Who needs kids when we have Fluffy & Rex, a US$125Bn growing Megatrend

Global pet care surpassed US$125 billion in 2018 (Euromonitor International). 73% of that was on pet food. What’s more, when recession hits, pet food is the last item on the shopping list to be traded down to a lesser perceived quality or brand. Pet food is marketed to owners not the pets. It’s growing at 6% compound annual growth rate (CAGR) since 2013 with strong tailwinds for the decade ahead, well ahead of global nominal GDP growth.

Global pet care surpassed US$125 billion in 2018 (Euromonitor International). 73% of that was on pet food. What’s more, when recession hits, pet food is the last item on the shopping list to be traded down to a lesser perceived quality or brand. Pet food is marketed to owners not the pets. It’s growing at 6% compound annual growth rate (CAGR) since 2013 with strong tailwinds for the decade ahead, well ahead of global nominal GDP growth.

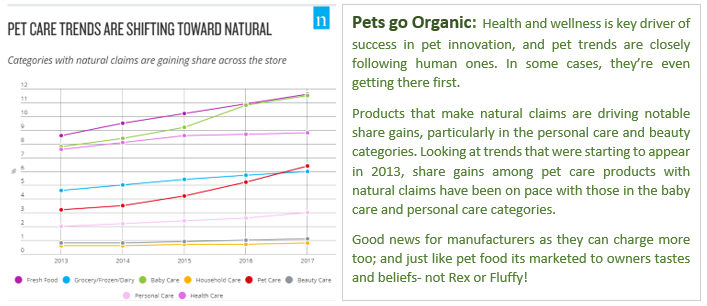

“Pet humanisation” whereby pets are being treated more like humans than animals – is becoming increasingly common. It’s a global trend across developed and middle-income nations everywhere. Their owners seek out higher quality foods, high-end accessories and more expensive medical treatments, even insurance! They are increasing their willingness to spend more on pet healthcare including the preventative type too. Pets are living longer, pushed by their owners desires, requiring more complex and extended medical care.

Take the UK for example; Mintel research highlighted the fast-growing trend for humanising pets (dogs in particular). Consumers are adjusting their daily lives to accommodate pets as part of their families.

- 24% of UK’s pet owners say it’s important to keep up to date with the latest styles of accessories.

- 56% of owners say that pets ‘like’ being given new accessories, rising to 62% of owners aged 16-44.

- 51% of 16-34s say it’s important to buy gifts for their pets to celebrate occasions. 30% of 16-24s bought a Christmas stocking for their pets.

- 35% of owners splashed out on beds, baskets and bedding within the past year as demand for stylising grows. Owners want their pet accessories to fit with their décor.

- 51% of owners are interested in wearable activity monitors; 27% believing they would also improve their pet’s activity levels too.

- 21% of owners either have used or are interested in restaurants with special pet menus! (not making this up)

Perhaps you might write this trend off to an induced ‘Brexit distraction’, but its global. Try taking your lovely mutt to the Vet next time without being told he needs $100+/month in pills, and undergoing diagnostic tests etc. Look at the merchandising in the Vet surgery, pet insurance banners, the expensive foods and toys. Notice how human the pet food adds on TV tonight are as if the food was for your consumption.

An age group agnostic trend – Demographics pushes higher spending for longer: In almost all spending categories, spending declines once a person reaches 55 years of age – but pet spending is peaking between the ages of 55 and 64. At the other end, millennials and Gen Zer’s are probably the first generation to grow up thinking of pets more like humans than animals. They are finding their independence and have disposable income – and they are buying pets and spoiling them. Great for the industry – these folks will be loyal customers for decades.

This Megatrend is supported by predictable growth drivers including population growth, a rising middle class and increasing global urbanisation. Strong tailwinds.

Which company? Insync’s identification of decade plus Megatrends with strong tailwinds, is one major prerequisite in our search for excellent companies to invest in wherever they reside. It is not enough to simply be operating within a Megatrend and be understanding of the influences of disruption on their industry. They also need to be positioned well to benefit from it as a business, have the managerial and financial prerequisites for success, as well as a proven track record of achievement. To be a Future-focused enterprise is a must. Insync is searching for the one or two best firms in one or more Megatrends that meets our stringent criteria.

For more information on other Megatrends, please visit Insync Funds Managers’ Website here.

For more information on other Megatrends, please visit Insync Funds Managers’ Website here.

EQT Responsible Entity Services Limited (“EQT”) (ABN 94 101 103 011), AFSL 223271, is the Responsible Entity for the Insync Global Quality Equity Fund and the Insync Global Capital Aware Fund. EQT is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). This information has been prepared by Insync Funds Management Pty Ltd (ABN 29 125 092 677, AFSL 322891) (“Insync”), to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Insync, EQT nor any of its related parties, their employees or directors, provide and warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

This publication contains general securities advice. In preparing the advice, Reach Markets Australia has not taken into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision on the basis of this advice, you need to consider, with or without the assistance of a securities adviser, whether the advice in this publication is appropriate in light of your particular investment needs, objectives and financial situation.

Reach Markets Australia and its associates within the meaning of the Corporations Act may hold securities in the companies referred to in this publication. Reach Markets Australia does, and seeks to do, business with companies that are the subject of its research reports. Reach Markets Australia believes that the advice and information herein is accurate and reliable, but no warranties of accuracy, reliability or completeness are given (except insofar as liability under any statute cannot be excluded). No responsibility for any errors or omissions or any negligence is accepted by Reach Markets Australia or any of its directors, employees or agents. This publication must not be distributed to retail investors outside of Australia.

It is recommended that you seek independent advice and read the relevant Product Disclosure Statement before making a decision in relation to any investment. Any advice contained in this communication is general and has not taken into account the investment objectives, financial situation and particular needs of any particular person.

General Advice Warning

Any advice provided by Reach Markets including on its website and by its representatives is general advice only and does not consider your objectives, financial situation or needs, and you should consider whether it's appropriate for you. This might mean that you need to seek personal advice from a representative authorised to provide personal advice. If you are thinking about acquiring a financial product, you should consider our Financial Services Guide (FSG) including the Privacy Statement and any relevant Product Disclosure Statement or Prospectus (if one is available) to understand the features, risks and returns associated with the investment.

Please click here to read our full warning.