The History of RBA’s Inflation Targeting and the future of Australian Cash Rates

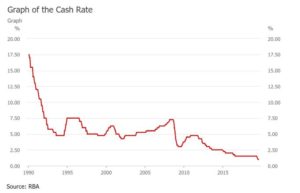

The RBA’s mandate is to target inflation within a 2-3% band over the course of the economic cycle. This target was established in 1993, formalised in 1996, and we have not seen double digit cash rates since then. Prior to the 90’s there was no inflation target in Australia.

The RBA’s mandate is to target inflation within a 2-3% band over the course of the economic cycle. This target was established in 1993, formalised in 1996, and we have not seen double digit cash rates since then. Prior to the 90’s there was no inflation target in Australia.

The highest we have seen the ‘RBA Cash Rate’ since Australia has maintained this target is 7.5% in 1994/95 when the government was using monetary policy to keep ‘inflationary expectations’ under control (i.e. through a high cash rate). The formalisation of inflation targeting by the RBA in 1996 saw these inflationary pressures disappear almost immediately.

The next peak was in 2007 with a cash rate of 7.25% for only six months during the ‘once in a lifetime’ resources boom, during which the Australian economy was extremely overheated. Within seven months, the cash rate had fallen to 3%, as another ‘once in a lifetime’ event (the GFC) hit. The cash rate is now 1%, and (as per the RBA’s mandate) will remain this low until there is an inflationary reason to increase it. With inflation currently at 1.6%, below the RBA medium term target of 2-3%, the RBA does not currently see a reason to increase the cash rate.

Due to the large impact of the GFC, many economists and market analysts expect inflationary pressures to be low for an extended period of time. The RBA now equates a neutral nominal cash rate of around 3.5% (see under ‘Considerations for Monetary Policy’).

And Australia isn’t the only one – low cash rates has become the norm internationally.

The United States cut its cash rate in July 2019 to a target range of 2-2.25% as US inflation remains subdued and the economic outlook has deteriorated amidst ongoing trade tensions with China.

China has recently lowered its interest rate to 4.25% in August, which is a record low.

The Eurozone has maintained the ECB rates at zero percent since March 2016 and has noted it is already making preparations for more quantitative easing zero (or lower) interest rates expected through the first half of 2020.

The UK held its BoE Bank Rate at 0.75% in August, which is higher than its record low of 0.25% in August 2016, but still low by historical standards.

The Bank of Japan’s key short term interest rate is negative at -0.1%, where it has been since January 2016.

With fears of a slowdown in the world economy and the fallout from the GFC a decade ago continuing, the world is stuck in a low inflation and low interest rate environment. Any slowdown in the world economy will further decrease inflationary pressures in Australia. However with the RBA cash rate at all-time lows of 1% there isn’t much room left for conventional monetary policy to jump start the economy.

The RBA is mandated to increase inflation so there isn’t pressure to increase cash rates in the short term. The world will still be pulling itself out of the GFC aftermath for many years to come and we should be prepared for low rates over the medium to long term.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.