APA Group (APA) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | APA | A$10.14 | A$11.00 | BUY |

| Date of Report 23/08/18 | ASX APA |

| Price A$10.14 | Price Target A$11.00 |

| Analyst Recommendation BUY | |

| Sector : Utilities | 52-Week Range: $7.59 – 10.29 |

| Industry: Pipeline | Market Cap: A$11,722.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate APA as a Buy for the following reasons:

- In our view, the bid will go through. The Board has unanimously backed the deal as attractive.

- Attractive upside from current share price to the offer price of $11.00.

- Attractive and growing distribution yield.

- Highly credit worthy customers.

- Currently assessing international opportunities – USA focus.

- Growth through acquisitions and innovation continues.

- Diversified customer base by sector.

- Largest owner of gas transmission pipelines in Australia.

- Opportunity to grow its renewable business

We see the following key risks to our investment thesis:

- The ACCC / FIRB reject the deal and the consortium fails to receive all regulatory approvals.

- The bid process attracts negative political attention.

- Negative market/investor sentiment towards “bond-proxies”.

- Future regulatory changes by pipeline regulators.

- Large portion of business exposed to the energy sector.

- Infrastructure issues such as explosions or ruptures.

- Adverse decision from COAG reviews transmission costs.

- Shorter contract terms on existing capacity.

ANALYST’S NOTE

APA’s FY18 results came in above market expectations, with operating earnings (EBITDA) of $1,518.5m, +1.3% above market expectations of $1,499m (and at the top end of management’s guidance range), NPAT of $264.8m, +4.9% above consensus estimate of $252.5m and distribution of 45cps in line with market expectations.

Looking out to FY19, the Company has provided distribution guidance of 46.5cps (before the allocation of any franking credits) which is a touch below current consensus expectations of 47cps and EBITDA to be in the range of $1,550 – 1,575m (versus current market expectations of $1,567m).

Whilst the near-term outlook for APA’s operations is stable, the near-term share price driver will be CKI’s bid at $11 per share, which now has APA’s Board approval and is awaiting ACCC / Foreign Investment Review Board (FIRB) approvals.

As we have previously noted, the deal will attract scrutiny and with all the political uncertainty in Canberra at the moment, the decision could be delayed. However, it is worth pointing out that should the deal be delayed, APA investors will receive 4cps distribution every month the bid is delayed past January 2019 to implementation. Maintain Buy with the bid price as our price target.

- Growing distributions supported by growing portfolio. APA has increased its distribution every year for the past 18 years, with FY18 distribution of 45cps up +3.4% on pcp and FY19 expected to be up a further +3.3%. From FY17-19, the Company has $1.4bn of growth projects which have been completed or due for completion by FY19. Some of the incremental returns from these projects did flow through in FY19. However, management noted that once all completed in FY19, they expect the additional revenues to be greater than $215m.

- On Board with the CKI deal. On 13 August, APA announced that the Board is unanimously recommending Cheung Kong Infrastructure’s bid for APA at $11 per share. This now means all eyes are on the regulators, with the ACCC expected to release its first response on September 13. The ACCC outcome will then be followed by a decision from FIRB. In our view the deal will attract scrutiny given APA’s very large portfolio of natural gas pipelines, despite it only have a relatively small percentage of the revenue coming from regulated assets. We note that CKI was previously blocked from bidding on the NSW electricity network Ausgrid.

- Attractive price offered. Given the attractive price being offered by CKI, in our view it is unlikely there will be a competing bid. The bid equates to an EV/EBITDA multiple of 14.8x on FY18 numbers and 30% premium to the pre-bid share price.

- CKI is no stranger to the Australian market. We note CKI is no stranger to doing deals in Australia (hence has a good understanding of regulatory process and approvals) and already has extensive assets in Australia. These assets include: 60% of DUET Group (VIC electricity distribution / VIC gas distribution / Energy Developments / gas pipelines), 51% of SA primary electricity distribution network, 72.5% of Australian Gas Networks (gas distributor) and 51% VIC electricity distribution networks.

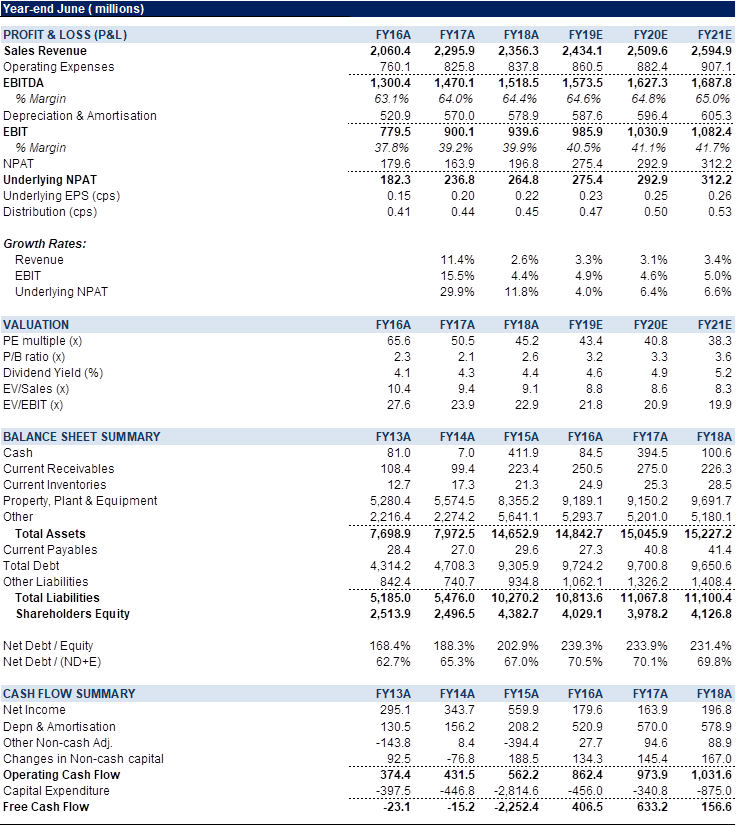

Figure 1: APA Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

APA Group Limited (APA) is a natural gas infrastructure company. The Company owns and/or operates gas transmission and distribution assets whose pipelines span every state and territory in mainland Australia. APA Group also holds minority interests in energy infrastructure enterprises. APA derives its revenue through a mix of regulated revenue, long-term negotiated contracts, asset management fees and investment earnings.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >