A massive Megatrend that’s only just beginning to reach into every part of our lives and industries.

Is it all just technology hype? We are hearing a lot about Artificial Intelligence (AI) and the reality is that it’s finally begun to deliver on the promises, some made more than 60 years ago.

Is it all just technology hype?

We are hearing a lot about Artificial Intelligence (AI) and the reality is that it’s finally begun to deliver on the promises, some made more than 60 years ago. Machine-learning systems however have recently demonstrated superhuman performance in domains as diverse as recognising objects in images, detecting fraud, diagnosing disease, security, and making recommendations to customers (chatbots). They are also the power behind applications like Google Translate (not a raft of linguists and polyglots). What AI will create and achieve into the future however is much, much more than we can imagine today

$1.2 Trillion USD to $3.9 Trillion USD in just 5 years: Global business value from AI totalled $1.2 trillion USD in 2018, up 70 percent from 2017, according to Gartner Inc. who are forecasting $3.9 trillion USD by 2022. “AI promises to be the most disruptive class of technologies during the next 10 years due to advances in computational power, volume, velocity and variety of data, as well as advances in deep neural networks (DNNs).” Source: Gartner

Artificial Intelligence is a constellation of technologies, allowing machines to sense, comprehend, act and learn. The most basic form of AI called “narrow AI,” is a collection of technologies that rely on algorithms and programmatic responses to simulate intelligence, generally with a focus on a specific task. When you use a voice recognition system like Alexa to turn on the lights, that’s weak AI in action. Alexa may sound smart, but it doesn’t have any advanced understanding of language and can’t determine the meaning behind the words you speak. Strong AI in contrast, is intended to think on its own. These are systems built with the human brain as their archetype. Strong AI is designed to be cognitive, to be aware of context and nuance and to make decisions that are not programmatic in nature but rather the result of a reasoned analysis. AI-enabled factory floor initiatives typically must gather several million gigabytes of data each week in order to have enough analytical data to make reasoned decisions about what might happen in the future.

Case Study – Healthcare:

Global consultancy firm Accenture predicts that the top AI applications may result in annual savings to the healthcare sector of $150 Bn USD by 2026. It is achieving this via efficiently diagnosing conditions, faster and earlier, as well as reducing misdiagnosis and lowering costs.

In 2015, misdiagnosing illness and medical error accounted for 10% of all US deaths. In light of this, the promise of improving the diagnostic process is one of AI’s most exciting healthcare applications. Incomplete medical histories and large caseloads can lead to deadly human errors. AI is immune to those variables and can predict and diagnose disease at a faster rate than most medical professionals, by drawing upon databases of millions of observations.

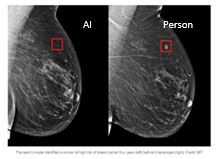

Breast cancer diagnosis: 5 years earlier; faster, more accurate and more diagnosed.

Breast cancer diagnosis: 5 years earlier; faster, more accurate and more diagnosed.

Rather than taking a one-size-fits-all approach, AI personalizes screening around a woman’s risk of developing cancer. For example, doctors might recommend one group of women get a mammogram every other year, while another higher-risk group might get supplemental MRI screening. When doctors can order mammograms based on patient need, they can avoid unnecessary exposure to radiation and unnecessary scan costs. In one study an AI model using algorithms and deep learning diagnosed breast cancer at a higher rate than 11 pathologists and up to 5 years earlier

Businesses need help in utilising Artificial Intelligence. To date many companies have lacked the expertise and resources to take full advantage of AI. Machine learning and deep learning typically require teams of AI experts, access to large data sets, and specialised infrastructure and processing power. Companies that can bring these assets to bear then need to find the right uses for AI, to create customised solutions and then scale them effectively. All this requires a level of investment, knowhow and sophistication that takes time to develop and is out of reach of most businesses internally. Naturally they turn to outside assistance and capability.

Which Company and why? Insync’s identification of decade plus Megatrends with strong tailwinds is one major prerequisite in our search for excellent companies to invest in, wherever they reside. It is not enough to simply be operating within a Megatrend and understand the influences of disruption on their industry. They also need to be positioned well to benefit from it as a business, have the managerial and financial prerequisites for success, and a proven track record of achievement. To be a Future-focused enterprise is a must.

Few meet these strict requirements of enduring success. Insync is always searching for the one or two best firms in a Megatrend that meet these stringent criteria. In this particular instance, our investors are taking advantage of the AI Megatrend via what we believe to be the world’s best services firm to industries globally for AI.

Accenture:

We believe Accenture is the only company today that has the full range of capabilities to integrate and deliver AI end-to-end services and deliver tangible outcomes for customers globally. In 2000, the business and technology consulting division of Arthur Anderson separated from its sibling – a global accounting and consulting firm whose roots began in the 1950’s. Changing its name to Accenture, it then listed in July 2001 on the NYSE and is headquartered in Ireland.

Interestingly Accenture’s technology roots began in the early 50’s in building the feasibility study for the world’s first commercial computer, GE’s UNIVAC computer and printer. In 2018 Accenture reported net revenues of $39.6 billion, built by more than 459,000 employees, serving clients in more than 40 industries, in over 200 cities across 120 countries. Accenture’s current client list includes 92 of the Fortune Global 100 and more than three-quarters of the Fortune Global 500.

The company is focused on providing end-to-end capabilities at scale across the full spectrum of professional services—spanning strategy, consulting, digital, technology and operations. In 3 years from 2015, Accenture’s revenues from digital doubled to $20bn USD, around half its total revenues. Overall revenue grew by 14% in fiscal 2018, as investments in digitisation (including AI) accelerates in businesses around the world.

As many worry whether we are heading into a recession, Accenture’s future focused growth outlook is more assured. Its projected growth and other key fiscal measures are expected to continue to rise despite the overall low growth economic environment.

Perhaps Accenture’s focus on AI is best summed up in it receiving first-paragraph position on its website tab – About Us. ‘Growing customer expectations. Market-shaping AI. Self-optimizing systems. The post-digital age shows no signs of slowing down, and the need for new ideas powered by intelligent technologies has never been greater.’

For more information on other Megatrends, please visit Insync Funds Managers’ Website here.

EQT Responsible Entity Services Limited (“EQT”) (ABN 94 101 103 011), AFSL 223271, is the Responsible Entity for the Insync Global Quality Equity Fund and the Insync Global Capital Aware Fund. EQT is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This information has been prepared by Insync Funds Management Pty Ltd (ABN 29 125 092 677, AFSL 322891) (“Insync”), to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Insync, EQT nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

This publication contains general securities advice. In preparing the advice, Reach Markets Australia has not taken into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision on the basis of this advice, you need to consider, with or without the assistance of a securities adviser, whether the advice in this publication is appropriate in light of your particular investment needs, objectives and financial situation.

Reach Markets Australia and its associates within the meaning of the Corporations Act may hold securities in the companies referred to in this publication. Reach Markets Australia does, and seeks to do, business with companies that are the subject of its research reports. Reach Markets Australia believes that the advice and information herein is accurate and reliable, but no warranties of accuracy, reliability or completeness are given (except insofar as liability under any statute cannot be excluded). No responsibility for any errors or omissions or any negligence is accepted by Reach Markets Australia or any of its directors, employees or agents. This publication must not be distributed to retail investors outside of Australia.

It is recommended that you seek independent advice and read the relevant Product Disclosure Statement before making a decision in relation to any investment. Any advice contained in this communication is general and has not taken into account the investment objectives, financial situation and particular needs of any particular person.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.