Aveo Group Ltd – (AOG) – BUY

Aveo Group (AOG) reported a solid FY18 result, with underlying profit up +17% to $127.2m, mainly driven by the delivery of 506 new units and Newstead achieving higher than expected development margins, and NTA up +16% to $3.92.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | AOG | A$2.37 | A$3.50 | BUY |

| Date of Report 16/08/18 | ASX AOG |

| Price A$2.37 | Price Target A$3.50 |

| Analyst Recommendation NEUTRAL | |

| Sector : Real Estate | 52-Week Range: A$2.18 – 2.86 |

| Industry: Real Estate Development & Management

| Market Cap: A$1,376.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate AOG as a Buy for the following reasons:

- Current share price is approximately 40% below group NTA per security of $3.92 (as at FY18).

- Strategic review could lead to initiatives which may close the gap between the share price and NTA.

- Attractive thematic play on ageing domestic population and Australia’s ageing population underpins AOG’s growth as an operator and developer of retirement living assets.

- Established retirement sales should start to normalize after being significantly impacted from the negative Four Corners story on the ABC in July 2017.

- Strong development pipeline to drive future earnings.

- Reasonable and growing dividend yield.

We see the following key risks to our investment thesis:

- Inability to turn around business image following negative light shed in media inquiry and possible adverse effects from class action – litigation costs may erode earnings.

- Weaker capital gains from sales as a result of weaker property markets in Sydney and Melbourne.

- Weaker demand for units, especially in an environment with increasing interest rates.

- With respect to valuation of established retirement assets, any changes to assumptions, especially around the discount rate used will cause downward valuations.

- Cost blow-outs or delays in developments leading to delays in contract settlements.

- Increased adoption of the Aged Care model as opposed to Retirement Living.

- Delays in approvals of contract settlements.

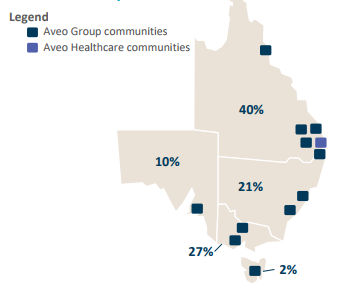

Figure 1: AOG’s Locations

Source: Company

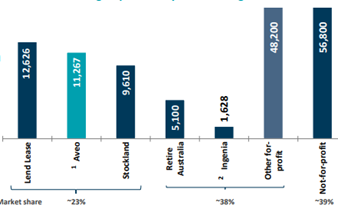

Figure 2: AZJ Rail Haulage Operation

Source: Company, Retirement Living Council, Grant Thornton, 2017, National Overview of the Retirement Village Sector

ANALYST’S NOTE

Aveo Group (AOG) reported a solid FY18 result, with underlying profit up +17% to $127.2m, mainly driven by the delivery of 506 new units and Newstead achieving higher than expected development margins, and NTA up +16% to $3.92.

The current share price is at approximately 40% discount to the NTA. Given this significant gap and the board’s view that the market is significantly undervaluing its assets (likely due to potential regulatory risks and sustainable sales growth), the Company has announced a strategic review to examine ways to close this gap. This could include introducing capital partners which could unlock capital (i.e. the Company sells down a substantial stake in the retirement business).

In our view, the Company could use this for capital management initiatives such as a buyback. Retirement sales remain subdued on the back of negative press the Company received earlier in the financial year. The Company is also targeting FY19 EPS of $0.204, which is slightly ahead of current consensus estimates of $0.20. No change to our Buy recommendation.

We like AOG for the following reasons:

1. remains an attractive thematic play on ageing Australian population which provides continuing demand;

2. strong development pipeline to drive future earnings; and

3. strong managerial response to the public inquiry.

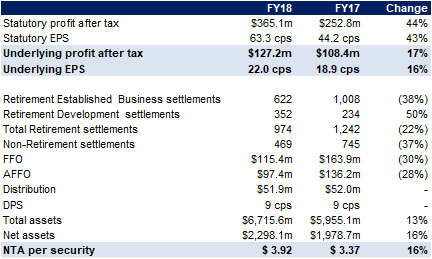

- FY18 results key points.

1. Underlying profit up +17% to $127.2m and underlying EPS up +16% to 22cps. Underlying profit was mainly driven by the delivery of 506 new units and Newstead achieving higher than expected development margins.

2. Retirement Established Business settlements continued to be impacted by the negative press AOG received during the year, with sales down -38% on pcp.

3. NTA per security increased +16% to $3.92. - NTA – mind the gap. Over the past 5-years, AOG’s NTA has increased from $2.78 to $3.92, representing a CAGR of +9.0% p.a. However despite this, AOG’s share price is trading significantly below its NTA, likely driven by:

1. Sustainable sales levels;

2. Downside risk to the industry from further industry regulatory changes; and

3. Outstanding class action against AOG. Management has announced a strategic review which will examine ways to close this gap, which may include the introduction of potential capital partners (domestic or international) into the retirement business. The results and implementation process is expected sometime next year. - Introduction of a capital partner could see potential capital management. With gearing of 16.8% well within management target range of 10-20%, any capital unlocked from this strategic review is likely to be return to shareholders, in our view.

- Outlook.

1. Management expects sales rates to normalize (i.e. +10% or more for the year).

2. AOG is on track to deliver 418 major development units in FY19 and targeting 500 units in FY20.

3. Based on current market conditions, the Company is targeting FY19 EPS of $0.204 per security.

4. Targeting full year distribution payout range of 40-60% of underlying profit.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

AOG FY18 RESULTS SUMMARY…

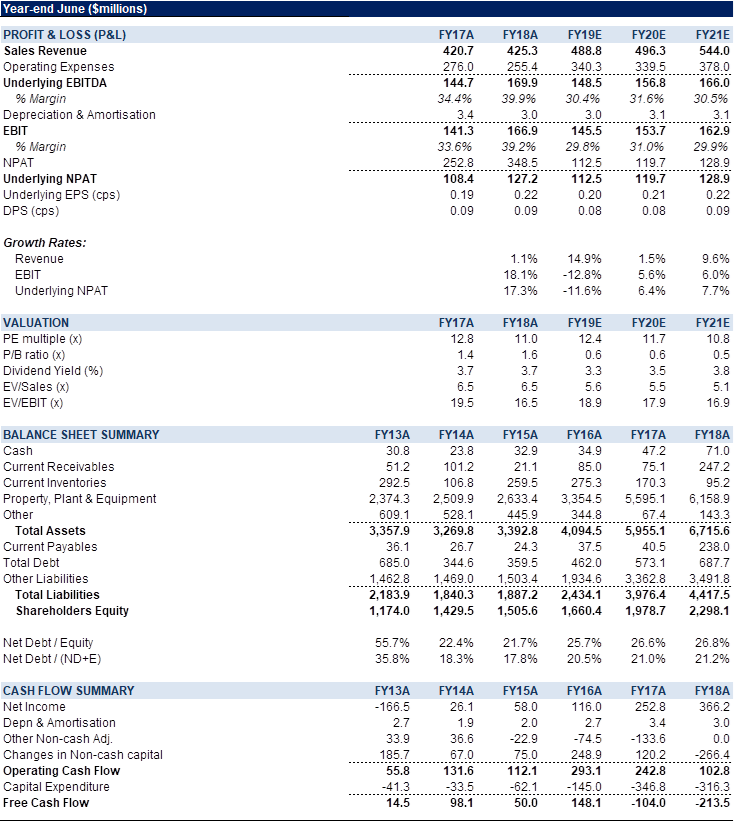

Figure 3: AOG key metrics

Source: Company

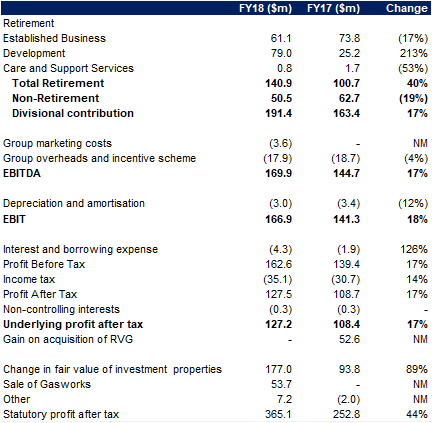

Figure 4: AOG P&L

Source: Company

Figure 5: AOG Financial Summary

Source: BTIG estimates, Company, Bloomberg

COMPANY DESCRIPTION

Aveo Group Ltd (AOG) is a retirement operator with 17,341 total units and beds. AOG’s earnings are driven from three segments: 1) income is derived from the initial sales price resident pays to buy a retirement unit; 2) AOG charges a recurring fee for amenities, housekeeping and emergency call services; 3) AOG charges a deferred management fee (DFM) when a unit is vacated. AOG earns capital gains of ~35%-plus of the unit’s value when it’s sold onto the next resident.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >