AGL Energy Ltd (AGL) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 13/08/18 | AGL | A$20.62 | A$23.00 | BUY |

| Date of Report 13/08/18 | ASX AGL |

| Price A$20.62 | Price Target A$23.00 |

| Analyst Recommendation BUY | |

| Sector : Energy | 52-Week Range: A$20.16 – 26.52 |

| Industry: Integrated Utilities | Market Cap: A$13,490.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate AGL as a Buy for the following reasons:

- Leading integrated energy company with exposure to renewable energy investments.

- Given recent share price de-rating the stock is trading on undemanding multiples and attractive dividend yield.

- Strong cash flow business which provided flexibility to deploy cash in growth opportunities and capital management.

- On-going focus on costs and digitalisation should support margins.

- Ready for growth opportunities with a solid balance sheet.

- Potential capital management initiatives (buyback)

We see the following key risks to our investment thesis:

- Competitive pressures leading to margin erosion.

- Increase in supply leading depressed prices.

- Regulatory risk (policy uncertainty).

- Un-scheduled shutdowns impacting earnings.

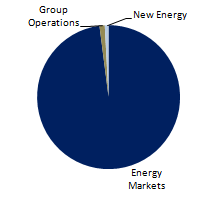

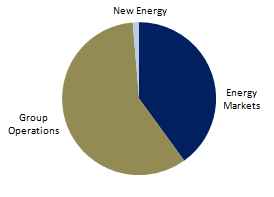

Figure 1: AGL Revenue by Segment

Source: Company

Source: Company

ANALYST’S NOTE

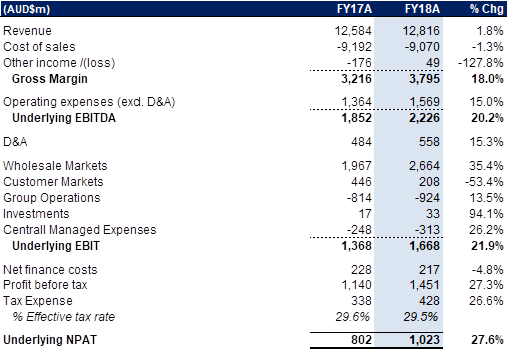

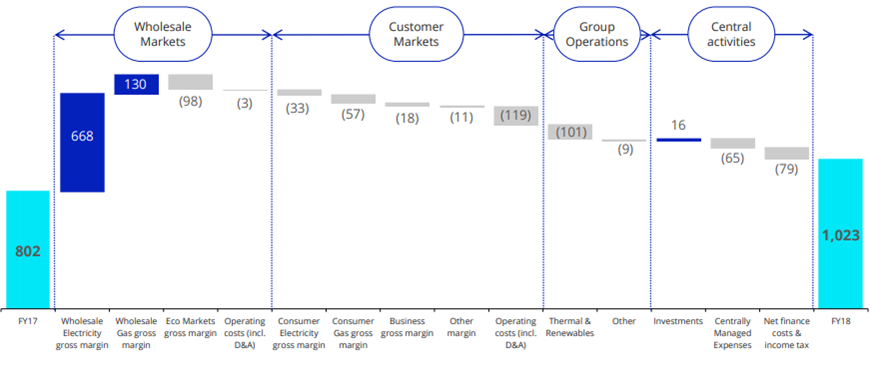

AGL Energy (AGL) delivered a strong FY18 result, with underlying net profit of $1.023bn +28% above prior year, coming in at the upper end of management’ guidance and 2.5% consensus estimates.

However, the outlook for wholesale energy prices, regulatory pressures (National Energy Guarantee + ACCC recommendations) and increased competitive pressures has seen the AGL’s share price come off since the results release.

Management has guided towards a mostly flat earnings growth outlook for FY19, which includes $120m in cost out benefits. The Company expects FY19 underlying profit of $970 – 1,070m versus pre-results consensus estimates of $1.1bn, that is -7.8% below estimates (using the midpoint of guidance). The Company expects Wholesale Markets earnings to peak this year, as electricity market prices start to decline.

On a positive note, with a strong balance sheet, we expect capital management to be on the agenda absent growth options. Management expect to update the market at the Feb-19 half year results in relation to a buyback. Given the share price de-rating, solid dividend yield and potential for capital management, we maintain our Buy rating.

- Group overview.

(1) Underlying profit of $1.02bn was ahead of consensus estimate of $995.1m.

(2) Net income of $1.59bn came in ahead of market estimate of $1.12bn.

(3) Revenue of $12.82bn was slightly below estimates of $12.98bn.

(4) Gross margin was up +18% to $3.8bn, driven by wholesale prices and higher per unit wholesale gas revenue offsetting higher gas supply costs.

(5) Outlook commentary disappointed the market, with the Company forecasting FY19 underlying profit of $970–1,070m versus pre-results release market estimates of $1.1bn.

(6) The Company will make a final decision on Crib Point LNG import terminal in FY19.

(7) AGL will provide $50m hardship debt relief and extension of discounts for loyal customers to all states.

- FY19 guidance.Management expects FY19 underlying profit to be $970 – 1,070m in FY19, the midpoint of which represents mostly flat NPAT growth on FY18. Management noted that the guidance reflects benefits from the business optimisation program mostly offsetting slower momentum in wholesale markets and increasing competitive pressures in Customer Markets. The Company expects Wholesale Markets earnings to peak this year, as electricity market prices start to decline. Increased competitive pressures will impact margins in Customer Markets.

- Initiating BOP to stand stillOperating costs were up $205m in FY18, which actually came in below Company’s own estimates. AGL has announced a business optimisation program (BOP) which will aim to return the Company’s cost base back to FY17 levels. As part of the BOP program, AGL will look to achieve $120m in cost savings in FY19. These measures are largely in response to competitive pressures going forward and lower wholesale energy prices.

- Buyback still on the cards. With a strong balance sheet and operating cash flow profile, AGL has the capacity to undertake additional capital management initiatives (buyback) on top of the attractive dividend yield.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 RESULTS SUMMARY…

Key headline numbers are provided in the table below.

Figure 3: AGL FY18 group headline numbers versus pcp

Source: Company

Figure 4: AGL FY18 group underlying profit drivers versus pcp

Source: Company

AGL COMS TABLE…

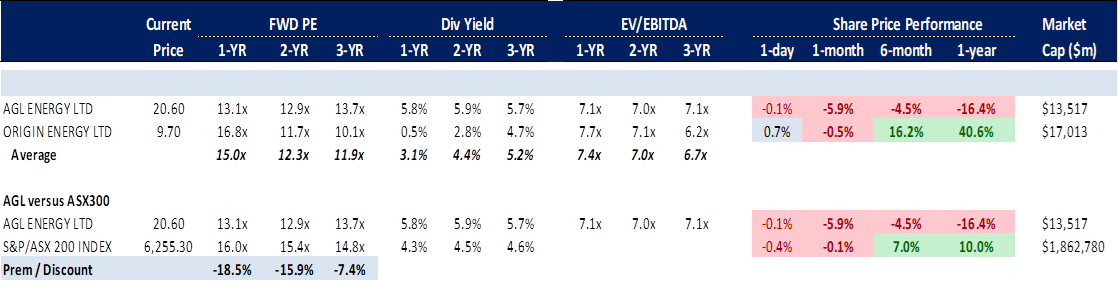

Figure 5: AGL peer group trading multiples

Source: Bloomberg

COMPANY DESCRIPTION

AGL Energy Limited (AGL) is one of Australia’s leading integrated energy companies and the largest ASX listed owner, operator and developer of renewable energy generation in Australia. The company sells and distributes gas and electricity. Further, it also retails and wholesales energy and fuel products to customers throughout Australia. The business operates four main segments: Energy Markets, Group Operations, New Energy and Investments

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >