Senetas (SEN) – Research Report

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 11/12/18 | SEN | $0.09 | $0.20 | BUY |

Date of Report 11/12/18 | ASX SEN |

Price $0.09 | Price Target $0.20 |

Analyst Recommendation BUY | |

| Sector : Technology | 52-Week Range: $0.14 – 0.09 |

| Industry: Technology Services | Market Cap: $98.4 million |

Source: Bloomberg

KEY RISKS

- PRODUCT RISK – encryptors are its key product therefore. SEN aims to mitigate risks by constantly updating and enhancing functionality.

- RELIANCE ON PARTNES – The major distributor is Gemalto which accounts for over 80% of SEN revenue.

- REVENUE VOLATILITY – SEN relies on one -off sales of hardware or a series of lease payments. This often causes inconsistency in revenue.

FUNDAMENTAL DRIVERS/CATALYSTS

MACRO & THEMATIC DRIVERS:

- PHASE IN ECONOMIC CYCLE – DRIVERS & RISKS ATTRIBUTABLE TO:

o Economic Growth Beta: Global economic cycle raises the spectre of caution on all aspects of technology.

- INDUSTRY CYCLE – The security / encryption sector will become a major thematic over the coming years.

- INDUSTRY DEMAND / PRICING POWER – Demand for leading edge security encryption products is strong and should exceed average growth of the technology sector.

MARKET PHASE

The market is currently at a major inflexion point … the high volatility and the break of uptrends of the leading indices points to a risk off strategy garnering momentum.

MICRO:

GROWTH STORY WITH EARNINGS MOMENTUM CATALYSTS?

A new product range and strategy –Senetas is a company in transition. It has moved from being a single product company to being a multiproduct company and has also broadened its technology base and skills.

Senetas remains a world leader in providing encryption technologies both hardware based and software based.

SEN products are now transport independent encrypting data over layer 2. 3 and layer 4 of the telecommunication data transport stack. This significantly opens up their addressable market.

SEN is using its expertise (through acquisitions) to provide additional cyber security technologies for governments and businesses around the world.

SEN aims to leverage its global distribution and business development capability to scale Votiro’s technology.

Future earnings drivers:

- First sales of virtualised (software based) encryption products – customer trials ongoing. This will be a major game changer for SEN.

- Leverage Gemalto’s adoption of SureDrop into its product portfolio

- Drive further sales of 100Gbps encryptor

What could go wrong?

Macro

- Dramatic slowdown in global growth & in the tech cycle.

- Is there a paradigm shift? Yes. Globally tech security is a major thematic, which is actually a positive.

- Competition in cyber security and encryption? Tesserent, WhiteCliff, Prophecy International, Covata, Elsight.

Micro

- Loss of major customer may have a flow on effect.

- Main business trend? Global demand is in a positive uptrend do not foresee any risks.

- Market dynamics? A shift in investor focus toward “value” plays will impact negatively. This is a growth play.

Earnings Surprise Potential

EARNINGS ESTIMATE MOMENTUM

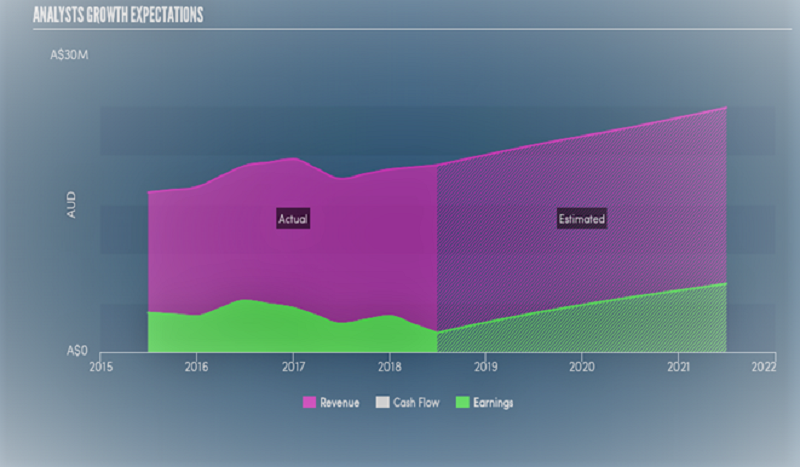

After a series of earnings downgrades, we believe the market will be revising upward Senetas’earnings estimates as a result of the following:

1. The positive pick up in sales from its new product offering.

2. Analyst coverage has recently been focused on earnings downgrades. We believe that this downgrade phase has been overdone.

3. In terms of sentiment the stock is carrying a fair amount of negative baggage. We believe, once the market understands the virtual encryption opportunity and the company starts to deliver some reasonable growth numbers in its 100Gbps encyptors the overall sentiment will become positive.

Growth Checks

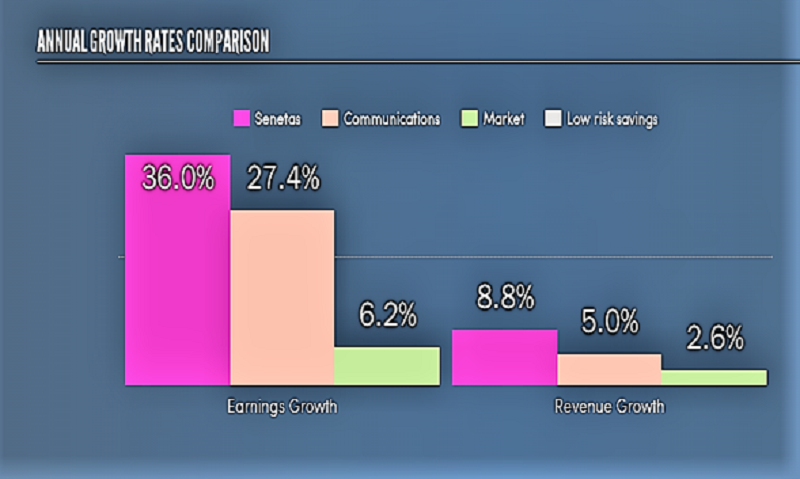

- Senetas’s revenue growth is expected to exceed the market average. (around 8% p.a.)

- Senetas’s earnings are expected to grow significantly at over 20% yearly.

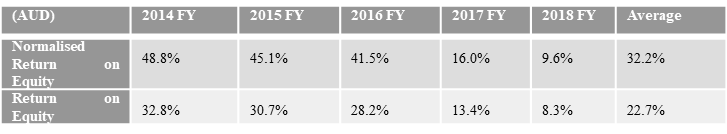

- SEN’s ROE has been dropping over the past few years … we believe we are currently in an ROE base and the ROE should start to pick up significantly.

Senetas's financial health and level of debt:

- SEN has no debt.

- Senetas’s cash (A$23m) cover its short term and long term commitments.

COMPANY DESCRIPTION

SEN specialises in the design, development, and manufacture of data network security and encryption hardware. SEN encryptors are used by government, corporates and cloud/ data centre service providers in over 30 countries.

First Guardian Capital Disclaimer

The author will not be liable to you or any other person for any loss or damage (including direct, consequential or economic loss or damage) however caused and whether by negligence or otherwise which may result directly or indirectly from the receipt or use of this communication or any files attached to it.

Read our full disclaimer here >

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >