ASX Options Game: How The Winner Turned $50k into $1.6 million

The last ASX Options Game broke a new record. In four weeks, winner Moon Patel from NSW turned $50k into $1.6 million. With a return of 3331%, this is by far the largest profit in the history of the game – by a long way!

The last ASX Options Game broke a new record. In four weeks, winner Moon Patel from NSW turned $50k into $1.6 million. With a return of 3331%, this is by far the largest profit in the history of the game – by a long way!*

Brett Danker was second with a final profit of $255k return, or 501%, while Chank Chen came in third. His final portfolio was $152k, a return of 306%.

Moon obviously completely destroyed the record, but even in regards to the rest of the leaderboard, the results were still better than what we’ve seen in previous games.

These are amazing results but it’s important to remember that these came from taking a few big risks.

The Options Game is a bit like playing a racing video game. If you round a corner too fast, there’s no great loss. You won’t get hurt, as it’s very different to being in a real race car. There’s opportunity to take risks and learn in the Options Game that you wouldn’t with real money.

Moon used some really simple trading strategies to get results, sticking to long calls and long puts. His approach was to ride the market, buying calls when the market was on its way and buying puts when the market was on the way down. He managed to lock in profits early, and did well despite using simple strategies by reading the market like a pro.

His trades are explained by professional Options traders Ivan Tchourilov and Peter Nelson in the video below, so check it out if you’re interested to learn exactly what he did.

If you would like to start trading too, you can do so in a couple of different ways. You can either join the next ASX Options Game to compete against other traders in a market simulation, or dive straight into trading in the live market by taking a seven-day trial to our Implied Volatility options trading platform.

Trade Tracker: A glance at Moon’s game trades

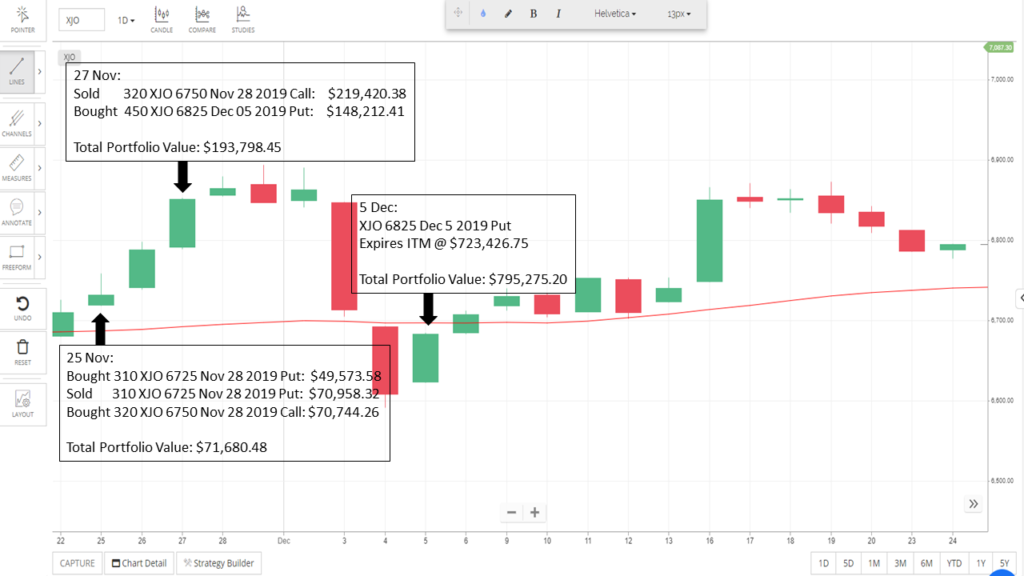

25 November:

- Bought 310 XJO 6725 Nov 28 2019 Put: $49,573.58

- Sold 310 XJO 6725 Nov 28 2019 Put: $70,958.32

- Bought 320 XJO 6750 Nov 28 2019 Call: $70,744.26

Total Portfolio Value: $71,680.48

27 November:

- Sold 320 XJO 6750 Nov 28 2019 Call: $219,420.38

- Bought 450 XJO 6825 Dec 05 2019 Put: $148,212.41

Total Portfolio Value: $193,798.45

5 December:

- XJO 6825 Dec 5 2019 Put

- Expires ITM @ $723,426.75

Total Portfolio Value: $795,275.20

10 December:

- Bought 2700 XJO 6725 Dec 12 2019 Call: $510,276.56Total Portfolio Value: $ 833,098.64

11 December:

- Sold 2700 XJO 6725 Dec 12 2019 Call: $814,603.72

- Bought 4000 XJO 6725 Dec 12 2019 Put: $587,521.76

Total Portfolio Value: $836,080.60

12 December:

- 4000 XJO 6725 Dec 12 2019 Put expires OTM.

- Bought 1800 XJO 6750 Dec 19 2019 Call: $ 479,150.28

Total Portfolio Value: $493,730.32

17 December:

- Sold 1800 XJO 6750 Dec 19 2019 Call: $1,819,490.47

Total Portfolio Value: $1,852,420.79

18 December:

- Bought 800 XJO 6750 Dec 19 2019 Call: $774,434.08

- Sold 800 XJO 6750 Dec 19 2019 Call: $863,716.70

Total portfolio Value: $1,941,703.41

19 December:

- Bought 3000 XJO 6850 Dec 24 2019 Put: $572,989.80

- Sold 3000 XJO 6850 Dec 24 2019 Put: $746,535.00

Total Portfolio Value: $2,115,248.61

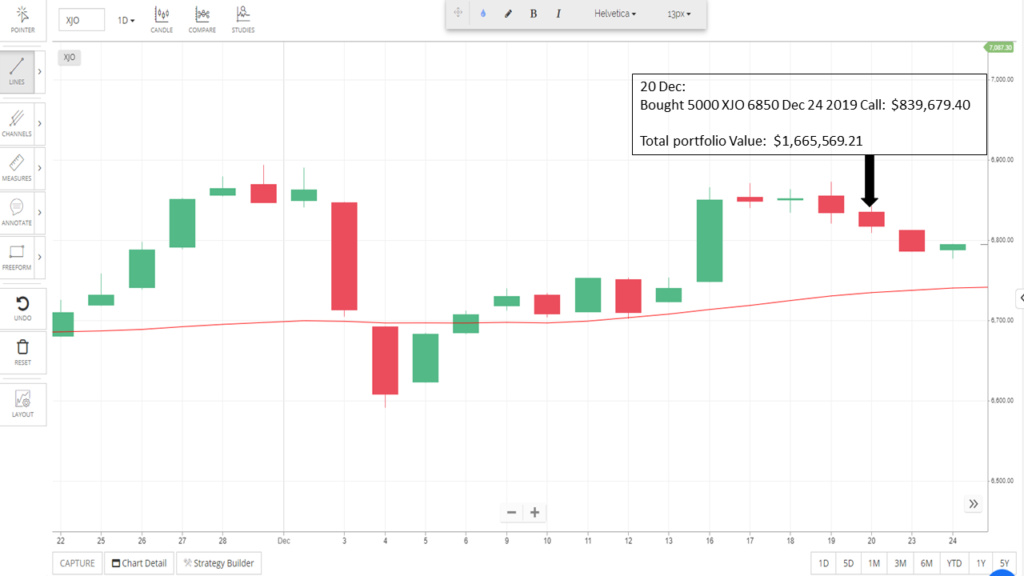

20 December:

- Bought 5000 XJO 6850 Dec 24 2019 Call: $839,679.40

Total portfolio value: $1 665 569.21

*Past returns do not reflect future returns.

Trading options is not suitable for everyone. There is a risk that you can lose more than the value of a trade or its underlying assets. You should only trade if you are confident that you fully understand what you are doing. If you are thinking about acquiring a financial product, you should consult our Financial Services Guide (FSG) at www.reachmarkets.com.au and the relevant Product Disclosure Statement first.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.