Who is the largest, most successful emerging market? – Part 1

We believe it’s the one with 7 superior long-term drivers working in its favour. These being.

We believe it’s the one with 7 superior long-term drivers working in its favour. These being.

- Demographic momentum across a variety of factors

- Knowledge and technology superiority

- Business ‘friendly’ regime

- Strong corporate governance

- Ability to adapt and transition

- Superior capital access

- Significant Megatrend exposures

Most of all it is a market that is well positioned to capitalize on the fourth industrial revolution. This is why we categorize it as an emerging market. It will surprise many. This new era we have now entered means all nations are ‘emerging’, as each adjusts (or fails to adjust) to the new reality. It is this quiet and accelerating revolution that is not only all-pervasive in our lives and communities, but also in its rewriting of many of the traditional valuation and selection criteria used to define what makes a ‘good’ investment in the future.

We will reveal its name in Part 2 of this Series. Most don’t regard it as an emerging market, and yet its emerging into pole position in our new world of commerce and economic and investment norms.

At Insync we are agnostic to geographic exposures. If one had to focus on geography, then large urban regions (as opposed to political boundaries) make a more useful view. This nation however has great reasons to be looked at in both ways. Our first key driver – Demographic favourability.

Demographics Rule. Ok.

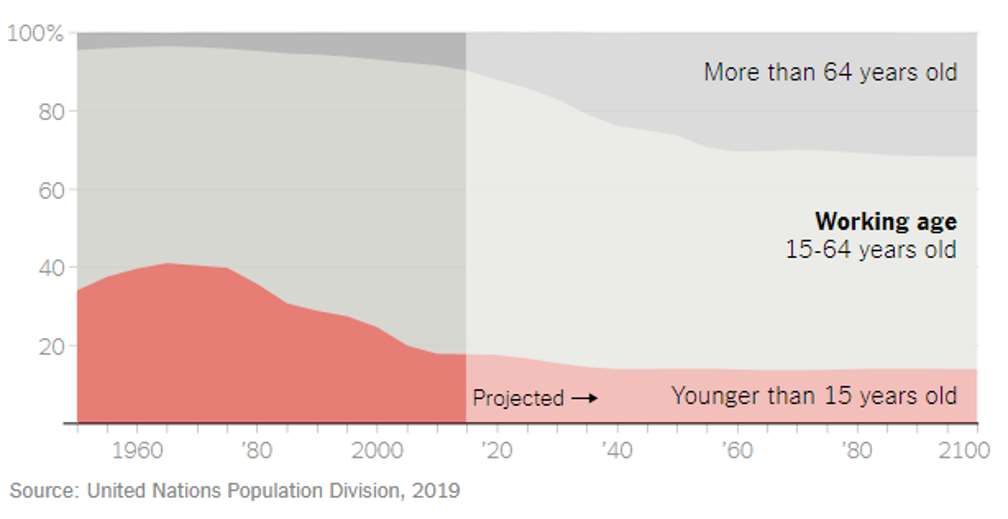

Japan, Germany and almost all developed nations of size (even China) on most key measures are in big trouble. Falling working age populations, below replacement birth rates and rapidly aging populations to boot. Political intervention has zero impact.

Demographic change influences the underlying structural growth of economies. Productivity growth, living standards, savings rates, consumption, and investment are further key measures it has had a big hand in shaping. It influences long-run unemployment rates, equilibrium interest rates, housing market trends, and the demand for financial assets. It is also not something that can be easily changed inside 2 or 3 decades either. If it’s running for you as a tailwind, not only is it a massive uncommon benefit but it is almost impossible for others to catch up.

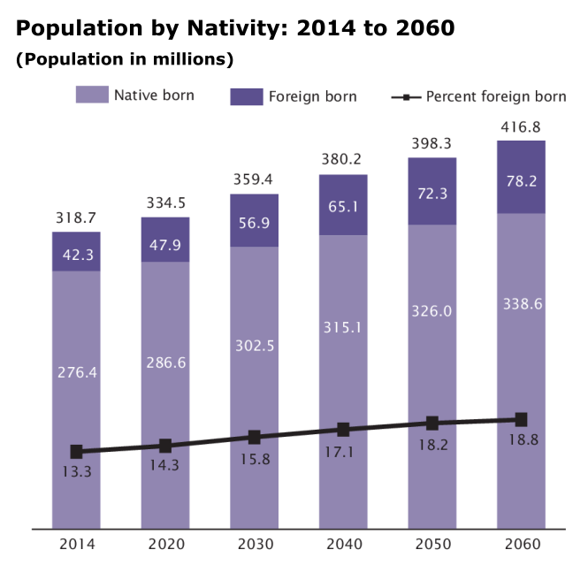

This leading emerging market’s most obvious demographic advantage is its size. It is in the world’s top 7 most populous countries, and it is likely to remain so until 2040. No developed country even comes close—the second and third largest OECD nations, Japan and Germany, have populations that are only a fraction of this nation. Germany for instance needs over 1 million immigrants of working age each year just to maintain its workforce (taxpayer) size. Excluding sub-Saharan Africa, our Number 1 ranked emerging nation is the only one where the rate of population growth is still increasing and its workforce relatively steady. It’s on track to grow slightly faster than the world population up to 2040.

But what about China? At first glance it is an impressive rival and nation. With almost 1.4 billion people, the last 4 decades have witnessed the most rapid and sustained burst of economic growth in human history. Its markets however are another story and so it becomes crucial as to how you access this growth and from where. With decades of extremely low fertility and no likelihood of mass immigration, China will see its population peak by 2027.

It’s worth remembering that the world passed ‘Peak Child’ over 8 years ago. Never will we see more children than there was back then, China too. It now faces a grave strategic threat from within; its working-age population has been steadily shrinking over the past five years and is set to decrease by at least 100 million by 2040. It is particularly acute with those under 30 whose ranks are expected to fall by over 30%. A double negative applies; loosing workers and adding to retirees that have no savings in place to sustain a 20+ year life expectancy.

Without this tailwind of demographic advantage, it is hard to prosper well for any length of time. For a nation facing into this as a headwind, they will have a very powerful force thwarting their efforts and watering down their success. Part 2 reveals the No.1 nation and the next 3 drivers for emerging success.

For more information on other Megatrends, please visit Insync Funds Managers’ Website here.

EQT Responsible Entity Services Limited (“EQT”) (ABN 94 101 103 011), AFSL 223271, is the Responsible Entity for the Insync Global Quality Equity Fund and the Insync Global Capital Aware Fund. EQT is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This information has been prepared by Insync Funds Management Pty Ltd (ABN 29 125 092 677, AFSL 322891) (“Insync”), to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Insync, EQT nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

This publication contains general securities advice. In preparing the advice, Reach Markets Australia has not taken into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision on the basis of this advice, you need to consider, with or without the assistance of a securities adviser, whether the advice in this publication is appropriate in light of your particular investment needs, objectives and financial situation.

Reach Markets Australia and its associates within the meaning of the Corporations Act may hold securities in the companies referred to in this publication. Reach Markets Australia does, and seeks to do, business with companies that are the subject of its research reports. Reach Markets Australia believes that the advice and information herein is accurate and reliable, but no warranties of accuracy, reliability or completeness are given (except insofar as liability under any statute cannot be excluded). No responsibility for any errors or omissions or any negligence is accepted by Reach Markets Australia or any of its directors, employees or agents. This publication must not be distributed to retail investors outside of Australia.

It is recommended that you seek independent advice and read the relevant Product Disclosure Statement before making a decision in relation to any investment. Any advice contained in this communication is general and has not taken into account the investment objectives, financial situation and particular needs of any particular person.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.