How an algorithmic trading system won the ASX Options Game

Investors and traders have always attempted to gain an edge on markets, a constant that will never go away. Whilst the old school ‘Wall St’ types have had their run of things until now – many believe a changing of the guard has already taken place.

Investors and traders have always attempted to gain an edge on markets, a constant that will never go away. Whilst the old school ‘Wall St’ types have had their run of things until now – many believe a changing of the guard has already taken place.

Today’s king are the quants – algorithmic driven trading using tested statistical models to find high probability trades.

Fundamental knowledge and experience will always have their place – however many of the largest hedge funds and investment banks globally see the most sound way to outperform and reduce risk is to use these complex mathematical models.

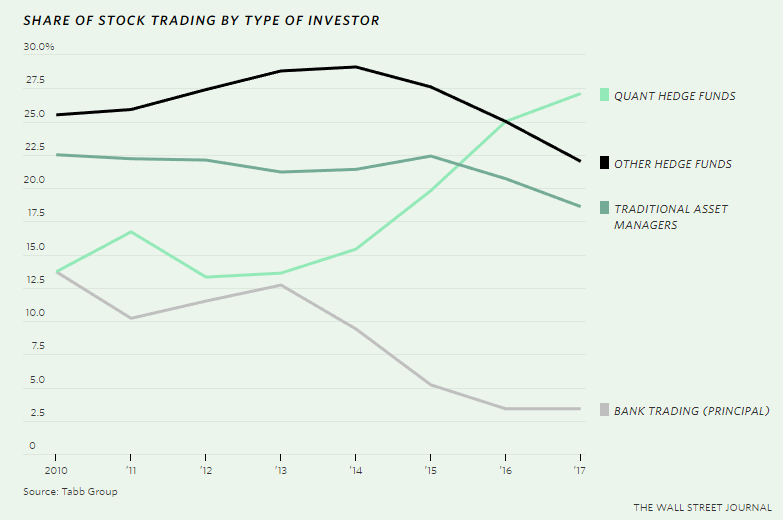

It’s not exactly a new concept, yet the last few years the paradigm has significantly shifted. In 2017, quantitative hedge funds were responsible for 27% of all U.S. stock trades by investors, up from 14% in 2013.

This change in dynamic is creating new – seriously high paying jobs previously unheard of in the finance industry. With bidding wars breaking out as the top firms attempt to fill their teams with mathematical genius’.

There is, of course, a flipside to the rise of maths dominating markets. Imagine what would happen if everyone’s rules and formulas were too similar? Well, that’s essentially what happened in 2007, with what became known as the “quant meltdown” as too many algorithms simultaneously triggered, causing a fast moving whirlwind of selling that continued to compound on itself.

Performance wise, 2018 was an interesting year for the quants. Considering the S&P500 finished the year down 6.7%, most funds struggled to navigate the bearish waters that closed out the year. However, some of the largest funds that utilised algorithmic base strategies fared better; Renaissance Technologies’ RIDGE Fund gained upward of 10% on the year. Whilst Bridgewater, the world’s largest hedge fund, posted gains in its flagship Pure Alpha strategy of 14.6%.

In our own world at Reach Markets, our brainchild of the quant philosophy – the ‘LITT Trading System’ finished first in the ASX Options Trading Game, posting a return of 274%* over an 8 week period.

Our team has also added a quant specialist over the last few months who will be solely focused on finding and testing new algorithmic based strategies. We’ll also continue to not only educate our clients with these, but work in automated recommendations to our trading platform as well.

If you would like to join us for a live webcast to learn about our backtested algorithmic trading system, please click here.

*Please note: Past returns do not reflect future returns

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only act on our recommendations if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.