Aurizon Limited (AZJ) – NEUTRAL

AZJ reported FY18 results as expected. Key highlights include EBIT up 6% to $940.6m driven by: (1) Coal up $8.6m (2%) on +7% higher volumes but partly offset by higher costs due to price escalation and costs to add capacity to deliver further volumes;

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 14/08/18 | AZJ | A$4.48 | A$3.98 | NEUTRAL |

| Date of Report 14/08/18 | ASX AZJ |

| Price A$4.48 | Price Target A$3.98 |

| Analyst Recommendation NEUTRAL | |

| Sector : Transportation & Logistics | 52-Week Range: A$4.11 – 5.49 |

| Industry: Industrials | Market Cap: A$8,756.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate AZJ as a Neutral for the following reasons:

- Higher (and stabilizing) commodity prices should translate into improving volumes.

- Steady momentum with the transformation program expected to achieve benefits (management achieved its $380m transformation target).

- ACCC has blocked the sale of Queensland Intermodal and Acacia Ridge Terminal. Proceedings are on foot in the Federal Court.

- On-market buyback of A$300m now complete.

- Attractive dividend yield.

- Solid free cash flow (despite free cash flow decreasing from $704m in FY17 to $669 in FY18).

We see the following key risks to our investment thesis:

- Significant decline in commodity prices leading to mine closures or reduce volumes from customers. We see potential declines in iron ore prices.

- Structural decline in some commodities (e.g. coal).

- High costs impacting margins.

- Contract repricing resulting in longer term revenue loss.

- Pricing pressure to increase.

- Cut in dividends.

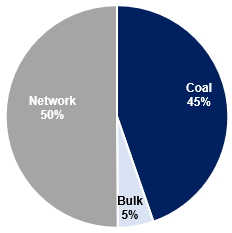

Figure 1: AZJ EBIT by segment

Source: FY18 Company reports

Figure 2: AZJ Rail Haulage Operation

Source: Company

ANALYST’S NOTE

AZJ reported FY18 results as expected. Key highlights include EBIT up 6% to $940.6m driven by:

1. Coal up $8.6m (2%) on +7% higher volumes but partly offset by higher costs due to price escalation and costs to add capacity to deliver further volumes;

2. Bulk up $64.5m due to transformation benefits and lower depreciation from prior year impairments, partly offset by lower volumes;

3. Network was flat at $480.6m with operating cost savings offset by non-recurrence of UT4 true-ups in prior year.

AZJ also completed its $300m buy-back in 2H18.

4. Final dividend of 13.1cps is 60% franked (and equates to 100% payout of underlying NPAT from continuing operations), up +47% versus prior year;

5. AZJ achieved its three-year transformation target of $380m with $133.6m in benefits delivered, including importantly removed Intermodal’s FY17 losses (mainly related to Intermodal Interstate);

6. Australian Competition and Consumer Commission (ACCC) blocked the sale for the Queensland Intermodal business and Acacia Ridge Terminal and has commenced proceedings in the Federal Court.

The ACCC has also sought an injunction to prevent Aurizon from closing its Queensland Intermodal business while proceedings are on foot. The attractive yield of approximately 4.1% may keep some investors interested in the stock, however we see the stock in a trading range. Neutral.

- Guidance. On above the rail business, management stated “underlying EBIT guidance for above rail business $390m – $430m”. In contrast, management noted that providing EBIT guidance for Network is challenging with the uncertain UT5 outcome/transitional tariffs, with a $130m range. Management sees above rail EBIT growth in FY2020 “due to higher coal volumes and transformation driving value”. Capital expenditure is expected to be $480m-$520m in FY19.

- Gearing. Gearing (net debt/net debt plus equity) remains stable at 42.3% but slightly above AZJ’s ~40% target gearing level. AZJ’s weighted average debt maturity tenor was 4.7 years (slightly lower than the 5.0 years in FY17). Group interest cost on drawn debt decreased to 4.5% (FY2017 5.0%) due to the rolling off interest rate hedges in June 2017. AZJ’s credit rating remains unchanged for Network and Aurizon Holdings at BBB+/Baa1.

- Network (~50% of EBIT). EBIT declined marginally to $480.6m in FY2018, with reductions in costs ($51.6m) offset by decreased revenue ($43.4m), mainly due to the non-recurrence of UT4 true-up of regulatory revenue in FY2017 and increased depreciation ($8.5m).

- Coal (~45% of EBIT). Underlying EBIT increased to $428.6m, up +2% on increased volumes and ongoing transformation program benefits which offset higher costs. Interestingly, as a market update, management pointed out “average hard coking coal price in FY2018 was US$204/t (+7% on the previous year), driven by continued growth in steel production in China and India… China crude steel production achieved a record 870mt, increasing by +6%. India recorded its 29th consecutive month in June 2018 of year-on-year growth in steel production… Given upward pressure on coal prices, opportunistic supply from the U.S and Indonesia continued to be incentivised to the market… metallurgical coal exports from the U.S lifted +33% and total coal export volume from Indonesia (almost entirely thermal coal) increased by +7%”.

- Bulk (~5% of EBIT). EBIT increased $64.5m to $50.1m, on transformation program benefits and lower net depreciation from impairments in FY2017 partly offset by lower volumes. Management commentary on iron ore was interesting in pointing out that “average iron ore price in FY2018 was US$69.0/t, remaining relatively flat against the previous year’s average of US$69.4/t. China, the world’s largest steel producer (and importer of iron ore) continued to drive demand, with hot metal production growing +2% in the 12 months to June 2018, against a backdrop of supply ramping up from Vale’s S11D project in Brazil and Roy Hill in the Pilbara. China’s demand shift towards higher grade iron ore continued during FY2018, with prices for lower grade iron ore products remaining at historically lower levels compared to the 62% Fe benchmark price… China’s increasing focus on reducing pollution and environmental regulation is favouring the use of higher grade ores”.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

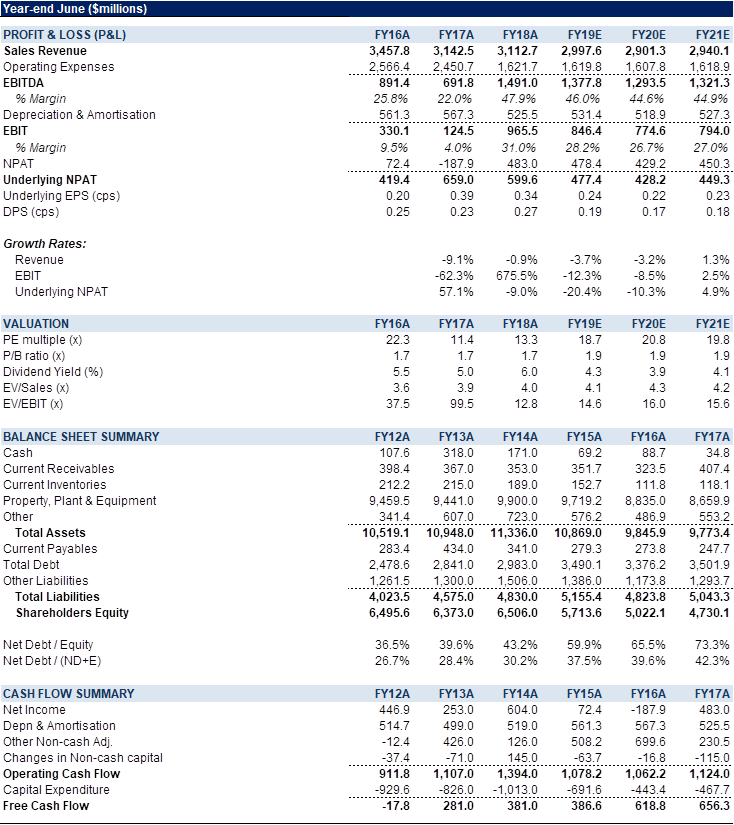

Figure 3: AZJ Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Aurizon Holdings Ltd (AZJ) operates an integrated heavy haul freight railway in Australia. It transports various commodities, such as mining, agricultural, industrial and retail products; and retail goods and groceries across small and big towns and cities, as well as coal and iron ore. The Company also operates and manages the Central Queensland Coal Network that consists of approximately 2,670 kilometres of track network; and provides various specialist services in rail design, engineering, construction, management, and maintenance, as well as offers supply chain solutions. In addition, it transports bulk freight for customers in the resources, manufacturing, and primary industries sectors. The Company was formerly known as QR National Limited and changed its name to Aurizon Holdings Limited in December 2012. AZJ is headquartered in Brisbane, Australia.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >