BHP Billiton (BHP) – Neutral

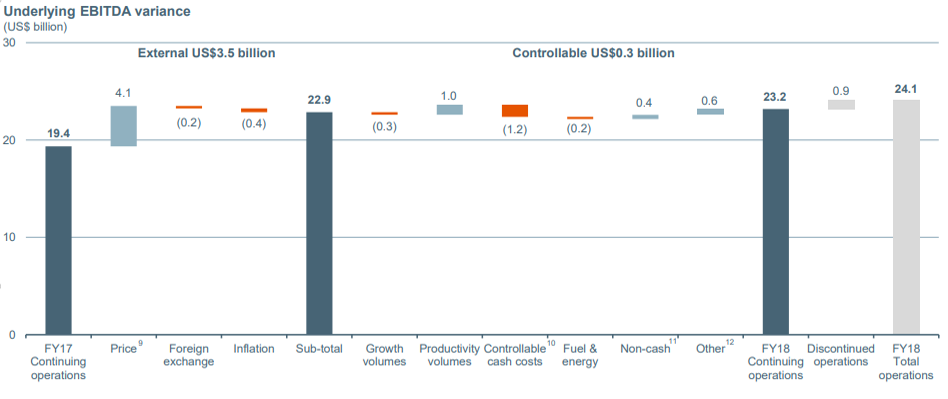

BHP FY18 results were mostly in line with estimates, with underlying EBITDA of US$24.1bn mostly in line with market expectations of US$24.5m (underlying EBITDA margin of 55% stable year on year) and underlying NPAT of US$8.9bn was also in line with expectations.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 23/08/18 | BHP | A$32.08 | A$31.50 | NEUTRAL |

| Date of Report 23/08/18 | ASX BHP |

| Price A$32.08 | Price Target A$31.50 |

| Analyst Recommendation NEUTRAL | |

| Sector : Materials | 52-Week Range: A$25.54 – 35.29 |

| Industry: Mining

| Market Cap: A$163,783.2m |

Source: Bloomberg

INVESTMENT STATEMENT

We rate BHP as a Neutral for the following reasons:

- Quality assets with competitive cost structure and leading market position.

- Growth in China outperforms market expectations.

- Commodities prices surprise on the upside.

- Management’s preference for oil and copper in the medium to long-term.

- Solid balance sheet position.

- Ongoing focus on productivity gains.

- Focus on returning excess free cash flow to shareholders in the absence of growth opportunities.

We see the following key risks to our investment thesis:

- Poor execution of corporate strategy.

- Deterioration in global macro-economic conditions.

- Deterioration in global iron ore/oil supply & demand equation.

- Deterioration in commodities’ prices.

- Production delay or unscheduled site shutdown.

- Movements in AUD/USD.

ANALYST’S NOTE

BHP FY18 results were mostly in line with estimates, with underlying EBITDA of US$24.1bn mostly in line with market expectations of US$24.5m (underlying EBITDA margin of 55% stable year on year) and underlying NPAT of US$8.9bn was also in line with expectations.

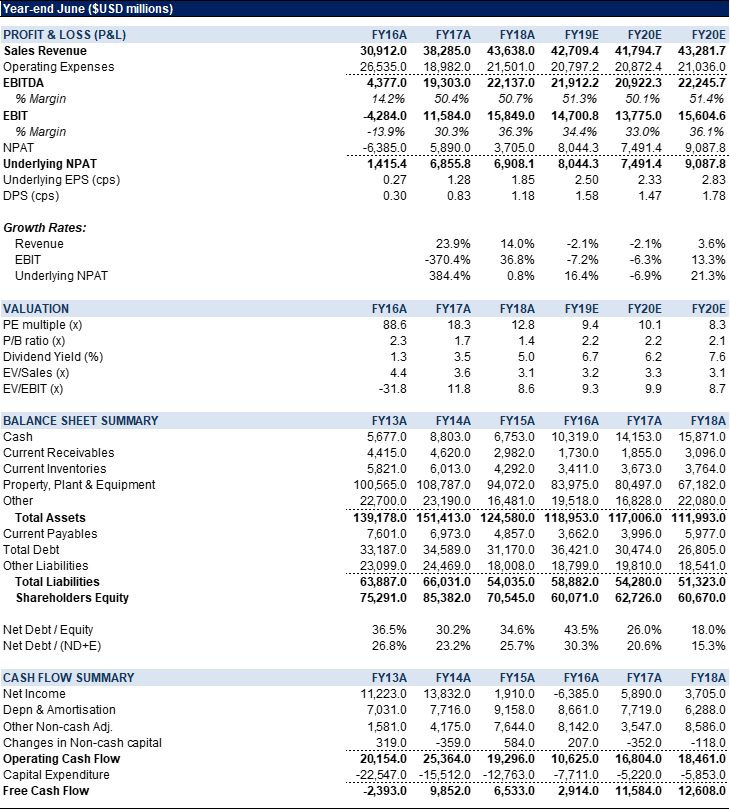

Underlying NPAT from continuing operation of US$9.6bn was up +33%. Group revenue of US$45.8bn was in line with estimates of $45.4bn. Net debt declined to US$10.9bn (from US$16.3bn in prior year) and now sits at the bottom end of management’s guidance range of US$10-15bn.

We expect greater proportion of free cash flow in the future to be returned to shareholders. The Company noted that they expect China’s growth to slow modestly in 2018 and that “near-term prospects for the U.S. economy are sound, with cyclical fundamentals solid…. however, we expect the increase in protectionism to weigh on consumer purchasing power and international competitiveness”.

We maintain our Neutral recommendation, moderating commodity prices and rising costs are offset by attractive shareholder return prospects (given the cash flow generative nature of BHP’s assets).

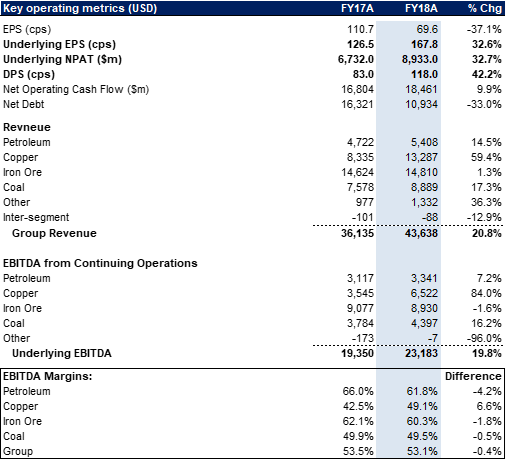

- By key commodities:

1. Iron Ore – Iron ore delivered EBITDA of US$8.9bn (down 1% on pcp), on margins of 61%. The commodity saw a marginal decrease in costs at US$14.26/t (-2% below pcp).

2. Petroleum – Conventional costs saw a +16% increase to US$10.06/boe, while EBITDA was up +7% to US$3.3bn.

3. Coal – saw record met coal production (despite geotech issues), helped deliver EBITDA growth of +16% to US$4.4bn. Costs for Queensland Coal (up +14%) and NSWEC (up +12%) both rose.

4. Copper – saw record Spence production and Escondida ore milled helped deliver a significant lift in EBITDA, up +84% to US$6.5bn. Costs were up +10% to US$1.25/lb, with the segment operating on 54% margins.

- Capital is coming. The Company declared a 2H18 dividend of US63cps, representing a payout ratio of 69%, taking the full year dividend to US118cps (largely in line with consensus estimates). In our view, some investors may have been expecting more on the dividend front in this result. However, management laid the platform for higher returns in the near future. The Company expects to maintain net debt in the range of US$10bn to US$15bn, with “greater proportion of future free cash flow expected to be returned”. As at FY18, the Company’s net debt position of US$10.9bn was comfortably at the bottom end of this range. In FY19, at current spot prices, the Company is expected to produce approximately US$9.0bn in free cash flow. All else being equal, we expect increased returns in the future.

- Near-term headwinds. At the half year results, management was confident in their US$2bn of additional productivity gains by end of FY19. However, at the full year results they have reduced that guidance towards US$1.0bn in savings which suggest cost pressures are being experienced across the industry. Further, commodity prices could moderate more aggressively should geopolitical and trade tensions take hold. This will clearly have implications for BHP’s free cash flow profile.

FY18 SEGMENTS RESULTS SUMMARY

Figure 1: FY18 results – key trading metrics

Source: Company

Figure 2: BHP EBITDA waterfall (US$bn)

Source: Company

Figure 3: BHP Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

BHP Billiton Limited (BHP) is a diversified global mining company, with dual listing on the London Stock Exchange and Australia Stock Exchange. The company’s principal business lines are mineral exploration and production, including coal, iron ore, gold, titanium, ferroalloys, nickel and copper concentrate. The company also has petroleum exploration, production and refining.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >