Invitrocue Limited (IVQ) – Dec Quarter Update

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/02/19 | IVQ | $0.071 | N/A | N/A |

| Date of Report 09/02/19 | ASX IVQ |

| Price $0.071 | Price Target N/A |

| Analyst Recommendation N/A | |

| Sector: Pharmaceuticals, Biotechnology & Life Sciences | 52-Week Range: $0.06 – $0.12 |

| Industry: Health Care | Market Cap: $36.5 million |

Source: Bloomberg

CAPITAL STRUCTURE

Shares on Issue (listed): 513.8 million

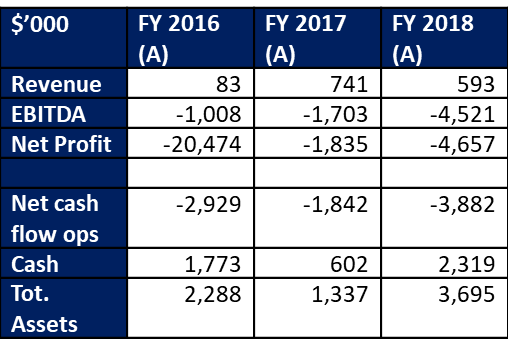

FINANCIAL SUMMARY

INVESTMENT PROPOSITION

Invitrocue’s core proposition is its capability to build a patient’s own cancer or micro-tumour in its laboratory for testing against approved first line chemo drugs and identifying alternative drug treatment. The effect will be that oncologists will be able to prescribe treatments with be a high degree of confidence regarding their outcome. This test has the potential to markedly improve the effectiveness of cancer treatment with a marked reduction in costs and greatly reduced patient trauma.

Infrastructure to support a global roll-out has been established with labs now operating in Singapore and Germany with further labs expected to be operating in Australia and Asia by mid-2019.

Commercialisation is now underway and sales momentum is expected to gather pace. A “hockey stick” growth profile for the Onco-PDO personalised oncology service is quite possible with a “take-off” occurring once a critical mass of testing laboratories is in place.

The pathway to eventual profitability is built on achieving scale and it is believed that breakeven will reached with a weekly run rate of about 20 tests (1,000 test per annum) across its network of labs. It is anticipated that this will be achieved during calendar 2020.

EVENT

Invitrocue recently released its Appendix 4C for the quarter ended 31 December 2018. During the period under review, the company generated cash receipts of $85K and achieved a net operating cash flow deficit of $870K. Cash balances as at 31 December 2018 were $1.2 million.

Highlights of the Reporting Period include:

- Increasing number of patients using Onco-PDO, which is commercially available in Asia and Europe

- Appointed Dr Andreas Lindner to new role of CEO of Invitrocue Europe in preparation for commercial roll-out of Onco-PDO in new markets in 2019

- New agreement signed with German laboratory partner to establish central lab in Europe

- Appointment of Assoc Professor Narayanan Gopalakrishna Iyer as Chairman of Clinical Advisory Board and Professor David Waugh as advisor to establish network in Australia

- New collaboration with Professor Zeng Yi of Shanghai Institute of Biochemistry and Cell Biology to develop new breast cancer models for Onco-PDO

- Conducted inaugural key opinion leader Onco-PDO educational seminar

ANALYSIS AND COMMENT

The first commercial use of the Onco-PDO test in April 2018 set in the train the commercialisation of this breakthrough diagnostic tool which will enable oncologists to prescribe treatments for their patients with a high degree of confidence in the performance of the drugs. The months since have been focussed on putting in place the infrastructure to support a global roll-out and scale-up strategy. Processing labs are now operational in Singapore and Germany with labs in Hong Kong, Australia and the UK due to open progressively through 2019. Management has been appointed in Europe to drive business development in that market, lab technicians have been recruited and its senior advisory ranks have been strengthened with a number of highly experienced appointments and marketing to influence leaders is being cranked up.

The volume of tests undertaken started to build towards the end of the quarter, off a very small base, with patients from Hong Kong and Malaysia in addition to those from Singapore. The first test has also been completed in Germany. The priority is now to build up volumes with consistent weekly throughput. To this end, the company has now entered into marketing arrangements directly with hospitals in Singapore. Previously, the company solely relied on oncologists marketing to their private patients with the hospitals only providing the facilities through which the oncologists operated. Now the hospitals will market the service directly to cancer patients being treated at their facilities.

Marketing is also building as evidenced by the company’s sponsoring of an educational seminar in Germany to promote Onco-PDO to oncologists. During 2019, the service will be marketed in France, Spain and Italy and volumes in that region are expected to build over the year. Although the development of a lab in Northern Ireland to service the UK is still on track, progress has been slowed due to Brexit priorities of the government. Nonetheless, an opening during 2019 is still anticipated.

In late January 2019, the company announced an agreement to develop Onco-PDO breast cancer models in China. We understand that this strategy will open a pathway into this potentially enormous market. Whilst private patients can go to Hong Kong for treatment and tests, however, this option is not otherwise available to most of the population so a new funding model needs to be developed. The development of the cancer models with a research institute may provide such an option. Further clarity from the company is anticipated over the next few months.

After much background development work during 2018, the key infrastructure and staffing needs to build sales traction have been put in place and expectations are high that volumes will build during 2019. Breakeven point is believed to be about 1,000 test per annum or about 20 per week cross the network of labs. With four or five labs in operation we would expect that this run rate should be achievable by early 2020.

The original liver testing business, which is utilised by pharmaceutical companies to test compounds and prospective drugs for toxicity, somewhat fell off the radar during 2018. Sales slumped due to equipment issues and some changes in industry dynamics whilst the company placed a greater priority on Onco-PDO. Accordingly, cash receipts in the December 2018 quarter were the lowest in at least 6 quarters. However, the project pipeline for clients has been rebuilt and in progress although there are lags in revenue recognition and cash receipts. More importantly, a product-based revenue model has been developed to support the services-based model. Apparently considerable client interest has been shown in products that have been developed for use in immunity testing and the company sees this as an opportunity to balance the timing risks in terms of the build up in scale of Onco-PDO.

The operating cash flow deficit of $870K was the lowest since the September 2017 quarter although still broadly in line with the typical quarterly deficit of about $900K to $1 million that has been in place since late 2017. We expect the quarterly deficit to remain broadly within this range over CY 2019 with increases in revenue, at least partially, offset by increased marketing and business development costs. The company has been regularly topping up its working capital with small placements and we expect this to continue through 2019. If the company achieves its sales growth projections over the next year we would expect that the cash flow deficit will narrow later in CY 2019 before turning positive during CY 2020.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

KEY POINTS

- Patented technology – Invitrocue’s bio-analytic solutions for the healthcare, pharmaceutical and cosmetics industries are underpinned by its high speed, low cost platform for replicating and testing human liver and cancer cells.

- Two commercial business units leveraging this technology – Invitrocue is maximising the commercial opportunities of the technology with multiple revenue streams from independent markets.

- Scaling up now underway – All efforts have been directed towards building the infrastructure to support a rapid roll-out of the Onco-PDO service. Agreements to establish joint venture labs are being negotiated and technical staff are being employed.

- Personalized Oncology services will quickly emerge as the core business– Cancer treatment is an enormous market with considerable opportunities for more effective and more efficient treatment protocols. Accordingly, revenue from testing cancer cells (personalised oncology; Onco-PDO) will quickly surpass the contribution from liver cell testing.

- Rapid growth anticipated – The number of tests processed at the Singapore lab will build rapidly as additional technicians are employed and as local and regional oncologists increase their use of the technology. Negotiations currently underway with cancer research institutions are expected to lead to the opening more testing laboratories which will drive quantum leaps in activity over the next two or three years.

- Growth to accelerate as independent laboratories are certified – Scaling of the Onco-PDO business will occur in stages as independent laboratories are certified to perform the tests. Maybe 10 – 15 laboratories worldwide are required to service the global market.

- Potential to build into a large business – Revenue growth will be driven by the pace of the certification of laboratories but it is conceivable that revenues could exceed US$100 million in five or so years.

- Capital light business model – Outsourced product manufacturing and service delivery will minimise capital requirements and corporate overheads. Gross margins are expected to settle between 45% and 50% once volume in both business segments reaches commercial levels.

BUSINESS OVERVIEW

Invitrocue provides bio-analytic solutions to the healthcare, pharmaceutical and cosmetics industries. The company has leveraged its patented technology into two commercial pathways; testing chemical compounds for toxicity, which is used by pharmaceutical companies in pre-clinical drug development, and testing of cancer cells to aid oncologists in identifying treatment regimens for individual patients opening the way to personalised treatment based on the unique characteristics of each patient.

These solutions are underpinned by the company’s patented high speed, low cost platform for growing, replicating and testing human liver and cancer cells. This platform is a 3-dimensional cell-based scaffolding technology which enables human cells to replicate quickly with a far more realistic representation of the in vivo (in body) condition compared with traditional 2-dimensional processes.

Invitrocue was founded in Singapore in 2012 by Prof Hanry Yu (currently a non-executive Director) and Dr Steven Fang (currently CEO) to further develop and commercialise analytical services for pharmaceutical companies based on these patented technologies. Research and testing laboratory facilities were established in Singapore and the company subsequently listed on the ASX in early 2016.

Invitrocue’s core capability and value proposition is the generation of data regarding human cell response to drug compounds. This data is critical in the development of drugs and cosmetics and is becoming increasingly important in the treatment of cancer and other diseases.

The competitive advantages of the company’s technology and processes are:

- Better representation of in vivo (in body) cell development

- Better prediction of drug response

- Cells can be kept alive longer (8 weeks compared with typically 2 weeks)

- Lower cost compared with other 3D based processes

- Eliminates the need for animal testing

Liver Cell Services is Invirtocue’s most established business stream. It provides a range of services to pharmaceutical and cosmetics businesses including drug metabolism assays, liver toxicity assays, infectious disease assays testing (such as hepatitis) and liver disease modelling. The company also sells liver cells; HepaCue fresh hepatocytes and mice carrying humanised liver cells.

These products and services are primarily used in pre-clinical drug development studies and in testing cosmetics. A key business driver is the move away from animal testing. Accordingly, Invitrocue offers a practical, cost effective alternative in an increasing range of diseases.

The company’s 3D scaffolding technology for growing cells has obvious application in testing cancer cells and opened the opportunity to develop a personalised oncology business. With continuing advances in identifying genetic aberrations in individuals, the ability to develop specifically targeted treatment options, especially for cancer patients, improves. Accordingly, some degree of personalised treatment is now part of the standard of care in the first diagnosis of cancer to the extent that genetic abnormalities can be identified. This would typically be through the identification of a biomarker (A biologic feature that can be used to measure the presence or progress of disease or the effects of treatment – medicinenet).

However, the success rate of any specific treatment is typically low, maybe as low as 35%, whilst there are relatively few biomarkers relative to the variance in the population. As a result, multiple treatment strategies, often employing combinations, are typical. Against this background, Invitrocue has developed a service (Onco PDO) whereby cancer cells can be tested for response to any number of drugs or combinations thereof. The service has a rapid turnaround (about 10 days) and is relatively inexpensive. Over 200 pilot tests were conducted with the first commercial tests undertaken in Singapore in April 2018. The strategy is to co-locate processing facilities within existing labs at research institutions who are aligned with cancer treatment hospitals. In addition to Singapore and lab has been opened in Munich, Germany with labs expected to be opened during 2019 in Australia,

Gordon Capital Disclaimer

DISCLOSURE: This publication has been prepared by Gordon Capital Pty Ltd, as Authorised Representative of InterPrac Financial Planning Pty Ltd, Australian Financial Services Licence No. 246638. The registered office of InterPrac Financial Planning Pty Ltd is Level 3, 29-33 Palmerston Crs, South Melbourne, VIC 3205.

Please note that Gordon Capital has been retained by INVITROCUE LIMITED to provide this report for a fixed fee. Gordon Capital does not provide specific investment recommendations and does not receive any additional benefit for the provision of this report. Gordon Capital aims to provide a balanced and objective analysis in this report.

Read the full disclaimers here >

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >