Challenger Ltd (CGF) – BUY

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 15/08/18 | CGF | A$11.09 | A$13.50 | BUY |

| Date of Report 15/08/18 | ASX CGF |

| Price A$11.09 | Price Target A$13.50 |

| Analyst Recommendation BUY | |

| Sector : Financials | 52-Week Range: A$10.52 – 14.42 |

| Industry: Life Insurance | Market Cap: A$7,605.2m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CGF as a Buy for the following reasons:

- Exposure to attractive retirement income market, with strong growth tailwinds. Indeed, on the FY18 analyst call, management pointed out “the Australian superannuation system is worth around $2.6 trillion. Over the last 10 years, the pool of superannuation savings in Australia has grown at a compound annual rate of 8%. Today, we have the fourth largest pension market in the world. the retirement phase of superannuation is now reaching scale. The $800bn currently in retirement is forecast to reach $2.1 trillion in a little more than a decade. This translates into meaningful superannuation balances at retirement… there are now more than 1.6 million retired member accounts with an average balance of more than 250,000. Industry and government are responding to this trend with an increasing focus on providing retirement income solutions. Regulations were introduced last year to enable the development of a wider range of longevity products. New means testing rules to support the use of these products will come into effect on July 1, 2019”.

- Growing relationship/distribution footprint bodes well for future earnings (MS Primary, BT and AMP added in FY17).

- Regulatory support with government considering a number of policy initiatives.

- Solid capital position.

- Further cost initiatives leading to reduction in already low cost-to-income ratio.

We see the following key risks to our investment thesis:

- Weaker than expected annuity sales growth within its Life (annuity) segment.

- Any increase in competition from major Australian banks in annuities.

- Weaker than expected net inflows for Funds Management segment (possibly from lower interest levels from financial planners/advisers/investors).

- Weaker than expected performance of boutique funds within its Funds Management segment.

- Lower investment yields.

- Uncertainty over capital requirements of deferred lifetime annuities.

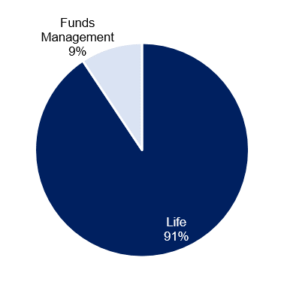

Figure 1: CGF EBIT by Segment

Source: Company

ANALYST’S NOTE

Challenger Ltd (CGF) reported mixed FY18 results over a period that was largely impacted by higher levels of capital following the $500m MS&AD equity placement.

At time of writing the share price is down -7.6% with Group ROE down to 16.5% (-180bps), normalised EPS lower at 68.1cps (-1%), and Life’s COE margin contracting to 393bps (-36bps).

Nevertheless, we remain confident in the long term industry trends and long-term outlook for CFG, especially with its strategic focus towards bolstering its market leading annuities position and impressive cost management efforts (cost to income ratio down to 32.7%).

CGF currently trading on a 15.7x FY19 PE-multiple, 14.4x FY20 PE-multiple and 3.2% dividend yield.

The sector is currently under scrutiny with respect to the Royal Commission into the financial services industry, however in our view this is a short term aberration – Reiterate Buy on a multi-year view.

- Life (91% of Group EBIT): FY18 Life EBIT was up +6% to $563m in FY18, driven by a $38m increase in normalised Cash Operating Earnings (COE). COE margins however, contracted by -36bps, due to lower product cash margin and smaller other income over the year. ROE also contracted by 250bps to 18.5% (from 21.0% in FY17), impacted by higher levels of capital following the MS&AD equity placement. Disappointingly, annuity sales were flat over the pcp. With Life’s focus on long-term annuity sales, management are guiding maturities to fall from ~25% of opening liabilities in FY18 to ~23% in FY19.

- Products to be available on every platform… CFG continues to make its annuities products available on platforms used by more than two-thirds of financial advisors. During FY18, CFG made its annuities available on the AMP platform; are ready to launch on BT Panorama in the coming weeks; and is working with Hub24 (fast growing platform this financial year) to make their annuities available.

- Japanese foray on track… CFG opened an office in Tokyo, Japan to support its MS&AD relationship, and have worked with the MS Primary to develop a second Australian dollar annuity product. On the analyst call, management noted that “this relationship is progressing well and contributed 15% of Challenger’s annuity sales for the year, in line with our expectations”.

- Funds Management (9% of Group EBIT): Funds Management saw strong new inflows over the half of $3.9bn (up +22%), however was down to $5.3bn on a full-year basis (down -15%). Strong investment performance across 91% (1-year period) of the Company’s funds helped push average FUM up +17% to $78.0bn, boosting management fees for the period. EBIT of $58m was up +28% compared to FY17, which helped increase ROE to 29.4% by +460bps.

- Annuity strategy on track, however short-term ROE takes a hit. The partnership with MS Primary to sell AUD annuities in Japan continues to perform well, generating 15% of Challenger’s FY18 annuity sales, in line with contribution expectations of $600m. CGF in recognition of MS&AD as a key distribution partner, completed a $500m equity placement to the Japanese entity, representing 6.3% of Challenger’s existing capital and subsequently increasing issued capital by ~10%. Subsequently, the Company’s pre-tax ROE declined to 16.5% versus guidance at 18.3% causing the market to react harshly with the share price currently down -7.6% at time of writing. However, we give management the benefit of the doubt, and see their strategic direction to bolster its Life segment as paying off in the long-term.

- Cost management continues to improve. CGF’s strong cost discipline approach continues to cement CFG’s position as a leading industry operator with the FY18 normalised cost to income ratio coming in at 32.7% (improvement of 70bps versus pcp).

- Solid capital position. CGF holds ~$1.3bn of excess regulatory capital and Group cash, equating to 1.53x the Prescribed Capital Amount, within its target range of 1.3x to 1.6x.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

FY18 RESULTS SUMMARY…

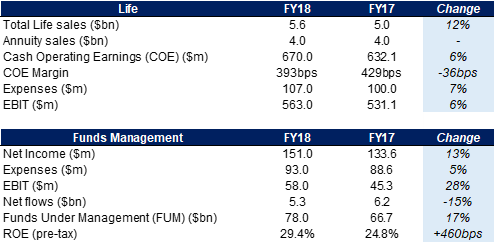

Figure 2: Group FY18 Results Summary

Source: Company

- Guidance. Management are guiding underlying NPAT growth between 8 – 12% for FY19, which represents levels between $438.48 – 454.72m. Management guidance range for cost to income ratio was maintained at 30 – 34%. Indeed, on the analyst call, management highlighted “we expect 2019 ROE to increase from its FY 2018 level, but not reach our 18% target in this year. In FY19, we expect growth in normalized NPAT of between 8% and 12% on FY 2018. This takes into account the reallocation of loss investment portfolio to favor fixed income over property which as we noted today we’re executing ahead of schedule”.

- Overview of FY18 results. While CFG’s normalised profit before tax of $547m came within guidance (albeit on the lower end of the $545 – 565m range), CFG recorded underlying NPAT of $406m, slightly under our own FY estimates of $415.5m by -2.3%. Subsequently, EPS was down -0.6% to 68.1cps, reflecting a +6% increase in the number of shares outstanding following the $500m equity placement to MS&AD in August 2017. Net Income increased by +7% to $822m in FY18, largely attributable to Life Cash Operating Earnings which was up by $38m (+6%), as well as an increase in Funds Management fee income (+13%) that benefitted from a jump in average Funds Under Management (+19%).

- Strong cost discipline. CGF delivered on its cost-to-income ratio target, which improved by 70bps to 32.7% over the pcp. Over the last decade, CFG has been able to reduce the ratio by 15 percentage points from 47.6% which means CFG is one of the industry’s leading operators (amongst competitors such as Magellan, Macquarie Bank, NAB, Perpetual, and AMP).

- Dividend payout at upper end of guidance. The Board declared a final FY18 dividend of 18.0cps (fully franked), bringing full year levels up to 35.5cps (compared to 34.5cps in the pcp). This equates to a normalised dividend payout ratio of 52.1% which sits above CGF’s guided range between 45 – 50%, however a dividend reinvestment plan is expected to reduce the payout by ~2%.

- Miss on the ROE front… CFG missed its pre-tax normalised ROE target of 18%, recording lower FY18 levels at 16.5% (which was down 180bps on the pcp) impacted by higher levels of capital following the $500m equity placement. FY19 normalised ROE is expected to increase from current levels, but not reach the 18% target.

Figure 3: Segment FY18 Results Summary

Source: Company

By segments:

- Life. Life’s normalised EBIT was up +6% to $563m, reflecting a $38m increase in normalised Cash Operating Earnings (COE). COE margins however, contracted by -36bps, driven by lower product cash margin and smaller other income over the year. ROE also contracted by 250bps to 18.5% (from 21.0% in FY17), impacted by higher levels of capital following the MS&AD equity placement. Disappointingly, annuity sales were flat over the pcp. Life’s annuity book growth was driven by sales and maturities. With Life’s focus on long-term annuity sales, management are guiding maturities to fall from ~25% of opening liabilities in FY18 to ~23% in FY19.

- Funds management. Funds management saw strong new inflows over the half of $3.9bn (up +22%), however was down to $5.3bn on full-year basis (down -15%). Strong investment performance across 91% (1-year period) of CFG’s funds helped push average FUM up +17% to $78.0bn, boosting management fees for the period. EBIT of $58m was up +28% compared to FY17, which helped increase ROE to 29.4% by +460bps. Two new boutiques in Garelick Capital Partners and Latigo Partners and six new strategies across existing boutiques were introduced. Fidante Partners is also preparing to reach a wider customer base with the introduction of exchange traded funds under the banner of Fidante ActiveX, which is set to launch in the first half of this year.

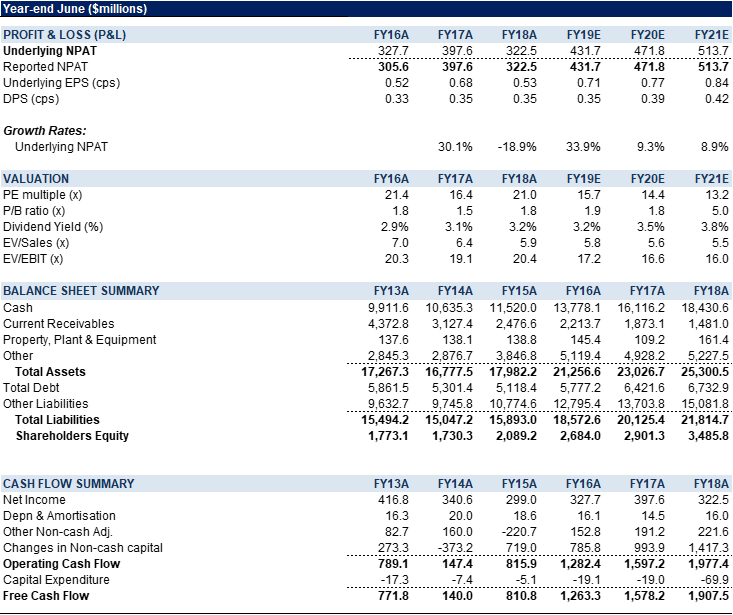

Figure 4: CGF Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Challenger Ltd (CGF) is an Australian-based investment management firm managing $81.1 billion in assets as of August 2018. CGF operates two core segments:

1. a fiduciary Funds Management division; and

2. APRA-regulated Life division. Challenger Life Company Ltd (Challenger Life) is Australia’s largest provider of annuities.

Recommendation Rating Guide

| Recommendation Rating Guide | Total Return Expectations on a 12-mth view |

| Speculative Buy | Greater than +30% |

| Buy | Greater than +10% |

| Neutral | Greater than 0% |

| Sell | Less than -10% |

Reach Markets Disclaimer

Reach Markets Pty Ltd (ABN 36 145 312 232) is a Corporate Authorised Representative of Reach Financial Group Pty Ltd (ABN 17 090 611 680) who holds Australian Financial Services Licence (AFSL) 333297. Please refer to our Financial Services Guide or you can request for a copy to be sent to you, by emailing [email protected].

Read our full disclaimer here >