flow chart…

Figure 6: CLI service flow chart

Source: BTIG, Company

Daily inputs are obtained from sensors and telemetered data that is generated from the field via low-powered, wireless mesh network and robust, easy-to-install satellite-based systems (secured from the acquisition of Indigo Systems in 2014). By combining the telemetered data with the unique crop models provided by NZIPFR (crop models for exclusive use by Croplogic), unique agronomic insights can be generated for viewing by the grower, either via a mobile app (Croplogic GrowerView iOS & Android), or more in-depth view via a PC (Croplogic GrowerView – Desktop). Croplogic will charge subscriptions for this service, based upon whether the crop is classified as high-value or low-value.

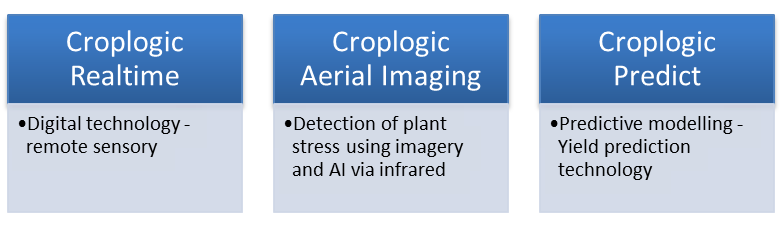

Figure 7: CLI core products

Source: BTIG, Company

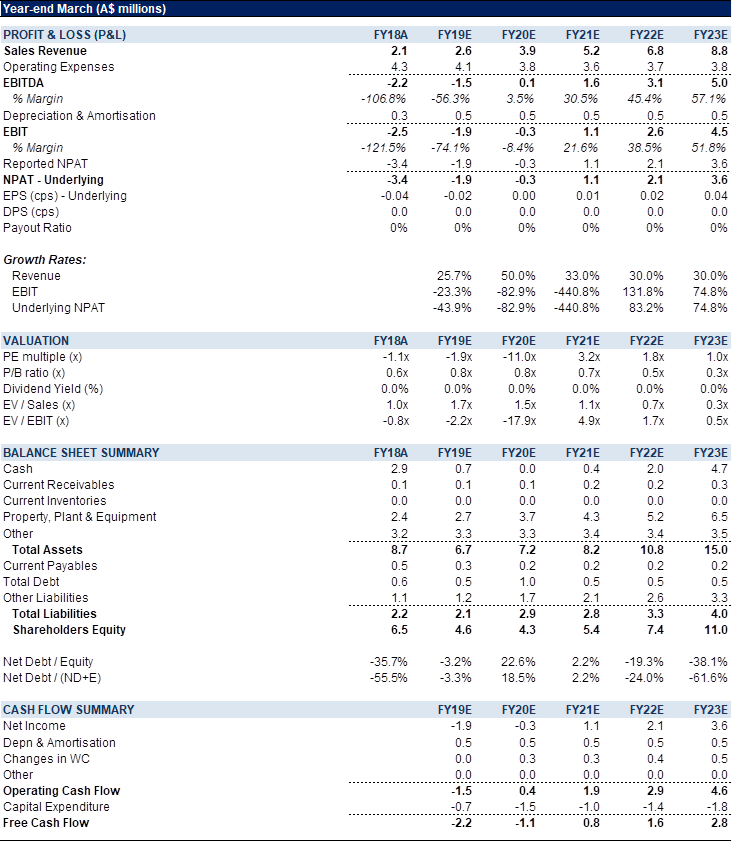

Figure 8: CLI Financial Summary

Source: BTIG, Company, Bloomberg

CropLogic’s suite of products complement each other, with users at times using more than one of these technologies in their farming procedures. For the advancement of these core technologies, Croplogic aims to continuously develop partnerships around the globe, particularly in key growth markets with leading agronomists, research institutes and industry participants e.g. processors. This approach has seen success so far from current partnerships with the New Zealand Government’s Callaghan Innovation, Plant and Food Research (PFR), and key potato processors in the U.S. and China such as Pepsico, ConAgra’s Lamb Weston and McCain Foods.

Commercialisation growth strategy…While Croplogic initially launched with an acquisition strategy to attain immediate market share and establish market presence, management does not believe their new growth phase necessitates this high cash burn approach. It believes that selling Croplogic technology directly to growers, via partnerships and distributors, aided by “referenceability” and an established reputation from Washington potato operations, will offer more sustainable, stable earnings growth. California, Idaho and Oregon are key regions that Croplogic aims to venture into in the near future. In doing this, it may be able to further establish its reputation in the market and at the same time help accumulate statistical data for further development and innovation.

CropLogic’s market share… In the U.S., Croplogic owns 30% of the potato market in Washington D.C., the second largest potato producing state after Idaho. This number is expected to grow to a US$1.0bn p.a. in the U.S. alone, with another US$2.0bn p.a. in markets outside the U.S., and Croplogic intends to launch Croplogic Realtime into 74% of Australia’s horticulture acres (gross product at the farm gate of AU$3.4bn) in September 2018.

*This Special Report was commissioned by CropLogic Ltd.

COMPANY DESCRIPTION

Formed in 2010, Croplogic (ASX: CLI) aims to assist farmers in improving crop yields by combining 30 years of extensive research and testing with exclusive use of NZIPR crop model technology with in-field agronomy support teams to provide further advice to growers. Farmers are able to utilise Croplogic technology to optimise irrigation and fertilisation needs to maximise yields. Croplogic operates three core technologies: digital (remote sensory), imagery & AI, and predictive modelling, with all three at different stages of development.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >