Ansell Ltd (ANN) – Neutral

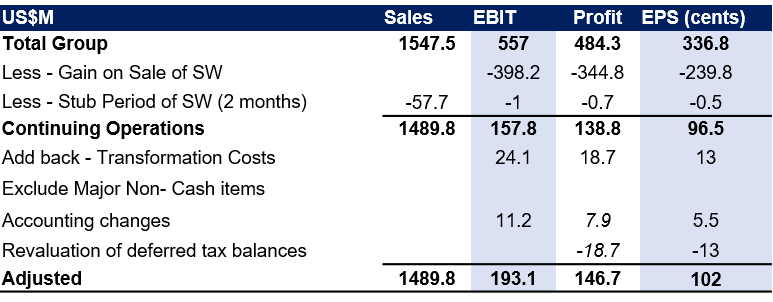

ANN’s share price fell by -7.2% after the Company reported FY18 net income of $484.3m which missed estimates of $490.7m and net income from continuing operations of $138.8m, which was well below market expectations of $147m. However full year revenue of $1.55bn came in above estimates of $1.50bn.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 22/08/18 | ANN | A$26.10 | A$26.75 | NEUTRAL |

| Date of Report 22/08/18 | ASX ANN |

| Price A$26.10 | Price Target A$26.75 |

| Analyst Recommendation NEUTRAL | |

| Sector : Healthcare | 52-Week Range: A$21.13 – 29.64 |

| Industry: Healthcare Supplies | Market Cap: A$3,614.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate ANN as a Neutral for the following reasons:

- ANN is a quality business with global manufacturing capabilities.

- Organic growth drivers are potentially positive for earnings.

- FX translation should be positive for the Company.

- Rubber input costs such as rising oil prices will be a negative impact for ANN’s raw material derivatives.

- ANN has a strong balance sheet position with flexibility to return cash to shareholders or borrowing capacity for acquisitions

We see the following key risks to our investment thesis:

- Product recall.

- Increase in competitive pressures.

- Adverse movements in AUD/USD.

- Emerging or developed market growth disappoints.

- Any worst or better prices for raw materials.

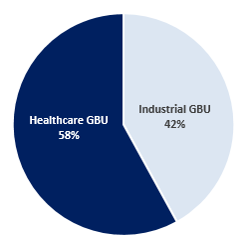

Figure 1: : ANN EBIT by Segment

Source: Company

ANALYST’S NOTE

ANN’s share price fell by -7.2% after the Company reported FY18 net income of $484.3m which missed estimates of $490.7m and net income from continuing operations of $138.8m, which was well below market expectations of $147m. However full year revenue of $1.55bn came in above estimates of $1.50bn.

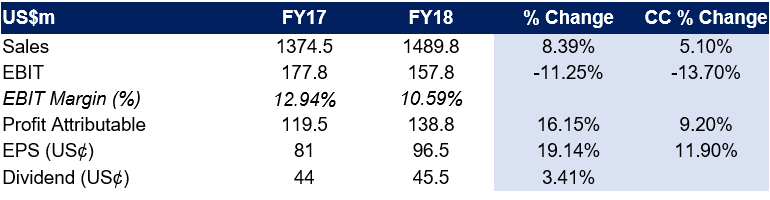

Divestment of SW division was reflected in the accounts of the Company. Interestingly, despite cost headwinds in raw commodities, sales were up +8.4% on pcp and EPS up +19.1% to 96.5 cps. Higher raw material costs did see group EBIT fall by -11.2%, however this drag appears temporary, as margins improved significantly in 2H18.

We note though, that if increasing raw material costs are sustained and U.S. import tariffs implemented at higher proposed levels, the cost impact, before mitigation, could represent a 5-6cps downside to midpoint of FY19 EPS guidance range. ANN trades on 16.9x PE20, ~2.7% dividend yield – Neutral.

- FY18 results-strong performance by continuing operations. On a continuing basis

1. Sales were up +8.4% (+5.1% on constant currency) on pcp, owing to +4.0% organic growth.

2. EBIT declined -11.2% (-13.7% on constant currency) to $158m, impacted by higher raw materials cost.

3. Profit gained +16.2% (+9.2% on constant currency), attributable to lower interest expense and lower U.S. tax rate.

4. EPS rose +19.1% (+11.9% on constant currency) to 96.5 cps (versus 81 cps in FY17), impacted by the share buy-back program, with 5.2m shares repurchased in FY18.

5. Management declared a final dividend of US25cps (unfranked), taking the FY18 dividend to US45.5cps.

6. Strong liquidity with net cash position of $28m, following divestment of Sexual Wellness division. However, the divestment lead to a fall in operating cash flows from $146m to $93.6m, primarily due to loss of operations from SW segment.

- FY19 outlook. Management noted, “external market conditions in FY19 are expected to generally remain supportive to top line growth. We are targeting continued organic revenue growth in the 3-5% range, and expect transformation cost benefits, pricing and product mix actions to benefit EBIT growth.” EPS is expected to be in the range of $1-1.12, negatively impacted by higher effective tax rate (impact of 3-5c). Management remains uncertain about the impact of the potential introduction of new tariffs on imports from the U.S. to China but noted that the cost impact of higher tariffs could represent a 5-6c downside to midpoint of EPS range. Transformation P&L cash costs of $20-23m are expected in FY19 (excluded from EPS guidance provided) and an additional non-cash fixed asset write down of $20-30m is anticipated. Management remains positive that continued success in ANN’s capital deployment strategy through acquisitions and share buybacks would help offset any temporary unfavourable impact from sustained higher RM costs or higher tariffs.

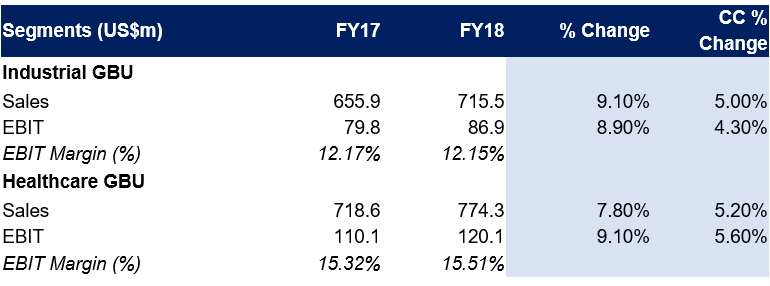

- Healthcare GBU (52% of revenue; 58% of EBIT) – solid results despite low surgical growth. The segment delivered organic revenue growth (excluding acquisition benefits) of +3% led by +8.6% growth in sales to emerging markets. Overall sales were up +5.2% (constant currency) which included the benefit from Nitritex acquisition in 2H17 and gammaSUPPLIES acquisition in 1H18. Surgical and safety solutions growth moderated to +1% compared to FY17, which included the temporary benefit of distributors restoring normal safety stock levels. Adjusted EBIT (constant currency) was up +5.6% on pcp, with improved 2H margins overcoming the first half impact of higher raw material costs. FY18 EBIT also benefited from a $4m reversal of accrued prior period indirect taxes. On a reported basis, sales and adjusted EBIT were up +7.8% and +9.1%, respectively.

- Industrial GBU (48% of revenue; 42% of EBIT). Sales increased +5.0% (constant currency) with organic growth of +5.2%. Mechanical grew +6.4% following strong growth of gloves and sleeves. Chemical sales grew by +1.4%, despite facing a drag following significant destocking at one major customer. Adjusted EBIT (constant currency) grew +4.3% on pcp but EBIT margins declined slightly, impacted by higher raw material costs in 1H18.

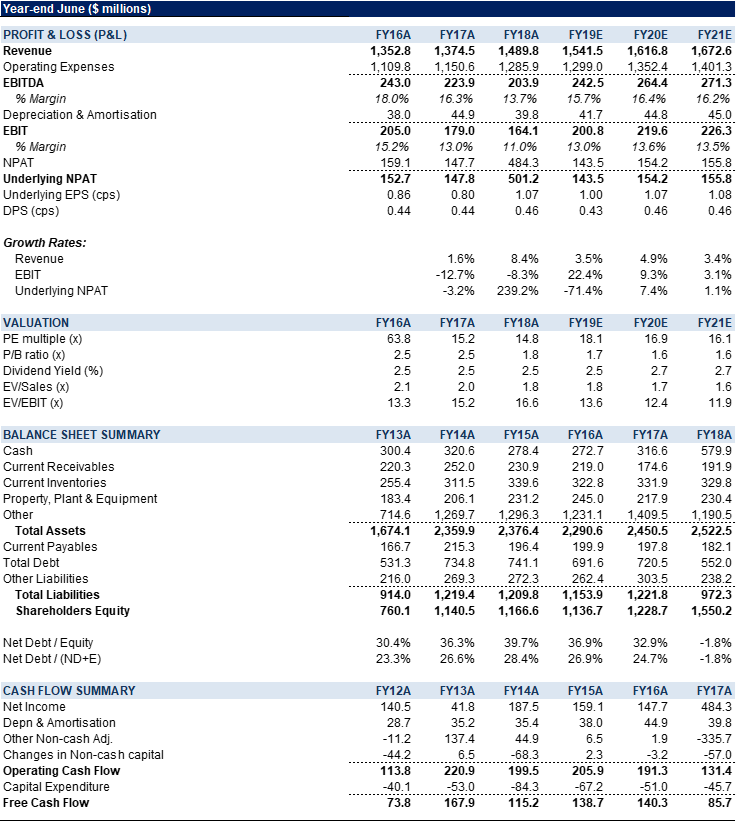

FY18 RESULTS SUMMARY…

Figure 2: ANN Results Summary

Source: Company: CC = Constant Currency

Figure 3: Non-Recurring items recorded in FY18

Source: Company

BY SEGMENTS…

Figure 4: Results – by segments

Source: Company: CC = Constant Currency

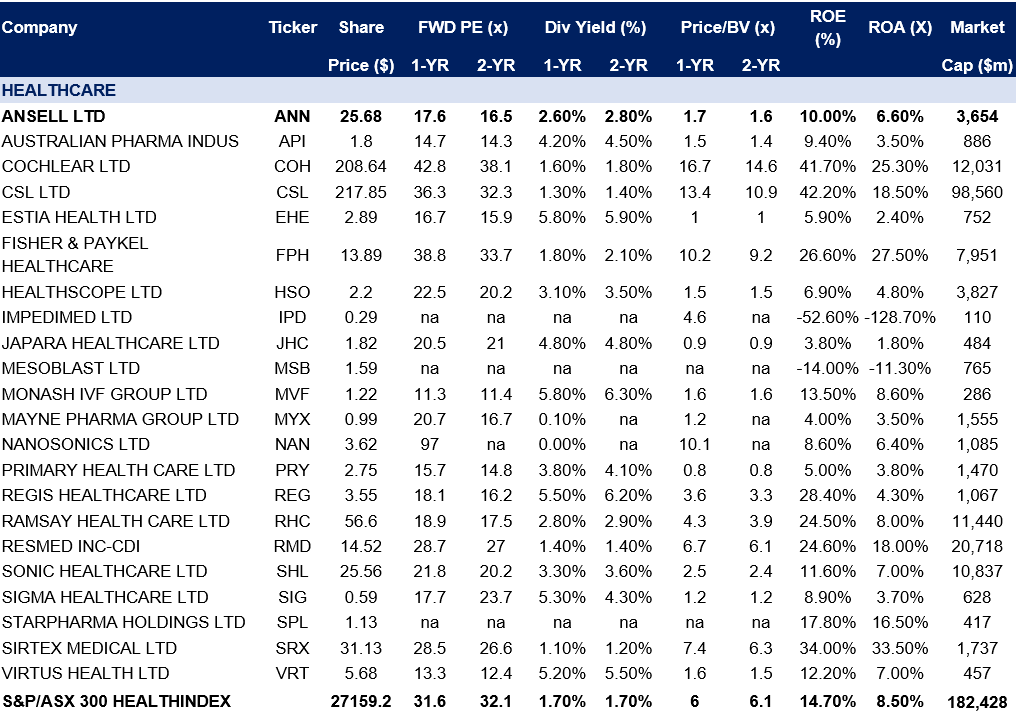

Figure 5: Peer group comparables – consensus

Source: Bloomberg

Figure 6: ANN Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Ansell Ltd (ANN) operates two global business units: (1) Ansell’s Industrial segment manufactures and markets multi-use protection solutions specific for hand, foot, and body protection, for a wide-range of industries such as automotive, chemical, metal fabrication; (2) Ansell’s Healthcare segment (Medical + Single Use) offers a full range of surgical and examination gloves covering all applications, as well as healthcare safety devices and active infection protection products. The segment also manufactures and markets single use hand protection. Ansell recently sold its Sexual Wellness Global Business Unit group.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >