AGL Energy Ltd (AGL) – NEUTRAL

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 25/10/18 | AGL | A$18.48 | A$23.00 | NEUTRAL |

| Date of Report 08/08/18 | ASX AGL |

| Price A$18.48 | Price Target A$23.00 |

| Analyst Recommendation NEUTRAL | |

| Sector : Energy | 52-Week Range: A$18.31 – 26.52 |

| Industry: Integrated Utilities | Market Cap: A$12,119.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate AGL as a Neutral for the following reasons:

- Leading integrated energy company with exposure to renewable energy investments.

- Given recent share price de-rating the stock is trading on undemanding multiples and attractive dividend yield.

- Strong cash flow business which provided flexibility to deploy cash in growth opportunities and capital management.

- On-going focus on costs and digitalisation should support margins.

- Ready for growth opportunities with a solid balance sheet.

- Potential capital management initiatives (buyback)

We see the following key risks to our investment thesis:

- Competitive pressures leading to margin erosion.

- Increase in supply leading depressed prices.

- Regulatory risk (policy uncertainty).

- Un-scheduled shutdowns impacting earnings.

ANALYST’S NOTE

We recently attended the AGL Energy (AGL) operational site visit at Loy Yang power station and adjacent coal mine in Victoria. The site visits also provided a chance to have a discussion with operational staff and included short presentations from senior management.

The site tour was overshadowed by the Australian Government formally announcing the Australian Energy Regulatory (AER) will introduce a default retail price for retail and small businesses by April 2019. This announcement was largely flagged and now provides a cloud over future earnings certainty given the threat of regulated prices has now increased. If current or subsequent government fully move down the regulated path, this is likely to lead to reduced investment in the industry at a time when it is needed the most.

With price regulation now clearly afoot and more price intervention highly probable, investors will take a cautious approach to the sector despite undemanding valuations. On this basis, we downgrade our recommendation to Neutral. A positive catalyst for AGL could be buyback given the solid balance sheet.

AGL management’s initial response.

Whilst on the site tour, interim CEO Brett Redman (previously CFO) provided the following thoughts in response to the Government’s announcement:

1. AGL has already substantially moved its legacy customers to market offer or on a discount, with 96% of its clients are on these contracts & only 4% on legacy contracts.

2. AGL welcomes reference pricing to give consumers a reference price to compare market offers. AGL is very supportive of this and is keen to compete on this front.

3. AGL would be highly concerned if there is a move towards regulated prices, as it creates uncertainty and allows subsequent governments to reduce/tweak it further (which will create uncertainty for investments).

Buyback still a potential positive. With a strong balance sheet and operating cash flow profile, AGL has the capacity to undertake additional capital management initiatives (buyback) on top of the solid dividend yield. An update is expected at the Feb-19 results.

FY18 result recap.

1. Underlying profit of $1.02bn was ahead of consensus estimate of $995.1m.

2. Net income of $1.59bn came in ahead of market estimate of $1.12bn.

3. Revenue of $12.82bn was slightly below estimates of $12.98bn.

4. Gross margin was up +18% to $3.8bn, driven by wholesale prices and higher per unit wholesale gas revenue offsetting higher gas supply costs.

5. Outlook commentary disappointed the market, with the Company forecasting FY19 underlying profit of $970–1,070m versus pre-results release market estimates of $1.1bn.

6. The Company will make a final decision on Crib Point LNG import terminal in FY19.

FY19 guidance. Management expects FY19 underlying profit to be $970 – 1,070m in FY19, the midpoint of which represents mostly flat NPAT growth on FY18. Management noted that the guidance reflects benefits from the business optimisation program mostly offsetting slower momentum in wholesale markets and increasing competitive pressures in Customer Markets. The Company expects Wholesale Markets earnings to peak this year, as electricity market prices start to decline. Increased competitive pressures will impact margins in Customer Markets.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

Loy Yang Site Visit…

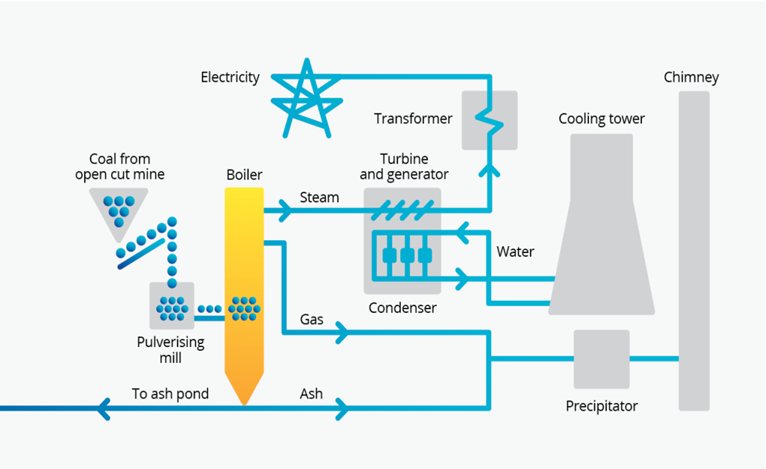

AGL acquired Loy Yang A power station and the adjacent mine in 2012, with the closure of the power station expected no later than 2048. The adjacent mine supplies to AGL Loy Yang and Loy Yang B (see site map below), with 2 billion tonnes in coal reserve (extracting at 28-32 million tonnes per annum). The Loy Yang A power station has capacity of 2,210 MW and annual generation of approximately 15,000 GWh.

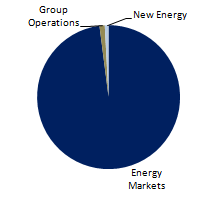

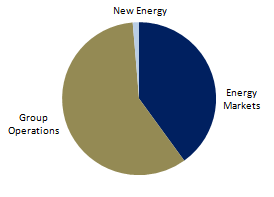

Figure 1: AGL Revenue by Segment

Source: Company

Source: Company

Source: CompanyFigure 3: Dark blue box = adjacent mine, Light blue box = Loy Yang A power station

Source: Company

The diagram below provides key features of the electricity generation process.

Figure 4: Dark blue box = adjacent mine, Light blue box = Loy Yang A power station

Source: Company

Figure 5: Mine site and conveyor belts transporting coal

Source: Company

Source: Company

Source: CompanyGovernment’s energy policy announcement…

Key points:

1. Government is pushing for lower prices relative to current standing offers. We note this could have double digit earnings impact for both Origin Energy (ORG) and AGL. We suspect the companies will look at other areas to limit the earnings gap.

2. Removing discounts such as “pay on time”.

3. Introduction of a default market offer and removing current retail “standing offers”, which will be consistent across retailers and price set by the AER.

4. Reference bill which will see electricity retailers market their respective discounts relative to a common reference point which is intended to help consumers understand and compare offers more easily.

5. The government will underwrite investment in new power generation, with conservative politicians pushing for coal-fired power.

6. Electricity retailers will be required to contract enough capacity to meet demand during peak times.

7. The Federal Government will seek state support on the policy but has flagged it will legislate over the states if need be. The COAG energy council will meet on 26 October.

COMPANY DESCRIPTION

AGL Energy Limited (AGL) is one of Australia’s leading integrated energy companies and the largest ASX listed owner, operator and developer of renewable energy generation in Australia. The company sells and distributes gas and electricity. Further, it also retails and wholesales energy and fuel products to customers throughout Australia. The business operates four main segments: Energy Markets, Group Operations, New Energy and Investments.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >